BofA's Assessment: The Case For Calm Amid High Stock Market Valuations

Table of Contents

BofA's Key Findings on Current Market Conditions

BofA's latest report paints a nuanced picture of the current stock market. While acknowledging the elevated valuations, they don't necessarily predict an imminent crash. Their analysis incorporates several key factors influencing their overall assessment. For example, they might project moderate GDP growth for the next year, coupled with a gradual decline in inflation. Specific data points will vary depending on the most recent report, but let's consider some possible conclusions:

- BofA's stance on inflation and its impact on stock valuations: BofA likely acknowledges that persistent inflation erodes purchasing power and can negatively impact corporate earnings, potentially putting downward pressure on stock prices. However, they might also assess the current inflation rate in relation to historical trends and the effectiveness of central bank measures to control it.

- BofA's view on interest rate hikes and their influence on market performance: Interest rate increases, a common tool to combat inflation, can impact borrowing costs for businesses and consumers, potentially slowing economic growth and affecting market performance. BofA's assessment would likely include an analysis of the likely magnitude and pace of these hikes and their potential consequences for the market.

- Any specific sectors or industries BofA highlights as particularly strong or vulnerable: BofA may identify specific sectors, such as technology or energy, that they believe are particularly well-positioned or vulnerable given the current economic climate and market trends. These insights would be crucial for informed investment decisions.

- BofA's prediction for market volatility in the near future: BofA's assessment will likely include a forecast for future market volatility. They might predict a period of increased uncertainty or even suggest a potential for a market correction, but the extent and timing of such events would be open to interpretation.

Understanding the Rationale Behind High Stock Market Valuations

Despite economic uncertainties, several factors contribute to the currently high stock market valuations. Investor optimism, fueled by various economic trends, plays a significant role:

- Low interest rates and their effect on company valuations: Historically low interest rates make borrowing cheaper for companies, boosting investment and increasing profitability, which in turn can support higher stock prices. This effect is especially pronounced for companies with high levels of debt.

- Strong corporate earnings and their role in supporting high stock prices: Robust corporate earnings, indicating strong company performance and future growth potential, can justify higher stock valuations. Positive earnings reports often lead to increased investor confidence and drive up stock prices.

- Impact of technological advancements and their influence on market growth: Technological innovation consistently drives market growth and creates new investment opportunities. Companies at the forefront of technological advancements often command high valuations due to their perceived growth potential.

- Geopolitical factors and their influence on investor sentiment: Global political events and economic policies can significantly impact investor sentiment and market performance. Uncertainty surrounding geopolitical issues can either increase or decrease risk appetite and influence stock valuations.

BofA's Investment Strategies for a High-Valuation Market

Navigating a high-valuation market requires a cautious yet proactive approach. BofA likely recommends a balanced strategy emphasizing diversification and risk management:

- Recommendations on asset allocation (e.g., stocks, bonds, real estate): BofA might suggest a diversified portfolio across asset classes, adjusting the allocation based on individual risk tolerance and investment goals. This might include reducing exposure to highly valued stocks and increasing allocations to less correlated assets like bonds or real estate.

- Suggested sectors for investment considering BofA's analysis: Based on their market analysis, BofA might recommend focusing on specific sectors they deem less vulnerable to economic downturns or with higher growth potential in the current climate.

- Advice on managing risk in a volatile market: Effective risk management is crucial. BofA might suggest strategies like dollar-cost averaging (investing a fixed amount at regular intervals), diversification, and setting stop-loss orders to limit potential losses.

- Emphasis on long-term investment strategies over short-term speculation: BofA likely stresses the importance of long-term investment horizons to ride out short-term market fluctuations and benefit from the long-term growth potential of the market.

The Case for a Measured Approach

BofA's assessment, while acknowledging the high valuations, likely doesn't advocate for panic selling. A measured approach is key. Avoid impulsive reactions based on short-term market noise. Focus on your long-term investment goals and maintain a diversified portfolio. This aligns with their overall recommendation for a calm and considered investment strategy.

Conclusion: Staying Calm Amidst BofA's Assessment of High Stock Market Valuations

BofA's assessment highlights the complexities of the current market environment. High valuations exist, but this doesn't automatically signal an impending crash. The key takeaway is the importance of a calm and measured approach. Their suggested investment strategies emphasize diversification, risk management, and a long-term perspective. Understand BofA's assessment by reviewing their reports and other reputable sources to develop a robust investment strategy based on their insights and your own risk tolerance. Learn more about navigating high stock market valuations and make informed decisions for your financial future.

Featured Posts

-

Espionage Ring Busted You Tuber And Nine Others Held In Punjab And Haryana

May 19, 2025

Espionage Ring Busted You Tuber And Nine Others Held In Punjab And Haryana

May 19, 2025 -

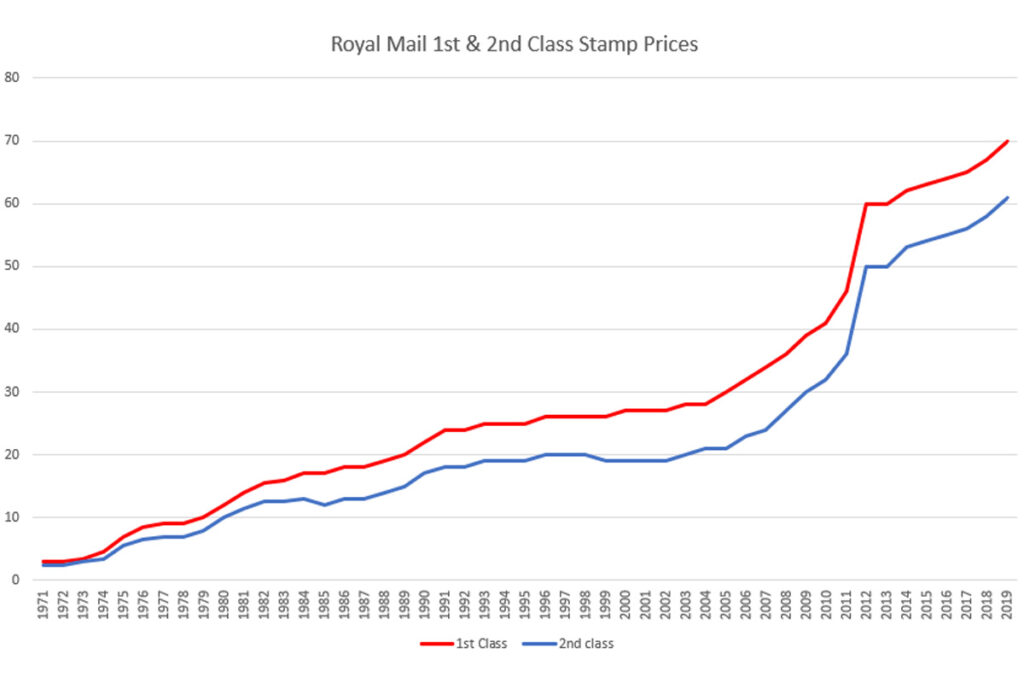

The Rising Cost Of Postage Stamps A Financial Burden For Many

May 19, 2025

The Rising Cost Of Postage Stamps A Financial Burden For Many

May 19, 2025 -

Jennifer Lawrence And Cooke Maroney Spotted Together After Baby No 2 Reports

May 19, 2025

Jennifer Lawrence And Cooke Maroney Spotted Together After Baby No 2 Reports

May 19, 2025 -

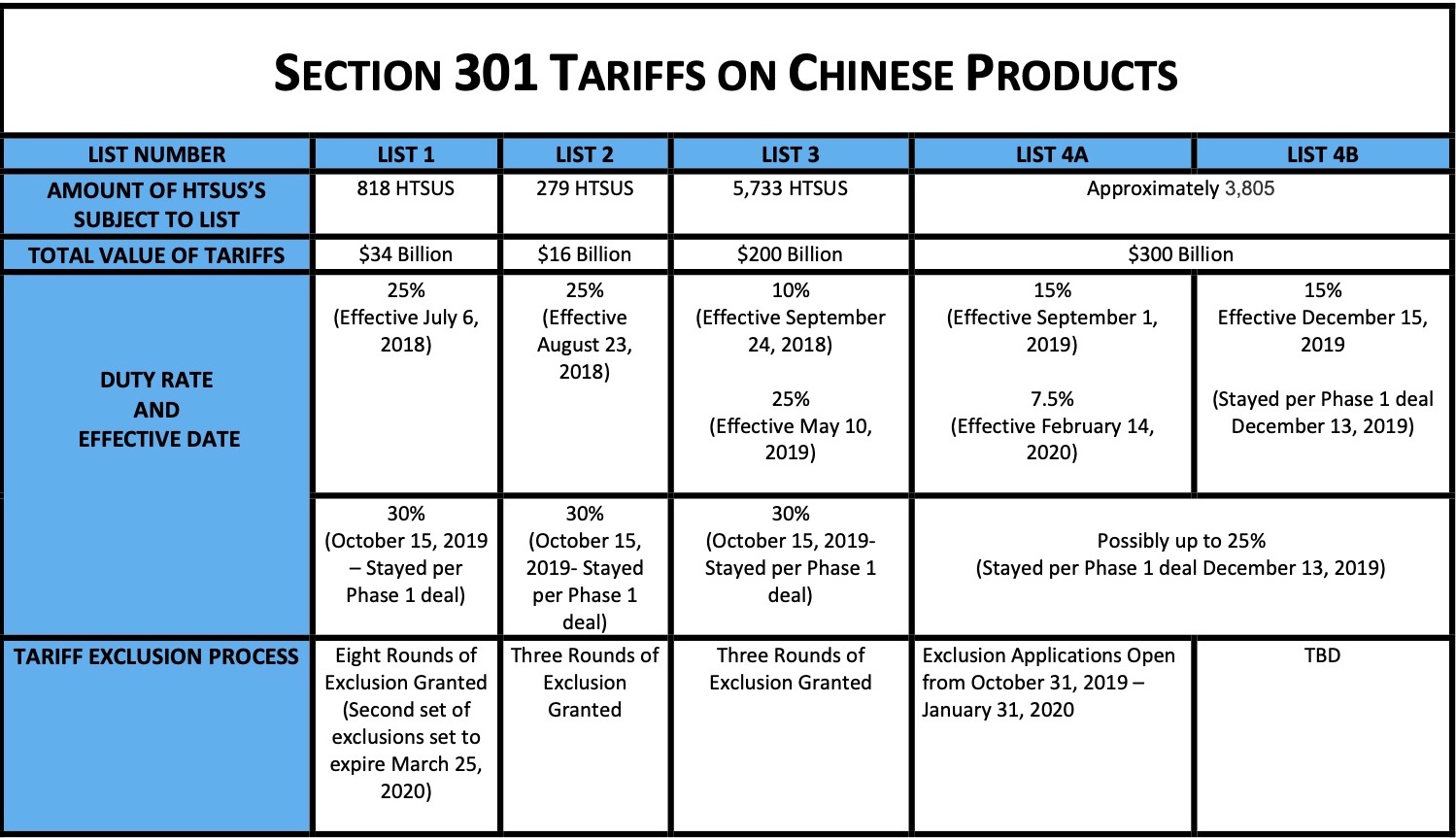

Trumps 30 Tariffs On China A Prolonged Impact Until 2025

May 19, 2025

Trumps 30 Tariffs On China A Prolonged Impact Until 2025

May 19, 2025 -

Securing The Future Of Jerseys Battle Of Flowers

May 19, 2025

Securing The Future Of Jerseys Battle Of Flowers

May 19, 2025