Bond Market Reaction: Powell's Comments Dampen Rate Cut Expectations

Table of Contents

Powell's Comments and Their Impact

Key Phrases that Shifted Market Sentiment

Powell's press conference contained several key phrases that significantly altered market sentiment regarding future interest rate adjustments. These comments deviated from previous more optimistic messaging, leading to a reassessment of the economic outlook and the Federal Reserve's likely course of action.

- "Further increases may be appropriate": This statement, in particular, caught the attention of market analysts, suggesting the possibility of additional rate hikes, contrary to expectations of imminent cuts. This phrase implied a more hawkish stance than previously communicated.

- "Inflation remains stubbornly high": This phrase underscored the persistence of inflationary pressures, reinforcing the need for continued monetary policy tightening. The acknowledgement of stubbornly high inflation dashed hopes for swift rate reductions.

- "Data dependency will guide future decisions": While seemingly neutral, this statement emphasized the uncertainty surrounding future monetary policy decisions, depending heavily on upcoming economic data releases. This lack of clear guidance contributed to market volatility.

These phrases, when considered collectively, painted a picture far less dovish than anticipated, significantly impacting the bond market's trajectory. The shift from hinting at potential rate cuts to acknowledging the possibility of further increases triggered a sell-off in bonds.

Market Expectations Before and After Powell's Speech

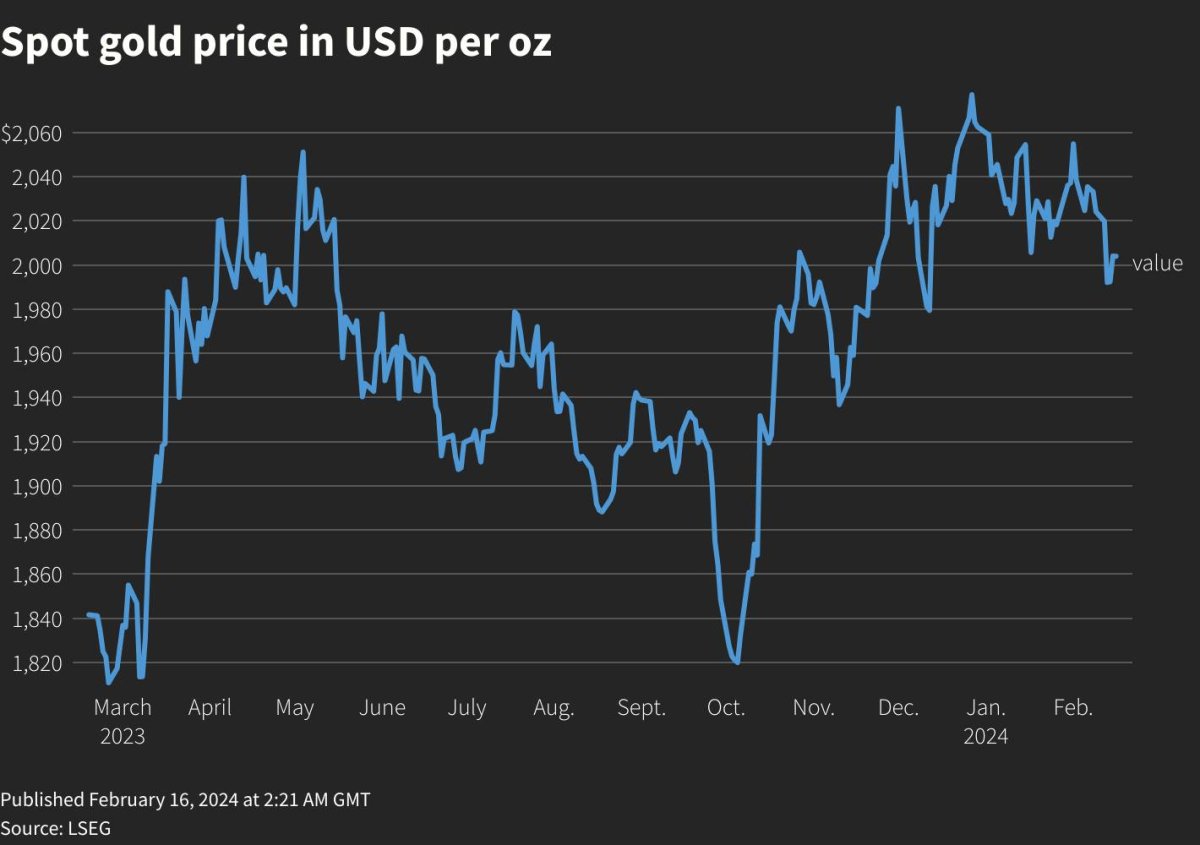

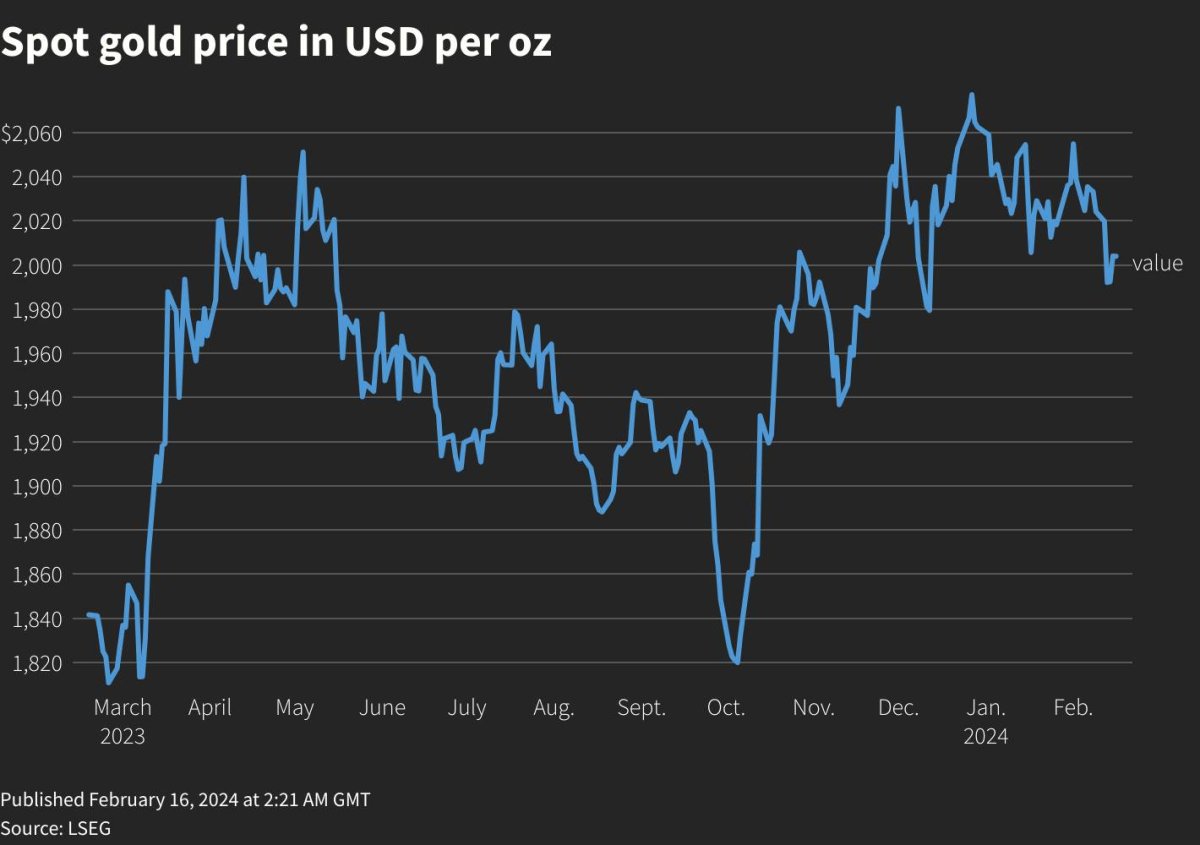

Before Powell's speech, many financial institutions predicted at least one, if not two, interest rate cuts by the end of the year. This expectation was largely fueled by slowing economic growth and easing inflationary pressures (though still elevated).

- Pre-speech predictions: Several major banks, including Goldman Sachs and JPMorgan Chase, forecast rate cuts in Q4 2024.

- Post-speech predictions: Following Powell's remarks, these forecasts were revised significantly. Many now anticipate interest rates remaining unchanged or even increasing further in the coming months.

The shift in predictions reflects a widespread recalibration of expectations based on the Federal Reserve's newly articulated stance. The market's initial optimism regarding rate cuts was quickly replaced by a more cautious outlook, reflecting the perceived persistence of inflationary pressures and the Fed's commitment to price stability.

Specific Reactions Within the Bond Market

Treasury Yields

The impact on Treasury yields was immediate and substantial. The dampened rate cut expectations led to a significant increase in yields across the maturity spectrum.

- 10-Year Treasury Yield: Increased by approximately 15 basis points in the days following Powell's speech.

- 2-Year Treasury Yield: Experienced a similar increase, reflecting the market's reassessment of short-term interest rate prospects.

- Yield Curve Steepening: The difference between short-term and long-term Treasury yields widened, indicating increased uncertainty about the future path of interest rates.

This upward pressure on Treasury yields is typical of a market reacting to a less accommodative monetary policy stance. Higher yields reflect investors' demand for increased compensation for holding bonds in a higher interest rate environment.

Corporate Bond Spreads

The increased uncertainty also impacted corporate bond spreads – the difference in yields between corporate bonds and comparable Treasury bonds. Wider spreads reflect increased risk premiums demanded by investors.

- Investment-Grade Corporate Bonds: Spreads widened slightly, reflecting increased risk aversion among investors.

- High-Yield Corporate Bonds: Spreads widened more significantly, indicating increased concerns about the creditworthiness of lower-rated companies in a higher interest rate environment.

This widening of spreads reflects a decrease in investor confidence and an increased demand for higher yields to compensate for the perceived increased credit risk.

Municipal Bond Market

The municipal bond market, generally considered less sensitive to interest rate changes than the Treasury market, also felt the effects of Powell's comments, albeit to a lesser extent.

- Municipal bond yields increased moderately, reflecting the overall upward pressure on interest rates across the fixed-income market.

- Trading volume remained relatively stable, suggesting that the impact on municipal bonds was less dramatic than on other segments.

The less pronounced impact on the municipal bond market is attributable to factors like its relative insulation from broader economic fluctuations and the demand for tax-exempt income.

Conclusion

Jerome Powell's recent comments significantly impacted the bond market, dampening expectations for imminent rate cuts and triggering a sell-off in bonds. This resulted in increased Treasury yields, wider corporate bond spreads, and a moderate increase in municipal bond yields. The key takeaway is the significant influence of the Federal Reserve's communication on investor sentiment and subsequent market behavior. The market's interpretation of Powell's words highlighted the crucial role of clear and consistent communication from central banks in shaping investor expectations and maintaining market stability.

Staying informed about the bond market reaction is crucial for investors. Monitor future announcements from the Federal Reserve and understand how shifts in monetary policy can impact your investment strategy. Continue to follow our coverage on the Bond Market Reaction for further analysis and insights. Understanding the bond market reaction to key economic indicators is essential for making informed investment decisions. Stay updated on the latest developments related to the bond market reaction to future policy announcements.

Featured Posts

-

Adam Sandlers Oscars 2025 Cameo A Detailed Look At The Outfit Joke And Chalamet Embrace

May 12, 2025

Adam Sandlers Oscars 2025 Cameo A Detailed Look At The Outfit Joke And Chalamet Embrace

May 12, 2025 -

400m Hurdle World Lead Sydney Mc Laughlin Levrone Dominates In Miami

May 12, 2025

400m Hurdle World Lead Sydney Mc Laughlin Levrone Dominates In Miami

May 12, 2025 -

2024 Senior Calendar Planned Trips And Activities

May 12, 2025

2024 Senior Calendar Planned Trips And Activities

May 12, 2025 -

Michael Johnson Weighs In Tyreek Hill Vs Noah Lyles A Track Showdown

May 12, 2025

Michael Johnson Weighs In Tyreek Hill Vs Noah Lyles A Track Showdown

May 12, 2025 -

Sheehan Ipswich Towns Undeterred Response To Setback

May 12, 2025

Sheehan Ipswich Towns Undeterred Response To Setback

May 12, 2025

Latest Posts

-

Iz Ave Marinike Tepi Da Li E Rech O Govoru Mrzhnje Protiv Roma

May 13, 2025

Iz Ave Marinike Tepi Da Li E Rech O Govoru Mrzhnje Protiv Roma

May 13, 2025 -

Natsionalni Savet Roma Analiza Iz Ava Marinike Tepi Govor Mrzhnje

May 13, 2025

Natsionalni Savet Roma Analiza Iz Ava Marinike Tepi Govor Mrzhnje

May 13, 2025 -

Rising Wildfire Threat Uks Rarest Wildlife On The Brink Of Extinction

May 13, 2025

Rising Wildfire Threat Uks Rarest Wildlife On The Brink Of Extinction

May 13, 2025 -

Is Bar Roma Worth The Hype A Blog To Toronto Review

May 13, 2025

Is Bar Roma Worth The Hype A Blog To Toronto Review

May 13, 2025 -

The Impact Of Wildfires On The Uks Rarest And Most Endangered Species

May 13, 2025

The Impact Of Wildfires On The Uks Rarest And Most Endangered Species

May 13, 2025