BigBear.ai Stock: Risk Assessment And Potential Returns

Table of Contents

BigBear.ai stock presents a compelling investment opportunity in the rapidly expanding artificial intelligence (AI) sector. However, like any growth stock, especially within the volatile AI market, it carries inherent risks. This article provides a comprehensive risk assessment and explores the potential returns associated with investing in BigBear.ai, equipping you with the information needed to make an informed decision. Understanding both the potential upside and the potential downsides is critical before considering a BigBear.ai investment.

Understanding BigBear.ai's Business Model and Market Position

Core Competencies and AI Solutions

BigBear.ai offers a suite of AI-powered solutions targeting diverse sectors. Their core competencies lie in providing advanced data analytics, robust cybersecurity solutions, and sophisticated geospatial intelligence solutions. These AI solutions are deployed across various industries, leveraging their expertise to solve complex problems.

- Successful Projects: BigBear.ai has secured contracts with government agencies and private sector clients for projects involving threat detection, predictive analytics, and mission-critical data processing. Specific examples often remain confidential due to the sensitive nature of their work.

- Quantifiable Achievements: While precise figures may be limited due to public company reporting requirements, BigBear.ai showcases consistent revenue growth and client acquisition, indicating a growing market demand for their services. Financial reports should be consulted for detailed performance metrics.

Competitive Landscape and Market Share

BigBear.ai operates in a competitive AI market, facing established players and emerging startups. Key competitors include companies specializing in data analytics, cybersecurity, and geospatial intelligence, each with their own strengths and weaknesses.

- Key Competitors: Direct comparisons require in-depth analysis of competitor financial performance and market share, which is beyond the scope of this general risk assessment. However, analyzing competitors' financial reports and news releases is crucial for a thorough BigBear.ai stock analysis.

- BigBear.ai's Unique Selling Propositions: BigBear.ai differentiates itself through its integrated approach, combining various AI technologies to provide comprehensive solutions. Their focus on high-value, mission-critical applications in sectors like defense and intelligence provides a competitive edge.

Assessing the Risks Associated with BigBear.ai Stock

Financial Risk

Assessing the financial risk of BigBear.ai requires a thorough examination of their financial statements, including revenue growth, profitability, and debt levels. Analyzing trends in these key metrics is vital.

- Key Financial Metrics: Investors should review BigBear.ai's publicly available financial reports to assess their revenue growth trajectory, profit margins, and debt-to-equity ratio. Comparison to industry benchmarks will assist in gauging financial health.

- Potential Future Financial Challenges: Growth stocks, by their nature, often experience periods of uneven profitability. Careful consideration of potential market downturns and their impact on BigBear.ai's revenue streams is essential.

Market Risk

The AI sector is inherently volatile, subject to rapid technological advancements, shifting market trends, and economic uncertainty.

- Market Volatility: The stock price of BigBear.ai, like many AI stocks, is likely to experience fluctuations due to overall market volatility, investor sentiment towards AI technology, and sector-specific news.

- Factors Impacting Stock Price: Changes in government regulations concerning AI technology, the emergence of disruptive technologies, and broader economic downturns are all factors that could influence BigBear.ai's stock price. Geopolitical risk could also play a role, depending on the company's client base and operations.

Technological Risk

The rapid pace of innovation in AI presents both opportunities and risks. BigBear.ai faces the challenge of adapting to ongoing technological changes.

- Potential Technological Advancements: New algorithms, computational advancements, and competing technologies pose an obsolescence risk. BigBear.ai must constantly innovate to remain competitive.

- Adaptation Strategy: Assessing BigBear.ai’s capacity for continuous innovation, investment in R&D, and ability to adapt to new technologies is crucial when evaluating the technological risk associated with this AI stock.

Evaluating the Potential Returns of BigBear.ai Stock

Growth Potential in the AI Market

The AI market is expected to experience substantial growth in the coming years. BigBear.ai's positioning within this market offers significant potential for future growth.

- Market Size Projections: Industry reports provide forecasts for the AI market's overall growth. Understanding BigBear.ai’s market share within these projections is key to assessing their long-term potential.

- Strategies for Capturing Market Share: BigBear.ai’s strategy for expanding its client base, developing new AI solutions, and penetrating new markets directly impacts their ability to capitalize on market growth.

Valuation and Investment Strategy

Determining BigBear.ai's intrinsic value and selecting a suitable investment strategy are vital.

- Stock Valuation: Various valuation methods exist, each with inherent limitations. Employing multiple valuation techniques provides a more comprehensive assessment.

- Investment Strategies: Long-term investors might benefit from potential long-term growth, while short-term traders might seek quick gains based on market volatility. Your risk tolerance should dictate your approach. Remember, past performance is not indicative of future results.

Conclusion

Investing in BigBear.ai stock involves navigating a landscape of significant risks and potential rewards. The financial health of the company, the competitive dynamics of the AI market, and the inherent volatility of growth stocks all contribute to the overall risk profile. However, the potential for substantial returns, driven by growth in the AI sector and BigBear.ai's strategic position, remains attractive to some investors.

Investing in BigBear.ai stock requires a careful assessment of both the risks and potential rewards. This analysis provides a starting point for your own research. Conduct further due diligence and consider your personal risk tolerance before making any investment decisions related to BigBear.ai stock or any other AI stock. Remember, thorough research is crucial when considering a BigBear.ai investment. Consult with a financial advisor before making any investment decisions.

Featured Posts

-

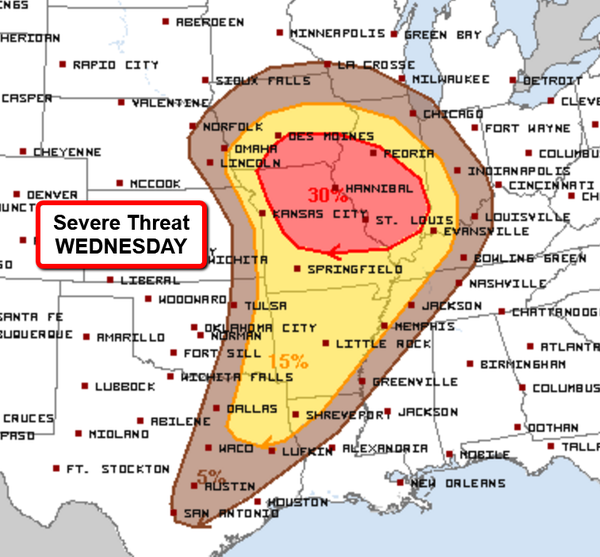

Fast Moving Storms Recognizing And Responding To Damaging Winds

May 20, 2025

Fast Moving Storms Recognizing And Responding To Damaging Winds

May 20, 2025 -

Hmrc Nudge Letters Dont Ignore This Important Update

May 20, 2025

Hmrc Nudge Letters Dont Ignore This Important Update

May 20, 2025 -

Nyt Mini Crossword Solutions For March 13th

May 20, 2025

Nyt Mini Crossword Solutions For March 13th

May 20, 2025 -

Xronia Provlimata Stoys Sidirodromoys Mia Vathyteri Matia Stin Katastasi

May 20, 2025

Xronia Provlimata Stoys Sidirodromoys Mia Vathyteri Matia Stin Katastasi

May 20, 2025 -

I Tzenifer Lorens Mia Deyteri Kori Gia Tin Ithopoio

May 20, 2025

I Tzenifer Lorens Mia Deyteri Kori Gia Tin Ithopoio

May 20, 2025

Latest Posts

-

David Walliams Fing The Fantasy Film Greenlit By Stan

May 21, 2025

David Walliams Fing The Fantasy Film Greenlit By Stan

May 21, 2025 -

Everything You Need To Know About Sandylands U On Tv

May 21, 2025

Everything You Need To Know About Sandylands U On Tv

May 21, 2025 -

Fing A Look At David Walliams New Fantasy Project Greenlit By Stan

May 21, 2025

Fing A Look At David Walliams New Fantasy Project Greenlit By Stan

May 21, 2025 -

Sandylands U Full Episode Guide And Air Dates

May 21, 2025

Sandylands U Full Episode Guide And Air Dates

May 21, 2025 -

David Walliams Fing Stans Greenlight And Production Details

May 21, 2025

David Walliams Fing Stans Greenlight And Production Details

May 21, 2025