BofA's View: Why Current Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Bullish Outlook: Understanding the Rationale

BofA maintains a generally positive outlook on the stock market, even with elevated valuations in certain sectors. Their rationale rests on a combination of strong economic fundamentals and expectations for continued corporate growth. This optimistic view isn't based on blind faith; instead, it's supported by several key factors:

- Strong Corporate Earnings: BofA points to robust corporate earnings reports as a significant indicator of underlying economic strength. Many companies continue to exceed expectations, demonstrating resilience in the face of economic uncertainty.

- Low Unemployment Rates: The persistently low unemployment rate suggests a healthy consumer spending environment, further bolstering corporate profitability and supporting future growth.

- Positive Future Growth Projections: BofA's analysts predict continued, albeit potentially moderated, economic growth in the coming years. This expectation underpins their belief that current valuations are sustainable, even with the present market fluctuations.

- Supportive Monetary Policy (Historically): While interest rate hikes have impacted valuations, BofA's past analysis often considered historically low interest rates a significant factor supporting higher valuations. (Note: This section should be updated to reflect current BofA statements on interest rate impacts). You can find more detailed analysis in [link to relevant BofA report].

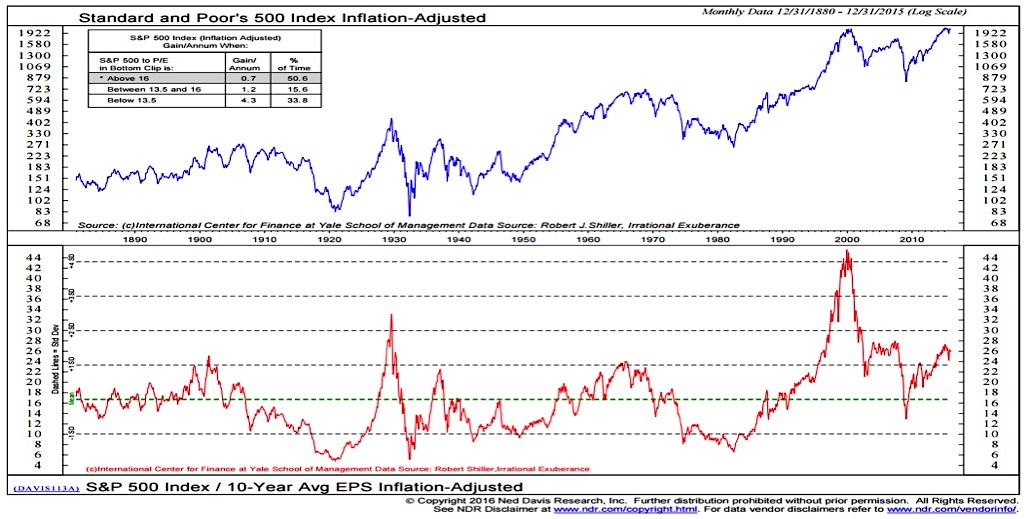

Addressing High Price-to-Earnings Ratios: A Deeper Dive

One of the most common investor concerns revolves around high price-to-earnings (P/E) ratios. These ratios, which compare a company's stock price to its earnings per share, can indicate whether a stock is overvalued. BofA acknowledges these elevated ratios but argues that the context is crucial:

- Extenuating Circumstances: BofA's analysis likely considers that historically low interest rates (prior to recent hikes) and strong projected future earnings growth have played a role in justifying higher P/E ratios.

- Future Growth Prospects: The bank contends that many companies' strong projected future earnings growth justifies the current, seemingly high, P/E ratios. This growth is expected to drive earnings upwards, thus reducing the P/E ratio over time.

- Historical Context: Comparing current P/E ratios to historical data within the context of broader economic conditions is key. BofA's research likely provides this comparative analysis, demonstrating that while ratios are elevated, they may not be unprecedented considering the unique circumstances. (Again, link to a relevant BofA report would be beneficial here).

The Role of Interest Rates in Market Valuations

Interest rates significantly influence stock market valuations. BofA's analysis likely incorporates the following:

- Low Interest Rates (Historically): Historically low interest rates have made stocks a more attractive investment compared to bonds, pushing up valuations. (Again, this requires updating to reflect current interest rate environment and BofA's current stance).

- Interest Rate Predictions: BofA's predictions for future interest rate movements are critical. Rising rates typically lead to lower valuations as the opportunity cost of holding stocks increases. Conversely, falling rates can boost valuations.

- Alternative Investment Options: BofA likely assesses the attractiveness of stocks relative to other investment options like bonds. The comparative yields influence investor choices and affect overall market valuations.

Long-Term Growth Potential: Why Investors Shouldn't Panic

BofA likely emphasizes the long-term growth potential of the market to counter short-term valuation concerns. This perspective often focuses on:

- High-Growth Sectors: BofA likely highlights sectors poised for strong long-term growth, such as technology, renewable energy, or healthcare.

- Key Growth Drivers: Specific companies and industries expected to drive this growth are often identified in their analyses.

- Long-Term Justification: BofA argues that the long-term growth potential inherent in these sectors justifies current valuations despite short-term market fluctuations. A long-term investment strategy, therefore, mitigates the risk associated with seemingly high valuations.

Conclusion: Don't Let Stock Market Valuations Deter You

BofA's analysis suggests that while current stock market valuations might appear high, several factors mitigate these concerns. Strong corporate earnings, low unemployment, positive growth projections (relative to the current economic climate), and the historical context of interest rates (requiring an update based on current conditions) all contribute to a cautiously optimistic outlook. The bank emphasizes the importance of considering long-term growth potential rather than solely focusing on short-term valuations. Don't let short-term fluctuations in stock market valuations impact your long-term investment strategy. Review BofA's analysis and make informed decisions based on their insights. For further information, please visit [link to BofA's investment research page] and [link to relevant BofA report on market valuations].

Featured Posts

-

Lietuvos Porsche Rinka 2024 Augimas Ir Tendencijos

Apr 29, 2025

Lietuvos Porsche Rinka 2024 Augimas Ir Tendencijos

Apr 29, 2025 -

Firefighters Respond To Gas Leak Downtown Louisville Buildings Evacuated

Apr 29, 2025

Firefighters Respond To Gas Leak Downtown Louisville Buildings Evacuated

Apr 29, 2025 -

Mlb 160km

Apr 29, 2025

Mlb 160km

Apr 29, 2025 -

Huawei Develops Exclusive Ai Chip To Rival Nvidia

Apr 29, 2025

Huawei Develops Exclusive Ai Chip To Rival Nvidia

Apr 29, 2025 -

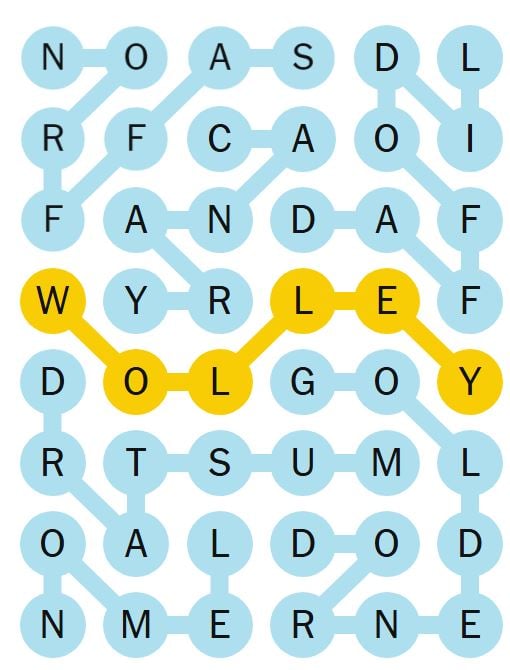

Nyt Strands February 28 2025 Complete Solutions And Spangram

Apr 29, 2025

Nyt Strands February 28 2025 Complete Solutions And Spangram

Apr 29, 2025

Latest Posts

-

Financial Fallout Fox News Hosts Spar Over Trumps Trade Policies

May 09, 2025

Financial Fallout Fox News Hosts Spar Over Trumps Trade Policies

May 09, 2025 -

Will Jeanine Pirro Become Dcs Top Prosecutor Thanks To Trump

May 09, 2025

Will Jeanine Pirro Become Dcs Top Prosecutor Thanks To Trump

May 09, 2025 -

Trump Tariffs Heated Debate Erupts Between Fox News Colleagues

May 09, 2025

Trump Tariffs Heated Debate Erupts Between Fox News Colleagues

May 09, 2025 -

Jeanine Pirro Trumps Pick For Dc Prosecutor

May 09, 2025

Jeanine Pirro Trumps Pick For Dc Prosecutor

May 09, 2025 -

The Tarlov Pirro Clash A Look At Their Differing Views On The Canada Trade War

May 09, 2025

The Tarlov Pirro Clash A Look At Their Differing Views On The Canada Trade War

May 09, 2025