BigBear.ai: To Buy Or Not To Buy? An In-Depth Stock Evaluation

Table of Contents

BigBear.ai Business Model and Competitive Landscape

Understanding BigBear.ai's Core Offerings

BigBear.ai provides a range of AI-powered solutions, data analytics services, and mission-critical applications to both government and commercial clients. Their offerings leverage advanced AI techniques to tackle complex problems across various sectors.

- AI-driven decision support: BigBear.ai develops AI systems that analyze vast datasets to provide actionable insights for better decision-making.

- Cybersecurity solutions: They offer advanced cybersecurity solutions utilizing AI and machine learning to detect and mitigate threats.

- Geospatial intelligence: BigBear.ai utilizes AI to process and analyze geospatial data, providing critical information for various applications, including defense and intelligence.

- Digital transformation services: They assist organizations in their digital transformation journey by providing AI-powered solutions to optimize operations and improve efficiency. These services target both government agencies and commercial enterprises.

Competitive Analysis

BigBear.ai operates in a fiercely competitive AI market. Key competitors include established tech giants like Palantir Technologies and smaller, specialized AI companies. BigBear.ai's competitive advantages lie in its focus on mission-critical applications and its deep expertise in government contracting. However, challenges include maintaining its market share against larger, more resource-rich competitors.

- Palantir Technologies: A major competitor offering similar data analytics and AI solutions, particularly to government agencies.

- IBM: A vast tech conglomerate with a strong presence in the AI and data analytics space.

- Google Cloud: Offers a range of AI and machine learning tools and services, competing directly with BigBear.ai in the cloud-based AI market.

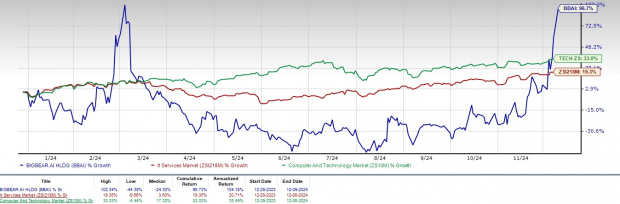

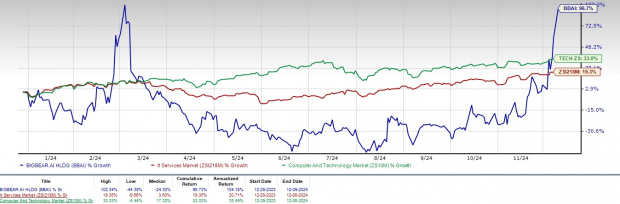

Financial Performance and Valuation of BigBear.ai Stock

Review of Key Financial Metrics

Analyzing BigBear.ai's financial performance requires careful examination of revenue growth, profitability, debt levels, and cash flow. While revenue growth has shown potential, consistent profitability remains a challenge, indicating a need for continued operational efficiency improvements. Debt-to-equity ratio and cash flow from operations are crucial factors to consider for investors assessing long-term viability.

- Revenue Growth: [Insert specific data points from recent financial reports, e.g., year-over-year growth percentage].

- Profit Margins: [Insert data on gross and net profit margins, highlighting trends].

- Debt-to-Equity Ratio: [Insert the most recent ratio and provide context].

- Cash Flow from Operations: [Insert data on cash flow from operations, indicating its strength or weakness].

Valuation Analysis

Evaluating BigBear.ai's stock valuation involves using various metrics such as the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio. Comparing these ratios to industry averages and those of its competitors provides insights into whether BigBear.ai stock is overvalued, undervalued, or fairly valued. A thorough discounted cash flow (DCF) analysis is also necessary for a comprehensive valuation.

- P/E Ratio: [Insert the current P/E ratio and compare it to industry averages].

- Price-to-Sales Ratio: [Insert the current P/S ratio and compare it to industry averages].

- Intrinsic Value: [Include any estimates of intrinsic value based on DCF or other valuation models].

Risk Assessment for BigBear.ai Investment

Market Risks

Investing in BigBear.ai involves several market risks inherent to the AI sector and the broader economy. These include technological disruptions, intense competition, and the impact of economic downturns. The rapid pace of innovation in AI could render BigBear.ai's technology obsolete, impacting its market position and profitability.

- Technological Disruption: The emergence of newer, more efficient AI technologies could negatively affect BigBear.ai's competitiveness.

- Market Volatility: Fluctuations in the overall stock market can significantly impact BigBear.ai's share price.

- Economic Uncertainty: Economic downturns can reduce demand for BigBear.ai's services, particularly from government and commercial clients.

Company-Specific Risks

BigBear.ai faces company-specific risks, including its reliance on government contracts, potential execution risks in delivering complex projects, and the impact of management changes. A significant decrease in government contracts could severely impact revenue and profitability.

- Dependence on Government Contracts: A substantial portion of BigBear.ai's revenue comes from government contracts. Changes in government spending could negatively affect the company.

- Execution Risk: The complexity of BigBear.ai's projects carries the risk of delays or cost overruns.

- Management Changes: Key personnel changes can create uncertainty and potentially impact the company's strategic direction.

Future Outlook and Growth Potential of BigBear.ai

Growth Projections

BigBear.ai's future growth depends on several factors, including market trends, technological advancements, and successful execution of its strategic initiatives. The expanding use of AI across various sectors provides significant growth opportunities. However, realizing this potential requires continued innovation and effective competition.

- Expansion into New Markets: Success in expanding into new markets would contribute to significant growth.

- Technological Advancements: Developing and implementing cutting-edge AI technologies will be crucial for future growth.

- Strategic Partnerships: Establishing strategic alliances with other companies could enhance market reach and capabilities.

Analyst Ratings and Price Targets

Financial analysts offer varied opinions on BigBear.ai's stock, providing a range of price targets and buy/sell recommendations. It's crucial to review these ratings from multiple reputable sources and understand their underlying rationale. These ratings should be considered alongside your own comprehensive analysis.

- [Insert summary of analyst ratings and price targets from reputable sources, citing sources].

Conclusion: Should You Buy BigBear.ai Stock? A Final Verdict

Investing in BigBear.ai stock presents both opportunities and significant risks. While the company operates in a rapidly growing market with potential for long-term growth, its financial performance, reliance on government contracts, and competitive landscape pose considerable challenges. The valuation analysis suggests [insert your conclusion – overvalued, undervalued, or fairly valued]. Therefore, based on this analysis, we recommend [insert your recommendation: buy, sell, or hold]. However, this is just one perspective. Before making any investment decisions regarding BigBear.ai stock, conduct your own thorough research and consider seeking advice from a qualified financial advisor. A comprehensive BigBear.ai stock analysis is crucial for a well-informed investment strategy. Remember to research BigBear.ai before investing.

Featured Posts

-

Abn Amro Bonus Scheme Under Investigation By Dutch Regulator

May 21, 2025

Abn Amro Bonus Scheme Under Investigation By Dutch Regulator

May 21, 2025 -

Investigation Uncovers 10 Minute Pilotless Lufthansa Flight After Co Pilots Medical Event

May 21, 2025

Investigation Uncovers 10 Minute Pilotless Lufthansa Flight After Co Pilots Medical Event

May 21, 2025 -

Toxic Chemical Contamination The Long Term Impact Of The Ohio Train Derailment

May 21, 2025

Toxic Chemical Contamination The Long Term Impact Of The Ohio Train Derailment

May 21, 2025 -

Should You Invest In D Wave Quantum Qbts Stock Now

May 21, 2025

Should You Invest In D Wave Quantum Qbts Stock Now

May 21, 2025 -

A Photographic Dynasty The Traverso Familys Cannes Story

May 21, 2025

A Photographic Dynasty The Traverso Familys Cannes Story

May 21, 2025

Latest Posts

-

Exploring The Rich Flavors Of Creme De Cassis Blackcurrant

May 22, 2025

Exploring The Rich Flavors Of Creme De Cassis Blackcurrant

May 22, 2025 -

Cassis Blackcurrant Liqueur Production Taste Profile And Cocktail Applications

May 22, 2025

Cassis Blackcurrant Liqueur Production Taste Profile And Cocktail Applications

May 22, 2025 -

Swiss Foreign Minister Cassis Condemns Pahalgam Terror Attack

May 22, 2025

Swiss Foreign Minister Cassis Condemns Pahalgam Terror Attack

May 22, 2025 -

Superalimentos Por Que Este Supera Al Arandano En Beneficios Para La Salud

May 22, 2025

Superalimentos Por Que Este Supera Al Arandano En Beneficios Para La Salud

May 22, 2025 -

Adios Enfermedades Cronicas El Poder Del Superalimento Para Una Vida Larga Y Saludable

May 22, 2025

Adios Enfermedades Cronicas El Poder Del Superalimento Para Una Vida Larga Y Saludable

May 22, 2025