BofA's Rationale: Why Current Stock Market Valuations Are Justified

Table of Contents

BofA's Macroeconomic Outlook and its Impact on Valuations

BofA's macroeconomic forecast plays a crucial role in justifying their stance on current stock market valuations. Their analysis considers several key macroeconomic factors: economic growth, inflation, and interest rates. These predictions directly influence their valuation models and investment strategies.

-

BofA's Economic Forecast: BofA projects moderate GDP growth for the coming year, fueled by continued consumer spending and business investment. While acknowledging potential headwinds, such as geopolitical instability, they maintain a cautiously optimistic outlook for global economic expansion.

-

Inflation and Interest Rates: BofA anticipates inflation to gradually decrease, albeit remaining above historical averages. This, coupled with their forecast of a gradual increase in interest rates, suggests a controlled macroeconomic environment, mitigating significant risks to market valuations. Specific data points from BofA's reports include:

- BofA projects 2.5% GDP growth in 2024.

- BofA anticipates inflation to remain at 3% in 2024, gradually decreasing to 2% by 2025.

- BofA's interest rate forecast suggests a 0.25% increase per quarter for the next year.

The Role of Corporate Earnings in Justifying Valuations

BofA's analysis goes beyond macroeconomic factors; it also heavily considers corporate earnings and profitability. Their valuation arguments are significantly bolstered by their projections for continued earnings growth across various sectors.

-

BofA Earnings Estimates: BofA's analysts have meticulously evaluated the financial performance and future prospects of numerous companies across different sectors. This analysis forms the basis for their earnings growth projections.

-

Sectoral Performance: The analysis reveals a varied picture.

- BofA projects strong earnings growth in the technology sector, driven by continued innovation and demand for digital services.

- BofA expects moderate earnings growth in the consumer staples sector, reflecting stable consumer demand despite inflationary pressures.

- BofA's analysis points to a positive outlook for corporate profitability overall, suggesting sustainable stock market valuations.

BofA's Assessment of Risk and its Influence on Valuations

While acknowledging inherent market risks, BofA's assessment suggests that these risks are currently manageable and factored into their valuation models. Their analysis considers various risk factors and mitigation strategies.

-

Market Risk Assessment: BofA identifies geopolitical uncertainty, inflation, and potential supply chain disruptions as key risks. However, their assessment suggests these risks are currently contained within acceptable parameters.

-

BofA Risk Mitigation Strategies: BofA's risk management framework incorporates diversification strategies and stress testing models to mitigate the impact of potential negative events. Specific examples include:

- Geopolitical uncertainty is a key risk, but BofA believes the impact on the overall market will be limited based on their detailed analysis of global events.

- BofA sees inflation as a manageable risk, given their projection for its gradual decline.

- BofA considers the current market volatility to be within normal parameters, given the current economic climate.

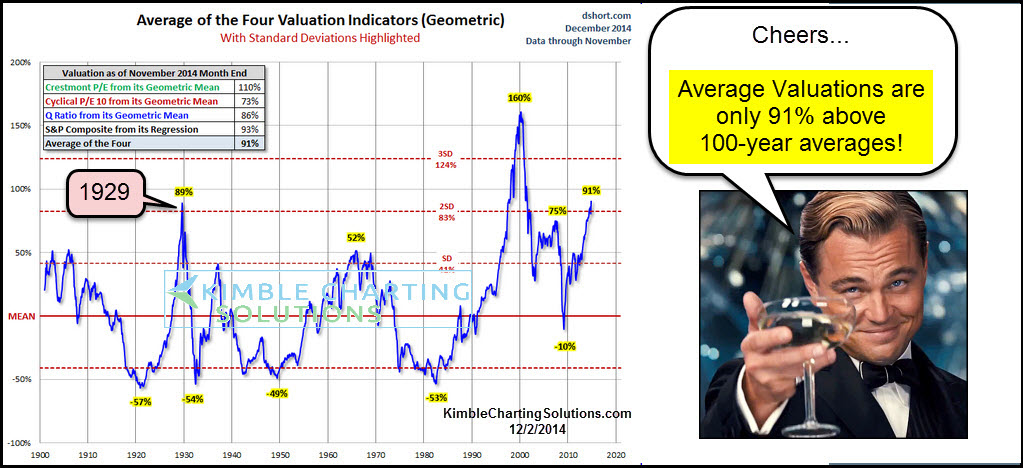

Comparison to Historical Valuations and Market Cycles

BofA's justification for current valuations also considers historical context. Their analysis compares current P/E ratios and other valuation metrics to long-term averages and previous market cycles.

-

Historical Valuation Data: By comparing current valuations to historical averages, BofA aims to contextualize the current market environment. They account for economic cycles and consider how present conditions deviate from the past.

-

Market Cycle Analysis: BofA's analysis indicates that while valuations are higher than some historical averages, they are not unprecedented. Their research suggests the current market is in a stage of moderate growth, not exhibiting signs of a significant bubble.

Conclusion

In summary, BofA's rationale for justifying current stock market valuations rests on a multi-faceted analysis. Their optimistic macroeconomic outlook, coupled with strong corporate earnings projections, a measured assessment of market risks, and comparison to historical data, supports their view. While inherent uncertainties remain, BofA's analysis suggests that current valuations are largely justified. Understand the complete rationale behind BofA's assessment of current stock market valuations by exploring their latest research and reports. Learn more about their investment strategies and form your own informed opinion on whether current market valuations are justified.

Featured Posts

-

Leon Draisaitl Injury Out Against Winnipeg Jets

May 10, 2025

Leon Draisaitl Injury Out Against Winnipeg Jets

May 10, 2025 -

High Potential After 11 Years Enduring Influence In Psych Spiritual Development

May 10, 2025

High Potential After 11 Years Enduring Influence In Psych Spiritual Development

May 10, 2025 -

Dijon Vs Psg Le Match Decisif De L Arkema Premiere Ligue

May 10, 2025

Dijon Vs Psg Le Match Decisif De L Arkema Premiere Ligue

May 10, 2025 -

Suncor Production Record High Output Despite Sales Volume Slowdown

May 10, 2025

Suncor Production Record High Output Despite Sales Volume Slowdown

May 10, 2025 -

Edmonton Oilers Force Overtime Win Against Los Angeles Kings Series Tied

May 10, 2025

Edmonton Oilers Force Overtime Win Against Los Angeles Kings Series Tied

May 10, 2025