Broadcom's VMware Acquisition: AT&T Exposes Potential 1,050% Price Hike

Table of Contents

Understanding the Broadcom-VMware Merger

The $61 billion acquisition of VMware by Broadcom, finalized in late 2022, represents a major consolidation in the enterprise software market. Broadcom, a semiconductor giant, aims to expand its software portfolio and leverage VMware's dominant position in virtualization. VMware, a leader in server virtualization and cloud infrastructure, boasts a significant market share, providing essential software for businesses worldwide to manage and optimize their IT resources. This merger, however, has drawn significant antitrust scrutiny and regulatory review, raising concerns about potential monopolistic practices and reduced competition.

- Key benefits for Broadcom: Expansion into the lucrative enterprise software market, access to VMware's extensive customer base, and diversification beyond its core semiconductor business.

- Potential challenges for Broadcom: Integrating two vastly different organizations, navigating regulatory hurdles, and managing potential customer backlash due to pricing changes.

- Impact on competitors: Increased pressure on competitors in the virtualization market, potentially leading to consolidation or decreased innovation.

AT&T's Dependence on VMware

AT&T, a telecommunications giant, relies heavily on VMware's virtualization technologies for its network infrastructure. VMware's vSphere and NSX products are crucial components of AT&T's network virtualization strategy, enabling efficient management of its vast data centers and enabling agile service delivery. This reliance, however, creates a vulnerability. Any significant price increase or service disruption from VMware could have far-reaching consequences for AT&T's operations and customer service.

- Specific VMware products used by AT&T: vSphere for server virtualization, NSX for network virtualization, and potentially other VMware cloud management solutions.

- The role of VMware in AT&T's network virtualization strategy: VMware is integral to AT&T's ability to virtualize its network functions, improving scalability, agility, and resource utilization.

- The potential impact on network performance and stability: Any disruption to VMware services could negatively impact AT&T's network performance, potentially leading to service outages and customer dissatisfaction.

The Alleged 1,050% Price Hike

The most alarming aspect of this merger for AT&T is the reported 1,050% price increase for VMware services. While the exact details and sources remain somewhat opaque, the claim suggests a dramatic shift in pricing following the acquisition. This alleged surge is attributed to Broadcom's increased market power and the reduced competition resulting from the merger. The credibility of this 1,050% figure requires further investigation, yet the potential for significant price increases is undeniable.

- Sources for the 1,050% price hike claim: While precise sources often remain confidential due to business sensitivities, industry analysts and leaked internal communications are potential sources of such claims.

- Comparison of VMware pricing before and after the acquisition: A detailed analysis of VMware's pricing strategies before and after the Broadcom acquisition is crucial to validating these claims.

- Potential impact on AT&T's operating costs and profitability: Such a dramatic price increase could significantly impact AT&T's operating costs, potentially reducing profitability and forcing difficult budgetary decisions.

Broader Implications for the Telecom Industry

The Broadcom-VMware merger doesn't just affect AT&T; its ripple effects extend throughout the telecom industry. Other telecom providers relying on VMware face similar challenges, particularly smaller companies with less negotiating leverage. This acquisition could lead to increased consolidation and decreased competition within the virtualization market, potentially driving up prices across the board. Regulatory bodies will play a crucial role in overseeing the merger and addressing concerns about anti-competitive practices.

- Impact on smaller telecom companies with limited negotiating power: Smaller companies may be forced to accept significantly higher prices due to their limited bargaining power compared to larger players like AT&T.

- Potential for increased cloud computing costs for telecom providers: The increased cost of virtualization could lead to higher overall cloud computing costs for telecom providers, affecting their operating budgets and potentially impacting consumer prices.

- The role of regulatory bodies in overseeing the merger: Regulatory bodies need to actively monitor the pricing strategies of Broadcom post-acquisition and ensure fair competition in the virtualization market.

Conclusion: Navigating the Future of VMware Pricing After the Broadcom Acquisition

Broadcom's acquisition of VMware presents significant challenges for the telecom industry, particularly for major players like AT&T. The potential for substantial price increases, possibly as high as 1,050% according to some reports, cannot be ignored. This could severely impact AT&T's budget and operational efficiency. To mitigate the impact, AT&T and other telecom companies must explore strategies like renegotiating contracts and investigating alternative virtualization solutions.

Stay updated on the Broadcom VMware acquisition. Monitor the impact of the Broadcom VMware deal on your organization's costs and explore alternative solutions to reduce your reliance on VMware products. Learn more about the potential price hikes from the Broadcom VMware merger and how they could affect your business. The future of virtualization pricing hinges on the ongoing developments surrounding this massive merger.

Featured Posts

-

Elias Rodriguez Accused In Jewish Museum Shooting After Free Palestine Chant

May 23, 2025

Elias Rodriguez Accused In Jewish Museum Shooting After Free Palestine Chant

May 23, 2025 -

Zimbabwe Dominates Bangladesh On Day One Complete Control Secured

May 23, 2025

Zimbabwe Dominates Bangladesh On Day One Complete Control Secured

May 23, 2025 -

Suksesi I Kosoves Ne Ligen E Kombeve Analize E Avancimit Dhe Perfitimeve

May 23, 2025

Suksesi I Kosoves Ne Ligen E Kombeve Analize E Avancimit Dhe Perfitimeve

May 23, 2025 -

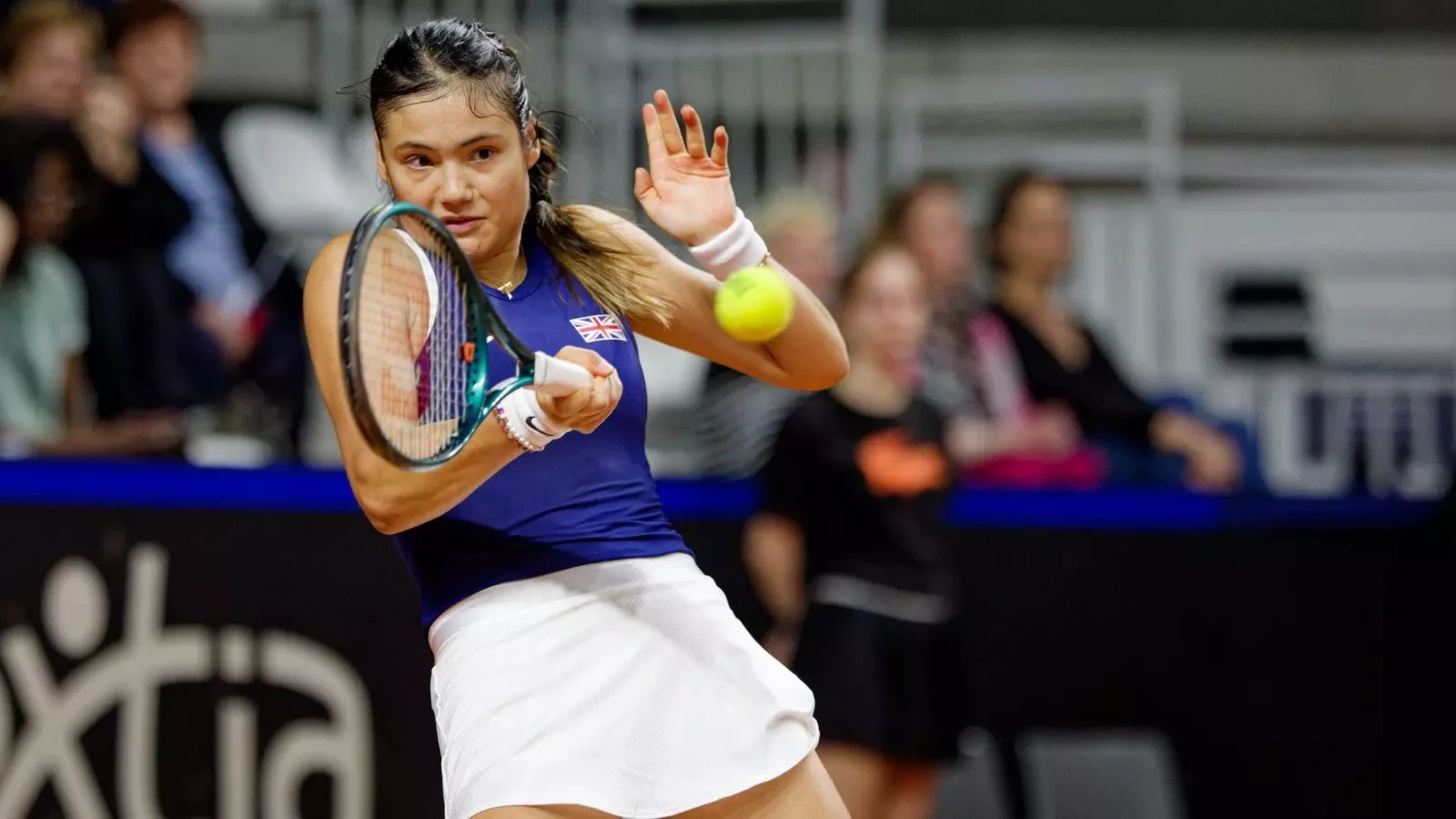

Unexpected Victory Kazakhstan Beats Australia In Billie Jean King Cup

May 23, 2025

Unexpected Victory Kazakhstan Beats Australia In Billie Jean King Cup

May 23, 2025 -

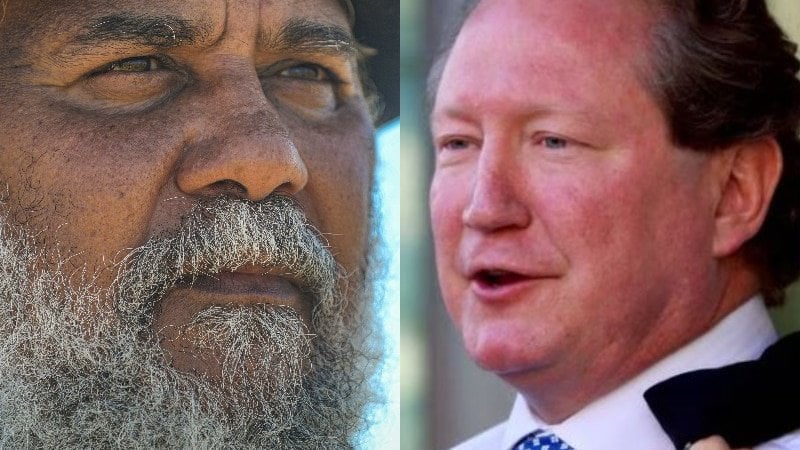

Rio Tinto Rebuttal Addressing Andrew Forrests Pilbara Wasteland Concerns

May 23, 2025

Rio Tinto Rebuttal Addressing Andrew Forrests Pilbara Wasteland Concerns

May 23, 2025

Latest Posts

-

Review Jonathan Groffs Just In Time A Captivating Bobby Darin Tribute

May 23, 2025

Review Jonathan Groffs Just In Time A Captivating Bobby Darin Tribute

May 23, 2025 -

Jonathan Groffs Just In Time A 1965 Style Party On Stage

May 23, 2025

Jonathan Groffs Just In Time A 1965 Style Party On Stage

May 23, 2025 -

Just In Time Review Jonathan Groff Shines In A Stellar Bobby Darin Musical

May 23, 2025

Just In Time Review Jonathan Groff Shines In A Stellar Bobby Darin Musical

May 23, 2025 -

Jonathan Groffs Just In Time Performance Exploring The Artistic Process And Raw Talent

May 23, 2025

Jonathan Groffs Just In Time Performance Exploring The Artistic Process And Raw Talent

May 23, 2025 -

Jonathan Groffs Past An Open Conversation About Asexuality

May 23, 2025

Jonathan Groffs Past An Open Conversation About Asexuality

May 23, 2025