BigBear.ai (BBAI) Stock: Analyst Downgrade Sparks Investor Worry

Table of Contents

The Analyst Downgrade: Reasons and Implications

Several prominent analyst firms have recently downgraded their rating on BigBear.ai (BBAI) stock. Specifically, [Insert Name of Analyst Firm 1] lowered its rating from [Previous Rating] to [New Rating], citing concerns about [Specific Reason 1, e.g., slower-than-expected revenue growth in Q[Quarter]]. Similarly, [Insert Name of Analyst Firm 2] adjusted its rating from [Previous Rating] to [New Rating], highlighting concerns about [Specific Reason 2, e.g., increased competition in the AI market].

- Specific reasons provided by analysts:

- Slower-than-anticipated revenue growth.

- Increased competition from established players in the AI sector.

- Concerns regarding the company's ability to secure large government contracts.

- Potential challenges in integrating recent acquisitions.

- Target price changes: [Insert details about target price changes from different analyst firms]. For example, "[Analyst Firm 1] lowered its price target from $[Previous Target Price] to $[New Target Price]."

- Comparison to previous ratings: The downgrades represent a significant shift from previous, more positive ratings, indicating a growing pessimism surrounding BBAI's short-term prospects.

The immediate impact of these downgrades was a noticeable drop in the BBAI stock price. [Insert data on stock price movement, ideally with a chart or graph showing the price fluctuation following the downgrade]. This volatility underscores the sensitivity of BBAI's stock price to analyst sentiment.

BigBear.ai's Business Model and Recent Performance

BigBear.ai operates in the rapidly evolving artificial intelligence and data analytics market. Its business model centers on providing advanced AI-powered solutions to government and commercial clients, focusing on areas such as [mention key areas like cybersecurity, intelligence analysis, etc.]. The company offers a range of services and products, including [mention specific offerings, e.g., data analytics platforms, AI-driven decision support tools].

Analyzing BBAI's recent financial performance reveals a mixed picture. While the company has reported [mention positive aspects, e.g., growth in specific segments], it has also faced challenges in [mention negative aspects, e.g., meeting revenue projections].

- Key revenue streams: Government contracts, commercial partnerships, software licenses.

- Recent contract wins or losses: [List significant contract wins and losses, specifying the impact on revenue].

- Comparison to industry competitors: BigBear.ai faces stiff competition from larger, more established players in the AI and data analytics market. [Compare BBAI's performance against key competitors, highlighting strengths and weaknesses].

The relatively weak financial performance, particularly compared to expectations, directly contributed to the negative analyst sentiment and subsequent downgrades.

Investor Sentiment and Future Outlook for BBAI Stock

Following the analyst downgrades, investor sentiment towards BBAI stock has soured, leading to significant sell-offs. However, this downturn also presents potential buying opportunities for investors with a long-term outlook.

- Short-term and long-term price predictions: [Include predictions from reputable sources, emphasizing the uncertainty inherent in such forecasts].

- Potential catalysts that could impact BBAI's stock price: Securing major government contracts, successful product launches, improved financial performance, and positive changes in the broader market conditions could positively influence BBAI's stock price. Conversely, further contract losses, heightened competition, or regulatory hurdles could negatively impact its performance.

- Risks associated with investing in BBAI stock: The high volatility of the stock price, dependence on government contracts, competitive pressure, and the inherent risks of investing in a growth-stage technology company should all be considered.

While the current outlook is cautious, some analysts maintain a bullish stance on BigBear.ai, highlighting its potential for long-term growth in the rapidly expanding AI market. Others, however, remain bearish, pointing to the current challenges and the intense competition.

Conclusion

The analyst downgrades have significantly impacted BigBear.ai (BBAI) stock, causing considerable price volatility and investor concern. The reasons behind these downgrades include slower-than-expected revenue growth, increased competition, and concerns about securing large contracts. While the short-term outlook appears uncertain, the long-term potential of BBAI remains a subject of debate among analysts. Before making any investment decisions regarding BigBear.ai (BBAI) stock, it's crucial to conduct thorough research, carefully weigh the risks and opportunities, and monitor BBAI's performance closely. Stay informed on BBAI stock movements and learn more about the BigBear.ai (BBAI) stock situation to make informed investment choices.

Featured Posts

-

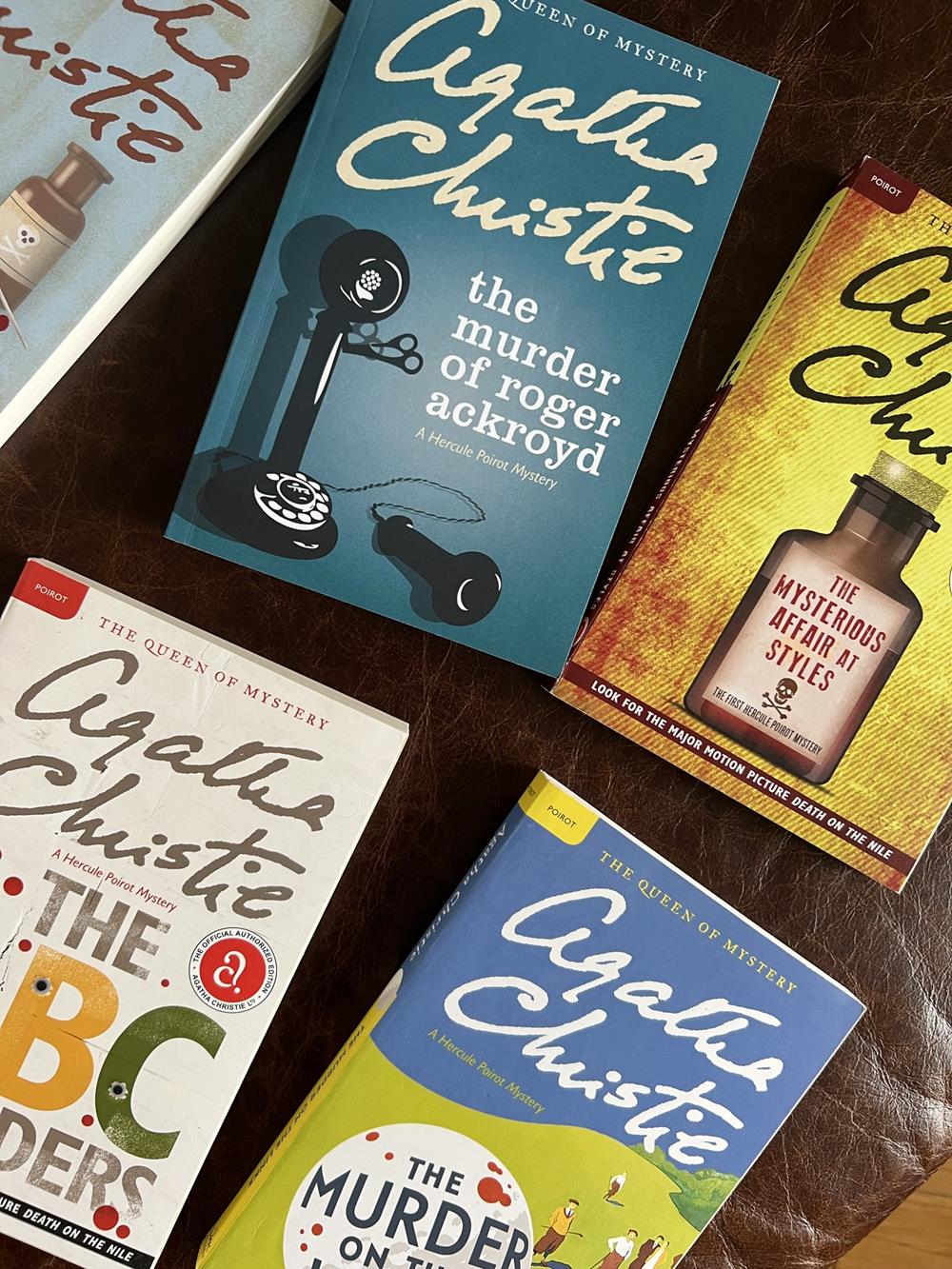

Exploring The World Of Agatha Christies Poirot From Books To Screen

May 20, 2025

Exploring The World Of Agatha Christies Poirot From Books To Screen

May 20, 2025 -

Apples Llm Siri A Comeback Strategy

May 20, 2025

Apples Llm Siri A Comeback Strategy

May 20, 2025 -

Affaire Jaminet Accord Trouve Pour Le Remboursement Des 450 000 E

May 20, 2025

Affaire Jaminet Accord Trouve Pour Le Remboursement Des 450 000 E

May 20, 2025 -

Thousands Of Uk Taxpayers Exempt From Filing Returns Hmrcs New Rules

May 20, 2025

Thousands Of Uk Taxpayers Exempt From Filing Returns Hmrcs New Rules

May 20, 2025 -

79 Manazerov Uprednostnuje Osobne Stretnutia Home Office Vs Kancelaria

May 20, 2025

79 Manazerov Uprednostnuje Osobne Stretnutia Home Office Vs Kancelaria

May 20, 2025

Latest Posts

-

Sydney Sweeney New Film Role Following Echo Valley And The Housemaid Success

May 21, 2025

Sydney Sweeney New Film Role Following Echo Valley And The Housemaid Success

May 21, 2025 -

What Is Sydney Sweeney Working On After Echo Valley And The Housemaid New Film Role Revealed

May 21, 2025

What Is Sydney Sweeney Working On After Echo Valley And The Housemaid New Film Role Revealed

May 21, 2025 -

Sydney Sweeneys Post Echo Valley And The Housemaid Projects Whats Next For The Newly Single Actress

May 21, 2025

Sydney Sweeneys Post Echo Valley And The Housemaid Projects Whats Next For The Newly Single Actress

May 21, 2025 -

Daftar Lengkap Juara Premier League Sepuluh Tahun Terakhir Dan Prediksi Musim Depan

May 21, 2025

Daftar Lengkap Juara Premier League Sepuluh Tahun Terakhir Dan Prediksi Musim Depan

May 21, 2025 -

Liverpool Juara Liga Inggris Siapa Pelatih Yang Berjasa 2024 2025

May 21, 2025

Liverpool Juara Liga Inggris Siapa Pelatih Yang Berjasa 2024 2025

May 21, 2025