BOE Should Consider Smaller QE In Future Economic Shocks: Greene's Proposal

Table of Contents

The Case for Smaller-Scale QE

The effectiveness of QE, particularly large-scale interventions, is not without its limitations. The efficacy of QE diminishes with each successive round of injections. This concept, known as diminishing marginal returns, suggests that the economic benefit derived from each additional unit of QE decreases as the scale of intervention grows.

Diminishing Returns of Large-Scale QE

Past BOE interventions, while initially successful, have shown signs of diminishing returns. The impact on key economic indicators like GDP growth and inflation has arguably become less pronounced with each subsequent QE program.

- Asset Bubbles: Large-scale QE can inflate asset prices, creating unsustainable bubbles in the housing market and other asset classes.

- Inflationary Pressures: Injecting excessive liquidity into the economy can fuel inflation, eroding purchasing power and destabilizing economic growth.

- Increased Inequality: The benefits of QE often disproportionately accrue to wealthier individuals and institutions, exacerbating existing income inequality.

For example, (insert data/statistics demonstrating diminishing returns of past BOE QE programs, if available. If not, replace with hypothetical examples to illustrate the point). The lack of targeted delivery in previous large-scale QE programs contributed to these negative consequences.

Greene's Proposed Framework for Targeted QE

Dr. Greene's proposal centers on a paradigm shift towards targeted QE, focusing on precision and efficiency. Her framework emphasizes three key elements:

Precision Targeting of Specific Sectors

Instead of broadly injecting liquidity into the entire economy, Greene suggests focusing QE on specific sectors or assets most in need of support. This targeted approach would involve:

- Identifying vulnerable sectors: Prioritize industries significantly impacted by the economic shock, such as small businesses or export-oriented sectors.

- Direct asset purchases: The BOE could directly purchase assets from these targeted sectors, providing immediate relief and boosting confidence.

- Sector-specific lending facilities: Establish targeted lending programs with favorable terms for businesses within the identified sectors.

Phased Rollout and Exit Strategy

Greene advocates for a gradual and phased implementation of QE, avoiding abrupt shifts in monetary policy. A clear exit strategy is crucial to minimize potential disruptions. Key components include:

- Gradual increase in QE: Start with smaller injections and gradually increase the scale of intervention based on real-time economic data.

- Pre-defined thresholds: Establish clear benchmarks to trigger QE expansion or contraction based on economic indicators.

- Transparent communication: Communicate the rationale for each QE decision and the anticipated timeline for its withdrawal.

Enhanced Transparency and Communication

Clear and consistent communication is essential for building public trust and managing expectations surrounding QE. Greene’s proposal stresses:

- Regular press conferences: The BOE should hold regular press conferences to explain QE decisions and address public concerns.

- Detailed reports: Publish detailed reports outlining the rationale, implementation, and impact of QE programs.

- Public engagement: Increase public engagement through online forums and educational initiatives to foster understanding.

Potential Challenges and Criticisms of Smaller QE

While Greene's proposal offers several advantages, it also faces potential challenges:

Concerns about Effectiveness

Some critics might argue that smaller-scale QE may be insufficient to address severe economic downturns. However:

- Early intervention: Targeted QE, implemented early, could potentially prevent a crisis from escalating to require large-scale interventions.

- Combination with other policies: Smaller QE can be coupled with other fiscal and monetary policies to achieve a more comprehensive approach.

- Flexibility: A more flexible approach allows adjustments based on emerging economic conditions.

Political and Practical Obstacles

Implementing Greene's proposal faces significant political and practical challenges:

- Data collection difficulties: Accurate and timely data on specific sectors is crucial for effective targeting.

- Implementation complexity: Targeted QE is more complex to implement than broad-based interventions.

- Political resistance: Gaining political consensus for a more complex and nuanced QE approach may be difficult.

Conclusion: The Future of QE and the BOE's Response to Economic Shocks

Greene's proposal for smaller QE presents a compelling alternative to the large-scale interventions of the past. By focusing on precision targeting, phased implementation, and enhanced transparency, it aims to mitigate the risks associated with traditional QE while maintaining effectiveness. While challenges remain, the potential benefits of a more targeted approach – reduced risks, increased efficiency, and improved public trust – warrant serious consideration. We encourage further discussion and research into the potential of smaller QE, including analysis of economic models and the development of refined strategies for targeted QE interventions. Let’s actively engage in shaping the future of QE and the BOE's response to economic shocks.

Featured Posts

-

Calendario Laboral 16 5 Millones De Espanoles Disfrutaran De Puente El 21 De Abril

Apr 23, 2025

Calendario Laboral 16 5 Millones De Espanoles Disfrutaran De Puente El 21 De Abril

Apr 23, 2025 -

Brewers Defeat Cubs 9 7 Strong Winds Favor Brewers

Apr 23, 2025

Brewers Defeat Cubs 9 7 Strong Winds Favor Brewers

Apr 23, 2025 -

Chinas Impact On Bmw And Porsche Sales Market Trends And Future Outlook

Apr 23, 2025

Chinas Impact On Bmw And Porsche Sales Market Trends And Future Outlook

Apr 23, 2025 -

Target Field Implements Facial Recognition For Go Ahead Entry

Apr 23, 2025

Target Field Implements Facial Recognition For Go Ahead Entry

Apr 23, 2025 -

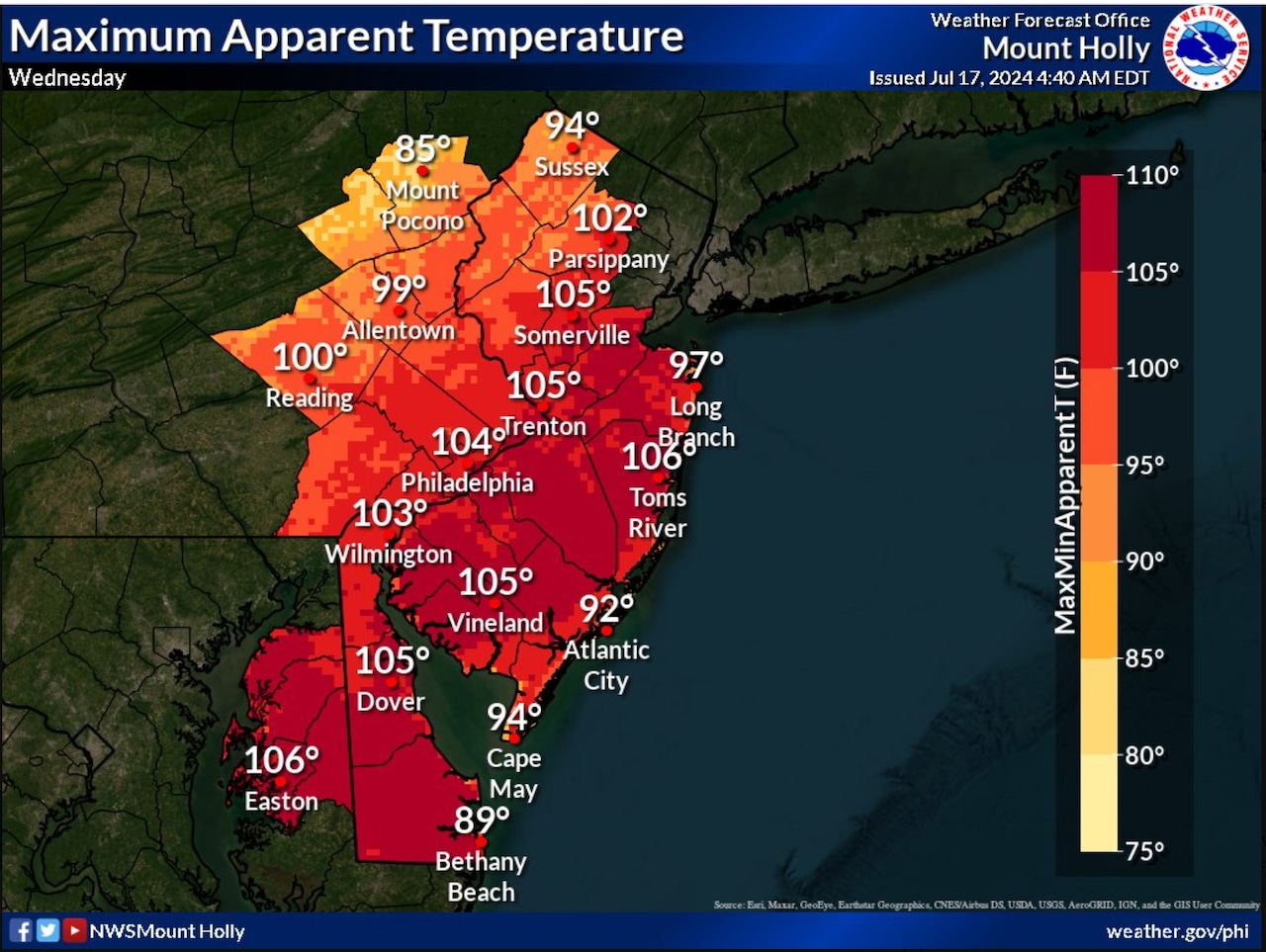

Lehigh Valley Facing Extensive Power Outages Due To High Winds

Apr 23, 2025

Lehigh Valley Facing Extensive Power Outages Due To High Winds

Apr 23, 2025

Latest Posts

-

Breaking News Arrest In Elizabeth City Weekend Shooting Investigation

May 10, 2025

Breaking News Arrest In Elizabeth City Weekend Shooting Investigation

May 10, 2025 -

February And March Elizabeth Line Strikes Affected Routes And Travel Advice

May 10, 2025

February And March Elizabeth Line Strikes Affected Routes And Travel Advice

May 10, 2025 -

Elizabeth Line Strike Dates Planned Action And Route Impacts In February And March

May 10, 2025

Elizabeth Line Strike Dates Planned Action And Route Impacts In February And March

May 10, 2025 -

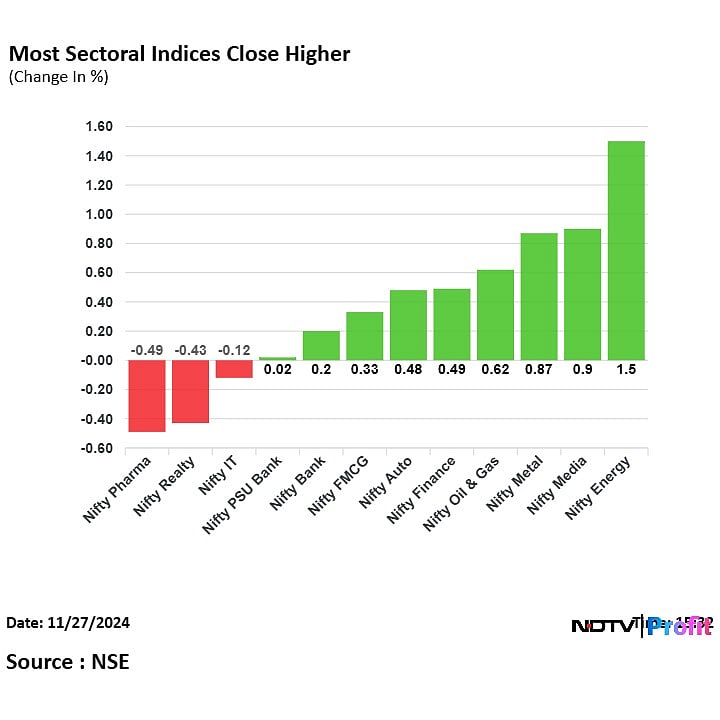

Stock Market News Sensex Nifty Record Significant Gains Sector Specific Updates

May 10, 2025

Stock Market News Sensex Nifty Record Significant Gains Sector Specific Updates

May 10, 2025 -

Indian Stock Market Update Sensex Nifty Rally Adani Ports Eternal Performance

May 10, 2025

Indian Stock Market Update Sensex Nifty Rally Adani Ports Eternal Performance

May 10, 2025