BP Executive Compensation: A Significant 31% Reduction

Table of Contents

BP, a global energy giant, has announced a significant 31% reduction in its executive compensation packages. This dramatic decrease follows increasing pressure from shareholders concerned about executive pay levels relative to company performance and a broader push towards responsible corporate governance within the energy sector. This article delves into the details of this reduction, its implications for the company, its shareholders, and its potential impact on the broader energy sector.

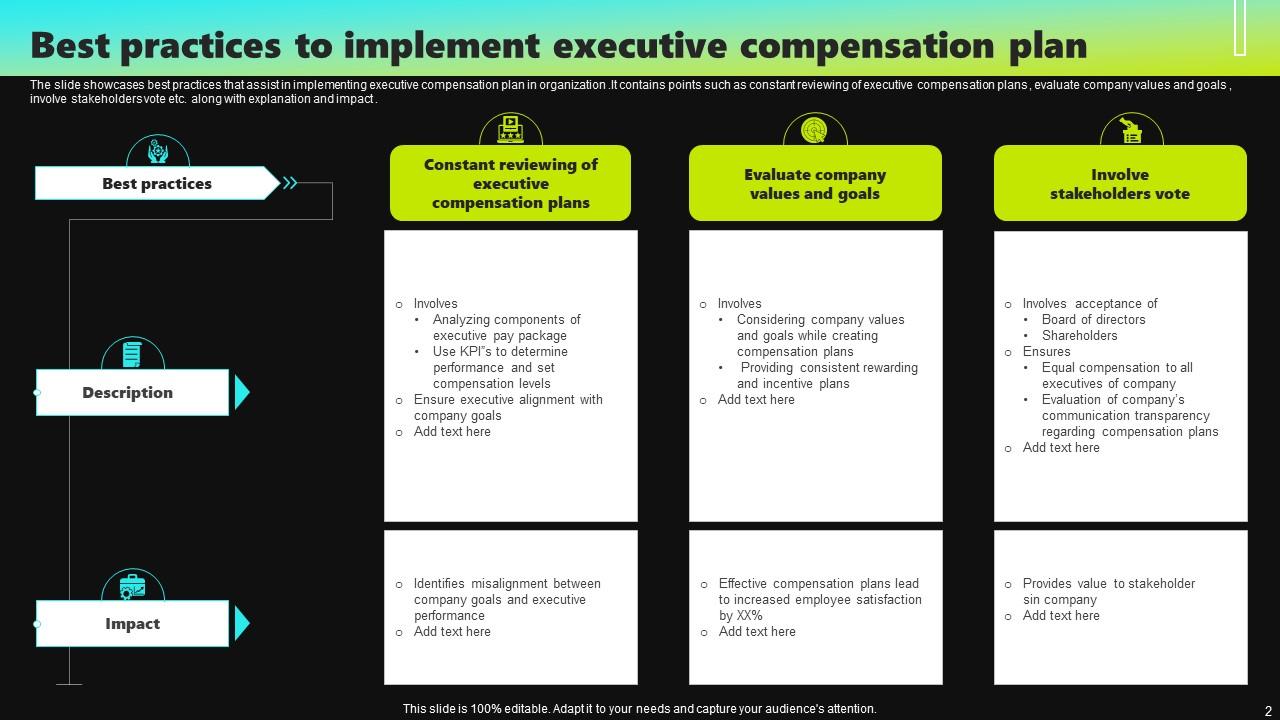

H2: The Breakdown of the 31% Reduction

H3: Salary Reductions: The 31% reduction in BP executive compensation primarily impacts base salaries. The CEO's salary, previously at [Insert Previous CEO Salary], has been reduced by [Insert Percentage]% to [Insert New CEO Salary]. Other key executives have also seen significant cuts, with an average salary reduction of [Insert Average Percentage]%.

- CEO: Previous salary: $[Previous Salary], New salary: $[New Salary] (a reduction of $[Dollar Amount])

- CFO: Previous salary: $[Previous Salary], New salary: $[New Salary] (a reduction of $[Dollar Amount])

- COO: Previous salary: $[Previous Salary], New salary: $[New Salary] (a reduction of $[Dollar Amount])

- Note: These figures are examples and should be replaced with actual data. Any performance-related bonuses will be assessed against revised, more stringent targets. This reflects a move toward stricter performance-based compensation. This adjustment focuses on aligning executive pay more closely with the company's overall performance and shareholder returns. Keywords: CEO salary BP, executive salary reduction BP, BP compensation cuts.

H3: Bonus and Incentive Changes: Beyond base salary reductions, BP has also significantly altered its bonus and long-term incentive (LTI) plans. Short-term bonus targets have been tightened, making it more challenging to achieve maximum payouts. Long-term incentive plans (LTIPs), often tied to share price performance and other key performance indicators (KPIs), have also been restructured to emphasize sustainable, long-term value creation rather than short-term gains.

- Reduced short-term bonus potential by [Insert Percentage]%.

- Revised LTIP structure to focus on ESG (Environmental, Social, and Governance) metrics and long-term shareholder value.

- Increased emphasis on achieving ambitious sustainability goals as a key performance indicator for bonuses and LTIPs. Keywords: BP executive bonuses, BP stock options, executive incentive plans BP, performance-based compensation BP.

H3: Impact on Total Compensation Packages: The combined effect of salary reductions, bonus changes, and adjustments to LTIPs results in a substantial decrease in total compensation packages for top executives. The average total compensation for top executives has fallen by approximately 31%, reflecting a significant commitment to aligning executive pay with broader company performance and shareholder interests.

- Average total compensation for top executives before the reduction: $[Previous Average Total Compensation]

- Average total compensation for top executives after the reduction: $[New Average Total Compensation] Keywords: Total compensation BP, executive pay BP, overall compensation reduction BP.

H2: Reasons Behind the BP Executive Compensation Cut

H3: Shareholder Activism: Growing shareholder activism played a crucial role in pushing for the reduction. Several major institutional investors voiced concerns about the disconnect between executive compensation and BP's financial performance, particularly in light of fluctuating oil prices and challenges in the energy transition. This pressure culminated in shareholder resolutions demanding greater transparency and accountability in executive compensation practices.

- Significant pressure from institutional investors regarding executive pay levels.

- Shareholder resolutions proposing changes to executive compensation structure.

- Increased scrutiny of executive pay practices by ESG rating agencies. Keywords: Shareholder activism BP, BP investor relations, corporate governance BP.

H3: Financial Performance: BP's recent financial performance, marked by periods of fluctuating profitability, also contributed to the decision. The reduction in executive compensation is presented as a reflection of the company's commitment to responsible financial management and ensuring shareholder value is prioritized.

- Fluctuations in oil prices impacting overall company profitability.

- Need to demonstrate fiscal responsibility to investors and stakeholders.

- Alignment of executive compensation with company's overall financial health. Keywords: BP financial performance, BP profitability, BP stock price, oil price impact BP compensation.

H3: Commitment to Responsible Corporate Governance: BP has publicly emphasized its commitment to improving corporate governance and responsible business practices. The reduction in executive compensation is framed as a key element of this broader strategy, demonstrating a willingness to align executive interests with broader stakeholder concerns.

- Public statements emphasizing commitment to responsible corporate governance.

- Alignment of executive compensation with broader ESG (Environmental, Social, and Governance) goals.

- Increased focus on long-term value creation rather than short-term gains. Keywords: corporate social responsibility BP, ESG investing BP, sustainable business practices BP.

H2: Implications and Future Outlook

H3: Impact on Employee Morale: The significant reduction in executive compensation could potentially impact employee morale, especially if it is perceived as unfair or inconsistent with compensation for other employees. BP will need to manage communications effectively to ensure transparency and mitigate potential negative consequences.

- Potential for decreased morale among employees if perceived as unfair.

- Need for effective communication strategies to address employee concerns.

- Importance of demonstrating fairness and equity across all levels of the organization. Keywords: BP employee morale, BP employee compensation, fair compensation BP.

H3: Industry-Wide Trends: The BP executive compensation cut reflects a broader trend toward greater scrutiny of executive pay within the oil and gas industry and the corporate world as a whole. Other major energy companies are also facing increased pressure to justify executive compensation levels and demonstrate alignment with shareholder interests and ESG goals.

- Increased pressure on energy companies to reduce executive pay.

- Growing emphasis on aligning executive compensation with company performance and sustainability goals.

- Greater scrutiny of executive compensation practices by regulators and investors. Keywords: oil and gas executive compensation, energy sector pay, executive pay trends.

H3: Long-Term Effects on BP's Strategy: The long-term effects of this compensation change on BP's strategy are yet to be fully realized. While it could improve investor relations and enhance the company's reputation, it might also present challenges in attracting and retaining top talent in a competitive job market.

- Potential for improved investor relations and enhanced company reputation.

- Potential challenges in attracting and retaining top talent.

- Need to balance cost-saving measures with the importance of maintaining a competitive workforce. Keywords: BP leadership, BP talent acquisition, BP strategic direction.

3. Conclusion:

The 31% reduction in BP executive compensation marks a significant shift in the company’s approach to executive pay, driven by a confluence of factors including shareholder pressure, financial performance considerations, and a stated commitment to responsible corporate governance. This bold move has far-reaching implications for the company, its employees, and the energy sector at large. While the long-term consequences remain to be seen, this drastic cut in BP executive compensation signals a potential paradigm shift in the landscape of executive pay within the industry. To stay abreast of further developments regarding BP executive compensation and its evolving corporate governance strategy, continue to follow our in-depth reporting on this crucial subject.

Featured Posts

-

Fan Favorite Villain Returns In Dexter Resurrection

May 21, 2025

Fan Favorite Villain Returns In Dexter Resurrection

May 21, 2025 -

Peppa Pigs Mummy Lavish Gender Reveal At Iconic London Location

May 21, 2025

Peppa Pigs Mummy Lavish Gender Reveal At Iconic London Location

May 21, 2025 -

Is The Goldbergs Still Relevant Exploring The Shows Enduring Appeal

May 21, 2025

Is The Goldbergs Still Relevant Exploring The Shows Enduring Appeal

May 21, 2025 -

Wjwh Jdydt Fy Tshkylt Mntkhb Amryka Tht Qyadt Bwtshytynw

May 21, 2025

Wjwh Jdydt Fy Tshkylt Mntkhb Amryka Tht Qyadt Bwtshytynw

May 21, 2025 -

Funko Unveils Official Dexter Pop Vinyl Figures

May 21, 2025

Funko Unveils Official Dexter Pop Vinyl Figures

May 21, 2025

Latest Posts

-

The Love Monster And Self Love Finding Balance

May 21, 2025

The Love Monster And Self Love Finding Balance

May 21, 2025 -

Overcoming The Love Monster A Step By Step Approach

May 21, 2025

Overcoming The Love Monster A Step By Step Approach

May 21, 2025 -

Confronting Your Inner Love Monster

May 21, 2025

Confronting Your Inner Love Monster

May 21, 2025 -

Funbox Opens First Permanent Location Indoor Bounce Park In Mesa Arizona

May 21, 2025

Funbox Opens First Permanent Location Indoor Bounce Park In Mesa Arizona

May 21, 2025 -

Is Sesame Street Coming To Netflix Plus Todays Other Big Stories

May 21, 2025

Is Sesame Street Coming To Netflix Plus Todays Other Big Stories

May 21, 2025