BlackRock ETF: Why Billionaire Investors Are Expecting A 110% Increase By 2025

Table of Contents

BlackRock, a global leader in investment management, is a titan in the Exchange-Traded Fund (ETF) market. ETFs are investment funds traded on stock exchanges, offering diversified exposure to various asset classes. Their accessibility and liquidity make them particularly appealing to high-net-worth individuals seeking efficient portfolio management. This article aims to explore the reasons behind billionaire investors' confidence in BlackRock ETFs and assess the validity of the projected 110% growth.

Factors Driving Billionaire Investment in BlackRock ETFs

Several key factors contribute to billionaire investors' significant interest in BlackRock ETFs.

BlackRock's Market Dominance and Brand Reputation

BlackRock's unparalleled position in the ETF industry is a major draw. Its vast size, extensive experience, and impeccable reputation for stability instill confidence in investors. Investing in a well-established, reputable fund manager like BlackRock offers several key advantages:

- Global Reach: BlackRock operates globally, providing access to a diverse range of market opportunities.

- Diversified Product Offerings: They offer a wide array of ETFs covering various asset classes, sectors, and investment strategies.

- Strong Track Record: BlackRock boasts a long history of strong performance across its various funds.

- Robust Research Capabilities: Their extensive research capabilities provide insights into market trends and potential investment opportunities.

Strategic Allocation and Portfolio Diversification

BlackRock ETFs offer unparalleled opportunities for portfolio diversification. Investors can access various asset classes, including equities, bonds, commodities, and real estate, within a single investment vehicle. This diversification is crucial for mitigating risk and maximizing long-term returns.

- Access to Different Market Segments: BlackRock ETFs provide exposure to diverse market segments, reducing reliance on any single sector or asset class.

- Low-Cost Diversification: ETFs offer a cost-effective way to achieve broad market diversification, minimizing expenses compared to individual stock purchases.

- Reduced Portfolio Volatility: Diversification helps to smooth out portfolio volatility, reducing the impact of market fluctuations.

Technological Advantages and Innovative ETF Strategies

BlackRock leverages cutting-edge technology in its ETF management, employing algorithmic trading and sophisticated data analysis for optimized portfolio construction and risk management. Furthermore, their innovative strategies, such as thematic ETFs focused on specific trends (e.g., sustainable energy, technology) and factor-based investing, appeal to sophisticated investors.

- Use of AI and Machine Learning: BlackRock incorporates AI and machine learning to improve trading efficiency and risk management.

- Advanced Analytics for Better Risk Management: Sophisticated analytical tools allow for proactive risk identification and mitigation.

- Access to Niche Investment Opportunities: BlackRock offers access to specialized investment opportunities that may be difficult to access individually.

Analyzing the 110% Growth Projection for BlackRock ETFs by 2025

The 110% growth projection is ambitious, but several underlying market trends could contribute to significant growth in BlackRock ETFs.

Underlying Market Trends Supporting the Prediction

Several factors could drive substantial growth in BlackRock ETFs:

- Growth of the Global ETF Market: The global ETF market is expanding rapidly, indicating increasing investor preference for this investment vehicle.

- Increasing Investor Preference for Passive Investing Strategies: Passive investing, a core strategy of many BlackRock ETFs, is gaining popularity over active management.

- Specific Sector Outperformance Projections: Strong projected growth in sectors like technology and sustainable investing, areas where BlackRock has significant ETF offerings, could contribute substantially to overall returns.

Potential Risks and Challenges

While the outlook is positive, it's crucial to acknowledge potential risks:

- Market Corrections: Market downturns could significantly impact ETF performance.

- Regulatory Changes: Changes in regulations could affect the ETF industry and BlackRock's operations.

- Increased Competition: Competition from other ETF providers could impact BlackRock's market share.

- Unexpected Global Events: Geopolitical instability or unforeseen economic events could negatively impact investment performance.

Expert Opinions and Market Analysis

Several financial analysts have expressed optimism about the long-term growth potential of BlackRock ETFs. While a precise 110% increase is speculative, positive market forecasts and BlackRock's market leadership support a bullish outlook. Further research into specific market reports and analyst opinions is advisable for a comprehensive understanding.

How to Invest in BlackRock ETFs

Investing in BlackRock ETFs is relatively straightforward. You'll need a brokerage account, which can be opened online with various firms. Remember to compare commission fees and minimum investment amounts before selecting a broker. Diversify your portfolio and set clear investment goals. Crucially, always consult a financial advisor before making any investment decisions.

- Choosing the Right Brokerage: Research different brokerages to find one that suits your needs and investment style.

- Understanding Trading Fees: Be aware of any commission fees or other charges associated with buying and selling ETFs.

- Diversifying Your Portfolio: Don't put all your eggs in one basket. Spread your investments across different ETFs to mitigate risk.

- Setting Investment Goals: Define your financial goals and investment timeline to guide your investment decisions.

BlackRock ETFs: A Promising Investment Opportunity?

Billionaire investors' interest in BlackRock ETFs is driven by the company's market dominance, diverse product offerings, technological advantages, and the overall positive outlook for the ETF market. The projected 110% increase by 2025 is ambitious but not unrealistic given the favorable market trends. However, potential risks, including market volatility and regulatory changes, must be considered.

Ready to explore the potential of BlackRock ETFs and their projected 110% increase by 2025? Research your options carefully, consider your risk tolerance, and consult a financial advisor today. Remember, thorough due diligence is crucial before making any investment decision.

Featured Posts

-

Lisa Rays Air India Complaint Airline Responds Calls Allegations Unfounded

May 09, 2025

Lisa Rays Air India Complaint Airline Responds Calls Allegations Unfounded

May 09, 2025 -

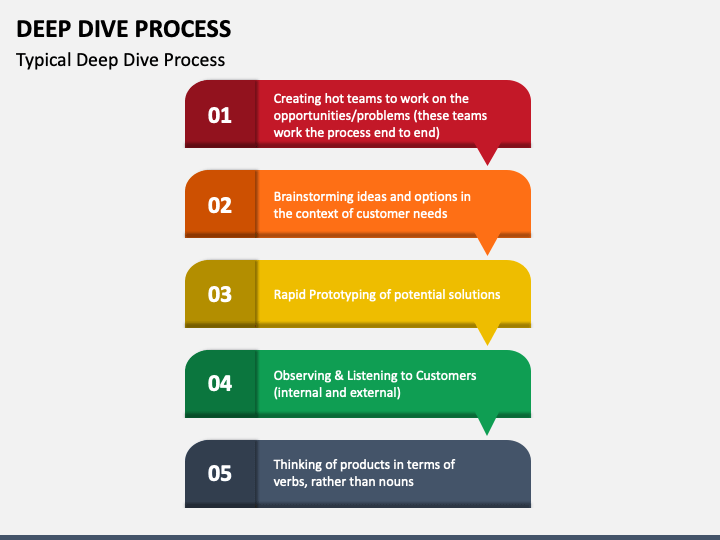

Palantirs Q1 2024 Results A Deep Dive Into Government And Commercial Performance

May 09, 2025

Palantirs Q1 2024 Results A Deep Dive Into Government And Commercial Performance

May 09, 2025 -

Golden Knights Triumph Over Red Wings Hertl Scores Two Hat Tricks

May 09, 2025

Golden Knights Triumph Over Red Wings Hertl Scores Two Hat Tricks

May 09, 2025 -

Nhl Playoffs Oilers Vs Kings Game 1 Prediction And Betting Picks

May 09, 2025

Nhl Playoffs Oilers Vs Kings Game 1 Prediction And Betting Picks

May 09, 2025 -

Nyt Strands Hints And Answers Wednesday March 12 Game 374

May 09, 2025

Nyt Strands Hints And Answers Wednesday March 12 Game 374

May 09, 2025