BofA On Stock Market Valuations: A Reason For Investor Calm

Table of Contents

BofA's Key Valuation Metrics and Their Interpretation

BofA's market valuation analysis employed several key metrics to assess the current state of the stock market. These include the widely used price-to-earnings ratio (P/E), the price-to-sales ratio (P/S), and the cyclically adjusted price-to-earnings ratio (CAPE), a measure that smooths out cyclical variations in earnings. BofA's stock valuation report utilizes these metrics to provide a comprehensive picture.

-

Price-to-Earnings Ratio (P/E): BofA found the current P/E ratio to be slightly above the historical average, but within a reasonable range considering the robust corporate earnings growth projected for the coming year. This suggests that while stocks might appear slightly expensive on the surface, the anticipated earnings growth could justify these valuations.

-

Price-to-Sales Ratio (P/S): The P/S ratio, which compares a company's market capitalization to its revenue, revealed a similar picture. BofA's analysis indicates that while certain sectors show elevated P/S ratios, others remain relatively undervalued, suggesting opportunities for selective investment.

-

Cyclically Adjusted Price-to-Earnings Ratio (CAPE): BofA's analysis of the CAPE ratio, which accounts for long-term economic cycles, provided a longer-term perspective. This metric, while still showing a slightly elevated valuation, suggests that the current market is not experiencing extreme overvaluation compared to historical levels. BofA's market valuation analysis focused particularly on the technology and consumer discretionary sectors.

Factors Contributing to BofA's Optimistic Outlook

BofA's positive valuation outlook is underpinned by several key economic factors:

-

Corporate Earnings Growth Projections: BofA projects robust corporate earnings growth in the coming quarters, driven by factors such as strong consumer spending and ongoing technological innovation. This anticipated growth helps to justify the current, somewhat elevated, valuation metrics.

-

Interest Rate Expectations: While interest rate hikes have impacted valuations, BofA's analysis suggests that the current trajectory of interest rate increases is largely factored into market prices. The bank anticipates a plateauing of interest rates, potentially easing pressure on valuations in the future.

-

Potential for Future Economic Growth: BofA's economic forecast remains relatively positive, predicting continued, albeit moderate, economic growth in the coming years. This outlook supports their view that current market valuations are not excessively inflated.

-

Geopolitical Considerations: While geopolitical uncertainty remains a significant risk, BofA's assessment incorporates the potential impact of various geopolitical events, concluding that the overall effect on valuations is likely to be manageable.

Addressing Potential Risks and Caveats

BofA's risk assessment acknowledges several potential headwinds:

-

Inflationary Pressures: Persistent inflationary pressures pose a significant risk to valuations, as higher inflation can erode corporate profits and increase interest rates. BofA's valuation cautions emphasize the need to closely monitor inflation trends.

-

Potential for Economic Slowdown or Recession: While BofA's base case scenario anticipates continued growth, the bank acknowledges the risk of an economic slowdown or even a recession, which could significantly impact stock valuations.

-

Geopolitical Instability: Ongoing geopolitical instability, particularly concerning the ongoing conflict in Ukraine, presents an ongoing threat to global market stability and can negatively influence investor sentiment.

-

Unexpected Shifts in Monetary Policy: Unforeseen shifts in central bank monetary policy could significantly impact market sentiment and valuations, requiring investors to adapt their strategies accordingly.

Implications for Investors Based on BofA's Analysis

BofA's investment advice, based on their analysis, suggests a cautious but optimistic approach:

-

Strategies for Navigating Current Market Conditions: BofA recommends a diversified portfolio approach, incorporating both growth and value stocks, to mitigate risk. Careful stock selection, based on individual company fundamentals, is also crucial.

-

Sector-Specific Investment Recommendations: BofA's market outlook for investors highlights opportunities in sectors expected to benefit from long-term growth trends, such as technology and healthcare, while suggesting caution in overexposed cyclical sectors.

-

Importance of Long-Term Investment Strategies: BofA emphasizes the importance of maintaining a long-term investment horizon, avoiding short-term market fluctuations driven by fear and greed.

-

The Role of Diversification in Mitigating Risk: Diversification remains paramount in reducing portfolio volatility and safeguarding against unexpected market events.

Conclusion

BofA's key findings regarding stock market valuations paint a picture of cautious optimism. While risks undoubtedly exist, the bank's analysis suggests that current valuations are not excessively high, supported by robust earnings growth projections and a relatively positive economic outlook. Understanding BofA's stock market valuations can help you navigate current market uncertainties and make informed investment choices. Stay informed on the latest market analysis from BofA. Access the full BofA report [link to report] to further your understanding of current market dynamics.

Featured Posts

-

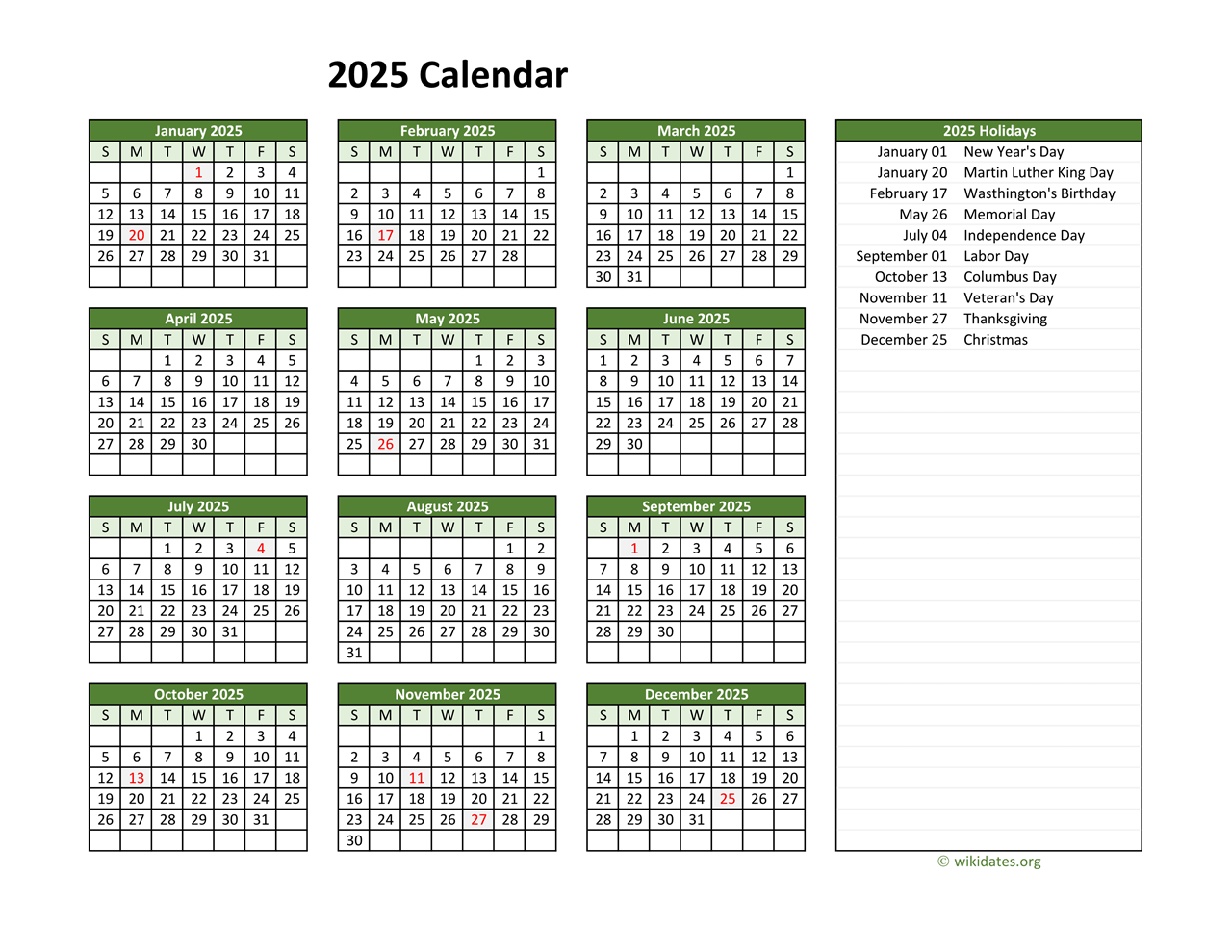

Complete 2025 Us Holiday Calendar Federal And Non Federal Dates

Apr 23, 2025

Complete 2025 Us Holiday Calendar Federal And Non Federal Dates

Apr 23, 2025 -

Scouting Michael Lorenzen Strengths Weaknesses And Potential

Apr 23, 2025

Scouting Michael Lorenzen Strengths Weaknesses And Potential

Apr 23, 2025 -

Son Dakika Guemueshane Okullari Tatil Mi Degil Mi 24 Subat Kar Yagisi Ve Aciklama

Apr 23, 2025

Son Dakika Guemueshane Okullari Tatil Mi Degil Mi 24 Subat Kar Yagisi Ve Aciklama

Apr 23, 2025 -

Easter Sunday And Monday In P E I Your Guide To Holiday Hours

Apr 23, 2025

Easter Sunday And Monday In P E I Your Guide To Holiday Hours

Apr 23, 2025 -

Solutions 30 Pourquoi Le Cours De L Action Est Il En Hausse

Apr 23, 2025

Solutions 30 Pourquoi Le Cours De L Action Est Il En Hausse

Apr 23, 2025

Latest Posts

-

Nyt Spelling Bee April 12 2025 Complete Solution And Hints

May 10, 2025

Nyt Spelling Bee April 12 2025 Complete Solution And Hints

May 10, 2025 -

Nyt Strands Game 376 Hints And Solutions For Friday March 14

May 10, 2025

Nyt Strands Game 376 Hints And Solutions For Friday March 14

May 10, 2025 -

Solve Nyt Strands Puzzle 366 Tuesday March 4 Hints And Answers

May 10, 2025

Solve Nyt Strands Puzzle 366 Tuesday March 4 Hints And Answers

May 10, 2025 -

Nyt Strands Game 366 Hints And Solutions For Tuesday March 4

May 10, 2025

Nyt Strands Game 366 Hints And Solutions For Tuesday March 4

May 10, 2025 -

Unlocking The Nyt Strands Crossword April 6 2025

May 10, 2025

Unlocking The Nyt Strands Crossword April 6 2025

May 10, 2025