BigBear.ai Holdings, Inc. (BBAI): Analyzing The Potential Of This AI Penny Stock

Table of Contents

Understanding BigBear.ai's (BBAI) Business Model and AI Capabilities

BigBear.ai (BBAI) is a technology company specializing in providing advanced AI-powered solutions and data analytics services. Their business model centers on leveraging cutting-edge artificial intelligence to solve complex problems across various sectors.

Core Services and Technologies

BigBear.ai offers a range of AI solutions designed to address the data challenges faced by its clients. These include:

- Predictive Analytics: Utilizing machine learning algorithms to forecast future trends and outcomes.

- Machine Learning Models: Developing custom models for specific client needs, enabling improved decision-making.

- Data Analytics and Visualization: Transforming raw data into actionable insights through sophisticated visualization tools.

- Cybersecurity Solutions: Leveraging AI to enhance cybersecurity defenses and protect sensitive information.

These technologies differentiate BBAI in the market by offering tailored, AI-driven solutions that go beyond simple data analysis, providing clients with predictive capabilities and proactive risk mitigation strategies. Key terms: BigBear.ai services, AI solutions, data analytics, machine learning, predictive modeling.

Target Markets and Client Base

BigBear.ai's client base spans various sectors, including:

- Government: Providing AI-driven solutions for national security, intelligence, and defense applications.

- Defense: Developing advanced technologies for military applications, enhancing situational awareness and operational efficiency.

- Commercial: Offering data analytics and AI solutions to improve efficiency and decision-making in commercial enterprises.

The company boasts several significant government contracts, which demonstrate its credibility and market penetration within the crucial defense and government sectors. The market for AI-powered solutions is experiencing explosive growth, indicating strong potential for future expansion and revenue generation for BBAI. Keywords: BigBear.ai clients, government contracts, defense industry, commercial applications, market growth.

Analyzing the Risks and Rewards of Investing in BBAI as a Penny Stock

Investing in penny stocks like BBAI presents a unique blend of risk and reward. Understanding both aspects is crucial before making any investment decisions.

Potential Risks

The inherent volatility of penny stocks is a major risk factor. BBAI stock price fluctuations can be dramatic, leading to substantial losses if the investment is not carefully managed. Other potential risks include:

- Financial Instability: BBAI's financial performance needs careful scrutiny, as any setbacks could significantly impact its stock price.

- Competition: The AI sector is highly competitive, and BBAI faces challenges from established players and emerging startups.

- Regulatory Hurdles: Navigating regulatory landscapes in the government and defense sectors can present challenges and delays.

These risks must be carefully considered before investing. Keywords: Penny stock risks, BBAI volatility, investment risks, financial risk, competitive landscape.

Potential Rewards

Despite the risks, the potential rewards of investing in BBAI are significant. The company's focus on a rapidly growing sector—artificial intelligence—offers considerable growth potential. Potential catalysts for price appreciation include:

- Successful Contract Wins: Securing large government or commercial contracts could significantly boost revenue and investor confidence.

- Technological Advancements: Innovation and development of new AI technologies could drive increased market share and valuation.

- Strategic Partnerships: Collaborations with larger tech companies or industry leaders could open up new market opportunities.

The potential for high returns makes BBAI an attractive proposition for investors with a higher risk tolerance. Keywords: BBAI potential returns, high-growth potential, AI market growth, investment opportunities.

Financial Performance and Future Outlook of BigBear.ai (BBAI)

Analyzing BBAI's financial performance and future outlook requires a careful review of several key metrics.

Recent Financial Results

[Insert a brief overview of BBAI's recent financial performance here, including relevant data such as revenue, earnings, and key financial ratios. Include charts if possible. Source the data appropriately.] This section should offer a concise and objective assessment of the company's recent financial health. Keywords: BBAI financials, revenue growth, earnings, financial performance, key metrics.

Growth Projections and Analyst Opinions

[Insert a summary of analyst forecasts and predictions for BBAI's future performance. Include information on factors influencing the outlook, such as market trends and competitive dynamics. Again, properly cite all sources.] This section should provide a balanced perspective on analyst opinions and potential growth trajectories. Keywords: BBAI forecast, analyst ratings, growth projections, market outlook.

Conclusion: Is BigBear.ai (BBAI) a Smart Investment? Your Next Steps

BigBear.ai (BBAI) presents a compelling investment opportunity within the rapidly expanding AI sector. However, its status as an AI penny stock necessitates a cautious approach. The potential for high returns is undeniable, but the inherent risks associated with penny stocks and the competitive landscape of the AI market cannot be ignored.

This analysis highlights the need for thorough due diligence before making any investment decision regarding BBAI stock. Weigh the potential rewards against the inherent risks, and remember that past performance is not indicative of future results. Consult with a qualified financial advisor to assess your risk tolerance and determine if BBAI aligns with your investment strategy. Further research into BigBear.ai's financials, competitive positioning, and market outlook is crucial before committing capital. Remember, investing in BigBear.ai (BBAI) or any AI penny stock requires careful consideration and a balanced understanding of both the upside and downside potential.

Featured Posts

-

Kaellman Ja Hoskonen Loppu Puolassa Mitae Seuraavaksi

May 21, 2025

Kaellman Ja Hoskonen Loppu Puolassa Mitae Seuraavaksi

May 21, 2025 -

Obstacles To Clean Energy Adoption A Comprehensive Overview

May 21, 2025

Obstacles To Clean Energy Adoption A Comprehensive Overview

May 21, 2025 -

Australian Foot Crossing New Speed Record Set By Man

May 21, 2025

Australian Foot Crossing New Speed Record Set By Man

May 21, 2025 -

Analysis Abc Cbs And Nbcs Handling Of The New Mexico Gop Arson Attack Coverage

May 21, 2025

Analysis Abc Cbs And Nbcs Handling Of The New Mexico Gop Arson Attack Coverage

May 21, 2025 -

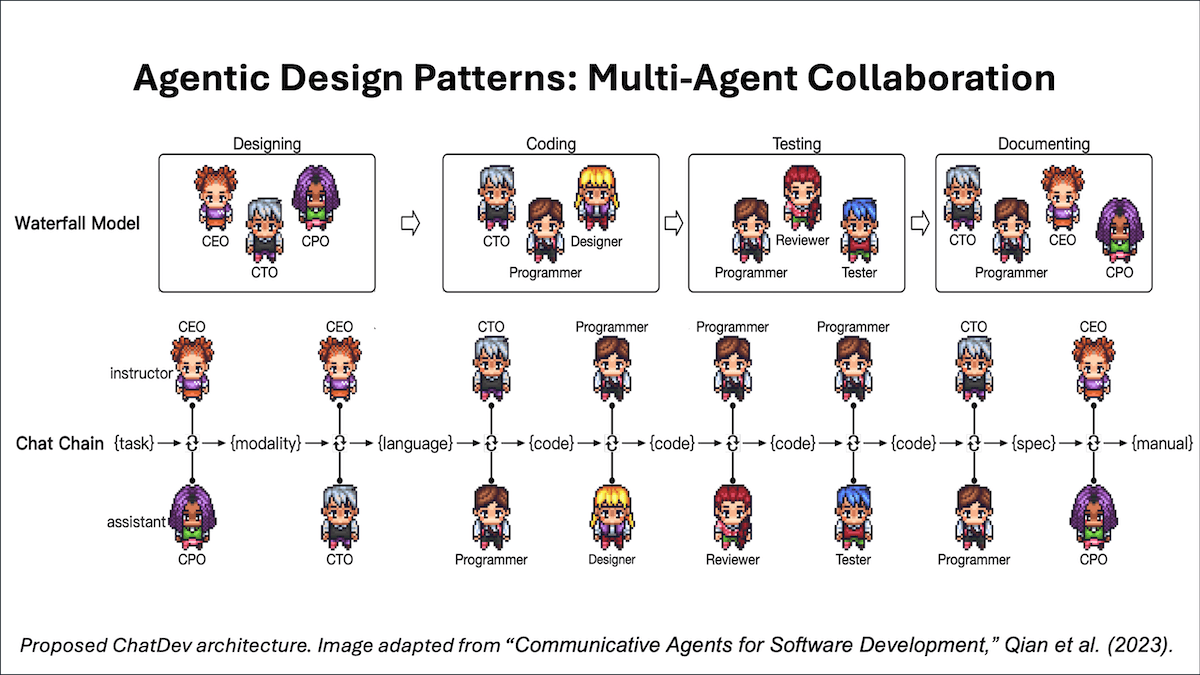

Chat Gpts Ai Coding Agent Features Benefits And Use Cases

May 21, 2025

Chat Gpts Ai Coding Agent Features Benefits And Use Cases

May 21, 2025

Latest Posts

-

Vybz Kartel Speaks Out Prison Life Freedom Family And New Music

May 22, 2025

Vybz Kartel Speaks Out Prison Life Freedom Family And New Music

May 22, 2025 -

Trinidad Concert Minister Debates Age Limits And Song Censorship For Kartel Performance

May 22, 2025

Trinidad Concert Minister Debates Age Limits And Song Censorship For Kartel Performance

May 22, 2025 -

Potential Ban And Age Restrictions For Kartels Upcoming Trinidad Concert

May 22, 2025

Potential Ban And Age Restrictions For Kartels Upcoming Trinidad Concert

May 22, 2025 -

Beenie Mans New York Takeover Is It A Streaming Event

May 22, 2025

Beenie Mans New York Takeover Is It A Streaming Event

May 22, 2025 -

Historic Night Vybz Kartel Live In New York

May 22, 2025

Historic Night Vybz Kartel Live In New York

May 22, 2025