BigBear.ai Stock Takes A Hit After Below-Expectations Q1

Table of Contents

Q1 Earnings Miss Expectations: Key Financial Metrics Reveal Weakness

BigBear.ai's Q1 earnings report revealed a significant shortfall in several key financial metrics, underscoring the weakness in the company's performance. This underperformance directly impacted BigBear.ai stock, contributing to its sharp decline.

Revenue Shortfall: A Significant Blow to BigBear.ai Stock

The reported revenue fell considerably short of analyst expectations. Compared to the projected $XX million, BigBear.ai only generated $YY million, representing a ZZ% decrease.

- Q1 2024 Revenue: $YY million

- Analyst Estimate: $XX million

- Difference: ZZ% shortfall

This shortfall was particularly noticeable in the [Specific Sector 1] and [Specific Sector 2] segments, which experienced significant revenue declines compared to the previous quarter and the same period last year. A visual representation of this revenue shortfall can be found in [insert chart/graph here, if available]. This revenue miss is a major factor contributing to the negative sentiment surrounding BigBear.ai stock.

Contracting Challenges: Obstacles in Securing New Business

BigBear.ai also encountered difficulties in securing new contracts, contributing to the overall revenue shortfall. The company faced stiff competition and experienced delays in several key projects.

- Loss of the [Contract Name] contract to a competitor.

- Significant delays in the [Project Name] project, impacting revenue recognition.

- Concerns about the company's ability to effectively compete in the crowded [Industry Sector] market.

This inability to secure new contracts and deliver existing ones effectively indicates potential weaknesses in BigBear.ai's sales pipeline and competitive strategy, further impacting investor confidence in BigBear.ai stock.

Increased Operating Expenses: Adding Pressure to Profitability

Adding to the pressure, BigBear.ai reported a substantial increase in operating expenses. This expense growth, coupled with the revenue shortfall, significantly impacted profitability and negatively affected BigBear.ai stock.

- Significant increases in [Specific Expense Category 1], [Specific Expense Category 2], and [Specific Expense Category 3].

- Increased spending on research and development, potentially indicating investment in future growth but impacting short-term profitability.

- Lack of efficiency in cost management compared to industry peers.

Market Reaction and Investor Sentiment: Analyzing the Stock Price Drop

The market reacted swiftly and negatively to BigBear.ai's Q1 earnings report, resulting in a substantial drop in the company's stock price.

Immediate Stock Price Impact: A Sharp Decline

BigBear.ai stock experienced a dramatic [percentage]% drop immediately following the announcement.

- Stock Price Before Announcement: $[Price]

- Stock Price After Announcement: $[Price]

- Trading Volume: [Volume] – significantly higher than the average daily volume, indicating intense investor activity.

[Insert chart/graph here showing stock price movement]. This sharp decline reflects the market's immediate assessment of the disappointing financial results.

Analyst Downgrades and Target Price Adjustments: A Loss of Confidence

Following the Q1 results, several prominent analysts downgraded their ratings for BigBear.ai stock and adjusted their target prices downward.

- [Analyst Name] downgraded BigBear.ai from [Rating] to [Rating], citing concerns about [Reason].

- [Analyst Name] lowered the target price from $[Price] to $[Price], reflecting the reduced expectations for future performance.

These downgrades reflect the growing skepticism among analysts regarding BigBear.ai's ability to meet future expectations.

Investor Concerns and Future Outlook: Uncertainty Looms

Investor sentiment surrounding BigBear.ai stock has turned overwhelmingly negative. Social media and financial news sites reflect concerns about the company's long-term viability and its ability to overcome the challenges it faces.

BigBear.ai's Response and Future Strategies: Looking Ahead

BigBear.ai's management acknowledged the disappointing Q1 results and outlined several strategies aimed at improving performance.

Management Commentary: Acknowledging Shortcomings and Outlining Plans

In a statement, the CEO [CEO Name] expressed disappointment with the Q1 results but emphasized the company's commitment to implementing necessary changes to improve future performance. [Include a relevant quote from the CEO].

Potential Turnaround Strategies: A Path to Recovery?

BigBear.ai is exploring various strategies for a turnaround, including:

- Cost-cutting measures to improve operational efficiency.

- Restructuring plans to streamline operations and improve focus.

- Potential partnerships or acquisitions to expand its market reach and capabilities.

Conclusion: The Future of BigBear.ai Stock: A Cautious Outlook

BigBear.ai stock's recent decline is primarily attributed to the disappointing Q1 earnings, characterized by a revenue shortfall, contracting challenges, and increased operating expenses. Investor concerns remain significant, and uncertainty surrounds the company's ability to execute its turnaround strategies. While the potential for recovery exists, investors should approach BigBear.ai stock with caution. Stay informed about future developments concerning BigBear.ai stock and conduct thorough research before making any investment decisions. For further in-depth analysis, refer to [link to reputable financial news source].

Featured Posts

-

Wtt Contender Chennai 2025 Sharath Kamals Final Match And Farewell

May 21, 2025

Wtt Contender Chennai 2025 Sharath Kamals Final Match And Farewell

May 21, 2025 -

Zoey Starks Injury What Happened On Wwe Raw

May 21, 2025

Zoey Starks Injury What Happened On Wwe Raw

May 21, 2025 -

Exploring The Different Facets Of The Love Monster

May 21, 2025

Exploring The Different Facets Of The Love Monster

May 21, 2025 -

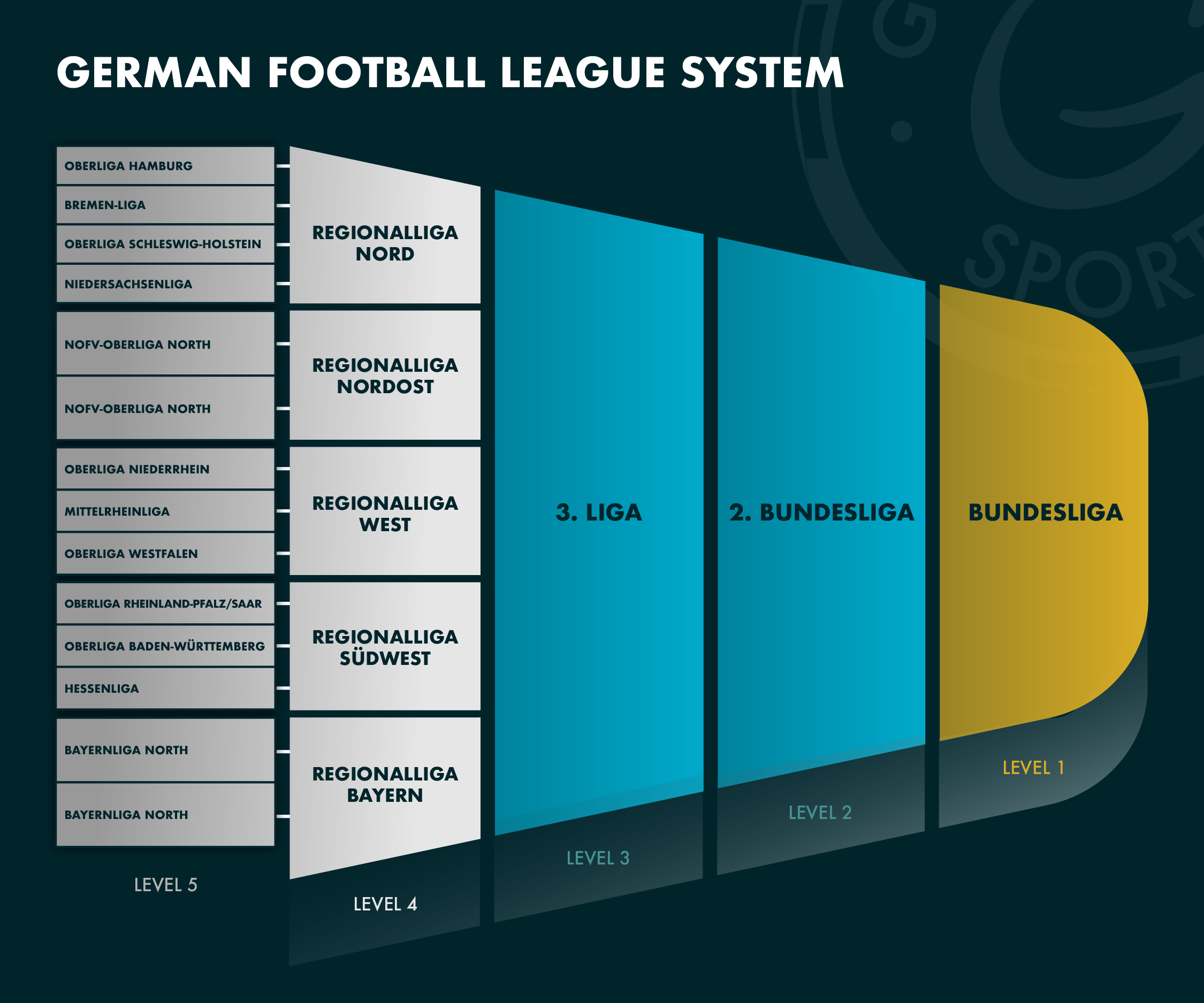

Live Bundesliga Highlights Relive The Excitement Of German Football

May 21, 2025

Live Bundesliga Highlights Relive The Excitement Of German Football

May 21, 2025 -

Allentown Boys Shatter Penn Relays Record With Sub 43 4x100m Time

May 21, 2025

Allentown Boys Shatter Penn Relays Record With Sub 43 4x100m Time

May 21, 2025

Latest Posts

-

Ancelotti Den Sonra Real Madrid Klopp Ve Diger Adaylar

May 22, 2025

Ancelotti Den Sonra Real Madrid Klopp Ve Diger Adaylar

May 22, 2025 -

Klopps Agent Addresses Real Madrid Manager Speculation

May 22, 2025

Klopps Agent Addresses Real Madrid Manager Speculation

May 22, 2025 -

Premier League Champions 2024 25 A Picture Special

May 22, 2025

Premier League Champions 2024 25 A Picture Special

May 22, 2025 -

Klopp Un Geri Doenuesue Beklentiler Ve Gerceklik

May 22, 2025

Klopp Un Geri Doenuesue Beklentiler Ve Gerceklik

May 22, 2025 -

Real Madrid In Yeni Teknik Direktoerue Klopp Guendemde

May 22, 2025

Real Madrid In Yeni Teknik Direktoerue Klopp Guendemde

May 22, 2025