BlackRock ETF Poised For 110% Growth: Why Billionaires Are Investing

Table of Contents

Understanding the BlackRock ETF's Potential

The iShares CORE U.S. Aggregate Bond ETF (AGG) is a passively managed exchange-traded fund that tracks the Bloomberg U.S. Aggregate Bond Index. This index represents a broad spectrum of investment-grade U.S. dollar-denominated bonds, including government bonds, corporate bonds, mortgage-backed securities, and more. Its diversified nature is a key attraction. The predicted 110% growth, while ambitious, is fueled by several factors:

- Rising Interest Rates: In an environment of rising interest rates, bond yields typically increase, boosting the value of existing bonds. AGG's exposure to a wide range of bonds allows it to benefit from this trend.

- Inflation Hedge: Bonds, particularly government bonds, are often seen as a hedge against inflation. If inflation remains elevated, AGG could offer a degree of protection to investors' capital.

- Economic Recovery: A robust economic recovery could lead to increased corporate profitability, positively impacting the value of corporate bonds within the AGG index.

- Historical Performance: While a 110% return is a projection, analyzing AGG's historical performance against relevant benchmarks (like other broad bond market ETFs) can provide context and assess its past resilience. (Insert compelling chart or graph visualizing projected and historical growth here).

Billionaire Investment Strategies & Diversification

Billionaires, like all investors, prioritize diversification to mitigate risk. ETFs, with their inherent diversification across numerous assets, are an attractive component of a well-structured portfolio. The AGG ETF fits this strategy perfectly:

- Diversification: AGG's holdings span a wide range of bond issuers and maturities, minimizing the impact of any single issuer defaulting.

- Lower Management Fees: Compared to actively managed bond funds, AGG's passive management keeps expenses low, maximizing returns for investors.

- Tax Advantages: The specific tax implications of investing in AGG will depend on individual circumstances and tax jurisdictions. However, many bond ETFs can offer tax advantages compared to other investment vehicles.

- Billionaire Examples: While specific billionaire holdings are often confidential, public information sometimes reveals significant investments in similar broad-market bond ETFs, highlighting the appeal of this asset class among high-net-worth individuals.

Risk Assessment and Mitigation

While the potential for significant growth is enticing, it’s crucial to acknowledge the inherent risks:

- Interest Rate Risk: Rising interest rates increase yields, but they also can decrease the value of existing bonds.

- Inflation Risk: Unexpectedly high inflation can erode the real value of bond returns.

- Credit Risk: The possibility of default by bond issuers exists, although AGG focuses on investment-grade bonds to mitigate this.

- Market Risk: Broad market downturns can affect bond prices.

Mitigation Strategies:

- Diversification: Including AGG as part of a larger, diversified portfolio across various asset classes reduces overall risk.

- Due Diligence: Thorough research and understanding of the ETF's investment strategy are vital.

- Risk Tolerance: Investors should only invest in AGG (or any other high-growth investment) if it aligns with their individual risk tolerance and financial goals.

Comparing BlackRock ETF to Competitors

Several competitors offer similar broad-market bond ETFs. Vanguard and State Street, for instance, have their own offerings. A comparison should consider:

- Expense Ratios: AGG typically boasts a competitive expense ratio.

- Tracking Error: How closely does the ETF track its underlying index?

- Historical Performance: Comparing past performance against competitors provides valuable context.

Choosing the right ETF often comes down to a nuanced comparison of these factors and individual investor needs.

Conclusion: Should You Invest in This BlackRock ETF?

The potential for 110% growth in the iShares CORE U.S. Aggregate Bond ETF (AGG) is certainly alluring, driven by factors such as rising interest rates and the potential for economic recovery. However, remember that past performance does not guarantee future results. Investing in any ETF, particularly one aiming for high growth, involves inherent risks. Diversification across your portfolio, careful consideration of your risk tolerance, and thorough due diligence are paramount. Before investing in this BlackRock ETF or any similar high-growth investment, conduct thorough research and consult with a qualified financial advisor to ensure it aligns with your individual financial goals and risk profile. Learn more about the potential of BlackRock ETFs and make informed investment decisions today.

Featured Posts

-

Us Fentanyl Seizure Pam Bondi On Historic Drug Bust

May 09, 2025

Us Fentanyl Seizure Pam Bondi On Historic Drug Bust

May 09, 2025 -

Trump Tariffs Devastate Wealth Of Top 10 Billionaires Including Buffett

May 09, 2025

Trump Tariffs Devastate Wealth Of Top 10 Billionaires Including Buffett

May 09, 2025 -

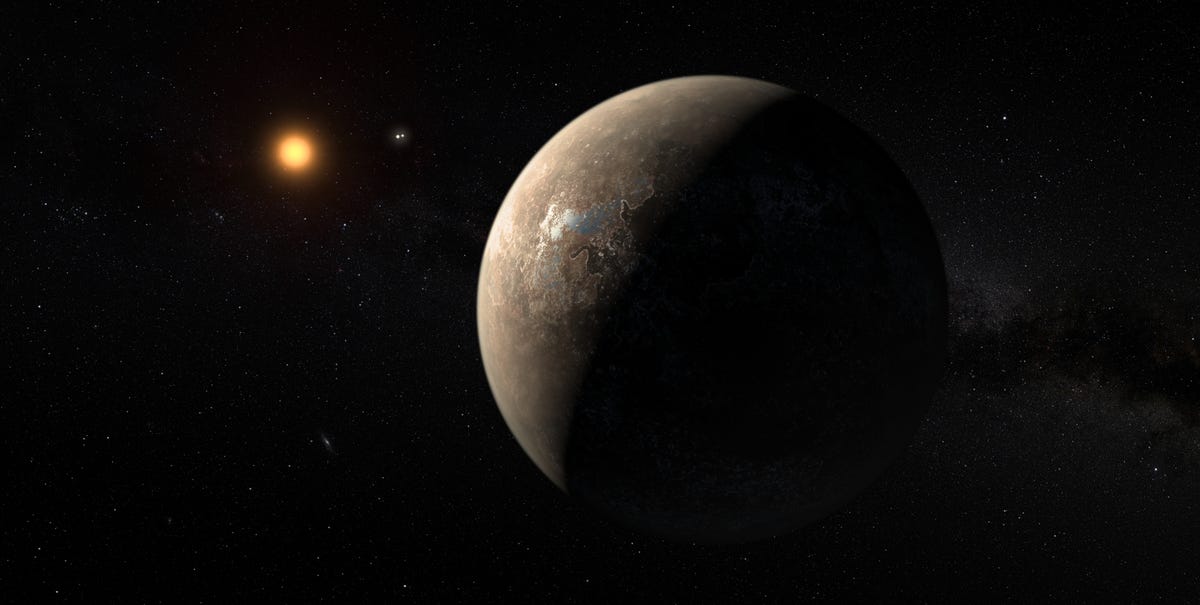

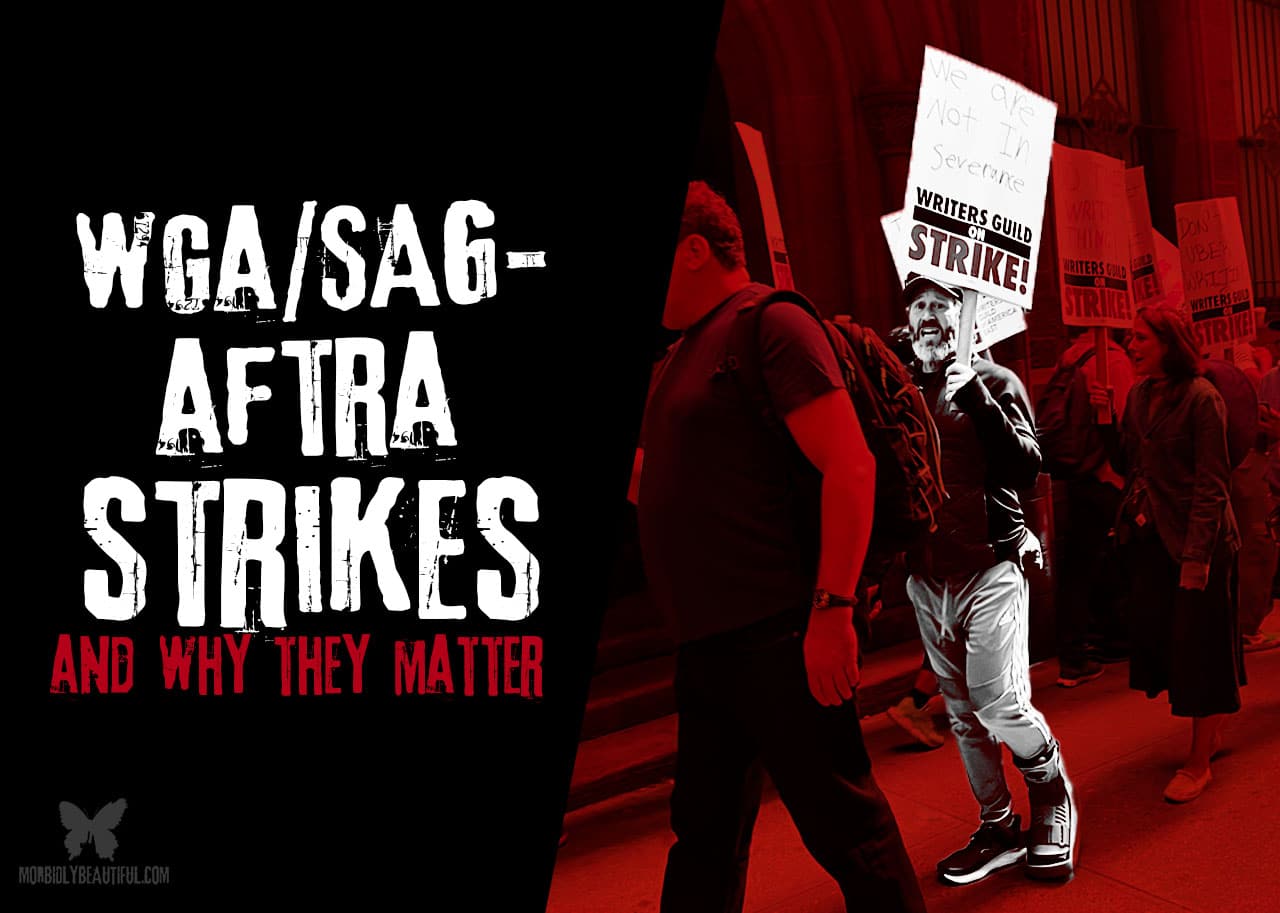

Hollywood Production Frozen Wga And Sag Aftra Strike Update

May 09, 2025

Hollywood Production Frozen Wga And Sag Aftra Strike Update

May 09, 2025 -

Colapinto Challenges Lawson For Red Bull Junior Team Spot

May 09, 2025

Colapinto Challenges Lawson For Red Bull Junior Team Spot

May 09, 2025 -

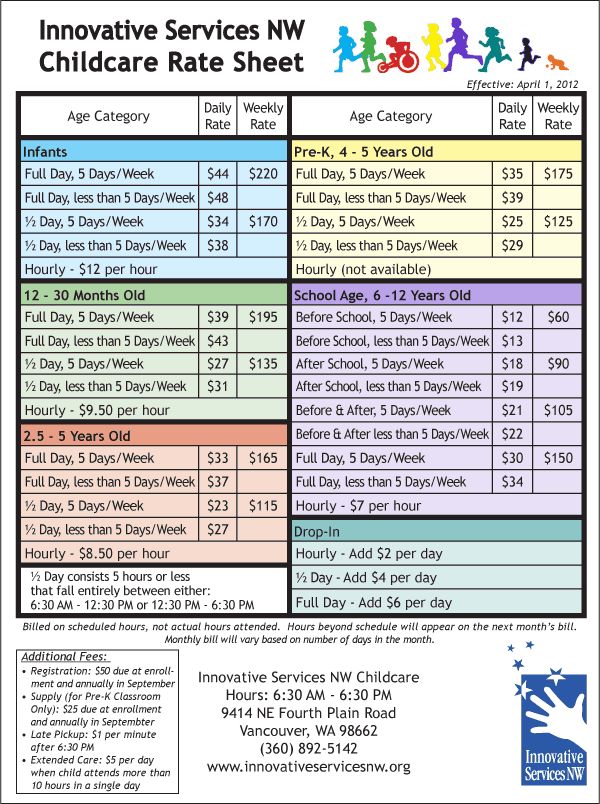

The High Price Of Childcare One Mans Experience With Babysitting And Daycare

May 09, 2025

The High Price Of Childcare One Mans Experience With Babysitting And Daycare

May 09, 2025