Broadcom's VMware Acquisition: AT&T Faces A Staggering 1,050% Price Increase

Table of Contents

Understanding the VMware Acquisition and its Impact on Pricing

Broadcom's acquisition of VMware, finalized in 2023, represents a significant consolidation of power in the enterprise software market. VMware provides critical virtualization, cloud computing, and network management solutions, integral to the infrastructure of many large telecommunications companies, including AT&T. This acquisition grants Broadcom control over a vast portfolio of technologies used by AT&T for its core operations.

The direct correlation between the acquisition and the reported 1050% price increase for AT&T stems from several factors:

- Reduced Competition: The merger eliminates a major competitor in the virtualization and cloud management space, leaving fewer options for large telecom providers like AT&T.

- Increased Market Power: Broadcom now holds substantial market power, allowing them to leverage their dominance and dictate pricing terms.

- Potential for Monopolistic Practices: Concerns are rising about the potential for Broadcom to engage in monopolistic practices, exploiting their market position to inflate prices without justification.

The financial implications of this 1050% price increase for AT&T are substantial:

- Increased Operational Costs: A drastic rise in the cost of essential infrastructure components significantly impacts AT&T's operating budget.

- Impact on Profitability: Higher operational costs directly affect profitability, potentially leading to reduced margins and impacting shareholder returns.

- Necessity for Price Adjustments: AT&T may be forced to pass these increased costs onto consumers, leading to higher prices for telecom services.

AT&T's Response and Future Strategies

While AT&T hasn't publicly released a detailed statement specifically addressing the 1050% figure, the company is undoubtedly facing significant challenges. To mitigate the impact of these increased costs, AT&T might pursue several strategies:

- Negotiating with Broadcom: AT&T may attempt to renegotiate pricing terms with Broadcom, seeking a more favorable agreement.

- Exploring Alternative Solutions: The company could actively explore alternative virtualization and cloud management solutions to reduce its reliance on Broadcom's products.

- Internal Cost-Cutting Measures: To offset the increased costs, AT&T may need to implement internal cost-cutting measures across its operations.

- Passing Costs to Consumers: A likely outcome is that AT&T will pass some or all of the increased costs to consumers, resulting in higher prices for their services.

The potential impact on AT&T's services and customer experience is concerning:

- Potential Service Disruptions: Negotiations with Broadcom or transitions to alternative solutions could potentially lead to temporary service disruptions.

- Price Increases for Consumers: Higher prices for AT&T's services could lead to customer dissatisfaction and potentially drive customers to competitors.

- Reduced Competitiveness: Increased costs could significantly reduce AT&T's competitiveness in the telecom market.

The Broader Implications for the Telecom Industry

The implications of Broadcom's acquisition of VMware extend far beyond AT&T. Other telecom providers relying on VMware solutions may face similar price hikes, leading to several potential consequences:

- Increased Consolidation: This acquisition could trigger further consolidation within the telecom industry, as smaller providers struggle to compete with larger players.

- Reduced Choice for Consumers: The reduced competition might ultimately limit consumer choice and potentially lead to less innovation.

- Potential Need for Regulatory Intervention: The substantial price increase raises concerns about market dominance and the potential need for regulatory intervention to prevent monopolistic practices.

Alternative Solutions and Future Outlook

Facing a 1050% price increase, AT&T and other telecom providers are likely to explore alternative strategies:

- Alternative Technologies: Shifting to alternative virtualization platforms, cloud providers, or network management solutions could offer some relief.

- Open-Source Alternatives: The adoption of open-source alternatives to VMware's products could become a more viable option for reducing dependence on Broadcom.

This acquisition has profound implications for the technology industry:

- Increased Focus on Open-Source Solutions: The event could accelerate the adoption of open-source alternatives in the enterprise software market.

- Potential for Innovation in Alternative Technologies: The price hike may drive innovation in alternative virtualization and cloud technologies.

- Need for Greater Regulatory Scrutiny: The acquisition underscores the need for increased regulatory scrutiny of large tech mergers and acquisitions to prevent anti-competitive practices.

Conclusion

Broadcom's acquisition of VMware has resulted in a massive price increase for AT&T – a staggering 1050% for certain services – posing significant challenges for the telecom giant and potentially impacting the broader industry. This significant price hike has far-reaching implications, including increased operational costs, potential service disruptions, and the necessity for price adjustments that could impact consumers. The long-term effects on competition, innovation, and regulatory oversight within the telecom sector remain to be seen. Stay informed about the ongoing developments surrounding the Broadcom VMware acquisition and its impact on the telecom industry. Understanding the ramifications of this deal is crucial for both businesses and consumers. Continue to follow this story as we uncover further details about the Broadcom VMware acquisition.

Featured Posts

-

Arsenal Gyoekeres Atigazolas Minden Amit Tudni Kell

May 28, 2025

Arsenal Gyoekeres Atigazolas Minden Amit Tudni Kell

May 28, 2025 -

Which One Piece Characters Served More Than One Pirate Crew

May 28, 2025

Which One Piece Characters Served More Than One Pirate Crew

May 28, 2025 -

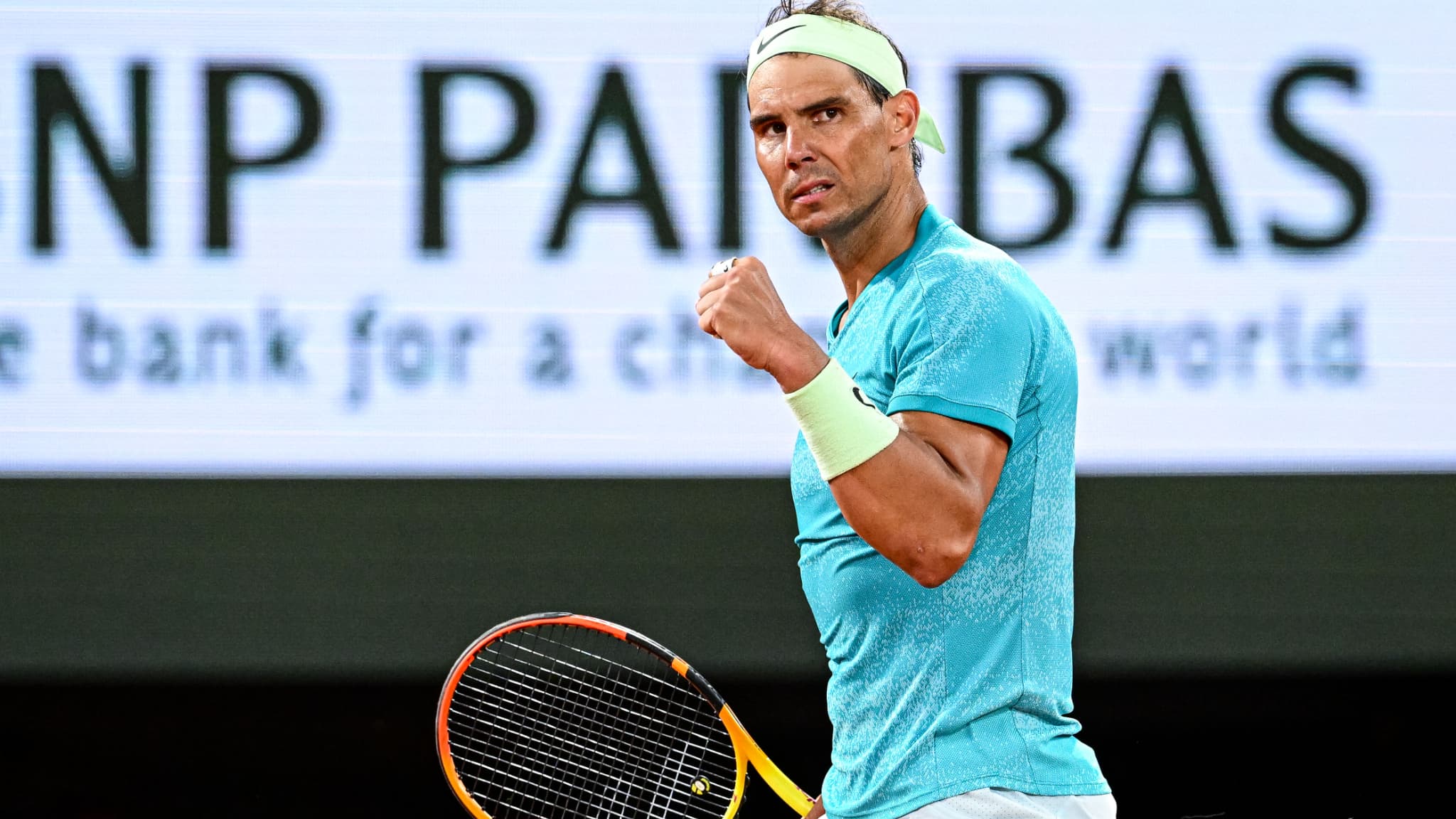

Roland Garros 2024 Nadals Farewell And Sabalenkas Championship

May 28, 2025

Roland Garros 2024 Nadals Farewell And Sabalenkas Championship

May 28, 2025 -

Bali Gubernur Koster Tolak Canang Jadi Indikator Inflasi

May 28, 2025

Bali Gubernur Koster Tolak Canang Jadi Indikator Inflasi

May 28, 2025 -

Hugh Jackmans Cozy Photos Spark Speculation The Sutton Foster Factor

May 28, 2025

Hugh Jackmans Cozy Photos Spark Speculation The Sutton Foster Factor

May 28, 2025

Latest Posts

-

La Landlord Practices Under Scrutiny Following Recent Wildfires

May 31, 2025

La Landlord Practices Under Scrutiny Following Recent Wildfires

May 31, 2025 -

Investing In Middle Management A Key To Enhanced Productivity And Employee Engagement

May 31, 2025

Investing In Middle Management A Key To Enhanced Productivity And Employee Engagement

May 31, 2025 -

Understanding Money Differently A New Podcast On Financial Literacy

May 31, 2025

Understanding Money Differently A New Podcast On Financial Literacy

May 31, 2025 -

Rethinking Middle Management Their Value In Todays Workplace

May 31, 2025

Rethinking Middle Management Their Value In Todays Workplace

May 31, 2025 -

Post Fire Rent Hikes In Los Angeles Spark Outrage And Investigation

May 31, 2025

Post Fire Rent Hikes In Los Angeles Spark Outrage And Investigation

May 31, 2025