BofA Reassures Investors: Why Current Market Valuations Aren't A Threat

Table of Contents

BofA's Key Arguments for a Positive Market Outlook

BofA's positive market outlook rests on several key pillars. Their analysts point to a confluence of factors suggesting that despite economic headwinds, the market's current valuation isn't inherently unsustainable. While acknowledging the challenges, BofA emphasizes the resilience of the underlying economy and the potential for continued growth.

-

Strong Corporate Earnings Despite Economic Headwinds: Despite inflationary pressures and supply chain disruptions, many companies have reported surprisingly strong earnings. This indicates that businesses are adapting and finding ways to maintain profitability even in a challenging environment. BofA highlights the effectiveness of cost-cutting measures and strategic pricing strategies employed by many corporations.

-

Resilience of the Consumer Sector and Spending: Consumer spending remains relatively robust, fueled by a strong labor market and pent-up demand in certain sectors. This sustained consumer activity provides a crucial underpinning for continued economic growth and corporate profitability, influencing BofA market valuations positively.

-

Effective Management of Inflation by Central Banks: While inflation remains a concern, BofA acknowledges the efforts of central banks globally to manage inflation through monetary policy adjustments. The belief is that these measures, though potentially impacting growth in the short-term, will ultimately contribute to long-term stability.

-

Long-Term Growth Potential in Specific Sectors: BofA identifies specific sectors poised for long-term growth, including technology, renewable energy, and healthcare. Investment in these sectors is seen as a key driver for future market expansion, mitigating concerns about current BofA market valuations.

-

Opportunities for Strategic Investments: BofA suggests that the current market presents opportunities for strategic investors to acquire undervalued assets and capitalize on long-term growth potential. This perspective underscores their belief that the current valuations offer attractive entry points for long-term investors.

Addressing Concerns About High Valuation Ratios

One of the main concerns surrounding current market valuations is the elevated Price-to-Earnings (P/E) ratios of many companies. Some investors worry that these ratios suggest the market is overvalued and ripe for a correction.

-

BofA's Counterarguments: BofA counters these concerns by comparing current P/E ratios to historical data, emphasizing that while elevated, they are not unprecedented. They also stress the importance of considering future growth prospects, not just current earnings. A company with high growth potential might justify a higher P/E ratio than a company with slower growth.

-

Long-Term Growth Potential: BofA strongly emphasizes the importance of looking beyond short-term market fluctuations and focusing on long-term growth potential. This long-term perspective is crucial in evaluating the sustainability of current valuations.

-

Interest Rates and Valuations: BofA acknowledges the impact of rising interest rates on valuations. Higher interest rates generally lead to lower valuations, as they increase the discount rate used to calculate the present value of future earnings. However, they believe that the current level of interest rates is still manageable and does not automatically negate the positive outlook.

-

Sectoral Impact on Market Valuation: BofA highlights that the overall market valuation is not uniform across all sectors. Some sectors are indeed more richly valued than others, reflecting differing growth prospects and risk profiles. A diversified approach is key to mitigate this risk.

BofA's Strategic Investment Recommendations

BofA offers several strategic investment recommendations based on their assessment of the current market.

-

High-Growth Sectors: BofA favors sectors with strong long-term growth potential, such as technology focused on artificial intelligence, renewable energy infrastructure, and healthcare innovation.

-

Rationale Behind Recommendations: The rationale behind these recommendations stems from the belief that these sectors are relatively less sensitive to short-term economic fluctuations and will benefit from long-term demographic and technological trends.

-

Risk Mitigation Strategies: BofA advises investors to employ risk mitigation strategies such as diversification and careful due diligence before making any investment decisions.

-

Specific Asset Classes: While not explicitly naming specific stocks, BofA’s recommendations point towards investments in companies within the high-growth sectors mentioned above, emphasizing a focus on long-term value creation.

Diversification as a Key Strategy

In navigating market uncertainty, diversification is paramount. A well-diversified portfolio can help mitigate risk and reduce the impact of any single asset's underperformance.

-

Different Asset Classes: Investors should consider diversifying across different asset classes, including equities, bonds, real estate, and alternative investments.

-

Reducing Overall Risk: Diversification is a fundamental risk management technique. By spreading investments across various assets, investors reduce their overall portfolio volatility and protect themselves from significant losses.

-

Alignment with BofA's Outlook: BofA's positive outlook doesn't negate the need for careful risk management. Diversification aligns perfectly with their strategic recommendations, allowing investors to participate in potential market upside while mitigating downside risks.

Conclusion

BofA's analysis suggests that while market volatility persists, current BofA market valuations, when viewed through a long-term lens, aren't necessarily a major threat. Their arguments emphasize the resilience of the underlying economy, the potential for continued growth in specific sectors, and the opportunities available for strategic investors. The key takeaways are the importance of considering long-term growth prospects, understanding the impact of interest rates on valuations, and employing robust risk management strategies like diversification.

Call to Action: Stay informed about BofA's market analysis and insights to make informed decisions about your investments. Learn more about mitigating risks associated with BofA market valuations and develop a robust investment strategy. Consider consulting a financial advisor to understand how BofA's perspective can inform your personal investment approach. Don't let short-term market fluctuations overshadow the potential for long-term growth. Understanding BofA market valuations and their implications is crucial for successful investment planning.

Featured Posts

-

The Diminishing Returns Of Armando Iannuccis Satire

May 26, 2025

The Diminishing Returns Of Armando Iannuccis Satire

May 26, 2025 -

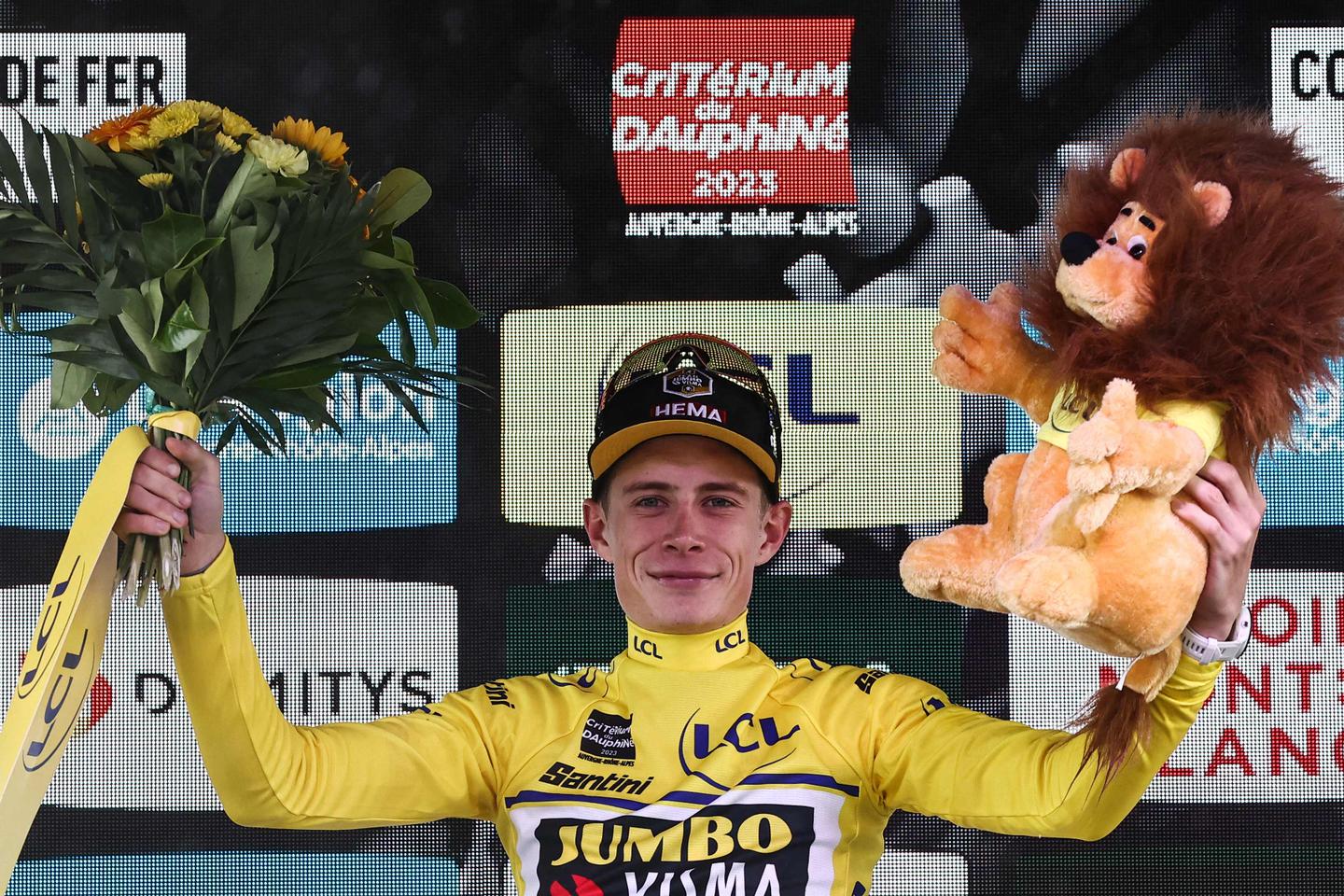

Jeu De Cyclisme Rtbf Preparez Vous Pour Le Tour De France

May 26, 2025

Jeu De Cyclisme Rtbf Preparez Vous Pour Le Tour De France

May 26, 2025 -

Comparaison Le Pen Ramadan Par Enthoven Une Analyse De La Morale Publique

May 26, 2025

Comparaison Le Pen Ramadan Par Enthoven Une Analyse De La Morale Publique

May 26, 2025 -

Frnsa Aktshaf Jthth Dakhl Mnzl Ttwrat Mthyrt Fy Qdyt Almthm Balqtl

May 26, 2025

Frnsa Aktshaf Jthth Dakhl Mnzl Ttwrat Mthyrt Fy Qdyt Almthm Balqtl

May 26, 2025 -

This Seasons Top Style Icons Ditch The Footballers Embrace F1 Fashion

May 26, 2025

This Seasons Top Style Icons Ditch The Footballers Embrace F1 Fashion

May 26, 2025

Latest Posts

-

Latest Ipswich Town Signings Enciso Phillips And Woolfenden

May 28, 2025

Latest Ipswich Town Signings Enciso Phillips And Woolfenden

May 28, 2025 -

Pacers Mathurin Cavaliers Hunter Game 4 Ejection

May 28, 2025

Pacers Mathurin Cavaliers Hunter Game 4 Ejection

May 28, 2025 -

Bennedict Mathurins Latest Message A Defining Moment For The Indiana Pacers

May 28, 2025

Bennedict Mathurins Latest Message A Defining Moment For The Indiana Pacers

May 28, 2025 -

Serious Injury Blow For Ipswich Towns Mc Kenna Philogene Bidace

May 28, 2025

Serious Injury Blow For Ipswich Towns Mc Kenna Philogene Bidace

May 28, 2025 -

Mathurin Ejected Pacers Cavaliers Game 4 Altercation

May 28, 2025

Mathurin Ejected Pacers Cavaliers Game 4 Altercation

May 28, 2025