Beyond The IPO: A Forerunner's Guide To Long-Term Startup Success

Table of Contents

Cultivating a Strong Company Culture Beyond the IPO

A thriving company culture is the bedrock of long-term success. It's the invisible force that drives employee engagement, fosters innovation, and ultimately, fuels sustainable growth, even beyond the IPO.

Building a High-Performing Team

Attracting and retaining top talent is paramount. This goes beyond simply filling roles; it's about building a team that shares your vision and values.

- Focus on Cultural Fit: Prioritize hiring individuals who align with your company's mission and values. Look for individuals with a growth mindset and a strong work ethic. Conduct thorough interviews that assess cultural fit alongside technical skills. This ensures employee retention and minimizes costly turnover.

- Invest in Development: Ongoing training and development programs are crucial for enhancing employee skills, boosting morale, and fostering a culture of continuous learning. This can include mentorship programs, workshops, and access to online learning platforms.

- Foster Collaboration: Create a collaborative and supportive work environment that encourages open communication, idea sharing, and teamwork. Implement tools and strategies that promote team building and effective communication across teams. Encourage knowledge sharing and cross-functional collaboration.

Establishing a Clear Vision and Mission

A clearly defined company vision and mission statement provide direction and purpose, guiding decisions long after the IPO excitement fades.

- A Compelling Vision: Craft a vision statement that's inspiring, ambitious, and easily understood by everyone in the company. This vision should be the north star, guiding your long-term strategy and decisions.

- Articulating Your Purpose: A clear mission statement articulates what your company does and why it matters. It should clearly communicate your company's corporate values and its purpose in the world.

- Consistent Communication: Regularly communicate your vision and mission to all stakeholders – employees, investors, customers – to ensure everyone is working towards the same goals. This strategic planning element is critical for alignment and motivation.

Strategic Financial Management Post-IPO

Successful financial management is essential for sustained growth beyond the IPO. It involves more than just meeting short-term financial targets; it's about building a financially resilient and scalable business.

Sustainable Growth Strategies

Smart financial planning is vital for long-term stability. Diversification and strategic investment are key components of this process.

- Diversify Revenue Streams: Don't rely on a single product or service. Diversifying your revenue streams mitigates risk and provides a buffer against market fluctuations. Explore new markets and product offerings to expand your revenue base.

- Invest in R&D: Continuous innovation is crucial for maintaining a competitive edge. Investing in research and development ensures that your company stays ahead of the curve and can adapt to changing market demands. This is key for business model innovation.

- Robust Financial Controls: Implement strong financial controls and reporting mechanisms to track performance, identify areas for improvement, and make informed financial decisions. This ensures effective financial management and risk management.

Managing Investor Expectations

Maintaining strong investor relations is crucial for long-term success. Transparency and open communication are critical.

- Transparent Communication: Maintain open and honest communication with your investors. Provide regular updates on your progress, both successes and challenges. This transparency builds trust and maintains investor confidence.

- Meeting Expectations: Deliver on your promises and meet your investors' expectations. Consistent performance and financial reporting are key to building a strong relationship with your investors.

- Long-Term Strategy: Develop a long-term growth strategy that aligns with your investors' goals and expectations. Show them a clear path toward continued growth and return on investment. This demonstrates effective stakeholder management.

Adaptability and Innovation in a Changing Market

The business landscape is constantly evolving. Adaptability and innovation are not just desirable traits – they are essential for long-term survival.

Embracing Change and Disruption

Staying ahead of the curve requires continuous monitoring of the market and a willingness to adapt.

- Market Analysis: Conduct regular market analysis to identify emerging trends, opportunities, and threats. This helps you anticipate changes and adapt proactively. This is crucial for disruptive technologies.

- Culture of Innovation: Foster a company culture that embraces innovation management, encourages experimentation, and rewards risk-taking. Create a safe space for employees to propose new ideas and explore new approaches.

- Business Model Adaptation: Be prepared to adapt your business model and strategies as market conditions change. Flexibility and responsiveness are vital for survival in a dynamic market.

Building a Resilient Business Model

A resilient business model can withstand economic downturns and unexpected challenges.

- Diversify Customer Base: Reduce dependence on any single customer or market segment by diversifying your customer base. This market diversification protects your business from significant revenue loss if one segment declines.

- Strong Supplier Relationships: Build strong relationships with your suppliers and partners to ensure a stable and reliable supply chain. This resilience is vital for navigating disruptions.

- CRM Implementation: Utilize a robust Customer Relationship Management (CRM) system to understand your customers, build loyalty, and increase customer lifetime value. This is essential for building business model resilience.

Conclusion

Successfully navigating the journey beyond the IPO requires a proactive and strategic approach. By cultivating a strong company culture, effectively managing finances, and embracing adaptability and innovation, startups can build a foundation for long-term success that extends far beyond the initial public offering. Don't just aim for the IPO – build a company that endures. Focus on achieving sustainable growth and lasting impact. Learn how to go beyond the IPO and build a truly successful and enduring business.

Featured Posts

-

Tommy Fury Budapesten Valasza Jake Paulnak Kepgaleria

May 14, 2025

Tommy Fury Budapesten Valasza Jake Paulnak Kepgaleria

May 14, 2025 -

Manchester United Eyeing Key Transfers A Strategic Positioning

May 14, 2025

Manchester United Eyeing Key Transfers A Strategic Positioning

May 14, 2025 -

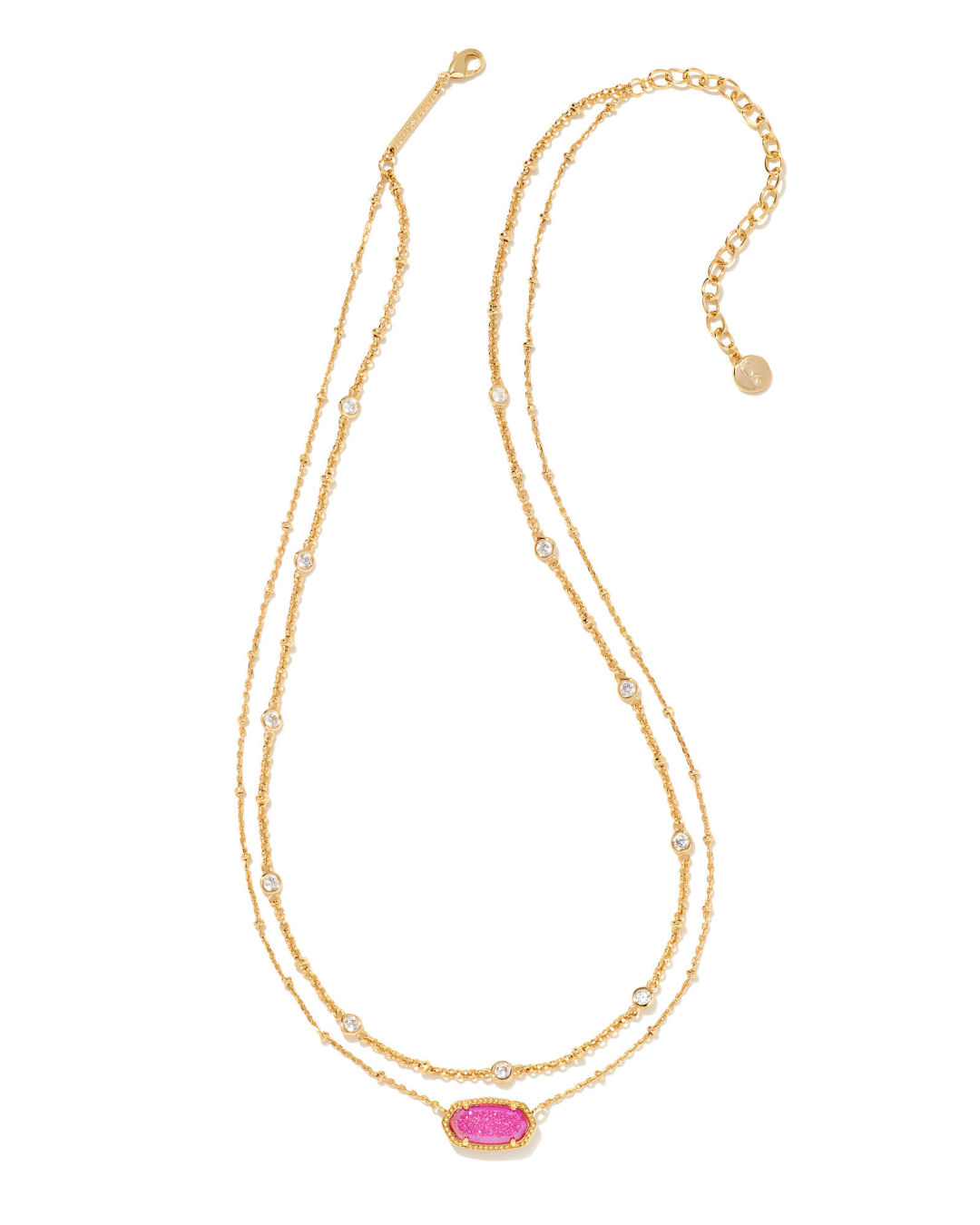

Budget Friendly Disney Jewelry Kendra Scotts Snow White Collection

May 14, 2025

Budget Friendly Disney Jewelry Kendra Scotts Snow White Collection

May 14, 2025 -

Yevrobachennya 2024 Data Mistse Uchasniki Ta Predstavnik Ukrayini

May 14, 2025

Yevrobachennya 2024 Data Mistse Uchasniki Ta Predstavnik Ukrayini

May 14, 2025 -

Coco Gauff And Peyton Stearns American Duo Triumphs In Rome

May 14, 2025

Coco Gauff And Peyton Stearns American Duo Triumphs In Rome

May 14, 2025

Latest Posts

-

The Truth About Vince Vaughns Italian Background

May 14, 2025

The Truth About Vince Vaughns Italian Background

May 14, 2025 -

Uncovering Vince Vaughns Heritage Italian Roots

May 14, 2025

Uncovering Vince Vaughns Heritage Italian Roots

May 14, 2025 -

Vince Vaughns Ancestry Is He Of Italian Descent

May 14, 2025

Vince Vaughns Ancestry Is He Of Italian Descent

May 14, 2025 -

Wynonna And Ashley Judds Docuseries Uncovering Family Truths

May 14, 2025

Wynonna And Ashley Judds Docuseries Uncovering Family Truths

May 14, 2025 -

Is Vince Vaughn Italian Exploring His Ethnicity

May 14, 2025

Is Vince Vaughn Italian Exploring His Ethnicity

May 14, 2025