BigBear.ai Faces Securities Fraud Allegations

Table of Contents

Securities fraud, in simple terms, involves intentionally misleading investors about a company's financial health or prospects to manipulate stock prices for personal gain. This can involve misrepresenting financial statements, omitting crucial information, or engaging in insider trading. The consequences of securities fraud are severe, ranging from significant financial penalties to criminal charges.

This article aims to provide a comprehensive overview of the allegations against BigBear.ai, analyze their potential impact on the company and its investors, and offer practical advice for navigating this complex situation.

The Allegations Against BigBear.ai

The allegations of BigBear.ai securities fraud center around claims of financial misrepresentation and accounting irregularities. While specific details are still emerging and subject to ongoing investigation, several sources, including SEC filings and news reports, point to a pattern of potentially misleading statements made to investors. These alleged actions constitute material misstatements, potentially violating federal securities laws. An investor lawsuit has already been filed, indicating the seriousness of the accusations.

- Specific Examples: Allegations include the overstatement of revenue, the underreporting of expenses, and the misrepresentation of the company's technological capabilities and contract wins. Precise figures and specifics remain under investigation.

- Timeline: The timeline of events leading to the allegations is still under scrutiny by regulatory bodies. However, reports suggest that concerns began to emerge [Insert timeframe, citing source if possible].

- Key Figures: Several key figures within BigBear.ai’s management and accounting departments are reportedly under investigation in connection with these allegations. [Insert names and titles if available, citing source].

Potential Impact on BigBear.ai's Stock and Operations

The allegations of BigBear.ai securities fraud have already had a significant impact on the company's stock price, causing substantial volatility. Investor confidence has plummeted, resulting in a dramatic decrease in market capitalization. This stock price volatility is likely to continue until the investigations are concluded and the full extent of the alleged fraudulent activities is determined.

- Stock Price Fluctuations: Since the allegations surfaced, BigBear.ai's stock price has experienced [Describe the fluctuations with data, citing sources].

- Potential for Delisting or Bankruptcy: The severity of the allegations raises concerns about the potential for delisting from the stock exchange or even bankruptcy, depending on the outcome of the legal proceedings.

- Impact on Operations: The scandal is likely to negatively impact the company's ability to secure new contracts, retain employees, and maintain positive relationships with clients and partners. Employee morale and retention are significant concerns.

Legal Ramifications and Ongoing Investigations

The legal ramifications of these BigBear.ai securities fraud allegations are substantial. The SEC investigation is ongoing, and the potential penalties for the company and its executives are severe. This could include significant fines, civil penalties, and even criminal charges. A class-action lawsuit filed by affected investors further complicates the legal landscape.

- Legal Actions: The SEC investigation is underway, and the potential legal actions include civil and criminal charges related to securities fraud.

- Potential Outcomes: Potential outcomes range from hefty financial penalties and mandated corporate reforms to criminal convictions and prison sentences for implicated individuals.

- Timeline: The legal proceedings are expected to be lengthy and complex, potentially stretching over several years.

Advice for Investors

For investors currently holding BigBear.ai stock or considering investing, it’s crucial to exercise caution and prioritize due diligence and risk management. The situation is inherently risky, and the potential for further losses is significant.

- Actions for Investors: Investors should carefully consider their risk tolerance and consult with a financial advisor before making any decisions concerning their BigBear.ai holdings. Diversification of investment portfolios is strongly recommended.

- Importance of Financial Advice: Seeking guidance from a qualified financial advisor is crucial to make informed decisions about the management of your investment portfolio in light of this developing situation.

- Strategies for Mitigating Losses: Strategies for mitigating potential losses might include selling existing shares or carefully assessing the potential for recovery before making further investments.

Conclusion: Understanding the BigBear.ai Securities Fraud Allegations

The BigBear.ai securities fraud allegations represent a serious situation with significant implications for the company, its investors, and the broader investment community. The ongoing investigations and legal proceedings will determine the full extent of the alleged fraudulent activities and their ultimate consequences. The potential impact on BigBear.ai's stock price, operations, and future prospects remains substantial. To protect their interests, investors need to carefully monitor BigBear.ai securities fraud updates, understand the risks of BigBear.ai investments, and conduct thorough research before making any investment decisions related to BigBear.ai or similar companies. Stay informed, consult with financial professionals, and make prudent choices to safeguard your financial future. Learn more about BigBear.ai securities fraud by following reputable news sources and official statements from regulatory bodies.

Featured Posts

-

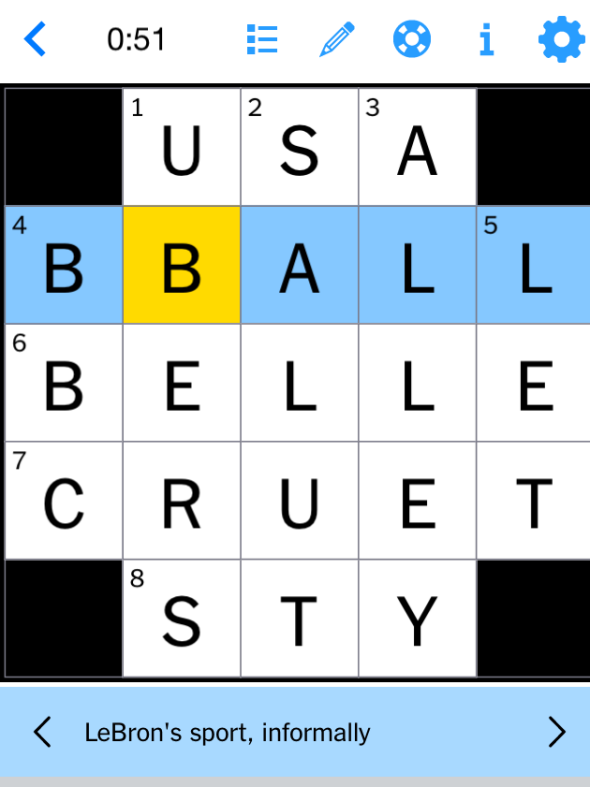

Finding Answers Nyt Mini Crossword Hints April 26 2025

May 21, 2025

Finding Answers Nyt Mini Crossword Hints April 26 2025

May 21, 2025 -

Funko Unveils Official Dexter Pop Vinyl Figures

May 21, 2025

Funko Unveils Official Dexter Pop Vinyl Figures

May 21, 2025 -

Real Madrid In Gelecegi Ancelotti Den Sonra Yeni Bir Doenem

May 21, 2025

Real Madrid In Gelecegi Ancelotti Den Sonra Yeni Bir Doenem

May 21, 2025 -

Navigating School Delays A Parents Guide To Winter Weather Advisories

May 21, 2025

Navigating School Delays A Parents Guide To Winter Weather Advisories

May 21, 2025 -

Section 230 And Banned Chemicals A Judges Ruling Impacts E Bay Listings

May 21, 2025

Section 230 And Banned Chemicals A Judges Ruling Impacts E Bay Listings

May 21, 2025

Latest Posts

-

Regreso A La Forma La Salud Y La Productividad De Javier Baez

May 22, 2025

Regreso A La Forma La Salud Y La Productividad De Javier Baez

May 22, 2025 -

Reddit Post Headed To The Big Screen Sydney Sweeney To Star In Warner Bros Production

May 22, 2025

Reddit Post Headed To The Big Screen Sydney Sweeney To Star In Warner Bros Production

May 22, 2025 -

Analisis Del Rendimiento De Javier Baez Salud Y Productividad

May 22, 2025

Analisis Del Rendimiento De Javier Baez Salud Y Productividad

May 22, 2025 -

Javier Baez Luchando Por La Salud Y La Productividad

May 22, 2025

Javier Baez Luchando Por La Salud Y La Productividad

May 22, 2025 -

Reddits Viral Missing Girl Story Fact Or Fiction A Sydney Sweeney Film

May 22, 2025

Reddits Viral Missing Girl Story Fact Or Fiction A Sydney Sweeney Film

May 22, 2025