Boeing's Jeppesen Sale To Thoma Bravo: A $5.6 Billion Transaction

Table of Contents

Jeppesen's Key Role in the Aviation Industry

Jeppesen, a name synonymous with aviation data and flight planning, has been a cornerstone of the industry for decades. Its history is intertwined with the evolution of air travel, from paper charts to the sophisticated digital aviation solutions used today. The company provides a comprehensive suite of products and services that are essential for safe and efficient air travel worldwide.

- Provides digital aviation solutions for pilots, airlines, and air traffic management: Jeppesen's offerings range from electronic flight bags and navigation charts to complex flight planning software and air traffic management systems.

- Offers comprehensive navigation data, including charts, weather information, and airport data: This data is crucial for pilots to navigate safely and efficiently, considering real-time weather conditions and airport information.

- Develops crucial flight planning and operational software: Jeppesen's software is used by airlines and pilots to optimize flight routes, fuel consumption, and overall operational efficiency.

- Supports safety and efficiency in air travel: By providing accurate and timely information and robust software, Jeppesen plays a vital role in enhancing safety and reducing operational costs across the aviation industry.

Thoma Bravo's Acquisition Strategy and Future Plans for Jeppesen

Thoma Bravo, a renowned private equity firm specializing in software and technology investments, is known for its strategic acquisitions and operational expertise. Their acquisition of Jeppesen signals a strong belief in the long-term growth potential of the aviation data and software market. Thoma Bravo's strategy likely involves several key elements:

- Thoma Bravo's expertise in software and technology companies: The firm has a proven track record of successfully investing in and scaling technology businesses, leveraging their operational capabilities to enhance profitability and market share.

- Potential for increased investment in Jeppesen's technology and product development: Expect to see significant investment in research and development, leading to innovative new products and services. This could involve expanding their existing offerings or developing entirely new solutions to address emerging needs within the aviation industry.

- Possible expansion into new markets or integration with other Thoma Bravo portfolio companies: Jeppesen could benefit from synergies with other Thoma Bravo investments in related sectors, potentially creating new opportunities for growth and market penetration.

- Strategic plans to enhance Jeppesen's market position: Thoma Bravo will likely focus on strengthening Jeppesen's competitive advantage through strategic acquisitions, partnerships, and aggressive marketing efforts.

Impact of the Sale on Boeing and the Aviation Industry

Boeing's decision to sell Jeppesen reflects a strategic shift towards focusing on its core aerospace businesses. By divesting this subsidiary, Boeing can streamline its operations and concentrate resources on its primary areas of expertise: aircraft manufacturing and related services.

- Boeing's strategic shift towards core aerospace businesses: This divestiture allows Boeing to allocate capital and resources more efficiently to its core competencies, driving growth and enhancing its competitiveness in the broader aerospace market.

- Potential impact on Jeppesen's pricing and service offerings: While the immediate impact is uncertain, there's potential for changes in pricing strategies and service offerings as Thoma Bravo aims to maximize profitability.

- The implications for competition in the aviation data and software market: The acquisition could intensify competition, prompting other players to innovate and enhance their offerings to maintain their market share.

- Boeing's future plans following the divestment: The sale provides Boeing with significant financial resources to invest in research and development, potentially furthering innovation in aircraft design and manufacturing.

Financial Aspects of the $5.6 Billion Transaction

The $5.6 billion price tag underscores the significant value of Jeppesen in the aviation market. This substantial investment highlights the importance of reliable navigation data and software in modern aviation.

- Breakdown of the $5.6 billion purchase price: While the exact details of the deal structure remain confidential, the price reflects Jeppesen's strong market position and its potential for future growth under new ownership.

- Financial gains for Boeing from the sale: The proceeds from the sale will provide significant financial flexibility for Boeing to pursue strategic initiatives and enhance its financial standing.

- Thoma Bravo's investment strategy and expected returns: Thoma Bravo expects to generate significant returns on its investment through operational improvements, strategic growth initiatives, and potential future divestment.

- Potential future financial performance of Jeppesen under new ownership: With Thoma Bravo's expertise in operational efficiency and technological advancement, Jeppesen's financial performance is expected to improve significantly.

Conclusion

The sale of Jeppesen to Thoma Bravo represents a pivotal moment for Boeing, Jeppesen, and the broader aviation industry. This $5.6 billion transaction signifies the ongoing importance of reliable aviation data and advanced flight planning software. While the full impact of this acquisition remains to be seen, the strategic realignment for Boeing and the potential for enhanced innovation under Thoma Bravo’s ownership will undoubtedly shape the future of aviation navigation and flight planning. Learn more about the impact of the Boeing Jeppesen sale and the future of aviation technology by following industry news and analyzing the strategies of both Thoma Bravo and Boeing.

Featured Posts

-

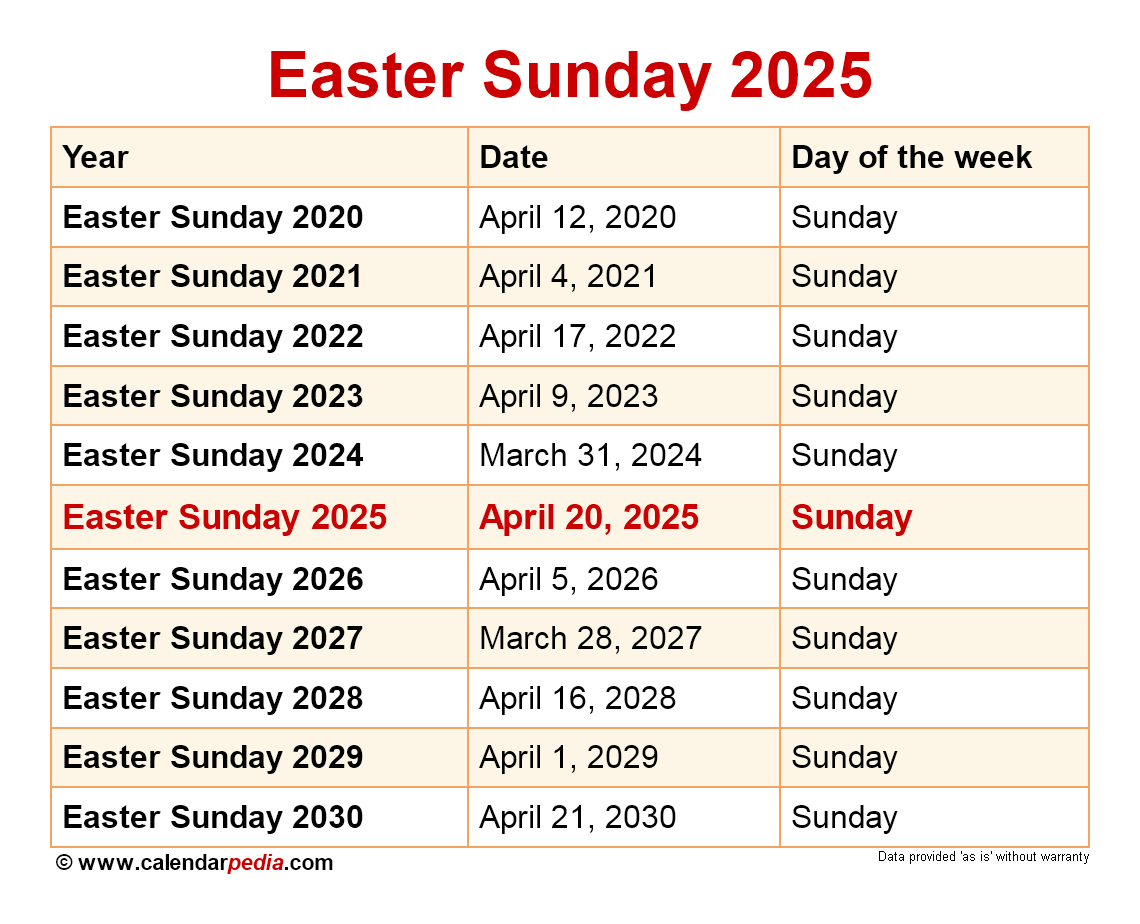

P E I Easter 2024 Holiday Schedule And Service Updates

Apr 23, 2025

P E I Easter 2024 Holiday Schedule And Service Updates

Apr 23, 2025 -

Bu Aksamki Diziler 17 Subat Pazartesi

Apr 23, 2025

Bu Aksamki Diziler 17 Subat Pazartesi

Apr 23, 2025 -

Die 50 2025 Alle Teilnehmer Sendetermine Stream And Mehr

Apr 23, 2025

Die 50 2025 Alle Teilnehmer Sendetermine Stream And Mehr

Apr 23, 2025 -

Allemagne Legislatives 2024 Enjeux Et Perspectives A J 6

Apr 23, 2025

Allemagne Legislatives 2024 Enjeux Et Perspectives A J 6

Apr 23, 2025 -

Why Pope Franciss Signet Ring Will Be Destroyed After His Death

Apr 23, 2025

Why Pope Franciss Signet Ring Will Be Destroyed After His Death

Apr 23, 2025

Latest Posts

-

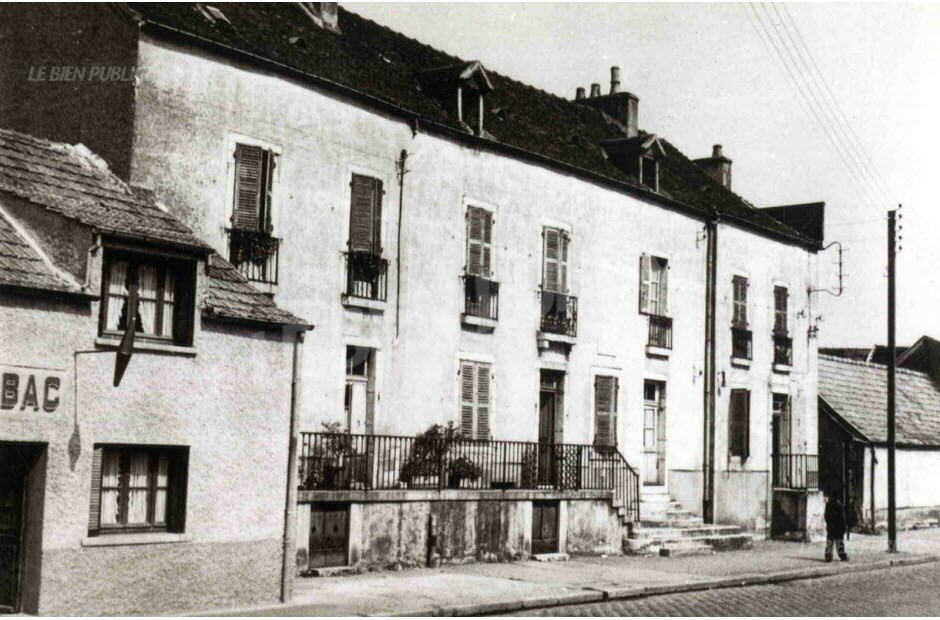

Gustave Eiffel Dijon Sa Ville Natale Et L Histoire De Sa Mere

May 10, 2025

Gustave Eiffel Dijon Sa Ville Natale Et L Histoire De Sa Mere

May 10, 2025 -

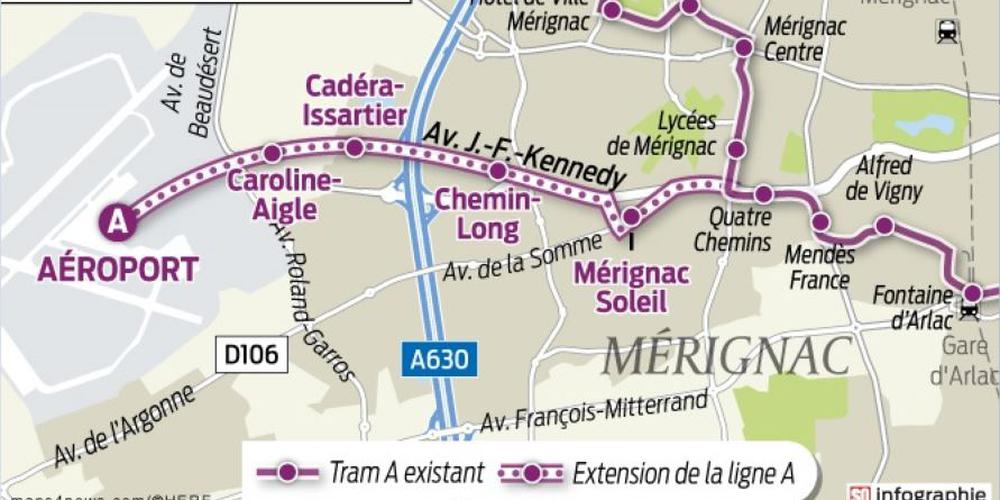

Dijon Concertation Adoptee Pour La Troisieme Ligne De Tram

May 10, 2025

Dijon Concertation Adoptee Pour La Troisieme Ligne De Tram

May 10, 2025 -

L Influence De Dijon Sur La Vie Et L Uvre De Gustave Eiffel

May 10, 2025

L Influence De Dijon Sur La Vie Et L Uvre De Gustave Eiffel

May 10, 2025 -

Conseil Metropolitain De Dijon La 3e Ligne De Tram Concertation Lancee

May 10, 2025

Conseil Metropolitain De Dijon La 3e Ligne De Tram Concertation Lancee

May 10, 2025 -

La Ville De Dijon La Cite De La Gastronomie Et La Situation D Epicure

May 10, 2025

La Ville De Dijon La Cite De La Gastronomie Et La Situation D Epicure

May 10, 2025