BofA's Take: Are High Stock Market Valuations Cause For Investor Concern?

Table of Contents

BofA's Assessment of Current Market Valuations

BofA employs a multifaceted approach to assessing market valuations, relying on several key metrics to paint a comprehensive picture.

Valuation Metrics Used by BofA

BofA utilizes a range of valuation metrics to gauge the overall health and potential risks associated with the current stock market. These include:

-

Price-to-Earnings ratio (P/E): This classic metric compares a company's stock price to its earnings per share. A high P/E ratio suggests investors are willing to pay more for each dollar of earnings, potentially indicating overvaluation. BofA's analysis likely considers both forward P/E (based on projected earnings) and trailing P/E (based on past earnings) to provide a more holistic view.

-

Price-to-Sales ratio (P/S): This ratio compares a company's market capitalization to its revenue. It’s particularly useful for valuing companies with negative earnings or those in rapidly growing sectors. BofA’s analysis likely incorporates P/S ratios to supplement the P/E data and offer a broader perspective on valuation.

-

Shiller P/E (CAPE): Also known as the cyclically adjusted price-to-earnings ratio, this metric smooths out earnings fluctuations over a 10-year period, providing a more stable measure of valuation. BofA’s use of the CAPE ratio helps to account for the cyclical nature of earnings and provides a longer-term perspective on valuation.

BofA's Findings on Overvaluation

BofA's conclusions on current market valuations vary depending on the specific metric used and the timeframe considered. While specific numerical data requires referencing BofA's official reports, their analysis generally points towards a market that is, at least in certain sectors, trading at relatively elevated levels compared to historical averages. This does not necessarily equate to an immediate crash, but rather highlights the increased risk associated with higher valuations.

- Elevated but not necessarily unsustainable: BofA’s findings may suggest that, while valuations are higher than historical averages, underlying factors such as strong corporate earnings and low interest rates could partially justify these levels.

- Sector-specific variations: The degree of overvaluation might vary significantly across different sectors, highlighting the importance of a diversified investment strategy.

- Cautionary note: BofA's analysis likely incorporates a degree of caution, acknowledging the inherent uncertainties in predicting future market performance.

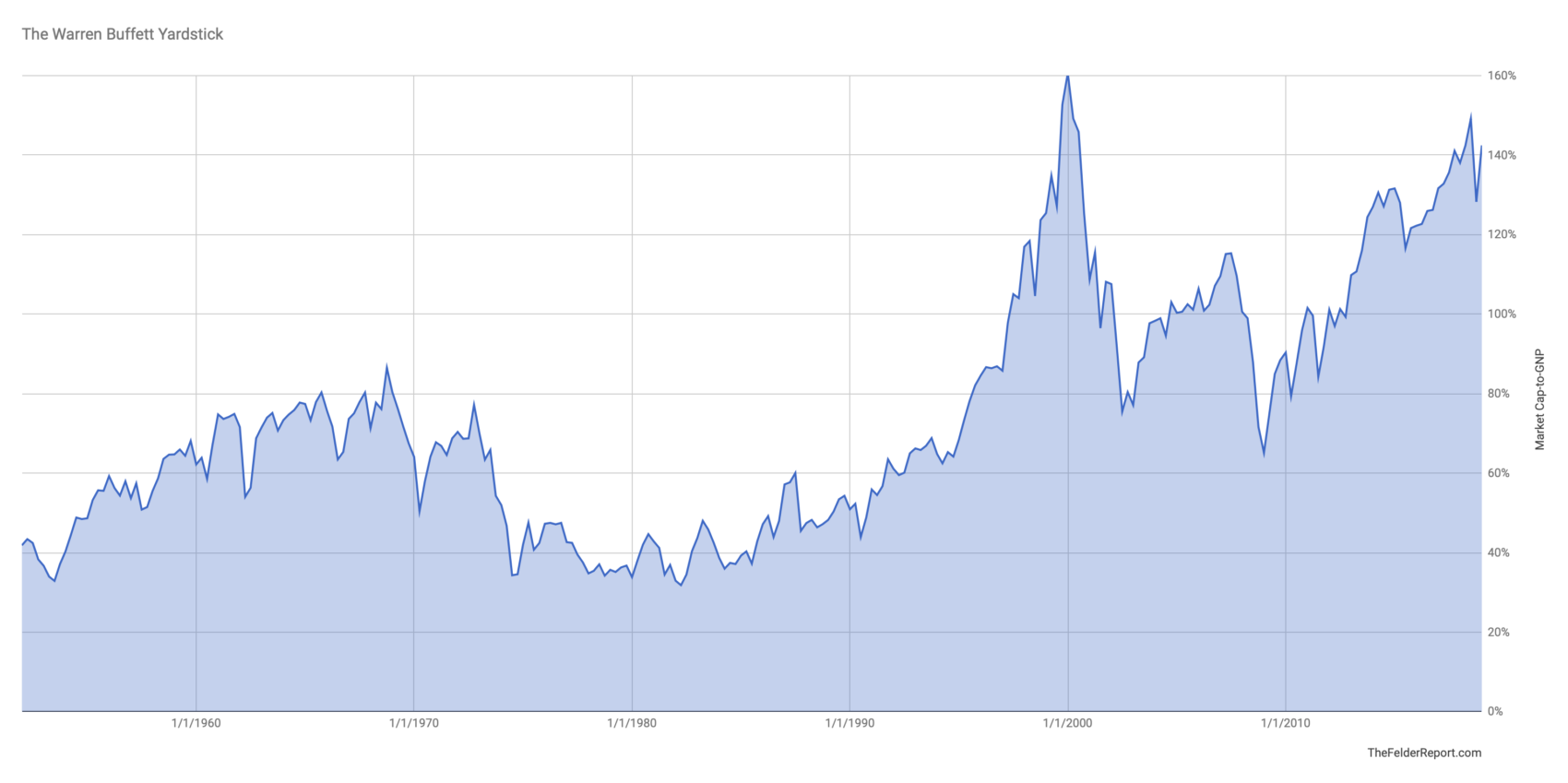

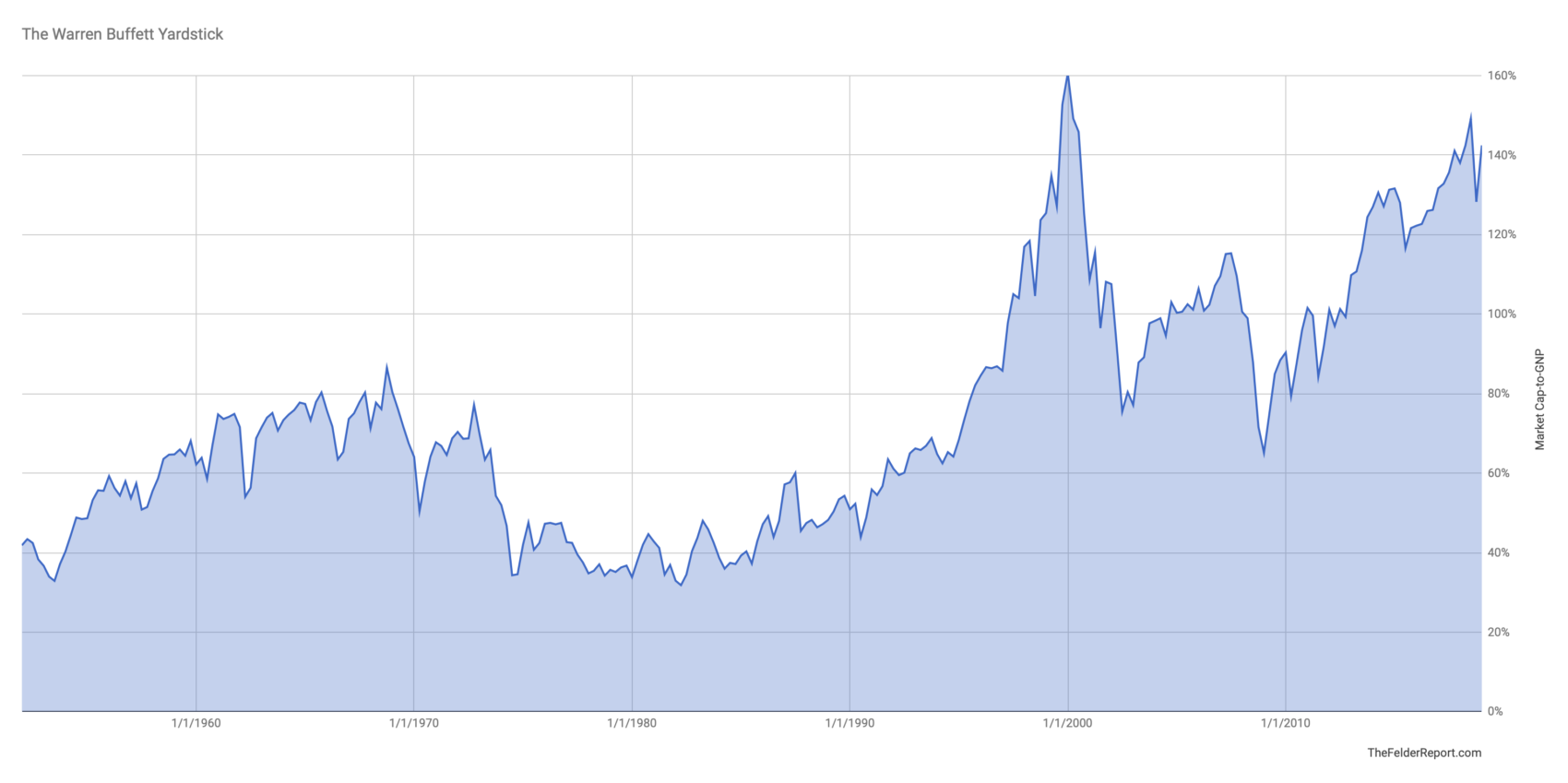

Comparison to Historical Valuations

Comparing current valuations to historical data offers crucial context. BofA likely references periods of similar high valuations in the past, such as the dot-com bubble or the pre-2008 financial crisis, to highlight potential parallels and risks. Examining the subsequent market performance during and after those periods provides valuable insights into potential future scenarios.

- Graphical representations: BofA's reports likely include charts comparing current valuation metrics to historical averages, visualizing the extent of current valuations relative to past market cycles.

- Periods of similar valuations: The analysis may highlight specific periods with comparable valuations and discuss the factors contributing to both similarities and differences between those periods and the present.

- Subsequent market performance: A key part of the analysis involves exploring the market performance following periods of high valuations, analyzing potential outcomes based on past experiences.

Factors Contributing to High Stock Market Valuations

Several interconnected factors contribute to the current high stock market valuations. Understanding these factors is crucial for interpreting BofA’s assessment and developing informed investment strategies.

Low Interest Rates

Historically low interest rates implemented by central banks globally have significantly impacted stock valuations.

- Reduced bond yields: Low interest rates make bonds less attractive, pushing investors towards higher-yielding assets such as equities.

- Increased borrowing: Lower borrowing costs stimulate corporate investment and expansion, potentially leading to increased earnings and higher stock prices.

Strong Corporate Earnings

Robust corporate earnings have played a significant role in supporting elevated valuations.

- Positive earnings growth: Many companies have reported strong earnings growth in recent years, bolstering investor confidence and driving demand for their stocks.

- Sustainability concerns: However, BofA’s analysis might assess the sustainability of these earnings, considering factors such as economic cycles, supply chain disruptions, and potential inflationary pressures.

Economic Growth and Inflation

The interplay between economic growth and inflation profoundly affects market valuations.

- Economic expansion: Periods of strong economic growth generally support higher stock valuations, as companies benefit from increased demand and higher revenues.

- Inflationary pressures: However, high inflation can erode corporate profits and increase interest rates, potentially dampening investor enthusiasm and leading to market corrections. BofA’s analysis would likely consider the current inflationary environment and its potential implications for future market performance.

Investor Concerns and Mitigation Strategies

While strong earnings and low interest rates support high valuations, investors must acknowledge the inherent risks.

Risks Associated with High Valuations

Investing in a highly valued market carries considerable risk.

- Market corrections: High valuations increase the likelihood of significant market corrections or even crashes if investor sentiment shifts negatively.

- Reduced future returns: Stocks purchased at high valuations may offer lower returns in the future, especially compared to investments made at lower valuations.

- Increased volatility: A highly valued market is generally more sensitive to negative news, leading to increased price volatility.

BofA's Recommendations for Investors

BofA’s recommendations likely emphasize a cautious and diversified approach.

- Diversification: Spreading investments across various asset classes (stocks, bonds, real estate, etc.) reduces the overall portfolio risk.

- Sector-specific analysis: Investors should conduct thorough research and identify undervalued sectors or companies that might offer better risk-adjusted returns.

- Risk management techniques: Employing stop-loss orders and other risk management strategies can help limit potential losses during market corrections.

Alternative Investment Options

BofA might suggest considering alternative investment options to diversify portfolios and reduce reliance on equities.

- Bonds: While offering lower returns than equities, bonds can provide stability and reduce overall portfolio volatility.

- Real estate: Real estate can serve as a hedge against inflation and offer diversification benefits.

- Other asset classes: Depending on investor risk tolerance and financial goals, alternative asset classes like commodities or private equity might be considered.

Conclusion

BofA's analysis of high stock market valuations offers valuable insights for investors. While strong corporate earnings and low interest rates have contributed to current levels, the elevated valuations present inherent risks, including the potential for market corrections and reduced future returns. Understanding BofA's take on high stock market valuations is crucial for informed investment decisions. Further research and a diversified approach, potentially incorporating alternative investment options, are recommended to manage risk in this market environment. Refer to BofA's official reports for detailed data and specific recommendations. Careful consideration of stock market valuation analysis is paramount for navigating the current market landscape and making sound investment choices.

Featured Posts

-

Hmrc Child Benefit Important Notifications And What To Do

May 20, 2025

Hmrc Child Benefit Important Notifications And What To Do

May 20, 2025 -

Hmrc Scraps Tax Returns For Thousands New Rule Changes Explained

May 20, 2025

Hmrc Scraps Tax Returns For Thousands New Rule Changes Explained

May 20, 2025 -

Comprendre Le Systeme De Numerotation Des Batiments Dans Le District D Abidjan

May 20, 2025

Comprendre Le Systeme De Numerotation Des Batiments Dans Le District D Abidjan

May 20, 2025 -

Robert Pattinson And Suki Waterhouse A Look At Twilight Star Relationships

May 20, 2025

Robert Pattinson And Suki Waterhouse A Look At Twilight Star Relationships

May 20, 2025 -

Cin Grand Prix Si Hamilton Ve Leclerc Diskalifiye Edildi

May 20, 2025

Cin Grand Prix Si Hamilton Ve Leclerc Diskalifiye Edildi

May 20, 2025

Latest Posts

-

Mainz Holds Onto Top Four After Dominant Gladbach Win

May 20, 2025

Mainz Holds Onto Top Four After Dominant Gladbach Win

May 20, 2025 -

Mainz Extends Top Four Push With Victory Over Gladbach

May 20, 2025

Mainz Extends Top Four Push With Victory Over Gladbach

May 20, 2025 -

Mainzs Impressive Win At Gladbach Secures Top Four Spot

May 20, 2025

Mainzs Impressive Win At Gladbach Secures Top Four Spot

May 20, 2025 -

The Enduring Love Of Cycling Scott Savilles Ragbrai And Commute Story

May 20, 2025

The Enduring Love Of Cycling Scott Savilles Ragbrai And Commute Story

May 20, 2025 -

From Ragbrai To Daily Rides Scott Savilles Passion For Cycling

May 20, 2025

From Ragbrai To Daily Rides Scott Savilles Passion For Cycling

May 20, 2025