Boston Celtics' $6.1 Billion Sale: Analyzing The Private Equity Acquisition

Table of Contents

The Record-Breaking Valuation of the Boston Celtics

The $6.1 billion price tag attached to the Boston Celtics sale represents a new high watermark for NBA franchise value. Several factors contributed to this record-breaking valuation:

-

Winning History and Legacy: The Celtics boast a rich history, including 17 NBA championships, a legacy that resonates deeply with fans and translates into significant brand recognition and value. This historical success is a key component of the Celtics' franchise value.

-

Massive and Loyal Fanbase: The Celtics possess one of the most passionate and loyal fan bases in the NBA, ensuring consistent high attendance, merchandise sales, and broadcast viewership. This dedicated fan base contributes substantially to the team's revenue streams.

-

Lucrative Media Deals and Revenue Streams: The Celtics benefit from lucrative local and national broadcast deals, as well as significant revenue generated from merchandise sales, sponsorships, and premium seating at TD Garden. These diverse revenue streams are crucial in justifying the high purchase price.

-

Prime Location in a Major Market: Being located in Boston, a major metropolitan area with a large, affluent population, provides access to a vast pool of potential fans, sponsors, and investors. This geographical advantage significantly boosts the franchise's value.

-

Potential for Future Revenue Growth: With the increasing popularity of the NBA globally and the expansion of digital media platforms, the Celtics have considerable potential for future revenue growth. This future growth potential played a vital role in attracting such a significant investment.

Compared to other recent NBA franchise sales, the Celtics' sale price represents a significant premium, reflecting the unique combination of factors mentioned above. Experts predict this sale will significantly impact the valuation of other NBA franchises, potentially setting a new benchmark for future transactions.

Bain Capital's Role in the Acquisition

Bain Capital, a prominent private equity firm, played a central role in the acquisition, leading a consortium that also included RSG and other investors. Their involvement highlights the growing interest of private equity firms in acquiring major sports franchises.

-

Bain Capital's Investment Strategy: Bain Capital's investment strategy typically focuses on identifying undervalued assets with high growth potential. The Celtics, with their strong brand and established revenue streams, perfectly align with this investment strategy.

-

The Consortium and its Contributions: The consortium involved in the acquisition brings together diverse expertise and resources, complementing Bain Capital's financial prowess. RSG, for example, likely provided valuable sports industry insights and operational expertise.

-

Implications for Celtics' Long-Term Strategy: Private equity ownership often involves a focus on maximizing returns through strategic investments and operational efficiencies. This could impact the Celtics' long-term strategy, potentially leading to changes in player acquisitions, team management, and overall business operations.

-

Potential Conflicts of Interest: The involvement of private equity raises potential questions regarding conflicts of interest. Maintaining transparency and ensuring the integrity of the team's operations under private ownership will be crucial.

Implications for the Future of NBA Franchises

The Boston Celtics' $6.1 billion sale has significant implications for the future of NBA franchises and the broader sports business landscape.

-

Influencing NBA Franchise Valuations: The sale price sets a new benchmark, potentially inflating the valuations of other NBA teams, especially those with comparable fan bases and market positions.

-

Increased Private Equity Interest: The deal signifies the increased interest of private equity firms in acquiring sports franchises, which could lead to more similar transactions in the future.

-

Impact on Team Management and Player Development: Private equity ownership may lead to changes in team management and player development strategies, prioritizing financial returns over other considerations.

-

Broader Financial Landscape: The transaction significantly alters the financial landscape of professional basketball, highlighting the substantial financial value of top-tier NBA franchises.

The Role of Media Rights and Revenue Streams

Media rights deals play a pivotal role in driving franchise valuations. The ever-evolving media landscape, including the rise of streaming services, is dramatically changing how sports are consumed and monetized.

-

Significance of Media Rights Deals: National and regional broadcast deals contribute significantly to NBA franchise revenue. The Celtics' lucrative deals are a major driver of their high valuation.

-

Impact of Streaming Services: The rise of streaming services like ESPN+ and other platforms offers new avenues for reaching wider audiences and generating revenue from digital media rights.

-

Other Revenue Streams: Beyond media rights, merchandising, sponsorships, and arena revenue, including premium seating and luxury suites, contribute to a franchise's overall profitability. The combination of these revenue streams significantly boosts the Celtics' overall financial value.

Conclusion

The $6.1 billion sale of the Boston Celtics represents a watershed moment for the NBA and the sports investment landscape. This record-breaking valuation, fueled by a powerful brand, dedicated fanbase, and lucrative media rights, underscores the ever-increasing value of major sports franchises. Bain Capital's participation signifies the growing influence of private equity in professional sports ownership. This transaction sets a new standard and will undoubtedly influence future dealings within the NBA and other professional sports leagues.

Call to Action: Stay informed about future developments in sports finance and the ongoing impact of the Boston Celtics' $6.1 billion sale. Continue learning about private equity acquisitions in the NBA and the dynamic shifts in sports franchise valuations.

Featured Posts

-

Hamer Bruins Moet Met Npo Toezichthouder Over Leeflang Praten

May 15, 2025

Hamer Bruins Moet Met Npo Toezichthouder Over Leeflang Praten

May 15, 2025 -

Berlin Kind Von Betrunkenen Mit Antisemitischen Parolen Angegriffen

May 15, 2025

Berlin Kind Von Betrunkenen Mit Antisemitischen Parolen Angegriffen

May 15, 2025 -

Padres Vs Cubs Prediction Cubs Chances For Victory

May 15, 2025

Padres Vs Cubs Prediction Cubs Chances For Victory

May 15, 2025 -

Fthina Kaysima Stin Kypro Symvoyles Kai Praktikes Plirofories

May 15, 2025

Fthina Kaysima Stin Kypro Symvoyles Kai Praktikes Plirofories

May 15, 2025 -

Stanley Cup Playoffs The Ultimate Viewing Guide

May 15, 2025

Stanley Cup Playoffs The Ultimate Viewing Guide

May 15, 2025

Latest Posts

-

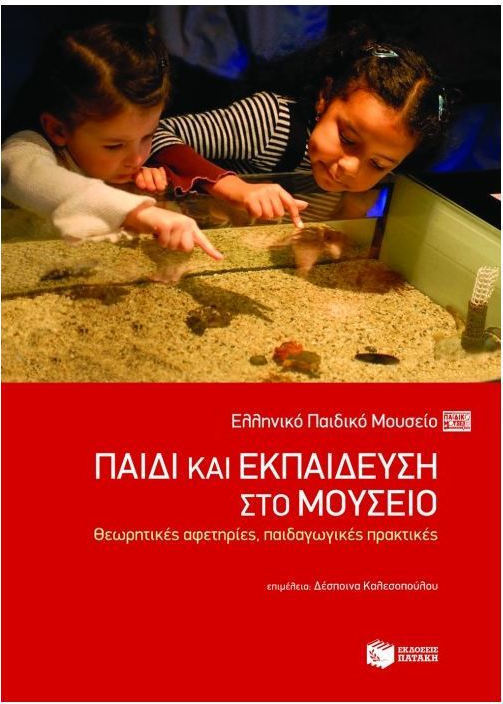

West Broad Street Foot Locker Argument Ends In Fatality Jon Burkett Reports

May 15, 2025

West Broad Street Foot Locker Argument Ends In Fatality Jon Burkett Reports

May 15, 2025 -

Analyzing The Future Of Foot Lockers Executive Structure

May 15, 2025

Analyzing The Future Of Foot Lockers Executive Structure

May 15, 2025 -

Elon Musks Gorklon Rust A Deep Dive Into The Name Change Of X

May 15, 2025

Elon Musks Gorklon Rust A Deep Dive Into The Name Change Of X

May 15, 2025 -

Is Further Executive Turnover At Foot Locker Imminent

May 15, 2025

Is Further Executive Turnover At Foot Locker Imminent

May 15, 2025 -

Nikes Turnaround Foot Locker Results Offer Insight

May 15, 2025

Nikes Turnaround Foot Locker Results Offer Insight

May 15, 2025