BP Chief Aims To Double Company Valuation: No US Listing Planned, According To FT

Table of Contents

Bernard Looney, BP's chief executive, has set an ambitious goal: to double the energy giant's valuation. This bold strategy, as reported by the Financial Times (FT), significantly excludes a planned US stock market listing. This article delves into the specifics of Looney's plan, exploring its potential impact and the reasons behind bypassing a US IPO. The implications for BP, its investors, and the broader energy sector are substantial.

Looney's Vision for Doubling BP's Valuation

Keywords: BP growth strategy, Looney's strategy, BP future, energy transition, profitability increase, shareholder value

Looney's plan to double BP's valuation hinges on a multifaceted strategy focused on increased profitability and enhanced shareholder value. This ambitious vision involves a significant shift towards renewable energy sources while optimizing existing oil and gas operations. Specific elements of this strategy include:

-

Increased Investment in Renewable Energy: BP plans to significantly ramp up investments in renewable energy sources such as solar and wind power. This aligns with the global shift towards cleaner energy and positions BP for growth in a rapidly expanding market. This strategic move is crucial for long-term sustainability and attracting environmentally conscious investors.

-

Operational Streamlining and Cost Reduction: Efficiency improvements across BP's operations will be key to boosting profitability. This includes streamlining processes, optimizing resource allocation, and leveraging technological advancements to reduce operational costs. This will free up capital for reinvestment in growth areas.

-

Focus on High-Margin Oil and Gas Projects: While transitioning to renewables, BP will continue to focus on profitable oil and gas projects, ensuring a stable revenue stream during the energy transition. This balanced approach allows for a gradual shift, mitigating risks associated with a complete reliance on renewables in the short term.

-

Strategic Acquisitions: Acquisitions of companies in complementary energy sectors will accelerate BP's growth and expansion into new markets. This approach will allow for faster entry into new technologies and geographies, boosting market share and diversification.

The FT report suggests ambitious, though unspecified, targets and timelines for achieving these goals. While precise details remain undisclosed, Looney has publicly stated his commitment to this transformative vision, emphasizing the potential for significant returns for investors.

Reasons Behind Bypassing a US Stock Market Listing

Keywords: US stock market, BP IPO, no US listing, regulatory environment, market conditions, strategic decision

BP's decision to forgo a US stock market listing, despite the potential access to a vast pool of capital, is a significant strategic move. Several factors likely contributed to this choice:

-

Regulatory Hurdles and Compliance Costs: The US regulatory environment for publicly listed companies is notoriously complex and expensive. Compliance costs associated with Sarbanes-Oxley Act (SOX) and other regulations could outweigh the benefits of a US listing for BP.

-

Current Market Conditions and Investor Sentiment: Prevailing market conditions and investor sentiment can significantly impact the success of an IPO. BP might have assessed that current market dynamics are not favorable for a successful US listing.

-

Maintaining a Strong Presence in Existing Markets: BP likely prioritizes maintaining its strong presence in its existing markets and investor base. A US listing might dilute this focus and introduce unnecessary complexity.

-

Potential Conflicts with Existing Investor Base: A US listing might introduce conflicts with BP's current investor base, potentially leading to diluted shareholder value. Staying focused on existing exchanges allows for a more controlled approach to investor relations.

The advantages of remaining primarily listed on exchanges like the London Stock Exchange include established investor relationships, streamlined regulatory compliance, and a deeper understanding of BP’s business model by local investors.

Market Reaction and Analyst Opinions on BP's Strategy

Keywords: market analysis, investor response, analyst predictions, stock price forecast, BP stock performance, energy sector outlook

The market reaction to Looney's ambitious plan has been mixed. Some analysts express optimism about BP's growth potential, highlighting the company's strong position in both traditional and renewable energy sectors. They see the strategy as a smart move to position BP for long-term success in a changing energy landscape.

However, others remain cautious, pointing to the challenges associated with achieving such a significant valuation increase. Concerns include the speed of the energy transition, potential regulatory hurdles, and competition from other energy companies. Predictions regarding BP's stock price vary widely, reflecting the uncertainty surrounding the implementation of Looney's plan. Many analysts agree that the success of the plan depends heavily on BP's ability to execute its strategy effectively and adapt to evolving market conditions.

Implications for the Energy Sector

Keywords: energy sector trends, industry competition, renewable energy investment, oil and gas future, market disruption

BP's strategy has significant implications for the broader energy sector. The increased investment in renewable energy will likely intensify competition in this rapidly growing market, potentially accelerating innovation and driving down costs. It might also trigger further consolidation within the oil and gas industry, as companies adapt to the shift towards cleaner energy.

The success of BP's strategy could influence other major players in the energy sector to accelerate their own transitions to sustainable energy solutions, leading to a faster shift away from fossil fuels. This would further enhance the focus on ESG factors in investment decisions.

Conclusion

Looney's ambitious goal to double BP's valuation represents a significant undertaking, involving a major shift towards renewable energy while maintaining a strong presence in the oil and gas sector. The decision against a US listing points to a strategic focus on optimizing existing relationships and navigating a complex regulatory landscape. Achieving this ambitious goal presents significant challenges but also substantial opportunities for BP and potentially the entire energy industry.

Call to Action: Stay informed about BP's progress in achieving its ambitious goal to double its valuation. Follow our updates on BP’s strategy and the energy sector’s response to this significant development. Learn more about the future of BP and the broader energy market by [link to relevant resources/further articles]. Keep an eye on the BP stock price and the unfolding implications of this bold plan to double BP's valuation.

Featured Posts

-

Sharing Success A Louth Food Businesss Guide To Growth

May 21, 2025

Sharing Success A Louth Food Businesss Guide To Growth

May 21, 2025 -

Cest La Petite Italie De L Ouest Architecture Toscane Et Charme Inattendu

May 21, 2025

Cest La Petite Italie De L Ouest Architecture Toscane Et Charme Inattendu

May 21, 2025 -

Planning Your Trip To The New Peppa Pig Theme Park In Texas

May 21, 2025

Planning Your Trip To The New Peppa Pig Theme Park In Texas

May 21, 2025 -

Serie A Lazio And Juventus Share The Spoils In Tense Match

May 21, 2025

Serie A Lazio And Juventus Share The Spoils In Tense Match

May 21, 2025 -

Gangsta Granny Activities Fun And Engaging Ideas For Young Readers

May 21, 2025

Gangsta Granny Activities Fun And Engaging Ideas For Young Readers

May 21, 2025

Latest Posts

-

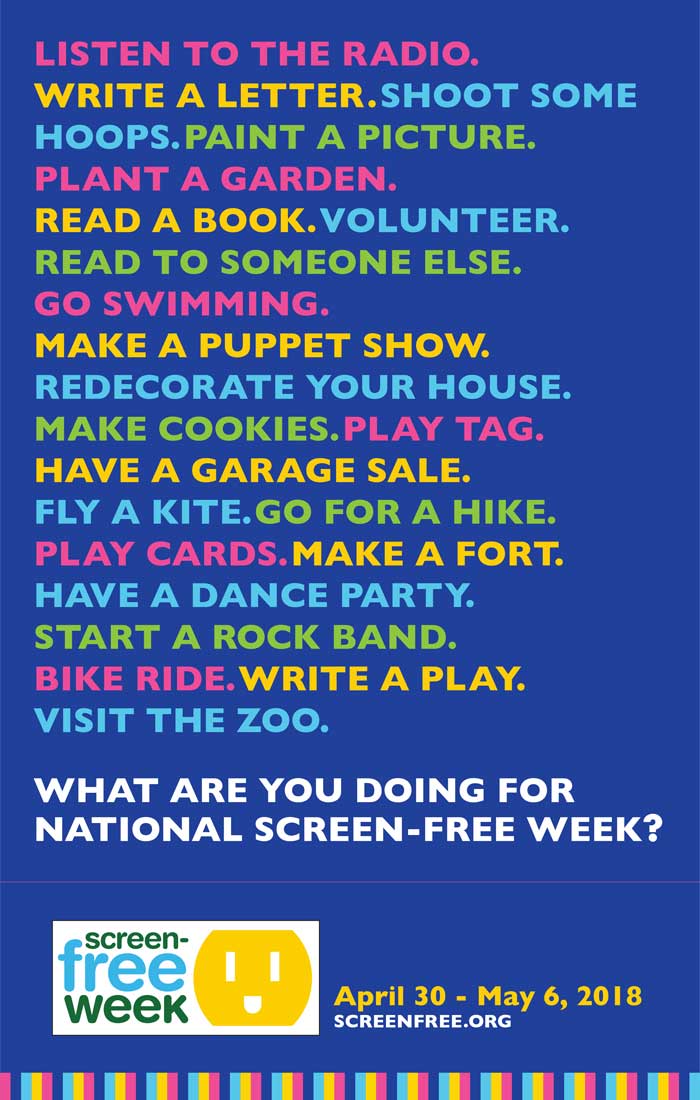

Digital Detox Your Familys Guide To A Screen Free Week

May 21, 2025

Digital Detox Your Familys Guide To A Screen Free Week

May 21, 2025 -

Making The Most Of A Screen Free Week With Your Kids

May 21, 2025

Making The Most Of A Screen Free Week With Your Kids

May 21, 2025 -

Overcoming Challenges During A Screen Free Family Week

May 21, 2025

Overcoming Challenges During A Screen Free Family Week

May 21, 2025 -

Your Guide To A Successful Screen Free Week With Children

May 21, 2025

Your Guide To A Successful Screen Free Week With Children

May 21, 2025 -

Capturing Cannes The Enduring Legacy Of The Traverso Family

May 21, 2025

Capturing Cannes The Enduring Legacy Of The Traverso Family

May 21, 2025