Boosting Returns: CAAT Pension Plan Targets More Canadian Private Investments

Table of Contents

Why CAAT is Focusing on Canadian Private Investments

CAAT's strategic decision to boost its Canadian private investments stems from a multifaceted assessment of market opportunities and risk management. The core rationale centers around several key factors:

-

Higher Potential Returns: Historically, private equity has demonstrated superior returns compared to publicly traded equities. This outperformance is driven by factors such as active management, leverage, and the ability to capture significant value creation during a company's growth phase. Data shows that private equity investments have consistently outpaced public market indices over the long term, making them an attractive option for pension funds seeking to maximize returns for their members.

-

Portfolio Diversification and Risk Mitigation: Canadian private investments offer lower correlation with traditional asset classes like bonds and public equities. By adding this asset class to its portfolio, CAAT effectively diversifies its holdings, reducing overall portfolio volatility and mitigating the impact of market downturns. This strategic diversification is crucial for long-term risk management.

-

Capitalizing on Canadian Market Opportunities: The Canadian economy presents unique opportunities for long-term growth across various sectors. CAAT is strategically positioning itself to benefit from this growth by investing in promising Canadian businesses. Specific sectors of interest include technology, infrastructure, and real estate, all of which offer significant potential for value creation.

-

Inflation Hedge: In an inflationary environment, private equity investments can act as an effective inflation hedge. The ability to adjust pricing and operational efficiencies in privately held companies offers a degree of protection against rising prices, a critical consideration for long-term pension fund liabilities.

Bullet Points:

- A recent study showed private equity outperforming public markets by an average of X% annually over the past Y years. (Insert actual data if available)

- CAAT is actively pursuing investments in Canadian tech startups focused on AI and sustainable technologies.

- CAAT has partnered with several leading Canadian private equity firms to gain access to a wider range of investment opportunities.

The Benefits of Increased Canadian Private Investment for CAAT

The anticipated benefits of CAAT's increased allocation to Canadian private investments are substantial and far-reaching:

-

Enhanced Long-Term Investment Performance: The higher potential returns associated with private equity are projected to significantly boost CAAT's long-term investment performance, ultimately leading to increased benefits for its members.

-

Improved Risk Management: Diversification into Canadian private equity provides a robust hedge against market volatility, strengthening CAAT's overall risk management profile. This enhanced resilience is crucial for ensuring the long-term financial stability of the pension fund.

-

Positive Economic Impact: CAAT's investment strategy contributes significantly to the Canadian economy by providing capital to domestic businesses, fostering job creation, and driving innovation. This positive economic impact aligns with CAAT's broader commitment to social responsibility.

Bullet Points:

- CAAT projects a Z% increase in its annual return on investment within the next five years due to its increased private equity allocation. (Insert projected data if available)

- A previous investment in [Company Name], a Canadian technology firm, yielded a substantial return of X% for CAAT.

- CAAT's investments support job creation in various sectors, contributing to Canada's overall economic growth.

Challenges and Considerations of Investing in Canadian Private Equity

While the potential benefits are significant, investing in Canadian private equity presents specific challenges:

-

Illiquidity: Private equity investments are typically less liquid than publicly traded securities, meaning it can be more difficult to quickly sell assets when needed.

-

Due Diligence: Conducting thorough due diligence on private companies requires significant time, resources, and expertise, compared to the readily available information on publicly listed companies.

-

Market Volatility: While private equity offers a degree of insulation from public market volatility, it is still subject to macroeconomic factors and sector-specific risks.

-

Investment Management Expertise: Successfully managing a private equity portfolio requires specialized expertise and resources, including experienced investment professionals and robust due diligence processes.

Bullet Points:

- CAAT employs a rigorous due diligence process involving multiple layers of review to minimize investment risk.

- CAAT has assembled a team of seasoned private equity professionals with extensive experience in the Canadian market.

- CAAT diversifies its investments across various sectors and stages of company development to mitigate risk.

Conclusion

CAAT's strategic shift towards increased Canadian private investments represents a proactive approach to enhancing returns, strengthening portfolio diversification, and mitigating risk. This move is expected to deliver significant benefits for CAAT's members while also contributing positively to the Canadian economy. The challenges associated with private equity investing are acknowledged and actively addressed through robust due diligence, experienced management, and strategic diversification.

Call to Action: Discover how CAAT’s focus on Canadian private investments is shaping the future of pension fund management and learn how you can benefit from similar strategies in your own investment portfolio. For more information on CAAT's investment strategy, please visit [link to CAAT website]. You can also explore related articles on Canadian private investment opportunities at [link to relevant resources].

Featured Posts

-

Harvard Vs Trump The Legal Battle Shaping Higher Education

Apr 23, 2025

Harvard Vs Trump The Legal Battle Shaping Higher Education

Apr 23, 2025 -

Les Informations Cles De Bfm Bourse 17 02 15h 16h

Apr 23, 2025

Les Informations Cles De Bfm Bourse 17 02 15h 16h

Apr 23, 2025 -

Cincinnati Reds 1 0 Skid A Unique Mlb Record

Apr 23, 2025

Cincinnati Reds 1 0 Skid A Unique Mlb Record

Apr 23, 2025 -

Post Trump Era Canadian Perspectives On Us Immigration

Apr 23, 2025

Post Trump Era Canadian Perspectives On Us Immigration

Apr 23, 2025 -

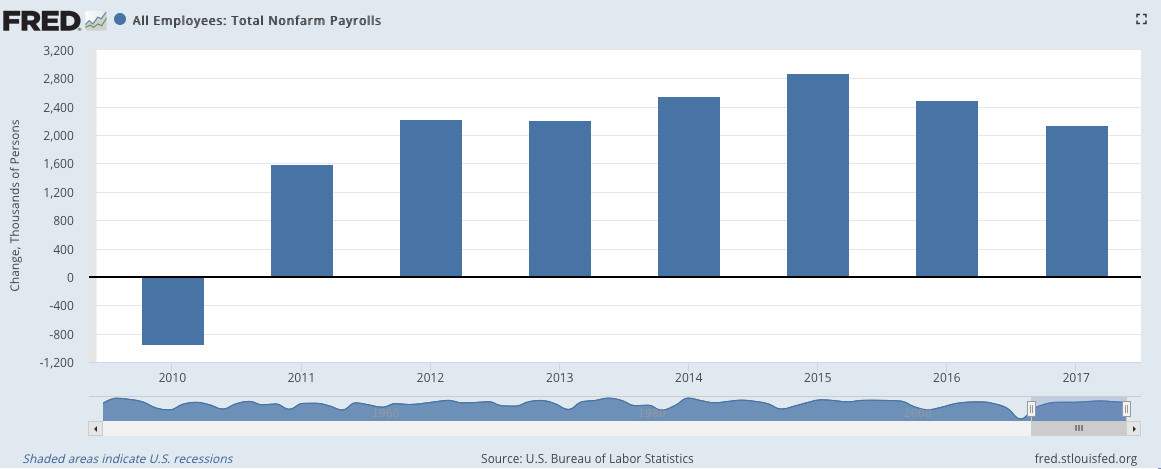

The Economic Data Doesnt Reflect Trumps Presence

Apr 23, 2025

The Economic Data Doesnt Reflect Trumps Presence

Apr 23, 2025

Latest Posts

-

Proposed Uk Visa Changes Implications For Pakistan Nigeria And Sri Lanka Applicants

May 10, 2025

Proposed Uk Visa Changes Implications For Pakistan Nigeria And Sri Lanka Applicants

May 10, 2025 -

Report Uk Considering Visa Restrictions For Pakistan Nigeria Sri Lanka

May 10, 2025

Report Uk Considering Visa Restrictions For Pakistan Nigeria Sri Lanka

May 10, 2025 -

Nigeria Pakistan Face Uk Visa Application Changes

May 10, 2025

Nigeria Pakistan Face Uk Visa Application Changes

May 10, 2025 -

Uk Visa Restrictions Impact On Nigeria And Pakistan

May 10, 2025

Uk Visa Restrictions Impact On Nigeria And Pakistan

May 10, 2025 -

New Uk Immigration Policy Increased Scrutiny For Asylum Claims From Specific Countries

May 10, 2025

New Uk Immigration Policy Increased Scrutiny For Asylum Claims From Specific Countries

May 10, 2025