BofA On High Stock Market Valuations: A Reason For Investor Calm

Table of Contents

BofA's Key Arguments for a Less Bearish Outlook

BofA's relatively positive outlook, despite high valuations, rests on several key pillars. Their analysis considers a range of economic indicators and corporate performance data to paint a more nuanced picture than a simple valuation metric might suggest.

-

Resilient Corporate Earnings: BofA highlights the continued strength of corporate earnings as a key factor supporting their view. Many companies have demonstrated resilience in the face of economic headwinds, exceeding expectations and showcasing robust profitability. This strong earnings performance helps justify, to some extent, the current high valuations.

-

Positive Economic Indicators: While acknowledging potential challenges, BofA points to certain positive economic indicators that suggest continued, albeit moderated, growth. These could include factors like consumer spending data or employment figures that indicate a degree of economic strength that can support higher stock prices. Specific data points cited by BofA in their reports should be referenced here, if available, to provide concrete evidence.

-

Inflation Outlook: BofA's analysis incorporates their outlook on inflation. While acknowledging inflation's impact on valuations and interest rates, their assessment may suggest that inflation is nearing a peak or is under control, reducing its negative pressure on the market. The specifics of BofA's inflation forecast are crucial for understanding their overall market outlook.

-

Interest Rate Hikes and Their Influence: BofA likely factored in the impact of interest rate hikes by the Federal Reserve. Their analysis would likely weigh the potential negative effect of higher rates on stock valuations against the positive effect of controlling inflation. Understanding their assessment of this delicate balance is critical.

Understanding the Nuances of High Stock Market Valuations

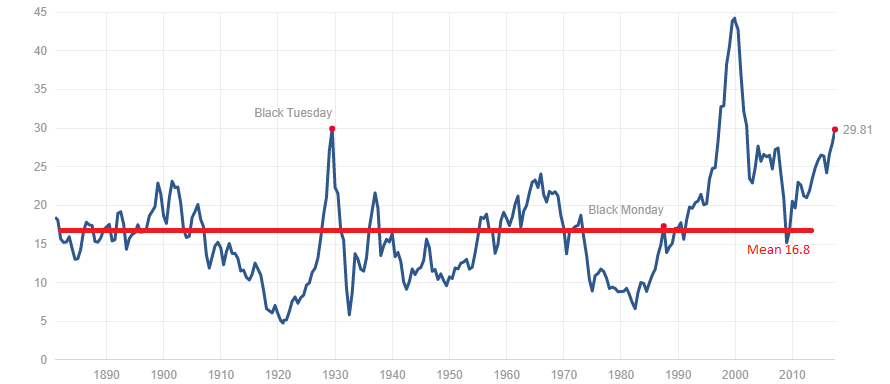

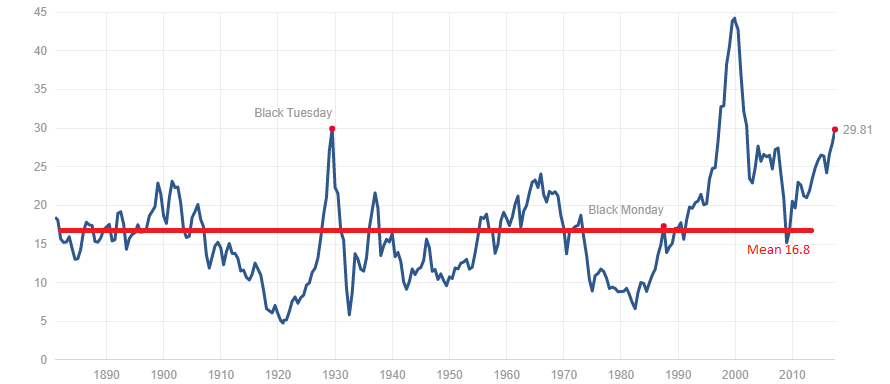

It's crucial to understand that "high valuations" aren't a monolithic concept. Several metrics can measure stock market valuations, each with its own limitations.

-

Price-to-Earnings Ratio (P/E): This compares a company's stock price to its earnings per share. A high P/E ratio can signal either high growth potential or overvaluation, depending on other factors.

-

Market Capitalization: This represents the total value of a company's outstanding shares. While a large market cap might suggest high valuations, it doesn't necessarily indicate overvaluation in isolation.

-

Discounted Cash Flow (DCF) Analysis: This more sophisticated method projects future cash flows and discounts them back to their present value. This provides a more nuanced valuation than simpler ratios, but relies heavily on assumptions about future performance.

-

Relative Valuation: This compares a company's valuation to those of its peers. High valuations relative to competitors might signal overvaluation, but could also reflect superior growth prospects.

Relying solely on any single valuation metric can be misleading. High valuations can be justified by factors like strong earnings growth, low interest rates, or anticipated future growth. Historically, high valuations have been observed without immediately leading to market crashes. Context is key.

BofA's Investment Strategy Recommendations

Given the current environment of high stock market valuations, BofA likely recommends a strategic approach focusing on long-term growth and risk management:

-

Portfolio Diversification: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) and sectors can mitigate risk and enhance potential returns.

-

Risk Management: Implementing robust risk management strategies, like stop-loss orders or diversification, is crucial to protect against market volatility.

-

Long-Term Investment Horizon: Focusing on the long-term and avoiding impulsive reactions to short-term market fluctuations is crucial for successful investing.

-

Sector Selection: BofA may recommend focusing on specific sectors poised for growth, even within a high-valuation environment. These sectors could be identified based on their resilience, growth potential, and other fundamental factors.

-

Asset Allocation: Careful asset allocation strategies are key to balancing risk and return in line with investor risk tolerance.

Addressing Investor Concerns about Potential Market Corrections

Market corrections are a normal part of the market cycle. While a correction is always a possibility, investors shouldn't panic.

-

Market Correction Probability: BofA’s assessment of the probability of a significant market downturn will influence investor strategies. Understanding their reasoning is crucial.

-

Risk Mitigation: Diversification, stop-loss orders, and a well-defined risk tolerance are important tools for mitigating risk during market volatility.

-

Investment Timing: Trying to time the market is often a losing strategy. A long-term perspective is vital. Investors should not attempt to predict the exact timing of market corrections.

-

Recession Probability: BofA’s assessment of the likelihood of a recession is key. A looming recession would change the entire picture and necessitate a different strategy.

Conclusion:

BofA's analysis suggests that while stock market valuations are indeed high, a balanced perspective is warranted. Their arguments, based on strong corporate earnings, certain positive economic indicators, and their assessment of inflation and interest rates, provide reasons for investor calm. Understanding the nuances of valuation metrics and adopting a well-diversified, long-term investment strategy are crucial for navigating this market environment. Remember that market corrections are normal, and a long-term perspective is vital. Learn more about BofA's market outlook and develop your own informed strategy on high stock market valuations. The key takeaway is that while valuations are high, BofA's analysis provides reasons for investor calm.

Featured Posts

-

Mlb Home Run Prop Bets Today May 8th Schwarber And More

May 18, 2025

Mlb Home Run Prop Bets Today May 8th Schwarber And More

May 18, 2025 -

Lady Gagas Critique Of Bowen Yangs Alejandro Ink

May 18, 2025

Lady Gagas Critique Of Bowen Yangs Alejandro Ink

May 18, 2025 -

Ib Ri S Dla Onetu Kto Zyskal A Kto Stracil Zaufanie Polakow

May 18, 2025

Ib Ri S Dla Onetu Kto Zyskal A Kto Stracil Zaufanie Polakow

May 18, 2025 -

Snl Controversy Bowen Yang Addresses Ego Nwodims Viral Weekend Update Segment

May 18, 2025

Snl Controversy Bowen Yang Addresses Ego Nwodims Viral Weekend Update Segment

May 18, 2025 -

Red Sox Closers Free Agency A Look At His Next Move

May 18, 2025

Red Sox Closers Free Agency A Look At His Next Move

May 18, 2025