Bitcoin Price Surge: Positive US Regulation Signals Drive Record High

Table of Contents

Positive Regulatory Developments in the US

Positive regulatory shifts in the US are significantly impacting Bitcoin's price. The increased clarity and a more welcoming approach from regulators are boosting investor confidence and driving institutional investment.

Grayscale Bitcoin Trust Victory

The recent court ruling in favor of Grayscale's application to convert its Bitcoin Trust (GBTC) into a spot Bitcoin ETF is a monumental catalyst.

- This ruling signifies a growing acceptance of Bitcoin by mainstream financial institutions, paving the way for broader adoption.

- Increased accessibility through ETFs could lead to a massive influx of institutional investment, significantly increasing demand and driving up the price.

- Expect further regulatory clarity and potential approval of other Bitcoin ETFs to follow, further legitimizing Bitcoin and attracting more investment. This could lead to sustained Bitcoin price growth.

Increased Regulatory Clarity and Oversight

The SEC's increased focus on establishing clear regulatory frameworks for cryptocurrencies, while stringent, ultimately provides stability and legitimacy to the market. This is a crucial element driving the current Bitcoin price surge.

- This reduces uncertainty and encourages institutional investment, as clearer rules mitigate risk.

- Clearer rules minimize risks for investors, making Bitcoin a more attractive asset for those previously hesitant due to the perceived volatility and regulatory uncertainty.

- It signals a move away from the "Wild West" image of the crypto market, attracting more risk-averse investors.

Growing Bipartisan Support for Crypto Innovation in Congress

Growing political support for the development of crypto infrastructure and blockchain technologies suggests a positive long-term outlook for Bitcoin and the broader cryptocurrency market.

- This bipartisan support fosters a more stable regulatory environment, reducing the risk of sudden policy shifts that could negatively impact Bitcoin's price.

- Increased innovation and development within the US crypto sector is likely, potentially leading to advancements that further enhance Bitcoin's utility and value.

- It could establish the US as a global leader in cryptocurrency technology, further boosting Bitcoin's international appeal and price.

Increased Institutional Investment in Bitcoin

Institutional investors are increasingly viewing Bitcoin as a viable asset class, contributing significantly to the recent price surge.

Attraction of Lower Risk and Potential High Returns

The combination of positive regulation and the proven track record of Bitcoin attracts institutional players seeking diversification and substantial returns.

- Institutional investors are increasingly allocating capital to digital assets, recognizing the potential for high returns.

- Bitcoin's established market position and resilience make it an appealing choice, especially compared to newer, less established cryptocurrencies.

- This injection of capital significantly impacts the price, as large buy orders can drive up demand and price.

Sophisticated Trading Strategies and Market Manipulation

The actions of large investors inevitably affect Bitcoin's price volatility. Understanding these dynamics is crucial.

- Large buy orders can influence market sentiment and propel price increases, creating a positive feedback loop.

- The potential for manipulation exists, and regulation plays a crucial role in mitigating this risk. Increased transparency and oversight are key to preventing manipulative practices.

- Institutional investors use sophisticated strategies to manage risk and optimize returns, influencing price movements in complex ways.

Macroeconomic Factors Contributing to Bitcoin's Rise

Macroeconomic factors are also playing a crucial role in Bitcoin's price appreciation.

Inflation Hedge

Bitcoin's limited supply and decentralized nature make it an attractive hedge against inflation and economic uncertainty.

- Investors are seeking alternative assets to preserve wealth during inflationary periods, driving demand for Bitcoin.

- Bitcoin's scarcity is a key differentiator from fiat currencies, making it a potentially more reliable store of value.

- This safe-haven asset appeal drives demand and price appreciation, particularly during times of economic instability.

Global Economic Instability

Uncertainty in global markets often leads investors to seek refuge in assets perceived as less correlated with traditional markets, like Bitcoin.

- Geopolitical risks and economic downturns increase the demand for Bitcoin as investors seek diversification.

- Investors look for diversification away from traditional assets, reducing overall portfolio risk.

- This flight to safety contributes to the surge in Bitcoin's price, as investors seek assets perceived as less vulnerable to macroeconomic headwinds.

Conclusion

The recent record high for Bitcoin is a testament to the evolving regulatory landscape in the US and the growing acceptance of cryptocurrencies by mainstream financial institutions. Positive regulatory developments, coupled with increased institutional investment and macroeconomic factors, have created a perfect storm for Bitcoin's price surge. Understanding these key drivers is crucial for anyone navigating the cryptocurrency market. Stay informed about further developments in US Bitcoin regulation and consider diversifying your investment portfolio with Bitcoin, but always conduct thorough research and manage your risk appropriately. Keep up-to-date on the latest news regarding the Bitcoin price and future Bitcoin regulations.

Featured Posts

-

Daltreys Explosive Revelation Deep Divisions Within The Who

May 23, 2025

Daltreys Explosive Revelation Deep Divisions Within The Who

May 23, 2025 -

The Last Rodeo Neal Mc Donoughs Standout Performance

May 23, 2025

The Last Rodeo Neal Mc Donoughs Standout Performance

May 23, 2025 -

3 Tutumlu Burc Zengin Olmanin Sirri Mi Bu

May 23, 2025

3 Tutumlu Burc Zengin Olmanin Sirri Mi Bu

May 23, 2025 -

Ispovest Vanje Mijatovic Razvod Tezina I Borba Za Svoju Pricu

May 23, 2025

Ispovest Vanje Mijatovic Razvod Tezina I Borba Za Svoju Pricu

May 23, 2025 -

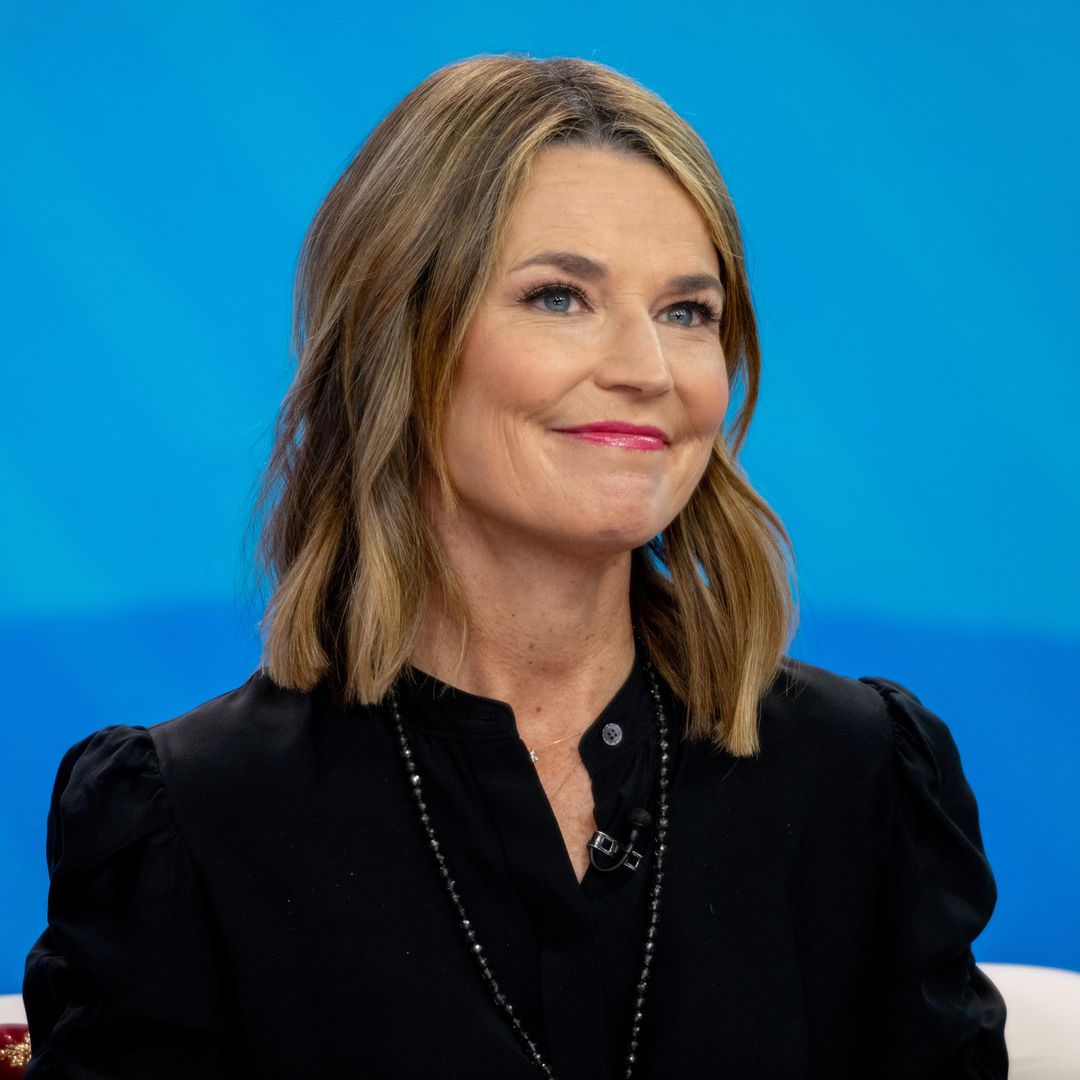

Savannah Guthries Replacement Co Host A Weekday Shake Up

May 23, 2025

Savannah Guthries Replacement Co Host A Weekday Shake Up

May 23, 2025

Latest Posts

-

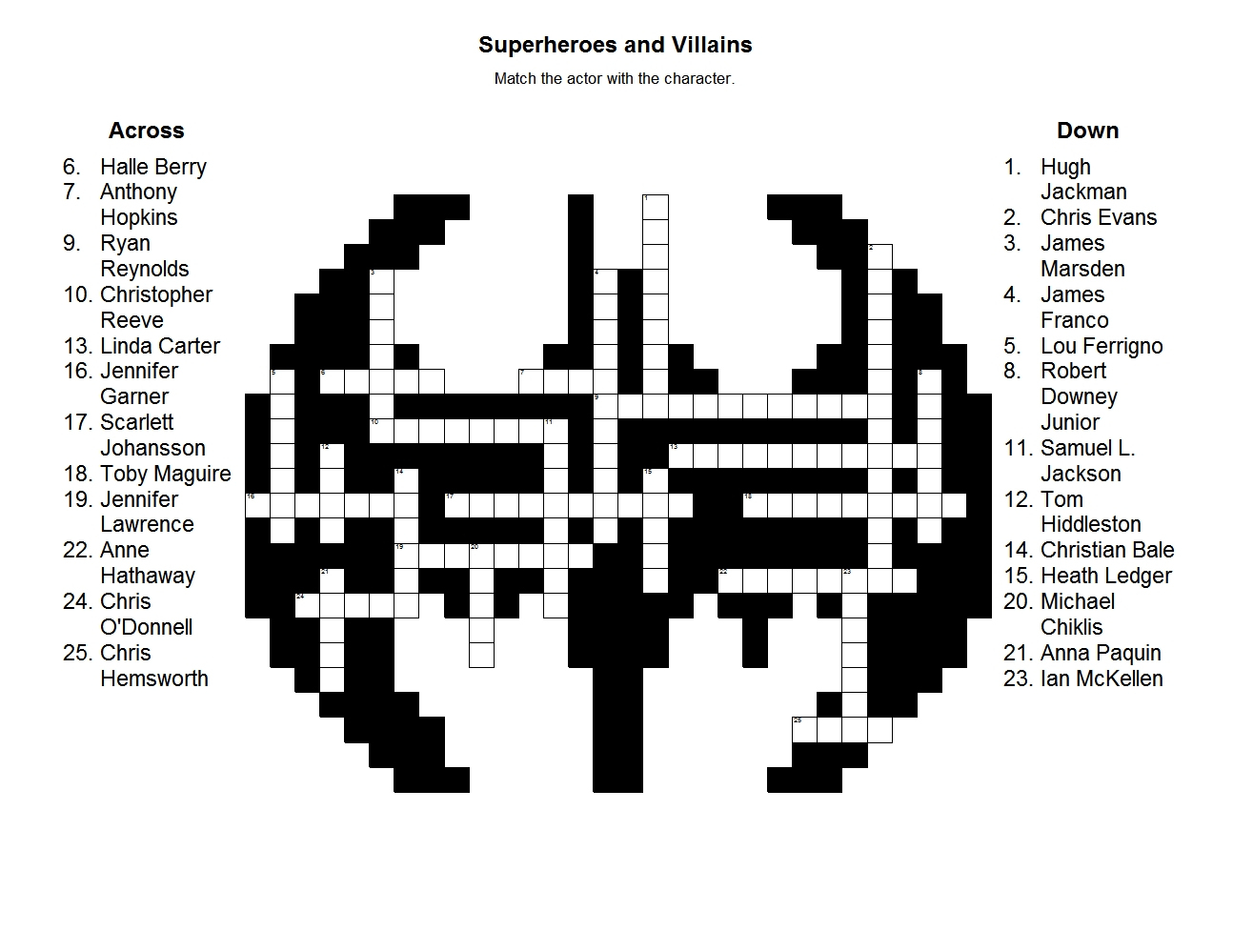

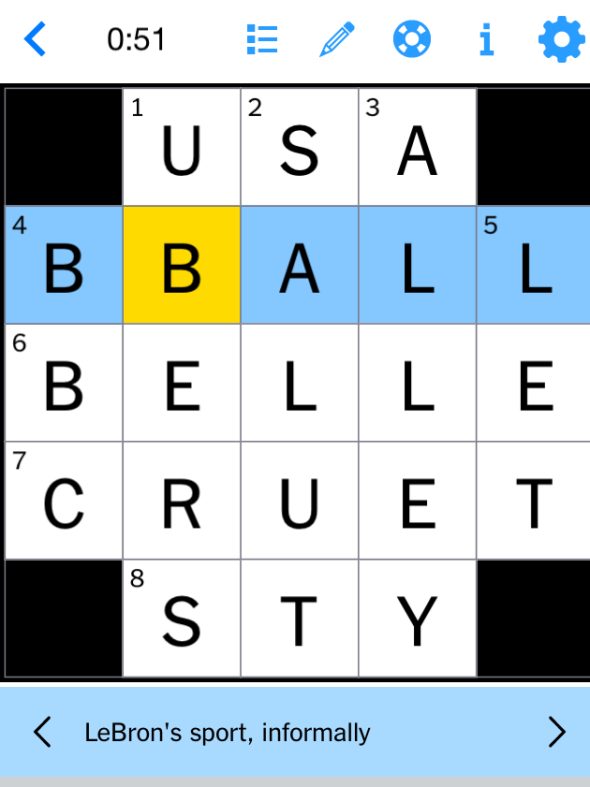

Marvel The Avengers Crossword Clue Full Solution And Tips For May 1st Nyt Mini

May 23, 2025

Marvel The Avengers Crossword Clue Full Solution And Tips For May 1st Nyt Mini

May 23, 2025 -

Nyt Mini Crossword Answers March 13 2025 Full Solution Guide

May 23, 2025

Nyt Mini Crossword Answers March 13 2025 Full Solution Guide

May 23, 2025 -

Solving The Marvel The Avengers Crossword Clue A Complete Guide

May 23, 2025

Solving The Marvel The Avengers Crossword Clue A Complete Guide

May 23, 2025 -

Complete Guide To The Nyt Mini Crossword March 3 2025

May 23, 2025

Complete Guide To The Nyt Mini Crossword March 3 2025

May 23, 2025 -

Nyt Mini Crossword Solutions For March 13 2025

May 23, 2025

Nyt Mini Crossword Solutions For March 13 2025

May 23, 2025