Bitcoin Price Rebound: A Look At Potential Future Growth

Table of Contents

Factors Contributing to the Bitcoin Price Rebound

Several converging factors are contributing to the recent Bitcoin price rebound. Understanding these dynamics is crucial for assessing the sustainability of this upward trend and predicting future price movements.

Increased Institutional Adoption

Large financial institutions and corporations are increasingly recognizing Bitcoin as a viable asset class. This institutional adoption is a significant driver of the Bitcoin price rebound.

- Examples of institutional investment: Grayscale Bitcoin Trust, MicroStrategy's substantial Bitcoin holdings, and the growing participation of other publicly traded companies are prime examples.

- Impact of institutional buying pressure: Large-scale purchases by institutions create significant buying pressure, directly impacting price increases and overall market stability. This sustained institutional interest provides a strong foundation for future growth. The influx of institutional capital reduces volatility in the short term and potentially builds long-term confidence in the cryptocurrency market.

Regulatory Clarity and Developments

Evolving regulatory frameworks globally are playing a crucial role in shaping Bitcoin's trajectory. Positive regulatory developments contribute to increased investor confidence, fueling the Bitcoin price rebound.

- Examples of positive regulatory developments: Certain countries are establishing clearer regulatory guidelines for cryptocurrencies, leading to a more predictable and attractive investment environment. Clarification on tax policies related to Bitcoin and other crypto assets reduces uncertainty for potential investors.

- Boosting investor confidence: A well-defined regulatory landscape fosters trust and encourages greater participation in the Bitcoin market. This positive regulatory environment increases investor confidence, leading to higher demand and price appreciation.

Growing DeFi Ecosystem

The rapid expansion of the decentralized finance (DeFi) ecosystem is another key factor driving the Bitcoin price rebound. Bitcoin's integration into DeFi applications significantly enhances its utility and overall demand.

- Examples of Bitcoin's use in DeFi: Wrapped Bitcoin (wBTC) allows Bitcoin to be used within Ethereum-based DeFi applications, opening up a vast array of opportunities for lending, borrowing, and yield farming. The growth of DeFi lending and borrowing platforms further expands Bitcoin's use cases.

- Increasing Bitcoin's utility and demand: The integration of Bitcoin into the DeFi ecosystem increases its utility beyond simply being a store of value. This increased utility drives demand and fuels price appreciation.

Macroeconomic Factors

Global macroeconomic conditions significantly influence Bitcoin's price, especially its role as a potential safe haven asset during times of economic uncertainty.

- Examples of macroeconomic factors: High inflation rates, geopolitical instability, and general economic uncertainty often drive investors towards Bitcoin as a hedge against inflation and a store of value outside traditional financial systems.

- Bitcoin as a safe haven asset: During periods of economic turmoil, investors often seek assets perceived as less susceptible to market fluctuations. Bitcoin's decentralized nature and limited supply make it an attractive option for investors seeking to diversify their portfolios and protect their assets from inflation.

Predicting Future Bitcoin Growth

While predicting the future price of Bitcoin is impossible, analyzing certain indicators can offer insights into potential future growth trajectories.

Technical Analysis

Technical analysis, using indicators such as moving averages and support/resistance levels, can provide clues about potential price movements. However, it's crucial to remember that technical analysis is not a foolproof predictive tool.

- Key technical indicators: Moving averages, Relative Strength Index (RSI), and support/resistance levels provide insights into potential price trends.

- Limitations of technical analysis: Technical analysis should be used in conjunction with fundamental analysis and other factors. It is not a guarantee of future price movements.

Adoption Rates and Market Sentiment

Increasing adoption rates and positive market sentiment are key drivers of Bitcoin's long-term growth potential. Broader acceptance by individuals and businesses will significantly impact its price.

- Factors influencing adoption rates: Increased media coverage, positive social media sentiment, and regulatory clarity all contribute to wider adoption. The growth of Bitcoin-related infrastructure, such as payment processors and exchanges, also plays a role.

- Driving price increases: Positive sentiment and growing adoption increase demand, pushing the price upward.

Technological Advancements

Advancements in Bitcoin technology, such as scalability improvements through the Lightning Network, enhance Bitcoin's usability and efficiency. These improvements can lead to increased adoption and price appreciation.

- Examples of technological advancements: The Lightning Network aims to improve transaction speeds and reduce fees, making Bitcoin more practical for everyday transactions. Other advancements in mining efficiency and security enhance the overall stability and appeal of Bitcoin.

- Positive effects on price: Technological improvements make Bitcoin more efficient and user-friendly, potentially attracting a larger user base and driving price increases.

Conclusion

The Bitcoin price rebound is driven by a confluence of factors, including increased institutional adoption, regulatory clarity, the growth of the DeFi ecosystem, and macroeconomic conditions. While predicting future price movements with certainty is impossible, the potential for future growth remains significant. The ongoing development of the Bitcoin ecosystem and its increasing integration into mainstream finance contribute to a positive outlook. The Bitcoin price rebound presents exciting opportunities, but thorough research is crucial. Stay informed about the latest developments in the Bitcoin market and continue your own analysis of the factors driving this potential Bitcoin price rebound. Remember to always conduct your own research before making any investment decisions.

Featured Posts

-

Kholodniy Aprel 2025 V Permi I Permskom Krae Prognoz Pogody So Snegopadami

May 09, 2025

Kholodniy Aprel 2025 V Permi I Permskom Krae Prognoz Pogody So Snegopadami

May 09, 2025 -

Adin Hills Stellar Goaltending Powers Vegas Golden Knights Past Columbus Blue Jackets

May 09, 2025

Adin Hills Stellar Goaltending Powers Vegas Golden Knights Past Columbus Blue Jackets

May 09, 2025 -

February And March Elizabeth Line Strikes Travel Advice And Updates

May 09, 2025

February And March Elizabeth Line Strikes Travel Advice And Updates

May 09, 2025 -

2025 Iditarod Ceremonial Start A Massive Crowd Celebrates In Anchorage

May 09, 2025

2025 Iditarod Ceremonial Start A Massive Crowd Celebrates In Anchorage

May 09, 2025 -

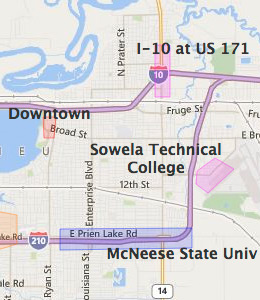

Live Music And Events Your Easter Weekend Guide To Lake Charles

May 09, 2025

Live Music And Events Your Easter Weekend Guide To Lake Charles

May 09, 2025