BigBear.ai (BBAI) Retains Buy Rating: Defense Spending Fuels Investment

Table of Contents

The Rising Tide of Defense Spending and Its Impact on BBAI

Global defense budgets are experiencing significant growth, driven by geopolitical instability and the need for advanced technological capabilities. This rise presents a substantial opportunity for technology companies specializing in defense solutions, particularly those leveraging AI and data analytics. BigBear.ai, with its core competency in providing AI-powered solutions to defense and intelligence agencies, is well-positioned to capitalize on this trend.

- Increased demand for AI-powered solutions in national security: Modern warfare relies heavily on real-time data analysis and predictive modeling, making AI a critical asset for national defense. BBAI's AI algorithms excel in this area.

- Government contracts and funding opportunities for BigBear.ai: The increased defense spending translates directly into more government contracts and funding opportunities for companies like BBAI, bolstering revenue streams and driving growth.

- BBAI's competitive advantage in the defense tech sector: BigBear.ai possesses a unique blend of expertise in AI, data analytics, and cybersecurity, making it a preferred partner for defense organizations seeking cutting-edge solutions.

- Recent contracts and partnerships: [Insert specific examples of recent contracts or partnerships secured by BBAI with defense agencies if available. This adds credibility and strengthens the argument.]

BigBear.ai's (BBAI) Core Competencies and Technological Advantages

BigBear.ai's strength lies in its advanced AI capabilities and data analytics solutions tailored for the unique demands of the defense sector. Its technology goes beyond simple data processing; it provides actionable intelligence and predictive insights.

- Advanced AI algorithms for intelligence analysis: BBAI utilizes sophisticated algorithms to process and analyze vast amounts of intelligence data, identifying patterns and anomalies that would otherwise be missed.

- Big data processing and management capabilities: The company possesses the infrastructure and expertise to handle the massive datasets typical of defense applications, ensuring efficient and effective analysis.

- Cybersecurity solutions for government and defense organizations: In today's interconnected world, cybersecurity is paramount. BBAI offers robust cybersecurity solutions to protect sensitive government and defense data.

- Unique value proposition: BBAI's technology differentiates itself through its focus on delivering actionable intelligence, not just raw data, allowing defense agencies to make more informed decisions.

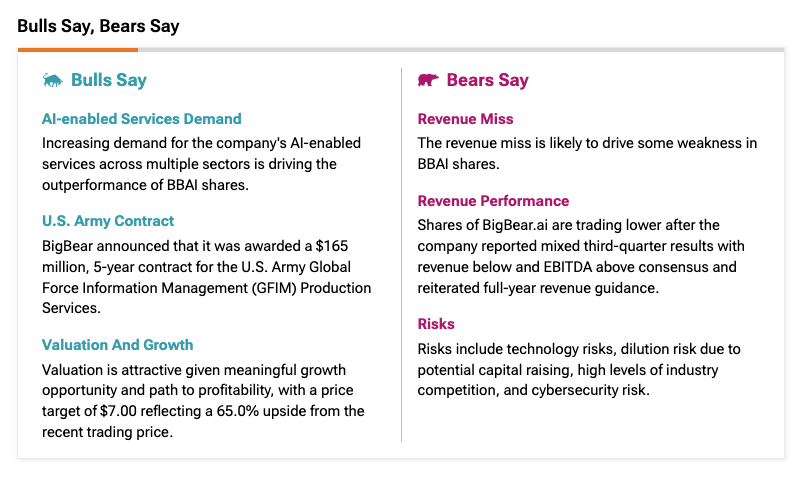

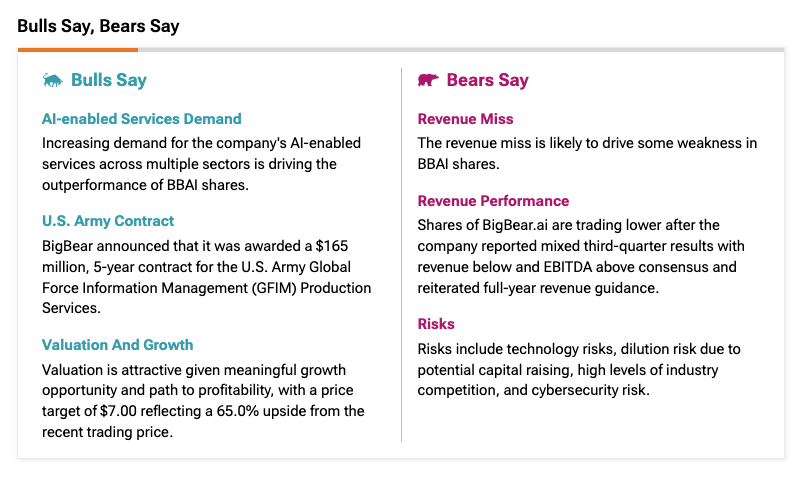

Analysis of the "Buy" Rating and Investment Considerations for BBAI Stock

The "Buy" rating assigned to BBAI stock by several analysts reflects a positive outlook driven by several factors. However, investors should carefully consider potential risks before investing.

- Analyst price targets and their justifications: [Insert details about analyst price targets and the reasoning behind them if available. Include citations where appropriate.]

- Long-term growth potential of BBAI: The ongoing growth in defense spending suggests substantial long-term growth potential for BBAI, making it an attractive investment for long-term investors.

- Risks associated with the defense sector and geopolitical uncertainties: Geopolitical instability and changes in defense priorities can impact the defense sector, posing a risk to BBAI's performance.

- Considerations for risk-tolerant vs. risk-averse investors: BBAI stock carries inherent risk, making it more suitable for risk-tolerant investors with a longer investment horizon.

- Financial Data: [Include relevant financial data such as P/E ratio, market capitalization, revenue growth, etc., if available. Source the data appropriately.]

Comparing BBAI to Competitors in the Defense Tech Space

BigBear.ai competes with other technology companies offering AI and analytics solutions to the defense sector. However, BBAI distinguishes itself through its specialized expertise and focus on delivering actionable intelligence.

- Comparison of market share and revenue: [Compare BBAI's market share and revenue to key competitors, if data is available. Cite your sources.]

- Analysis of technological capabilities and competitive advantages: BBAI’s unique AI algorithms and focus on actionable intelligence give it a competitive edge.

- Discussion of the overall competitive landscape: The defense technology sector is competitive, but BBAI's specialized expertise positions it for success.

Conclusion: Investing in the Future of Defense Technology with BigBear.ai (BBAI)

BigBear.ai (BBAI) stock presents a compelling investment opportunity, driven by the significant growth in global defense spending and BBAI's unique position as a leader in AI-powered defense solutions. While inherent risks exist within the defense sector, the long-term growth potential, fueled by increased demand for advanced technology, makes BBAI an attractive prospect for investors with a long-term perspective and a moderate-to-high risk tolerance. Remember to conduct thorough due diligence and consider your personal investment goals before making any investment decisions. Learn more about BigBear.ai (BBAI) and its investment potential today!

Featured Posts

-

Love Monster A Guide To Understanding The Complexities Of Love

May 21, 2025

Love Monster A Guide To Understanding The Complexities Of Love

May 21, 2025 -

David Walliams Vs Simon Cowell Bgts Explosive Row

May 21, 2025

David Walliams Vs Simon Cowell Bgts Explosive Row

May 21, 2025 -

Chicago Cubs Fans Hot Dog Moment Channels Lady And The Tramp

May 21, 2025

Chicago Cubs Fans Hot Dog Moment Channels Lady And The Tramp

May 21, 2025 -

Le Metier De Cordiste A Nantes Une Profession En Plein Essor

May 21, 2025

Le Metier De Cordiste A Nantes Une Profession En Plein Essor

May 21, 2025 -

Britains Got Talent David Walliams And Simon Cowells Public Feud Explodes

May 21, 2025

Britains Got Talent David Walliams And Simon Cowells Public Feud Explodes

May 21, 2025

Latest Posts

-

Vybz Kartels Brooklyn Shows A Night To Remember For Fans

May 22, 2025

Vybz Kartels Brooklyn Shows A Night To Remember For Fans

May 22, 2025 -

The Influence Of Rum Culture On Kartels A Stabroek News Report

May 22, 2025

The Influence Of Rum Culture On Kartels A Stabroek News Report

May 22, 2025 -

Vybz Kartels Sold Out Brooklyn Shows A Triumphant Return

May 22, 2025

Vybz Kartels Sold Out Brooklyn Shows A Triumphant Return

May 22, 2025 -

Stabroek News Examining The Intersection Of Kartel And Rum Culture

May 22, 2025

Stabroek News Examining The Intersection Of Kartel And Rum Culture

May 22, 2025 -

Minister Limits Vybz Kartels Activities In Trinidad And Tobago

May 22, 2025

Minister Limits Vybz Kartels Activities In Trinidad And Tobago

May 22, 2025