Bitcoin Price Soars To Record High On Expected US Regulatory Clarity

Table of Contents

The Influence of Anticipated US Regulatory Clarity on Bitcoin's Value

The uncertainty surrounding US Bitcoin regulations has historically been a major driver of price volatility. Periods of regulatory ambiguity have often led to sharp price drops as investors, particularly institutional ones, hesitated to commit significant capital due to the perceived risk. However, the recent positive shift in sentiment suggests a growing belief that clearer regulations are on the horizon.

This expectation of a well-defined regulatory landscape is a significant catalyst for the current Bitcoin price surge. The potential benefits are numerous and far-reaching:

- Reduced risk for institutional investors: Clearer rules reduce the perceived risk for large-scale investors, encouraging greater participation and investment.

- Increased mainstream adoption and legitimacy: Well-defined regulations lend legitimacy to Bitcoin, boosting confidence among everyday investors and driving wider adoption.

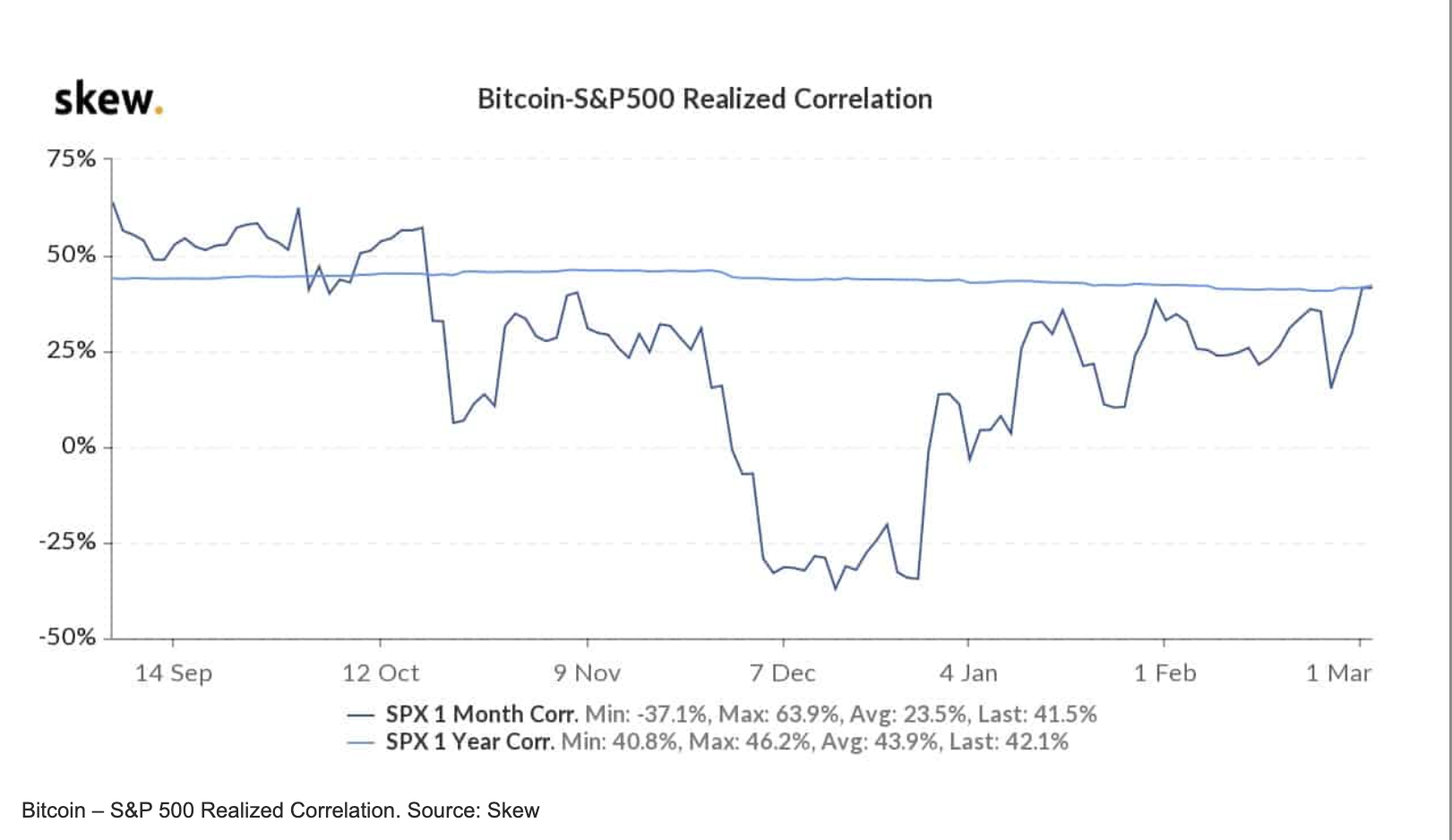

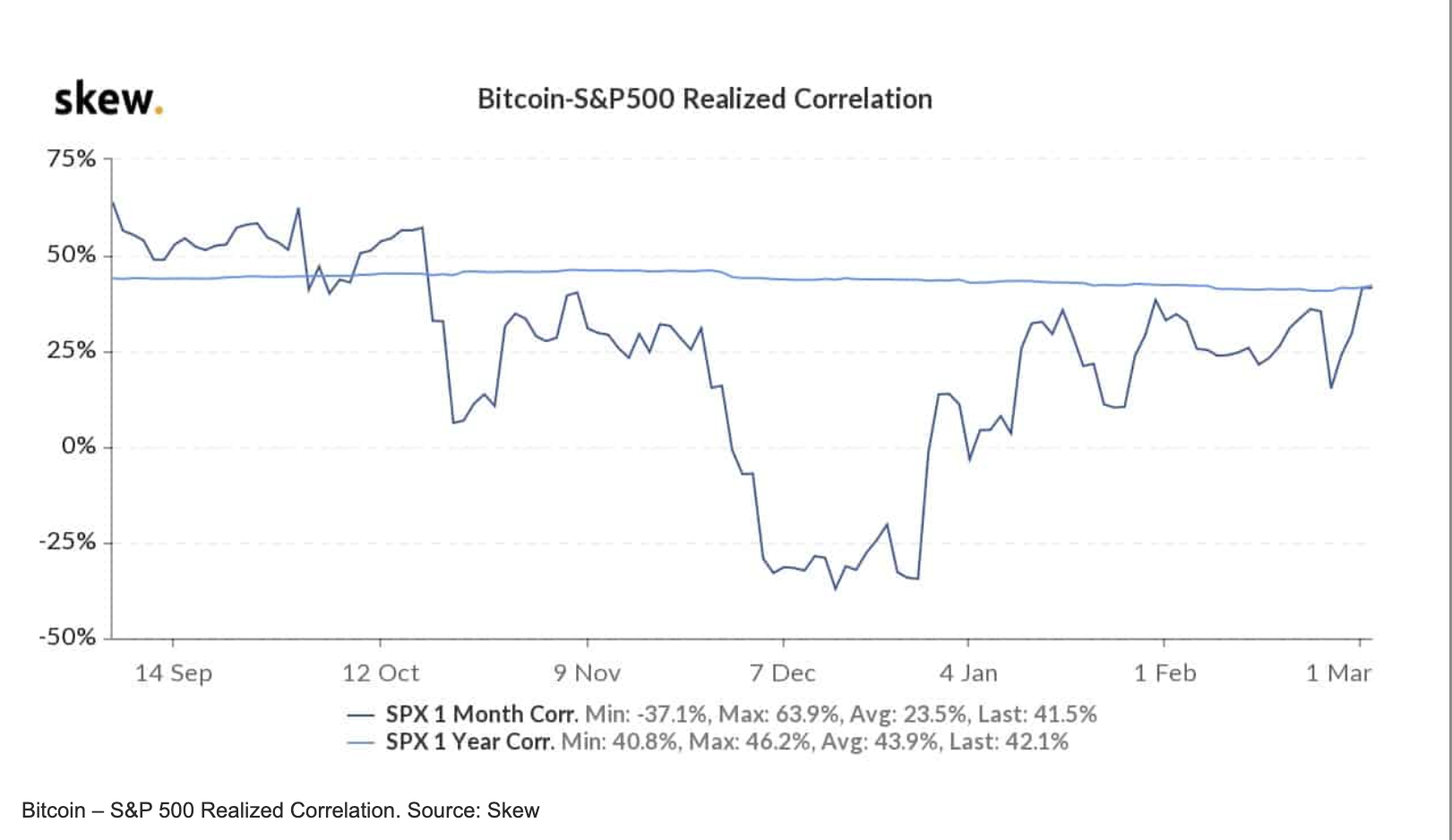

- Improved market stability and price predictability: A regulated market tends to be more stable, reducing extreme price swings and making Bitcoin a more attractive investment.

- Stimulation of innovation within the Bitcoin ecosystem: A clearer regulatory framework can foster innovation by reducing legal hurdles for Bitcoin-related businesses and projects.

Other Factors Contributing to Bitcoin's Recent Price Surge

While expected US regulatory clarity is a major driver, several other factors have contributed to Bitcoin's recent price surge:

Macroeconomic Factors: Global inflation, geopolitical instability, and concerns about traditional financial systems are pushing investors towards alternative assets like Bitcoin, perceived as a hedge against inflation and economic uncertainty.

Institutional Investment and Adoption: The increased participation of institutional investors, including large corporations and investment firms, has significantly boosted demand and pushed the Bitcoin price higher. This shift signifies growing acceptance of Bitcoin as a legitimate asset class.

- Increased institutional adoption by major corporations like MicroStrategy and Tesla.

- Growing interest from hedge funds and investment banks actively managing Bitcoin holdings.

- The Lightning Network's improvement in transaction speeds and scalability, making Bitcoin more user-friendly for everyday transactions.

- Growing awareness and adoption of Bitcoin as a store of value, similar to gold.

Analyzing the Volatility and Potential Risks Despite the Record High

Despite the record high, it's crucial to acknowledge the inherent volatility of the Bitcoin market. While positive regulatory expectations are bullish, potential risks remain:

- Potential for sudden price corrections: The Bitcoin market is known for its dramatic price swings, and even with positive regulatory news, corrections are possible.

- Regulatory changes could still negatively impact the market: While anticipated regulations are positive, unforeseen changes could negatively affect the price.

- Security risks associated with holding and trading Bitcoin: Investors must be aware of the security risks involved in storing and trading Bitcoin, such as hacking and scams.

- The importance of diversifying investments: As with any investment, diversification is crucial to mitigate risk.

Navigating the Future of Bitcoin Price and US Regulatory Landscape

The recent surge in the Bitcoin price is largely driven by the anticipated clarity in US regulations, coupled with macroeconomic factors and increased institutional adoption. While this presents significant opportunities, investors must carefully weigh the potential risks. The future trajectory of the Bitcoin price will depend heavily on the actual implementation of these regulations and the continued evolution of the cryptocurrency market.

Stay updated on the latest developments in Bitcoin price and US regulatory clarity to make informed investment decisions. Further research into Bitcoin investment strategies and the specifics of US regulatory frameworks for cryptocurrencies is highly recommended. Understanding these factors is crucial for successfully navigating the dynamic world of Bitcoin investment.

Featured Posts

-

The 2027 French Election A Look At Jordan Bardella And His Rivals

May 24, 2025

The 2027 French Election A Look At Jordan Bardella And His Rivals

May 24, 2025 -

Legendas F1 Motor Egyedi Porsche Koezuti Modell

May 24, 2025

Legendas F1 Motor Egyedi Porsche Koezuti Modell

May 24, 2025 -

Annie Kilner Social Media Posts And The Kyle Walker Incident

May 24, 2025

Annie Kilner Social Media Posts And The Kyle Walker Incident

May 24, 2025 -

Luchshie Goroskopy I Predskazaniya Na Mesyats

May 24, 2025

Luchshie Goroskopy I Predskazaniya Na Mesyats

May 24, 2025 -

The Complete Dc Legends Of Tomorrow Fans Guide

May 24, 2025

The Complete Dc Legends Of Tomorrow Fans Guide

May 24, 2025

Latest Posts

-

The Last Rodeo A Western Featuring Neal Mc Donough

May 24, 2025

The Last Rodeo A Western Featuring Neal Mc Donough

May 24, 2025 -

The Last Rodeo Neal Mc Donoughs Standout Role

May 24, 2025

The Last Rodeo Neal Mc Donoughs Standout Role

May 24, 2025 -

Neal Mc Donough Rides Tall A Look At The Last Rodeo

May 24, 2025

Neal Mc Donough Rides Tall A Look At The Last Rodeo

May 24, 2025 -

2025 Memorial Day Sales A Shopping Experts Guide To The Best Deals

May 24, 2025

2025 Memorial Day Sales A Shopping Experts Guide To The Best Deals

May 24, 2025 -

Memorial Day 2025 Top Sales And Deals To Shop Now

May 24, 2025

Memorial Day 2025 Top Sales And Deals To Shop Now

May 24, 2025