Boston Celtics Sold For $6.1 Billion: Fans React To Private Equity Takeover

Table of Contents

The Sale Details: Who Bought the Celtics and What's Next?

The Boston Celtics were acquired by [Insert Name of Private Equity Firm Here], a prominent private equity firm known for its investments in [mention their previous successful investments or areas of expertise]. This acquisition represents a significant strategic move for the firm, adding a prestigious NBA franchise to their portfolio.

The sale's implications for the Celtics' future are far-reaching. While the new owners have publicly stated their commitment to maintaining the team's winning tradition, many questions remain unanswered. Will there be significant changes to the team's management structure? Could we see shifts in coaching strategies or player recruitment approaches? Only time will tell.

The financial aspects of the deal are equally compelling. While the exact breakdown of payments to each stakeholder remains confidential, the $6.1 billion price tag sets a new benchmark for NBA franchise valuations. This substantial investment likely signifies an expectation of significant returns for the new owners, potentially through increased revenue streams from merchandise sales, media rights, and ticket sales. However, such a significant investment also brings inherent financial risks, particularly in the volatile world of professional sports.

- Key Financial Figures:

- Total sale price: $6.1 billion

- [Insert details about individual stakeholder payouts, if available]

- [Insert details about projected ROI for the private equity firm, if available]

- Ownership Changes:

- [Previous owner(s) and their stake]

- [New owner(s) and their stake]

- [Any changes in board structure or management]

Fan Reactions: A Spectrum of Emotions

The $6.1 billion Boston Celtics sale has evoked a wide spectrum of emotions among the team's loyal fanbase. Social media platforms like Twitter, Facebook, and Reddit have become battlegrounds for expressing everything from excitement and cautious optimism to deep concern and outright anger. The keywords "fan reaction," "social media reaction," "Celtics fans," "NBA fans," and "public opinion" are crucial to understanding the situation.

Many fans express apprehension regarding the potential impact of private equity ownership on ticket prices, potentially making attending games less accessible for long-time supporters. Concerns have also been raised about the potential prioritization of profit maximization over long-term team building and player development. Conversely, some fans view the significant investment as a positive sign, hoping it translates into improved infrastructure, better player recruitment, and ultimately, a stronger team.

- Summarized Fan Sentiments:

- Excitement: Hope for increased investment in the team and improved competitiveness.

- Concern: Worries about rising ticket prices and a potential shift away from a fan-centric approach.

- Anger: Frustration at the loss of previous ownership and concerns about the new owners' priorities.

- Skepticism: Uncertainty about the long-term implications of private equity ownership.

The Impact of Private Equity on the NBA

The Boston Celtics sale is part of a larger trend: the increasing involvement of private equity firms in professional sports. This influx of capital brings both opportunities and challenges. Keywords such as "private equity in sports," "NBA investment," "sports finance," and "professional sports ownership" accurately reflect this significant trend.

While private equity can provide substantial financial resources for team improvements and infrastructure upgrades, it also raises concerns about potential conflicts of interest. The prioritization of short-term financial returns over long-term team building remains a key point of contention. Furthermore, the impact on player salaries and the competitive balance within the NBA needs careful consideration. The influx of private equity could potentially exacerbate existing financial disparities between teams.

- Private Equity vs. Traditional Ownership:

- Private Equity: Focus on ROI, potential for significant investment, shorter-term horizons.

- Traditional Ownership: Long-term vision, focus on legacy and community, potentially slower investment pace.

Long-Term Implications for the Boston Celtics

The long-term success of the Boston Celtics under their new private equity owners hinges on several factors. Will the new owners maintain a commitment to on-court excellence, or will short-term profit maximization overshadow long-term strategic planning? The team’s ability to attract and retain top talent will be a crucial determinant of its success. Furthermore, navigating the complexities of navigating the NBA landscape – balancing player development, competitive roster management, and financial prudence – will be paramount for their success. The potential for future success, enhanced financial stability and competitive advantage must be weighed against the risks associated with the increased pressure of delivering immediate returns to investors.

Conclusion: The Future of the Boston Celtics After the $6.1 Billion Sale

The $6.1 billion sale of the Boston Celtics marks a pivotal moment in the franchise's history. The sheer financial magnitude of the transaction, the identity of the new private equity owners, and the diverse fan reactions all underscore the significance of this event. This acquisition is not only a significant event for the Celtics but also signals broader changes in the financial landscape of the NBA.

The future of the Boston Celtics under new ownership remains uncertain, full of both exciting possibilities and potential challenges. The team's success will depend on the new owners' commitment to long-term development and their ability to balance financial goals with a commitment to on-court excellence and community engagement.

Share your thoughts on the Boston Celtics sale! What are your predictions for the future of the Celtics under new ownership? Discuss the implications of this major Boston Celtics private equity takeover in the comments below.

Featured Posts

-

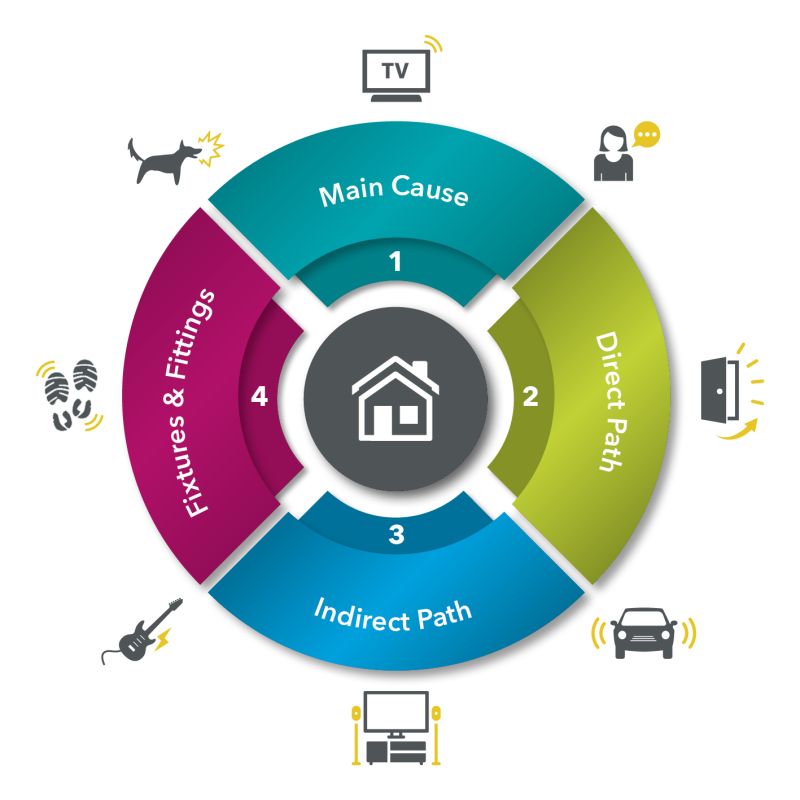

Tokyo Apartments Prioritizing Peace And Quiet With Soundproofing

May 17, 2025

Tokyo Apartments Prioritizing Peace And Quiet With Soundproofing

May 17, 2025 -

Peringatan Houthi Serangan Rudal Mematikan Mengancam Dubai Dan Abu Dhabi

May 17, 2025

Peringatan Houthi Serangan Rudal Mematikan Mengancam Dubai Dan Abu Dhabi

May 17, 2025 -

Tam Krwz Ke Jwtwn Pr Pawn Rkhne Waly Khatwn Mdah Awr Adakar Ka Rdeml

May 17, 2025

Tam Krwz Ke Jwtwn Pr Pawn Rkhne Waly Khatwn Mdah Awr Adakar Ka Rdeml

May 17, 2025 -

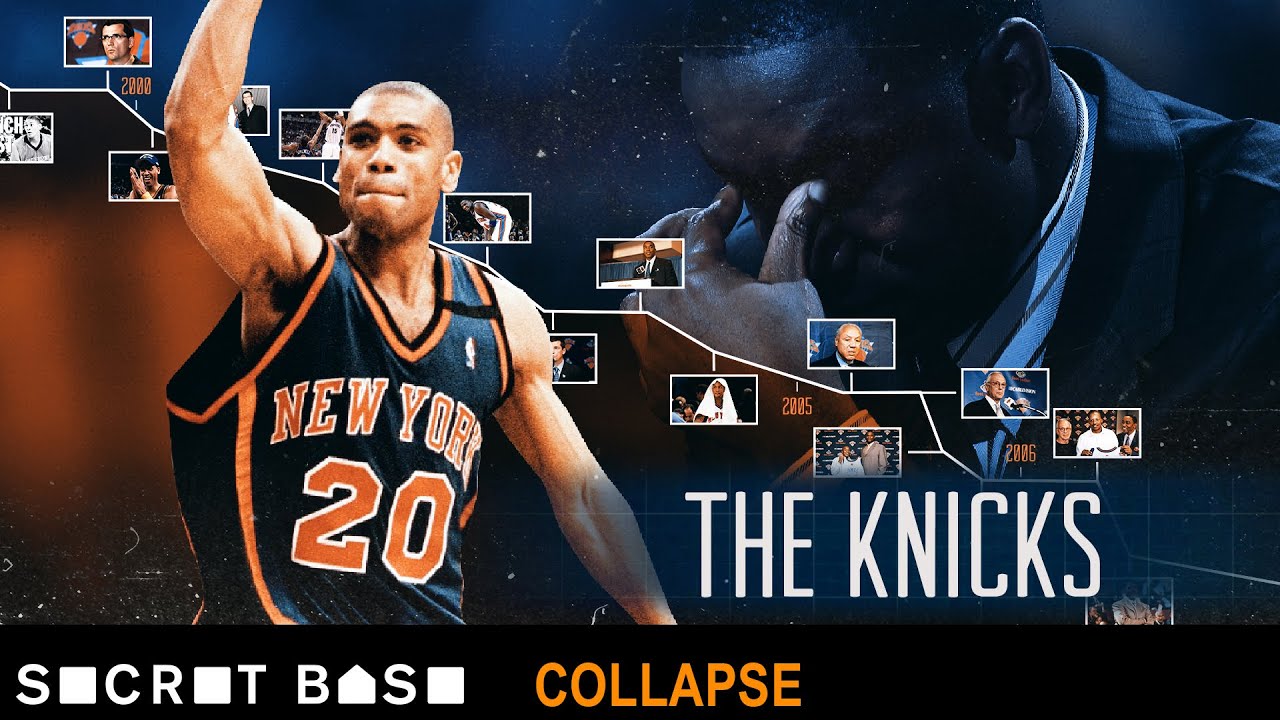

Analyzing The Knicks Near Miss In Overtime

May 17, 2025

Analyzing The Knicks Near Miss In Overtime

May 17, 2025 -

No Kyc Casinos 2025 A Comparison Of Top Platforms Including 7 Bit Casino

May 17, 2025

No Kyc Casinos 2025 A Comparison Of Top Platforms Including 7 Bit Casino

May 17, 2025

Latest Posts

-

5 26

May 18, 2025

5 26

May 18, 2025 -

2011

May 18, 2025

2011

May 18, 2025 -

5 26 52

May 18, 2025

5 26 52

May 18, 2025 -

Asamh Bn Ladn Ky Mqbwlyt Awr Alka Yagnk Ka Byan Ayk Tfsyly Tjzyh

May 18, 2025

Asamh Bn Ladn Ky Mqbwlyt Awr Alka Yagnk Ka Byan Ayk Tfsyly Tjzyh

May 18, 2025 -

Alka Yagnk Ka Dewy Asamh Bn Ladn Myre Mdahwn Myn Srfhrst The

May 18, 2025

Alka Yagnk Ka Dewy Asamh Bn Ladn Myre Mdahwn Myn Srfhrst The

May 18, 2025