Bitcoin Reaches New Peak Amidst Positive US Regulatory Outlook

Table of Contents

Easing Regulatory Concerns Fuel Bitcoin's Rise

The recent positive shift in the US regulatory outlook has played a crucial role in Bitcoin's price increase. Reduced uncertainty and a potential for clearer frameworks are boosting investor confidence.

Positive Statements from US Officials

Several recent statements from US government officials have been interpreted positively by the Bitcoin market. These statements suggest a move towards a more nuanced and potentially supportive regulatory approach to cryptocurrencies.

- Treasury Secretary Janet Yellen's recent comments emphasized the potential for responsible crypto innovation, acknowledging the need for a balanced approach that fosters innovation while mitigating risks. [Insert link to source if available].

- Senator Cynthia Lummis's involvement in crafting comprehensive cryptocurrency legislation indicates a growing understanding and acceptance of digital assets within the US government. [Insert link to source if available].

- The SEC's recent focus on clarifying regulatory pathways for cryptocurrencies, rather than outright prohibition, has significantly calmed investor fears. [Insert link to source if available].

These statements have significantly improved investor confidence, leading to a more positive market sentiment and increased willingness to invest in Bitcoin. The reduced fear of a complete regulatory crackdown is a key catalyst for the current bull run.

Increased Clarity on Regulatory Frameworks

The potential for clearer and more defined regulations is a game-changer. Previously, the lack of clarity created significant uncertainty, hindering institutional investment and broader adoption. Now, the prospect of a more defined regulatory path is attracting significant capital.

- A clear regulatory framework will likely attract institutional investors who require legal certainty before committing substantial funds.

- Reduced uncertainty encourages smaller investors, increasing overall market liquidity and driving up prices.

- Clear rules could lead to increased innovation in the crypto space, fostering further growth and adoption of Bitcoin and other digital currencies.

Institutional Investment Drives Bitcoin Demand

The surge in institutional investment is another significant factor driving Bitcoin's price to new heights. Large-scale investors are increasingly viewing Bitcoin as a viable asset class.

Growing Institutional Adoption

Several major financial institutions have significantly increased their Bitcoin holdings, demonstrating growing confidence in the cryptocurrency's long-term potential.

- MicroStrategy, a publicly traded business intelligence company, has made significant investments in Bitcoin, becoming one of the largest corporate holders. [Insert link to source if available].

- Tesla's purchase of Bitcoin further solidified the cryptocurrency's position as a legitimate asset for major corporations. [Insert link to source if available].

- Numerous other institutional investors, including hedge funds and asset management firms, are increasingly allocating a portion of their portfolios to Bitcoin. [Insert link to source if available - aggregate data from various sources].

This growing institutional adoption provides a strong foundation for continued Bitcoin price growth, as large-scale purchases exert significant upward pressure on the market.

Increased Availability of Bitcoin Investment Vehicles

The emergence of various investment vehicles is making it easier for institutional investors to participate in the Bitcoin market.

- The development of Bitcoin ETFs and other exchange-traded products simplifies the process for institutional investors, offering more accessible and regulated investment options.

- The creation of specialized Bitcoin investment trusts allows for larger-scale investments with enhanced security and management.

Macroeconomic Factors Contributing to Bitcoin's Growth

Macroeconomic factors also contribute significantly to Bitcoin's price surge. Global economic uncertainty and inflationary pressures are driving investors to seek alternative assets.

Inflationary Pressures and Safe-Haven Demand

High inflation and economic uncertainty are driving investors towards Bitcoin as a potential hedge against inflation and a store of value.

- Bitcoin's limited supply of 21 million coins makes it an attractive asset in times of monetary expansion and devaluation.

- Its decentralized nature and resistance to government control add to its appeal as a safe haven asset.

Global Adoption and Growing Use Cases

Bitcoin's global adoption and expanding use cases are also contributing to its price increase.

- The increasing number of merchants accepting Bitcoin for payments shows its growing utility beyond speculation.

- The wider adoption of blockchain technology, the underlying technology of Bitcoin, indicates a growing understanding and acceptance of its potential in various sectors.

Conclusion

The recent surge in Bitcoin's price is a result of a confluence of factors. Easing regulatory concerns in the US, a significant increase in institutional investment, and prevailing macroeconomic conditions all contribute to the current bullish trend. The positive regulatory outlook, combined with the increasing mainstream adoption of Bitcoin, is creating a compelling narrative for sustained growth.

Call to Action: The positive regulatory outlook and increasing institutional interest are creating exciting opportunities in the Bitcoin market. Learn more about investing in Bitcoin responsibly and stay updated on the latest developments in the evolving regulatory landscape. Consider diversifying your portfolio by carefully researching and understanding the risks and rewards associated with Bitcoin investment. Remember to conduct thorough research before making any investment decisions. Stay informed about Bitcoin price predictions and market trends to make well-informed decisions regarding your Bitcoin investment strategy.

Featured Posts

-

Leaving Soon Hulus End Of Month Movie Lineup

May 23, 2025

Leaving Soon Hulus End Of Month Movie Lineup

May 23, 2025 -

The Importance Of Middle Managers Driving Company Success And Employee Growth

May 23, 2025

The Importance Of Middle Managers Driving Company Success And Employee Growth

May 23, 2025 -

How Trumps Budget Cuts Reshaped Museum Programming In America

May 23, 2025

How Trumps Budget Cuts Reshaped Museum Programming In America

May 23, 2025 -

Us Regulatory Developments Boost Bitcoin To Record High

May 23, 2025

Us Regulatory Developments Boost Bitcoin To Record High

May 23, 2025 -

Reactia Publicului La Aparitia Fratilor Tate In Bucuresti

May 23, 2025

Reactia Publicului La Aparitia Fratilor Tate In Bucuresti

May 23, 2025

Latest Posts

-

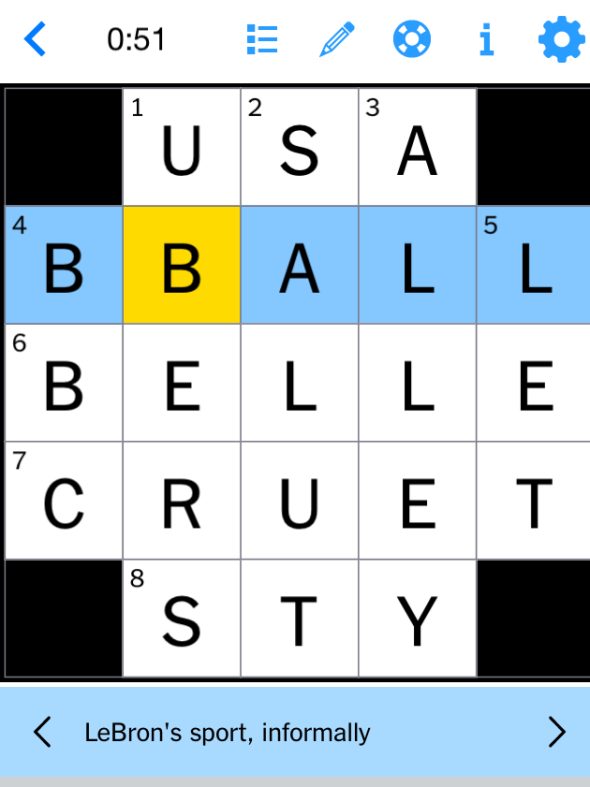

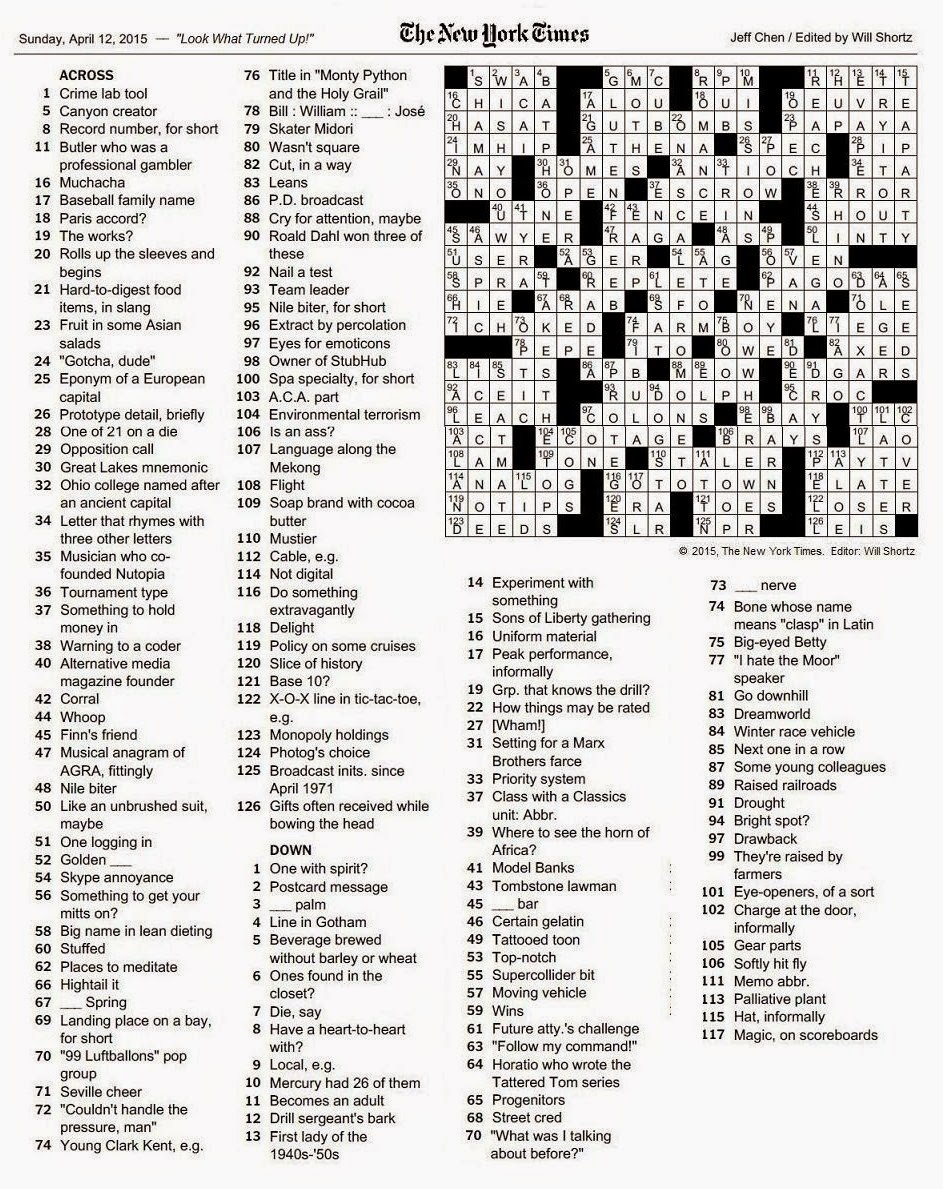

Complete Guide To The Nyt Mini Crossword March 3 2025

May 23, 2025

Complete Guide To The Nyt Mini Crossword March 3 2025

May 23, 2025 -

Nyt Mini Crossword Solutions For March 13 2025

May 23, 2025

Nyt Mini Crossword Solutions For March 13 2025

May 23, 2025 -

March 3 2025 Nyt Mini Crossword Find The Answers Here

May 23, 2025

March 3 2025 Nyt Mini Crossword Find The Answers Here

May 23, 2025 -

Solve The Nyt Mini Crossword Hints For March 3 2025

May 23, 2025

Solve The Nyt Mini Crossword Hints For March 3 2025

May 23, 2025 -

Nyt Mini Crossword Answers March 3 2025 Complete Solutions

May 23, 2025

Nyt Mini Crossword Answers March 3 2025 Complete Solutions

May 23, 2025