BigBear.ai (BBAI): Analyzing The Revenue Miss And Leadership Instability Impact

Table of Contents

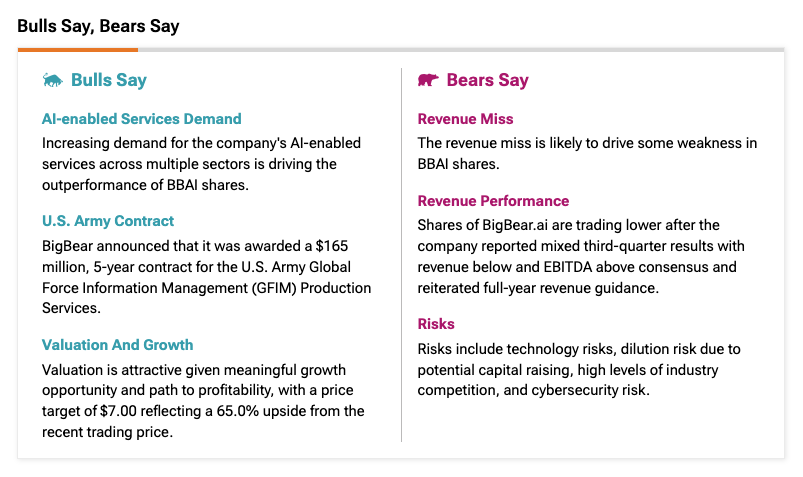

Deep Dive into BBAI's Revenue Miss

Analyzing the Q[Quarter] Earnings Report:

BigBear.ai's recent earnings report revealed a significant revenue miss, falling considerably short of analysts' expectations. [Insert specific figures here: e.g., "The company reported revenue of X, compared to the anticipated Y, representing a Z% shortfall."]. The company attributed this underperformance to [Insert company's explanation here. Be specific and cite the source, such as the earnings call transcript]. This shortfall also impacted other key financial metrics. For example, Earnings Per Share (EPS) was [Insert EPS figure], significantly lower than projections. Revenue growth rate showed a [Insert percentage and direction, e.g., negative X%] decline, further highlighting the severity of the underperformance. These figures, detailed in the BBAI earnings report and the earnings call transcript, paint a concerning picture of the company's immediate financial health. Keywords used include: "BBAI earnings," "revenue guidance," "financial performance," "earnings call transcript."

Impact on Investor Sentiment:

The market's reaction to BBAI's revenue miss was swift and negative. The BBAI stock price experienced a sharp drop of [Insert percentage and timeframe] following the announcement, reflecting a significant loss of investor confidence. Trading volume also increased dramatically, indicating heightened activity driven by investors reacting to the disappointing news. [Insert relevant data here, such as a link to a stock price chart or mention specific analyst ratings downgrades]. The negative sentiment is further evidenced by [mention any other indicators of decreased investor confidence, such as decreased institutional holdings or negative press coverage]. Keywords used: "investor confidence," "stock market reaction," "BBAI stock forecast."

Leadership Instability at BigBear.ai (BBAI): The CEO Transition

Details of the Leadership Change:

The revenue miss coincided with significant leadership changes at BigBear.ai. [Insert details of the CEO change here, including the reason for the departure – resignation, dismissal, etc.]. [Name the new CEO, if applicable], who brings [mention their background and relevant experience], now leads the company. This transition presents both opportunities and challenges. While a new leader might bring fresh perspectives and strategic direction, the leadership vacuum during the transition period can create uncertainty and potentially hinder operational efficiency. Keywords used: "BBAI CEO," "leadership transition," "management changes," "corporate governance."

Impact on Company Morale and Operations:

A CEO transition, especially one following disappointing financial results, can significantly impact employee morale. Uncertainty about the company's future direction and potential restructuring can lead to decreased productivity and increased employee turnover. The leadership change might also affect ongoing projects, potentially delaying contract fulfillment or impacting future partnerships. Maintaining operational stability during such a significant shift will be a critical challenge for the new leadership. Keywords used: "employee morale," "operational efficiency," "strategic direction," "BBAI future."

The Combined Impact: Revenue Miss and Leadership Instability

Synergistic Effects:

The combined effect of the revenue miss and leadership instability creates a significant challenge for BigBear.ai. The revenue shortfall undermines investor confidence, making it more difficult to attract capital and secure new contracts. Simultaneously, the leadership transition adds another layer of uncertainty, potentially delaying strategic decision-making and hindering efforts to address the underlying causes of the revenue shortfall. These factors work synergistically to exacerbate the company's challenges.

Long-Term Implications:

The long-term implications for BBAI depend on how effectively the new leadership addresses these challenges. Failure to swiftly improve financial performance and regain investor trust could lead to a further decline in the BBAI stock price, potential difficulty in attracting and retaining talent, and even the possibility of acquisition or restructuring. Conversely, a successful turnaround could strengthen the company's market position and pave the way for future growth.

Potential Recovery Strategies:

Several strategies could aid BBAI's recovery. These include [list potential strategies such as: cost-cutting measures, refocusing on core competencies, improved sales and marketing strategies, enhanced investor relations, securing new strategic partnerships, and demonstrating clear progress towards profitability]. The success of these strategies will depend on the new leadership's ability to execute them effectively and regain investor trust. Keywords used: "BBAI outlook," "market position," "recovery strategy," "long-term prospects."

Conclusion: BigBear.ai (BBAI): Navigating Uncertainty

BigBear.ai (BBAI) faces significant headwinds following its recent revenue miss and leadership change. The severity of the revenue shortfall, coupled with the uncertainty surrounding the CEO transition, poses substantial challenges to the company's short-term and long-term prospects. The impact on the BBAI stock price and investor confidence is undeniable. However, the situation is not without potential for recovery. The effectiveness of the new leadership in implementing a robust turnaround strategy will be crucial in determining BBAI's future. We encourage readers to conduct further BBAI stock analysis, actively monitoring BBAI's progress and staying informed about its strategic decisions and financial performance. Careful consideration of the BBAI future prospects is essential for any investor considering a position in this company. For further in-depth understanding, consider exploring independent BBAI investment resources and conducting thorough due diligence before making any investment decisions.

Featured Posts

-

Seth Rollins And Bron Breakkers Attack On Sami Zayn On Wwe Raw

May 21, 2025

Seth Rollins And Bron Breakkers Attack On Sami Zayn On Wwe Raw

May 21, 2025 -

Manchester City Eyeing Arsenal Great As Guardiolas Potential Replacement

May 21, 2025

Manchester City Eyeing Arsenal Great As Guardiolas Potential Replacement

May 21, 2025 -

Is It Time For A Logitech Forever Mouse A Critical Analysis

May 21, 2025

Is It Time For A Logitech Forever Mouse A Critical Analysis

May 21, 2025 -

North Carolina Report May 9 2025 A Summary Of Key Events

May 21, 2025

North Carolina Report May 9 2025 A Summary Of Key Events

May 21, 2025 -

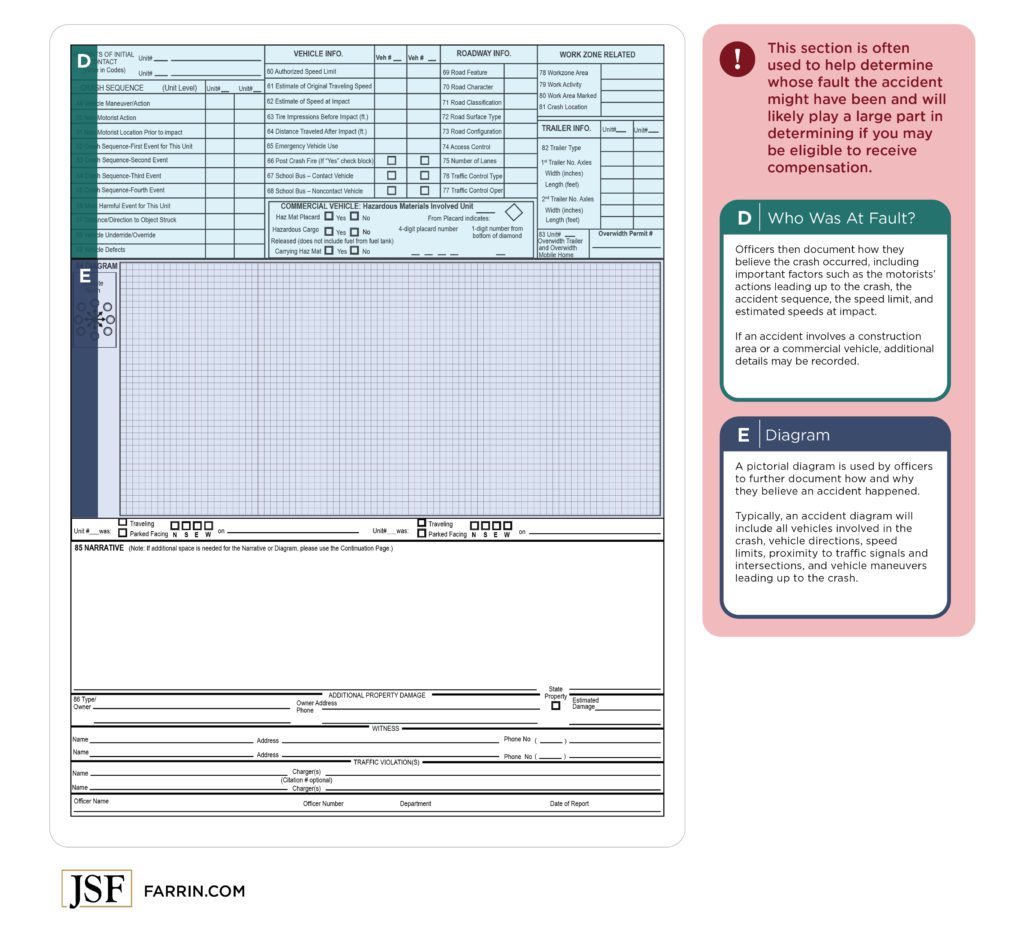

Why Did D Wave Quantum Qbts Stock Price Jump This Week

May 21, 2025

Why Did D Wave Quantum Qbts Stock Price Jump This Week

May 21, 2025

Latest Posts

-

Minister Limits Vybz Kartels Activities In Trinidad And Tobago

May 22, 2025

Minister Limits Vybz Kartels Activities In Trinidad And Tobago

May 22, 2025 -

Vybz Kartel Shows Support As Dancehall Stars Trinidad Visit Faces Restrictions

May 22, 2025

Vybz Kartel Shows Support As Dancehall Stars Trinidad Visit Faces Restrictions

May 22, 2025 -

Kartel Activities And The Rum Industry Insights From Stabroek News

May 22, 2025

Kartel Activities And The Rum Industry Insights From Stabroek News

May 22, 2025 -

Trinidad And Tobago Imposes Movement Restrictions On Vybz Kartel

May 22, 2025

Trinidad And Tobago Imposes Movement Restrictions On Vybz Kartel

May 22, 2025 -

Trinidad Trip Curtailed For Dancehall Artist Support From Kartel

May 22, 2025

Trinidad Trip Curtailed For Dancehall Artist Support From Kartel

May 22, 2025