Brace For More Stock Market Losses: Investors Defy Gravity

Table of Contents

Ignoring Warning Signs: Why Investors Are Defying Gravity

The current market exuberance seems to ignore several critical warning signs. This defiance of gravity is fueled by a combination of factors, primarily investor psychology and the increasingly prominent role of artificial intelligence in trading.

Overconfidence and Complacency among Investors

A pervasive sense of overconfidence and complacency is driving irrational exuberance. Years of relatively stable growth have lulled many investors into a false sense of security, leading them to underestimate the potential for significant stock market losses. This behavior is evident in several key areas:

- Ignoring historical market downturns: Many newer investors lack firsthand experience with major market corrections, leading them to underestimate the speed and severity of potential losses.

- Focusing on short-term gains over long-term strategies: The pursuit of quick profits overshadows long-term investment planning, increasing vulnerability to market volatility.

- Underestimating the impact of inflation and interest rate hikes: The persistent rise in inflation and the Federal Reserve's aggressive interest rate hikes are often overlooked or downplayed in favor of optimistic market forecasts.

The Role of Artificial Intelligence and Algorithmic Trading

The increasing prevalence of AI-driven trading strategies is another factor contributing to the current market climate and potentially amplifying future stock market losses. While AI can offer advantages in terms of speed and data analysis, it also introduces potential risks:

- High-frequency trading and its impact on market stability: The rapid execution of trades by AI algorithms can contribute to increased market volatility and even trigger flash crashes.

- Potential for algorithmic trading to trigger flash crashes: A cascade of automated sell orders triggered by a single event can lead to a rapid and dramatic market downturn.

- Lack of human oversight in algorithmic decision-making: The reliance on complex algorithms without sufficient human oversight can lead to unforeseen consequences and amplify losses during a downturn.

Economic Headwinds Fueling Potential Stock Market Losses

Several significant economic headwinds pose a substantial threat to continued market growth and could trigger significant stock market losses.

Inflation and Rising Interest Rates

Persistently high inflation and the Federal Reserve's aggressive interest rate hikes are creating a challenging environment for businesses and investors alike. This impacts stock valuations in several ways:

- Increased borrowing costs for companies: Higher interest rates make it more expensive for companies to borrow money, impacting their profitability and potentially leading to reduced investments and hiring.

- Reduced consumer spending due to higher prices: As prices rise, consumers have less disposable income, leading to decreased demand for goods and services and potentially slowing economic growth.

- Potential for a recessionary environment: The combined effects of inflation and rising interest rates increase the risk of a recession, which would likely trigger significant stock market losses.

Geopolitical Uncertainty and Supply Chain Disruptions

The ongoing geopolitical conflicts and persistent supply chain disruptions are adding to the overall market uncertainty and contributing to increased market volatility, paving the way for potential stock market losses.

- Energy price volatility: Geopolitical instability continues to significantly impact energy prices, impacting inflation and overall economic growth.

- Global trade tensions: Trade wars and sanctions create uncertainty for businesses, impacting their ability to plan and invest.

- Increased uncertainty about future economic growth: The combination of geopolitical risks and supply chain disruptions increases uncertainty about future economic growth, leading to increased investor caution and potentially triggering market sell-offs.

Preparing for Stock Market Losses: Strategies for Investors

Given the potential for significant stock market losses, investors should take proactive steps to protect their portfolios.

Diversification and Risk Management

Diversification and effective risk management are crucial for mitigating potential losses during market downturns.

- Allocating assets to less volatile investments: Diversifying investments across different asset classes, such as bonds and real estate, can help reduce the overall risk of your portfolio.

- Utilizing stop-loss orders to limit potential losses: Stop-loss orders can automatically sell your investments when they reach a predetermined price, limiting potential losses.

- Rebalancing portfolios regularly: Regularly rebalancing your portfolio helps to maintain your desired asset allocation and reduces risk.

Long-Term Investing and Emotional Discipline

Maintaining a long-term perspective and practicing emotional discipline are crucial during market volatility.

- Staying invested during market volatility: Panic selling during market downturns can lead to significant losses. Staying invested allows you to benefit from market rebounds.

- Ignoring short-term market fluctuations: Focus on your long-term investment goals and avoid making impulsive decisions based on short-term market movements.

- Focusing on long-term investment goals: Maintain a clear understanding of your long-term financial objectives and avoid being swayed by short-term market fluctuations.

Conclusion: Are You Ready for More Stock Market Losses?

This article has highlighted several factors suggesting a significant risk of future stock market losses, despite the current market's apparent defiance of gravity. Investors should not be complacent. The combination of overconfident investor behavior, AI-driven trading risks, persistent inflation, rising interest rates, and geopolitical uncertainty creates a volatile environment.

Key takeaways include the importance of diversifying investments, actively managing risk, and maintaining a long-term investment strategy with emotional discipline. Don't be caught off guard. Learn more about protecting your portfolio from potential stock market losses. Start planning your investment strategy today!

Featured Posts

-

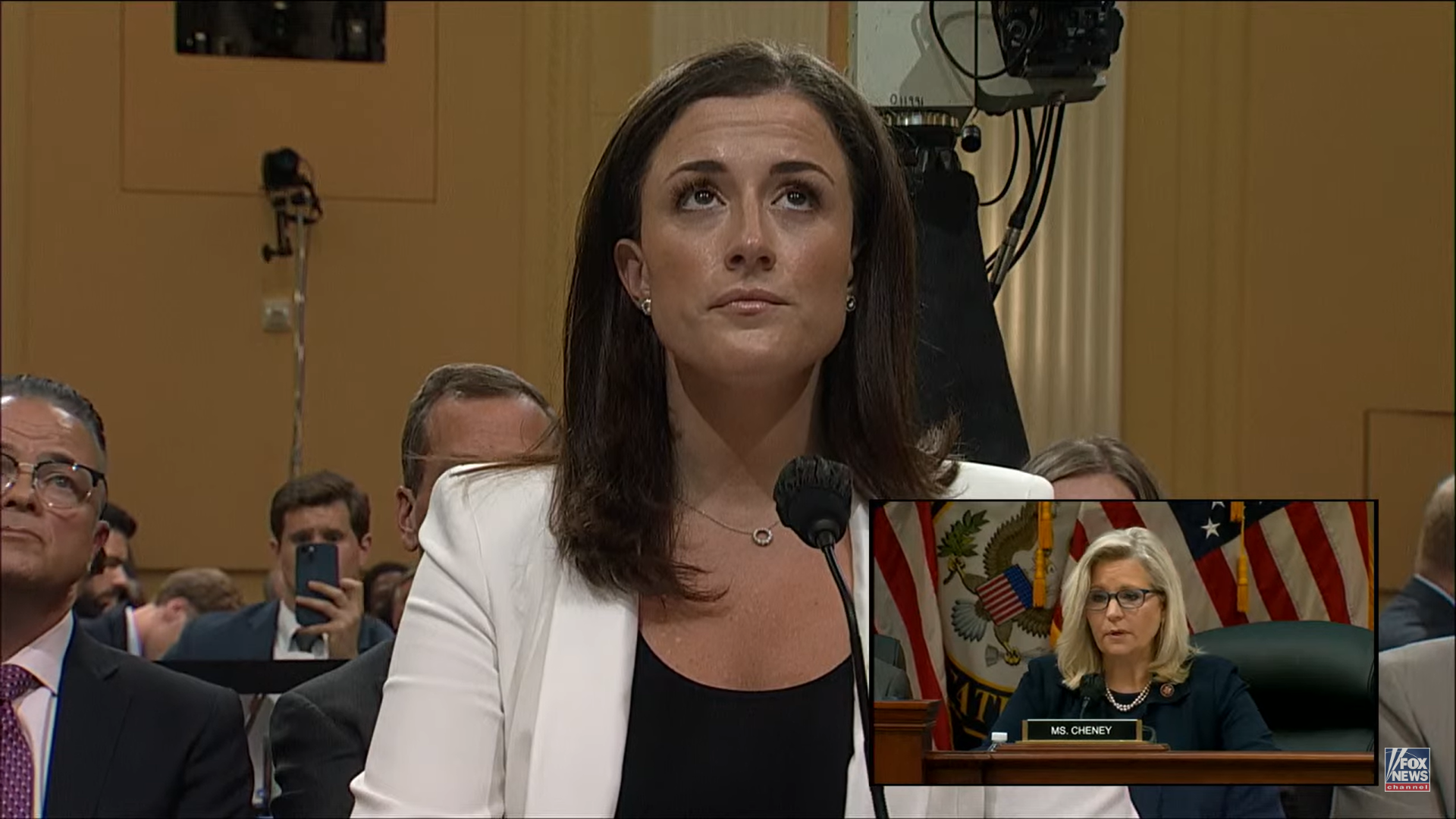

Cassidy Hutchinson From Jan 6 Hearings To Tell All Memoir

Apr 22, 2025

Cassidy Hutchinson From Jan 6 Hearings To Tell All Memoir

Apr 22, 2025 -

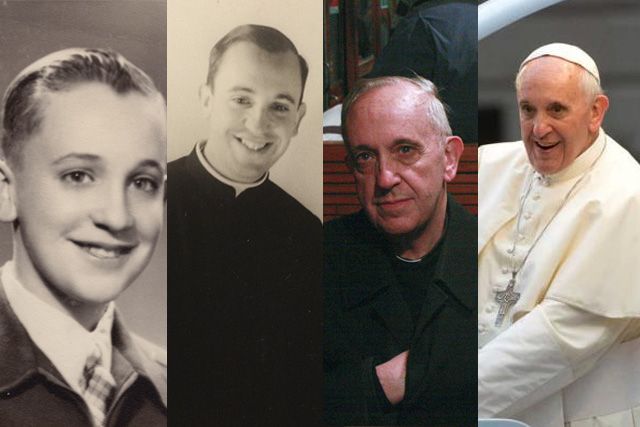

A Compassionate Papacy Ends Remembering Pope Francis

Apr 22, 2025

A Compassionate Papacy Ends Remembering Pope Francis

Apr 22, 2025 -

Russias Easter Truce Ends Renewed Fighting In Ukraine

Apr 22, 2025

Russias Easter Truce Ends Renewed Fighting In Ukraine

Apr 22, 2025 -

The Closing Of Anchor Brewing Company What Went Wrong

Apr 22, 2025

The Closing Of Anchor Brewing Company What Went Wrong

Apr 22, 2025 -

Trump Era Trade Policies Risks And Realities For American Financial Primacy

Apr 22, 2025

Trump Era Trade Policies Risks And Realities For American Financial Primacy

Apr 22, 2025