Big Wall Street Comeback: How Bear Market Bets Are Failing

Table of Contents

Unexpected Economic Resilience Fuels the Comeback

The impressive recovery of the stock market is largely fueled by an unexpectedly resilient economy. Several key factors are contributing to this positive trend, defying the predictions of a prolonged downturn.

Inflation Cooling Faster Than Expected

Recent Consumer Price Index (CPI) reports paint a picture of inflation cooling more rapidly than initially anticipated.

- Decreasing Inflation Rates: The latest CPI figures show a significant deceleration in the inflation rate, suggesting the Federal Reserve's aggressive interest rate hikes are starting to have a tangible impact.

- Federal Reserve Response: While the Fed remains vigilant, the decreased inflation rate opens up the possibility of a slower pace of future interest rate increases, or even a potential pause, boosting investor confidence.

- Impact on Market Sentiment: The positive inflation data has significantly improved market sentiment, leading to increased investor optimism and a surge in stock prices. This shift is a key driver of the Big Wall Street Comeback.

This lower-than-anticipated inflation is a powerful catalyst for the market's upward trajectory. It eases concerns about aggressive monetary tightening and allows investors to focus on the underlying strength of the economy.

Strong Corporate Earnings Reports

Beyond macroeconomic factors, robust corporate earnings are another cornerstone of this surprising market rally. Many companies are reporting better-than-expected results, defying predictions of a widespread earnings recession.

- Strong Performance Across Sectors: Key sectors such as technology, healthcare, and consumer staples are showing impressive profitability and revenue growth. Companies like [insert example of a strong performing company in tech], [insert example in healthcare], and [insert example in consumer staples] have exceeded analysts' expectations.

- Increased Profitability: Many companies are demonstrating an ability to manage rising costs effectively, maintaining healthy profit margins despite inflationary pressures. This resilience is bolstering investor confidence and driving market gains.

- Positive Outlook: The strength of corporate earnings suggests a degree of underlying economic resilience that was not fully captured in initial bear market predictions.

This unexpectedly strong performance underscores the ability of many businesses to adapt and thrive even in challenging economic conditions.

Bearish Bets Underestimating Market Adaptability

Bearish forecasts frequently underestimated the adaptability of both consumers and businesses, leading to inaccurate market predictions. The market's resilience highlights the limitations of solely relying on pessimistic scenarios.

Misjudging Consumer Spending

Despite high inflation and rising interest rates, consumer spending has remained surprisingly resilient.

- Persistent Consumer Confidence: While consumer confidence has fluctuated, it has not plummeted as severely as some forecasts predicted. This suggests a greater level of resilience than many analysts anticipated.

- Strong Retail Sales: Retail sales figures have been relatively robust, indicating that consumers are continuing to spend, albeit perhaps more cautiously.

- Shifting Spending Habits: Consumers may be adjusting their spending habits, prioritizing essential goods and services, but they are not cutting back as dramatically as some bearish predictions suggested.

This consumer resilience has played a critical role in supporting economic growth and fueling the Big Wall Street Comeback.

Underestimating Technological Innovation

Technological advancements, particularly in sectors like AI and renewable energy, are driving significant economic growth and market opportunities. This was a factor largely underestimated in many bear market predictions.

- AI Revolution: The rapid advancements in artificial intelligence are creating new markets and driving innovation across various sectors, fueling economic growth and investment.

- Renewable Energy Boom: The increasing demand for renewable energy is creating new job opportunities and investment possibilities, adding to the overall economic resilience.

- Technological Disruption: Technological disruptions are constantly creating new industries and business models, driving economic growth and market opportunities.

These technological advancements are creating new sources of economic growth and investment, contradicting initial predictions of a prolonged economic slowdown.

Shifting Investor Sentiment and Market Behavior

The Big Wall Street Comeback is also being driven by a significant shift in investor sentiment and market behavior.

Increased Risk Appetite

Investors are increasingly exhibiting a higher risk appetite, moving away from the risk-aversion that characterized much of the early stages of the potential bear market.

- Shift in Sentiment: The positive economic data and strong corporate earnings have significantly boosted investor confidence, leading to a greater willingness to take on risk.

- Increased Market Volatility: This increased risk appetite has also led to increased market volatility, creating both opportunities and challenges for investors.

- Search for Higher Returns: With interest rates remaining relatively high, investors are seeking higher returns, leading them to invest more aggressively in the stock market.

This shift in risk tolerance is a crucial factor driving the current market rally.

Short-Squeezes and Market Manipulation

While not the sole driver, the possibility of short squeezes and market manipulation deserves careful consideration in analyzing this unexpected market rebound.

- Short Selling Activity: High levels of short selling prior to the recent rally suggest that a significant short squeeze could have contributed to the rapid price increases in certain stocks.

- Market Dynamics: It's crucial to acknowledge the complex interplay of factors driving market movements. Short squeezes can amplify price movements but are not typically the sole cause of sustained market trends.

- Regulatory Scrutiny: The potential role of short squeezes and market manipulation warrants continued scrutiny by regulators to maintain market integrity.

It’s important to analyze this aspect with caution, acknowledging the inherent complexities and potential controversies surrounding market manipulation allegations.

Conclusion

The "Big Wall Street Comeback" is defying initial bear market predictions due to unexpected economic resilience, underestimated market adaptability, and a shift in investor sentiment. Factors like cooling inflation, strong corporate earnings, and technological innovation are all playing a crucial role in this surprising market resurgence. While market volatility remains, understanding the forces driving this unexpected turnaround is crucial for investors.

Call to Action: While the "Big Wall Street Comeback" presents opportunities, navigating this dynamic market requires careful consideration. Stay informed about the evolving economic landscape and adapt your investment strategies accordingly to capitalize on the opportunities presented by this unexpected market shift. Learn more about managing your investments in a dynamic market and make informed decisions to navigate the ongoing Big Wall Street Comeback effectively.

Featured Posts

-

Leon Draisaitl Injury Update Oilers Stars Playoff Availability

May 10, 2025

Leon Draisaitl Injury Update Oilers Stars Playoff Availability

May 10, 2025 -

From Scatological Documents To Podcast An Ai Powered Transformation

May 10, 2025

From Scatological Documents To Podcast An Ai Powered Transformation

May 10, 2025 -

Past Controversy How A Drunk Episode Could Affect Jeanine Pirros Us Attorney Nomination

May 10, 2025

Past Controversy How A Drunk Episode Could Affect Jeanine Pirros Us Attorney Nomination

May 10, 2025 -

Pakistan Stock Exchange Outage Amidst Market Volatility And Rising Tensions

May 10, 2025

Pakistan Stock Exchange Outage Amidst Market Volatility And Rising Tensions

May 10, 2025 -

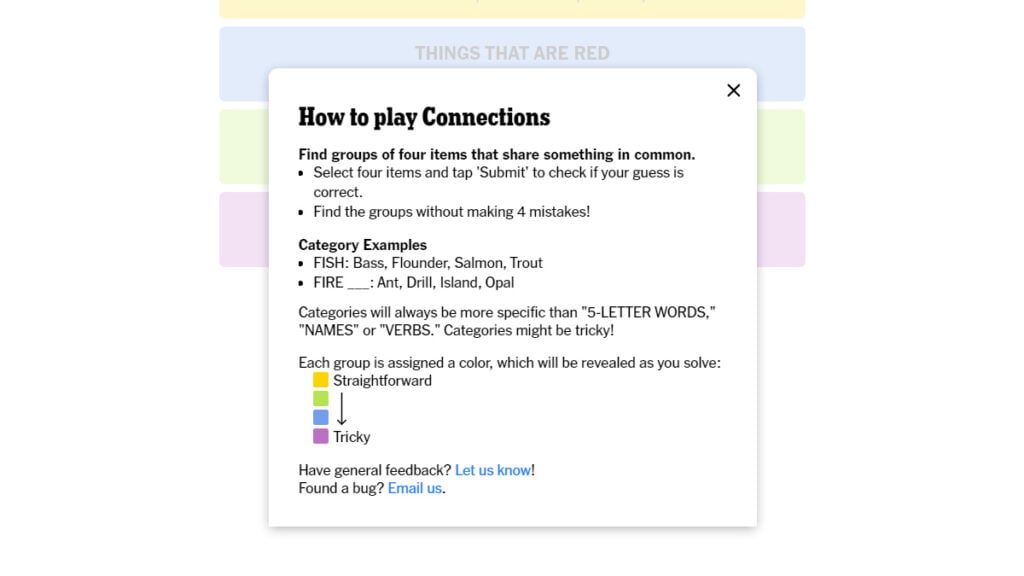

Solve The Nyt Spelling Bee April 1 2025 Clues And Answers

May 10, 2025

Solve The Nyt Spelling Bee April 1 2025 Clues And Answers

May 10, 2025