Breaking Free: Strategies To Overcome A Lack Of Funds

Table of Contents

Mastering the Art of Budgeting: Controlling Your Spending

Effective budgeting is the cornerstone of financial stability. It's about understanding where your money goes and making conscious decisions about how you spend it. Without a budget, it's easy to overspend and find yourself constantly struggling with a lack of funds.

-

Track Your Spending: For at least a month, meticulously record every expense. Use budgeting apps like Mint or YNAB (You Need A Budget), spreadsheets, or even a simple notebook. This will reveal spending patterns and areas where you can cut back.

-

Categorize Your Expenses: Organize your expenses into categories like housing, food, transportation, utilities, entertainment, debt payments, and savings. This provides a clear picture of your spending habits.

-

Set Realistic Goals: Establish both short-term and long-term financial goals. Short-term goals might include paying off a small debt or saving for a vacation. Long-term goals could be buying a house or securing early retirement.

-

Prioritize Essential Expenses: Focus on necessities like housing, food, and transportation before allocating funds to non-essential spending.

-

The 50/30/20 Rule: A popular budgeting guideline suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. Adjust this rule to fit your specific circumstances.

Keywords: budgeting, financial planning, expense tracking, money management, saving money

Boosting Your Income: Exploring Multiple Revenue Streams

Diversifying your income sources is crucial for overcoming a lack of funds and building financial resilience. Multiple income streams provide a safety net and accelerate your progress towards financial goals.

-

Freelancing and Gig Work: Leverage your skills to earn extra income through platforms like Upwork and Fiverr. Many individuals find success in writing, graphic design, virtual assistance, or web development.

-

Part-Time Jobs or Side Hustles: Consider a part-time job or a side hustle that complements your schedule and interests. This could involve anything from dog walking to tutoring to driving for a ride-sharing service.

-

Renting Out Assets: If you have a spare room, a car, or other assets, explore renting them out through platforms like Airbnb or Turo. This can generate passive income.

-

Investing: Investing in stocks, bonds, or real estate can generate long-term wealth, but requires careful research and risk management. Start small and educate yourself before investing significant funds.

-

Selling Unused Items: Declutter your home and sell unused items online through platforms like eBay or Craigslist. This can provide a quick injection of cash.

Keywords: side hustle, extra income, freelancing, passive income, investing, money-making ideas

Tackling Debt: Strategies for Debt Reduction

High levels of debt significantly impact your financial well-being and contribute to a lack of funds. Addressing your debt is crucial for long-term financial health.

-

Debt Consolidation: Consolidating multiple debts into a single loan with a lower interest rate can simplify payments and save you money over time.

-

Debt Snowball/Avalanche Methods: The snowball method focuses on paying off the smallest debts first for motivational purposes. The avalanche method targets debts with the highest interest rates first to minimize total interest paid.

-

Negotiating with Creditors: Contact your creditors and explain your financial situation. They may be willing to negotiate lower payments or more flexible repayment terms.

-

Debt Counseling: Consider seeking professional debt counseling from a reputable agency. They can provide guidance and help you create a debt management plan.

Keywords: debt management, debt reduction, debt consolidation, debt counseling, credit repair

Seeking Support: Utilizing Resources and Assistance

Many resources are available to help individuals facing a lack of funds. Don't hesitate to seek assistance if needed.

-

Government Assistance Programs: Research government assistance programs in your area, such as food stamps (SNAP), unemployment benefits, or housing assistance.

-

Non-Profit Organizations: Numerous non-profit organizations offer financial aid and support services to those in need.

-

Credit Counseling Services: Credit counseling agencies can provide guidance on managing debt and improving your credit score.

-

Community Support Groups: Connect with local community groups or churches that offer financial assistance or support.

Keywords: financial aid, government assistance, nonprofit organizations, community resources, support services

Breaking Free from Financial Constraints

Overcoming a lack of funds requires a multifaceted approach. By mastering budgeting, generating additional income, managing debt effectively, and utilizing available resources, you can significantly improve your financial situation. Proactive financial management is key. Take control of your finances today and break free from your lack of funds by implementing these strategies. Start budgeting, explore additional income streams, and tackle your debt head-on. Your financial freedom awaits!

[Link to relevant resources on financial planning and management]

Featured Posts

-

Where To Buy High Quality Cassis Blackcurrant

May 22, 2025

Where To Buy High Quality Cassis Blackcurrant

May 22, 2025 -

Groeiend Autobezit Drijft Occasionverkopen Bij Abn Amro Omhoog

May 22, 2025

Groeiend Autobezit Drijft Occasionverkopen Bij Abn Amro Omhoog

May 22, 2025 -

Antiques Roadshow Couple Arrested After Jaw Dropping National Treasure Appraisal

May 22, 2025

Antiques Roadshow Couple Arrested After Jaw Dropping National Treasure Appraisal

May 22, 2025 -

Analyzing Bgts Blockbusters Special A Critical Look

May 22, 2025

Analyzing Bgts Blockbusters Special A Critical Look

May 22, 2025 -

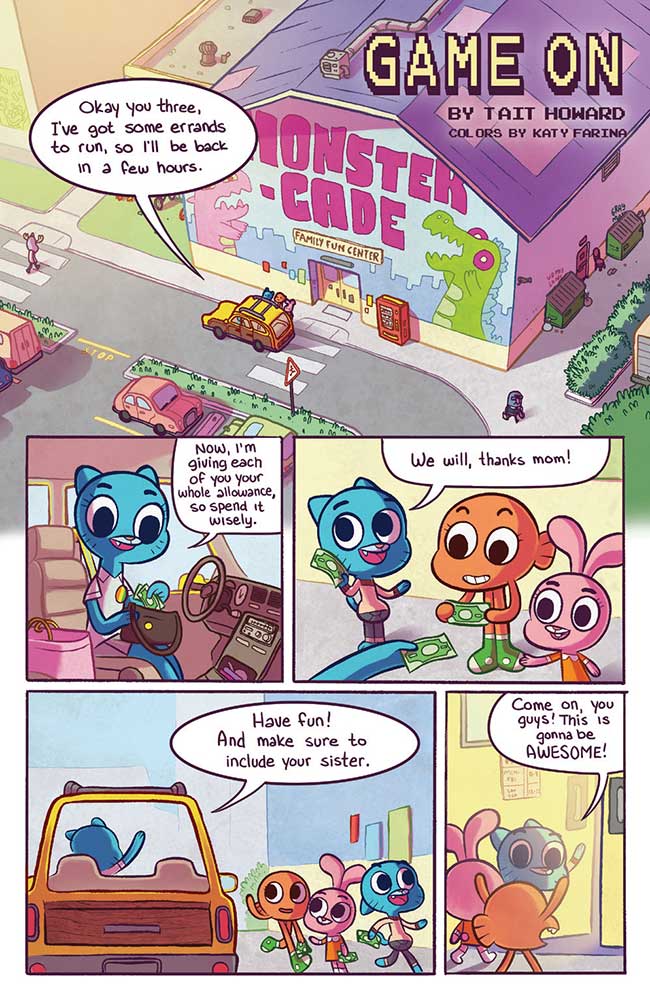

A Sneak Peek At The Next Gumball Chapter

May 22, 2025

A Sneak Peek At The Next Gumball Chapter

May 22, 2025

Latest Posts

-

Jaw Dropping Antiques Roadshow Find Results In Couples Arrest For Trafficking

May 22, 2025

Jaw Dropping Antiques Roadshow Find Results In Couples Arrest For Trafficking

May 22, 2025 -

National Treasure Trafficking Antiques Roadshow Episode Ends In Arrest

May 22, 2025

National Treasure Trafficking Antiques Roadshow Episode Ends In Arrest

May 22, 2025 -

Jail Time For Couple Following Antiques Roadshow Appraisal

May 22, 2025

Jail Time For Couple Following Antiques Roadshow Appraisal

May 22, 2025 -

Antiques Roadshow Couple Arrested After Jaw Dropping National Treasure Appraisal

May 22, 2025

Antiques Roadshow Couple Arrested After Jaw Dropping National Treasure Appraisal

May 22, 2025 -

Couples Antiques Roadshow Appearance Results In Prison Sentence

May 22, 2025

Couples Antiques Roadshow Appearance Results In Prison Sentence

May 22, 2025