Bitcoin Price Prediction: Could Trump's 100-Day Speech Push BTC Past $100,000?

Table of Contents

Trump's Potential Economic Policies and Their Influence on Bitcoin

Trump's potential economic policies could significantly impact Bitcoin's price, depending on their nature and implementation. Understanding these potential effects is crucial for accurate Bitcoin price prediction.

Fiscal Policy and Bitcoin: A Safe Haven or Inflationary Risk?

Changes in fiscal policy, particularly concerning spending, taxation, and national debt, profoundly affect investor sentiment. Bitcoin, often viewed as a hedge against inflation and a safe haven asset, could see its value fluctuate based on these shifts.

- Increased Infrastructure Spending: A significant increase in infrastructure spending could fuel inflation, potentially driving investors toward Bitcoin as a store of value. Historically, periods of high inflation have shown a positive correlation with Bitcoin's price.

- Tax Cuts: Significant tax cuts, while stimulating the economy, could also lead to increased inflation and a higher demand for Bitcoin as a protection against currency devaluation.

- Increased National Debt: A rising national debt could erode investor confidence in fiat currencies, potentially increasing the appeal of Bitcoin as an alternative. Data shows that during periods of economic uncertainty, Bitcoin often sees increased demand.

Regulatory Changes and Bitcoin: A Tightening or Loosening Grip?

The regulatory landscape surrounding cryptocurrencies is another major factor. A hypothetical Trump administration's approach to Bitcoin regulation could drastically influence its price.

- Stricter Regulation: Increased regulation could stifle innovation and adoption, potentially leading to a price decline. Examples from other countries show that overly restrictive regulations can negatively impact Bitcoin's price in those regions.

- More Lenient Approach: A more permissive regulatory environment could boost investor confidence and attract new users, potentially driving the price upward. The contrasting regulatory approaches in different jurisdictions demonstrate the significant impact of government policy on Bitcoin's adoption and valuation.

Market Sentiment and Speculation Around Trump's Return

Market sentiment and speculation play a huge role in Bitcoin's price volatility. The mere mention of Trump's name often triggers strong reactions in financial markets.

The Trump Effect on Investor Confidence: Risk On or Risk Off?

Trump's pronouncements and policies have historically elicited strong reactions, both positive and negative, in various markets. His return could influence investor risk appetite, impacting Bitcoin's price.

- Increased Volatility: A return to power might lead to greater market uncertainty, boosting Bitcoin's price due to its speculative nature and its role as a haven during times of uncertainty.

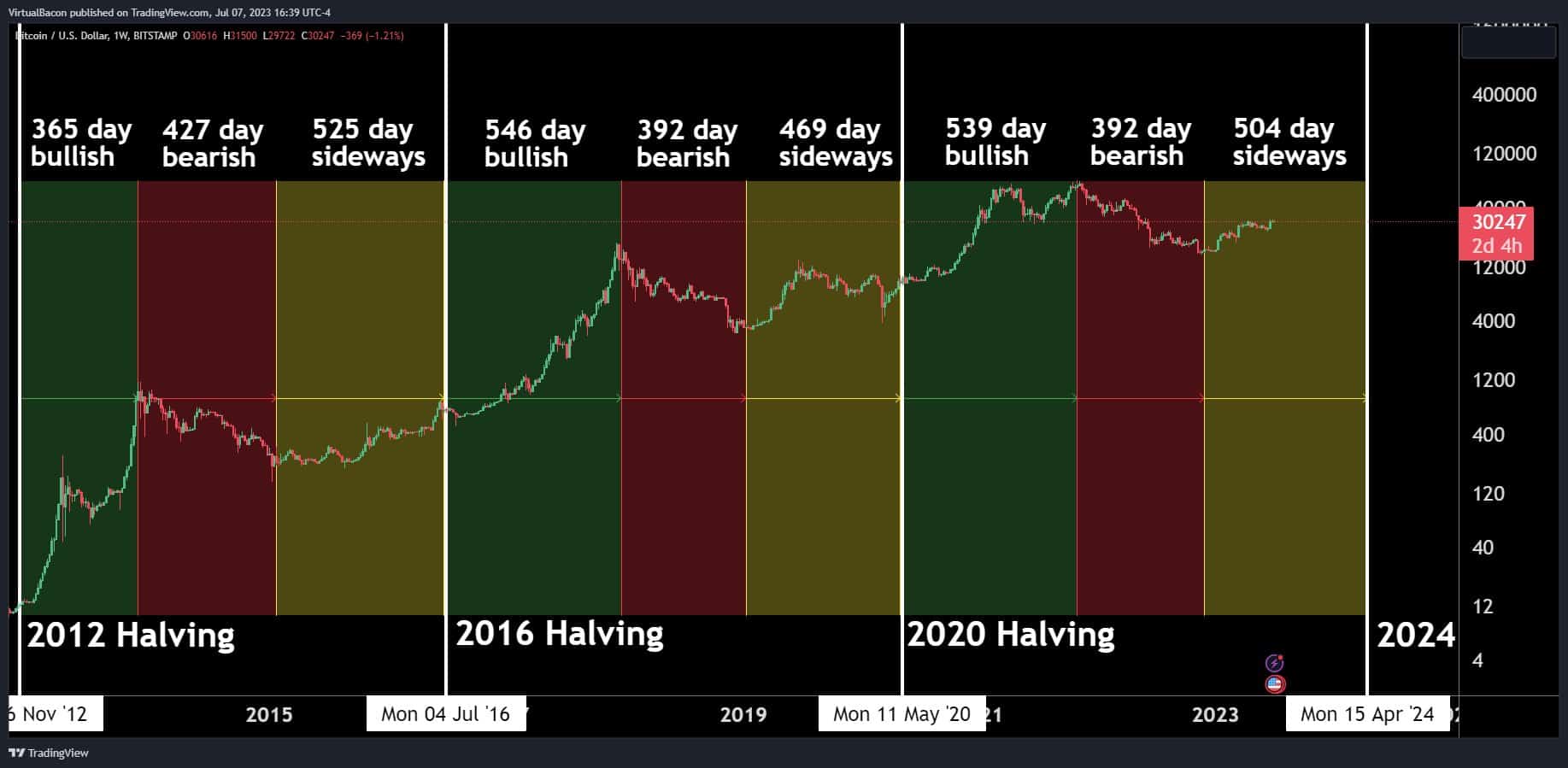

- Historical Precedents: Examining historical market reactions to Trump's past actions and statements is crucial for predicting potential future impacts on Bitcoin's price.

Social Media and Bitcoin Price: The Power of Narrative

Social media significantly influences Bitcoin price fluctuations. Narratives surrounding Trump and Bitcoin, whether positive or negative, can trigger dramatic price swings.

- FUD and Hype Cycles: The spread of fear, uncertainty, and doubt (FUD) or overly optimistic hype related to Trump's policies and Bitcoin could cause intense price volatility.

- Historical Examples: Numerous instances demonstrate how social media sentiment has directly influenced Bitcoin prices; Trump’s pronouncements would likely amplify this effect.

Alternative Factors Affecting Bitcoin Price Beyond Trump's Influence

While Trump's potential actions are significant, several other factors independently influence Bitcoin's price.

Macroeconomic Factors: The Bigger Picture

Global macroeconomic conditions play a critical role in Bitcoin's price.

- Global Economic Uncertainty: Periods of economic uncertainty often drive investors towards Bitcoin as a safe haven, potentially pushing its price higher.

- Inflation Rates: High inflation rates often correlate with increased Bitcoin adoption, as investors seek protection from currency devaluation.

- Interest Rate Hikes: Changes in interest rates directly affect investor sentiment and can impact Bitcoin's price.

- Geopolitical Events: Global geopolitical events and instability can also create demand for Bitcoin as a safe haven asset.

Technological Advancements in the Bitcoin Ecosystem: The Future of Bitcoin

Technological advancements within the Bitcoin ecosystem also impact its long-term price.

- Lightning Network Adoption: Increased adoption of the Lightning Network could improve scalability and transaction speeds, positively impacting Bitcoin's price.

- Taproot Upgrade: The Taproot upgrade enhances Bitcoin's privacy and efficiency, potentially boosting its adoption and price.

- Other Innovations: Future technological developments could further enhance Bitcoin's functionality and appeal, driving price increases.

Conclusion: Bitcoin Price Prediction and the Unknowns

Predicting Bitcoin's price is inherently speculative. While a hypothetical Trump return and associated policies could significantly influence Bitcoin's price trajectory – potentially pushing it past $100,000 under certain favorable conditions or negatively impacting it under others – many other macroeconomic and technological factors will play crucial roles. The analysis presented here highlights the various potential scenarios and their corresponding impacts. Could Trump’s hypothetical actions truly push BTC past $100,000? The answer remains uncertain, but understanding the interplay of these factors is key to navigating this complex landscape. Stay tuned for future Bitcoin price predictions and follow our analysis of Bitcoin price to stay informed about the ever-evolving factors influencing this dynamic cryptocurrency. Learn more about the factors influencing Bitcoin price and make informed decisions.

Featured Posts

-

The Implications Of The Attorney Generals Warning To Trumps Critics

May 09, 2025

The Implications Of The Attorney Generals Warning To Trumps Critics

May 09, 2025 -

Nyt Strands Game 354 Hints And Solutions For Thursday February 20

May 09, 2025

Nyt Strands Game 354 Hints And Solutions For Thursday February 20

May 09, 2025 -

Democratizing Investment Jazz Cash And K Trade Partner To Expand Stock Market Access

May 09, 2025

Democratizing Investment Jazz Cash And K Trade Partner To Expand Stock Market Access

May 09, 2025 -

Anchorage Protests Thousands Rally Against Trump Policies Again

May 09, 2025

Anchorage Protests Thousands Rally Against Trump Policies Again

May 09, 2025 -

The Trump Administrations First 100 Days Its Effect On Elon Musks Fortune

May 09, 2025

The Trump Administrations First 100 Days Its Effect On Elon Musks Fortune

May 09, 2025