Boosting Sustainability: Funding Options For Small And Medium Enterprises

Table of Contents

Government Grants and Subsidies for Sustainable Practices

Many governments recognize the vital role SMEs play in achieving national sustainability goals and offer generous support. Numerous government grants and subsidies are available specifically for businesses implementing eco-friendly initiatives. These programs often prioritize projects with measurable environmental benefits, encouraging innovation and the adoption of sustainable technologies.

- Types of projects eligible for funding: Renewable energy installations (solar panels, wind turbines), waste reduction and recycling programs, sustainable sourcing of materials, energy efficiency improvements, and the development of green products or services.

- Application processes and requirements: Each grant program has specific eligibility criteria and application procedures. These typically involve submitting a detailed project proposal outlining the environmental impact, budget, and timelines. Thorough documentation is crucial.

- Resources for finding relevant government funding opportunities: Government websites are your primary source. For example, in the US, the Environmental Protection Agency (EPA) and the Small Business Administration (SBA) offer numerous programs. In the UK, the Department for Business, Energy & Industrial Strategy (BEIS) provides grants and funding schemes for sustainable businesses. (Note: Replace these examples with relevant links and country/region-specific information if targeting a particular geographic area).

Finding and Applying for Green Grants

Successfully securing a green grant requires proactive research and strategic application. Utilize online grant search engines that specialize in environmental projects. Network with other businesses and organizations involved in sustainability to learn about funding opportunities. Attend industry events and workshops focused on green business and funding. Develop a strong application that clearly articulates your project's environmental benefits and financial viability.

Private Investment and Venture Capital for Green Businesses

The investment landscape is changing, with a growing number of investors actively seeking environmentally conscious businesses. Angel investors, venture capital firms, and impact investors are increasingly recognizing the potential of sustainable SMEs to generate both financial returns and positive social and environmental impact.

- Attracting investors: A compelling business plan highlighting your sustainability initiatives is crucial. Investors look for clear goals, measurable results, and a well-defined strategy for achieving them. Showcase your commitment to environmental responsibility and your unique value proposition.

- Demonstrating positive environmental and social impact: Quantify the environmental benefits of your products or services. Provide data demonstrating reduced carbon emissions, waste reduction, or improved resource efficiency. Highlight the positive social impact of your business, such as fair labor practices or community engagement.

- Understanding investor expectations and return on investment (ROI): Investors expect a reasonable return on their investment. Demonstrate the financial viability of your business and its potential for growth. Clearly articulate your financial projections and your plan for achieving profitability.

Pitching Your Sustainable Business to Investors

Crafting a compelling pitch deck is essential. Clearly communicate your business model, its sustainability features, the market opportunity, and the financial projections. Practice your pitch thoroughly and be prepared to answer tough questions about your business's environmental and financial performance. Highlight any pilot projects or early successes to demonstrate the feasibility of your sustainability initiatives.

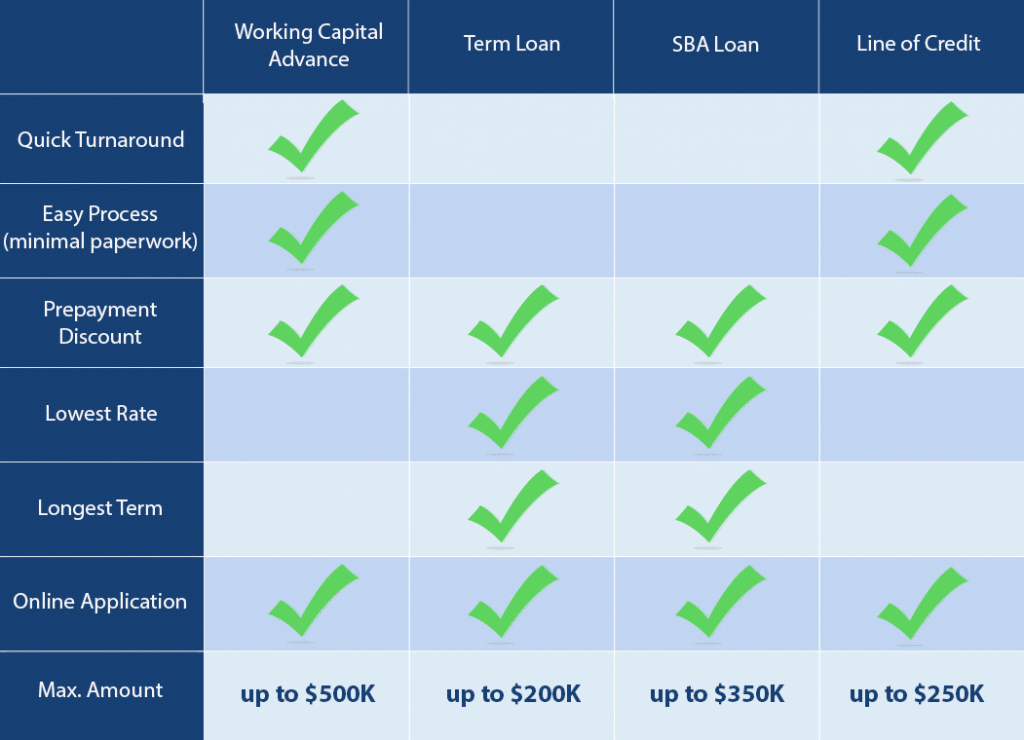

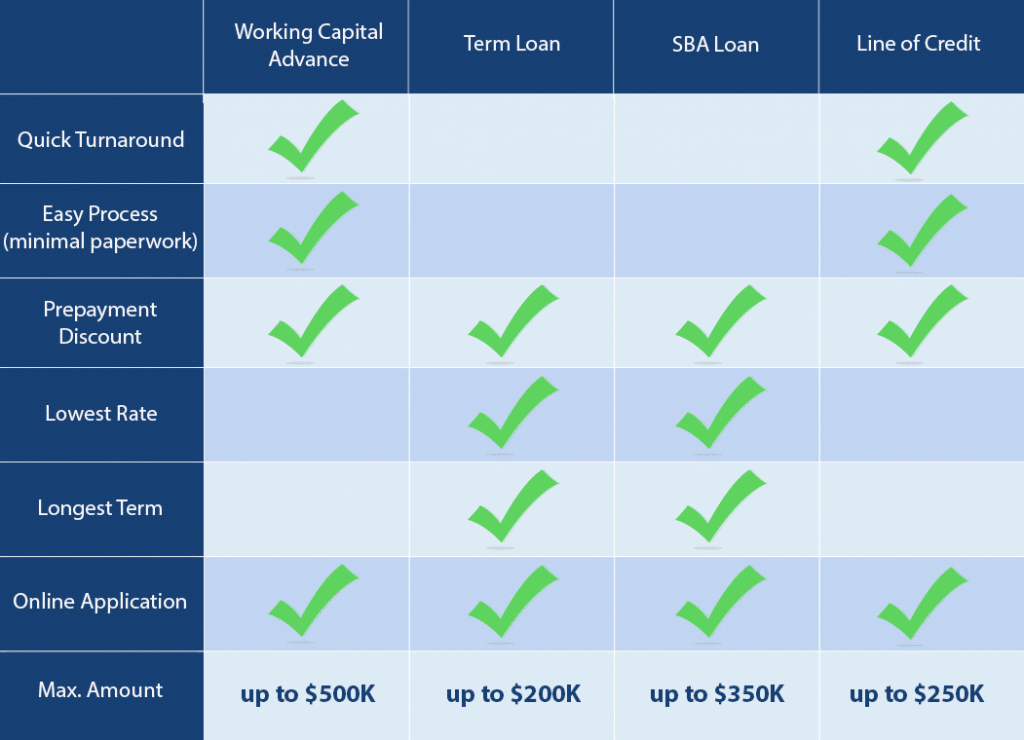

Green Loans and Financing Options

Many financial institutions now offer green loans and other financing specifically designed to support sustainable projects. These loans often come with preferential interest rates and flexible repayment terms, making them an attractive option for SMEs.

- Banks and financial institutions offering green financing: Numerous banks and credit unions are increasingly offering green loan products. Research local and national institutions known for their commitment to sustainable finance.

- Eligibility criteria and application processes: Green loans typically have eligibility criteria similar to traditional loans, but they often require a more detailed assessment of the environmental impact of the project.

- Understanding the terms and conditions of green loans: Carefully review the loan terms, including interest rates, repayment schedules, and any associated fees.

Securing Favorable Loan Terms

Strengthen your loan application by providing detailed financial projections, demonstrating your business’s profitability and creditworthiness. Highlight the environmental benefits of your project and how it contributes to a sustainable future. Negotiate with lenders to secure favorable interest rates and repayment terms.

Crowdfunding and Community-Based Funding

Crowdfunding platforms offer a unique opportunity to raise capital for sustainable projects by directly engaging with potential customers and supporters. This approach can generate valuable brand awareness and build community support.

- Choosing the right crowdfunding platform: Different platforms cater to different types of projects and audiences. Research platforms specializing in eco-friendly projects or those that align with your target market.

- Developing a compelling crowdfunding campaign: Create a compelling narrative that highlights the environmental benefits of your project and resonates with your target audience. Use high-quality visuals and videos to showcase your project.

- Building a strong online presence to attract backers: Promote your crowdfunding campaign through social media, email marketing, and your website. Engage with potential backers and build a community around your project.

Building a Successful Crowdfunding Campaign

A successful crowdfunding campaign requires strong marketing and engaging content. Regularly update your backers on your progress and actively solicit feedback. Offer incentives to encourage early contributions and build excitement around your project.

Internal Funding and Resource Optimization for Sustainability

Before seeking external funding, explore internal resources and operational efficiencies. Optimizing existing resources can free up capital for new sustainability initiatives.

- Internal cost-saving measures: Identify areas where you can reduce costs without compromising quality. This could involve streamlining processes, negotiating better deals with suppliers, or reducing energy consumption.

- Re-investing profits into sustainable projects: Allocate a portion of your profits to fund sustainable initiatives. This demonstrates your commitment to sustainability and can enhance your brand image.

- Innovative financing models within the company: Explore internal financing options such as leasing equipment or implementing a revenue-sharing model.

Improving Operational Efficiency for Sustainability

Implementing waste reduction strategies, improving energy efficiency, and optimizing resource utilization can significantly reduce operational costs and free up capital for sustainability investments.

Conclusion: Securing Funding for a Sustainable Future

Securing funding for sustainability initiatives requires a multifaceted approach. This article highlighted several key options: government grants, private investment, green loans, crowdfunding, and internal resource optimization. Remember, a well-defined business plan with a strong sustainability focus is crucial for attracting investors and securing funding. Showcase the environmental and social impact of your initiatives, and demonstrate their financial viability. Start boosting your sustainability today! Explore funding options for your sustainable SME and take the first step towards a greener business model by researching available funding for sustainability.

Featured Posts

-

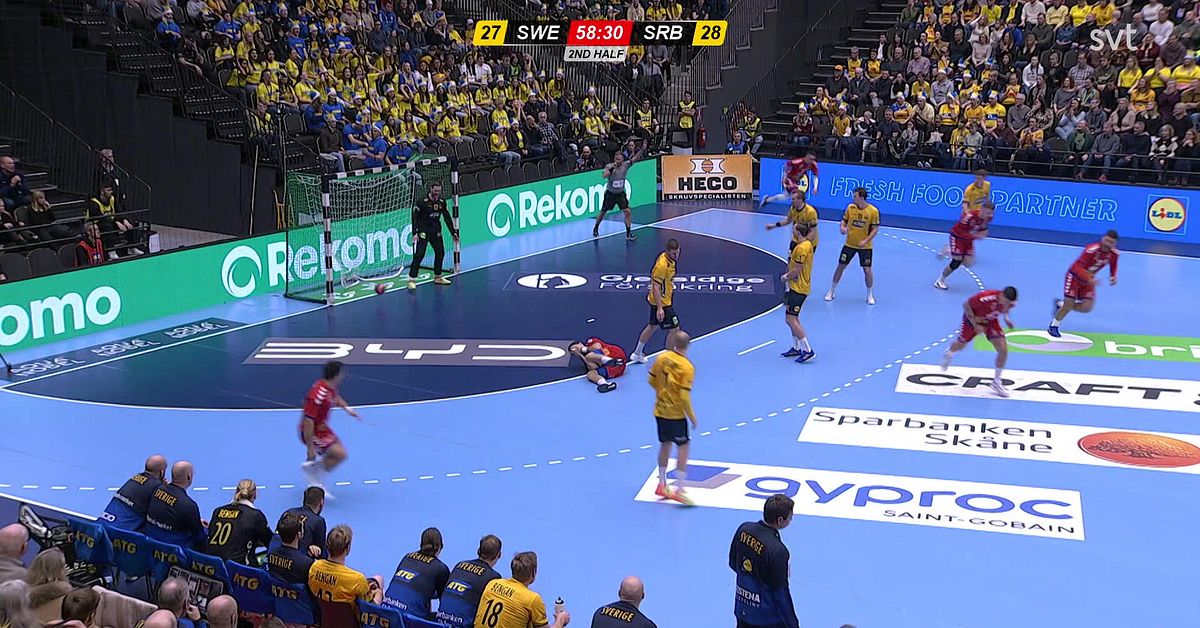

Basel Segern Avgoer Svt S Eurovision Planer Foer Sverige

May 19, 2025

Basel Segern Avgoer Svt S Eurovision Planer Foer Sverige

May 19, 2025 -

Muere Juan Aguilera Adios A La Leyenda Del Tenis Espanol

May 19, 2025

Muere Juan Aguilera Adios A La Leyenda Del Tenis Espanol

May 19, 2025 -

Disciplinary Hearing For Paulo Fonseca After Lyon Referee Incident

May 19, 2025

Disciplinary Hearing For Paulo Fonseca After Lyon Referee Incident

May 19, 2025 -

World Cup Qualifiers Haaland Leads Norway To 5 0 Triumph

May 19, 2025

World Cup Qualifiers Haaland Leads Norway To 5 0 Triumph

May 19, 2025 -

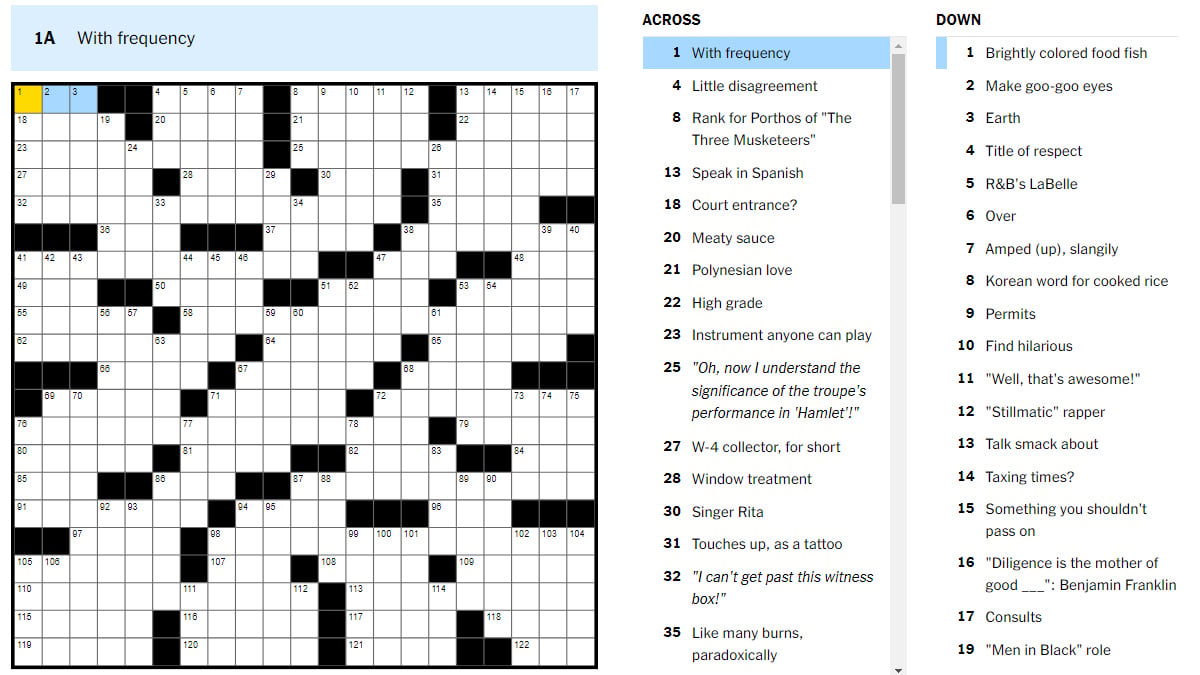

Solve The Nyt Mini Crossword Answers For March 26 2025

May 19, 2025

Solve The Nyt Mini Crossword Answers For March 26 2025

May 19, 2025