Broadcom's VMware Deal: AT&T Faces A Potential 1,050% Cost Increase

Table of Contents

Understanding the Broadcom-VMware Merger and its Implications

Broadcom's Acquisition Strategy

Broadcom, a leading designer of semiconductors and infrastructure software, has a history of strategic acquisitions. This VMware acquisition is another bold move designed to further solidify its dominance in the technology landscape. Broadcom's strategy focuses on consolidating key players in the semiconductor and infrastructure software markets to create a powerful, vertically integrated enterprise.

- Past Acquisitions: Broadcom's previous acquisitions include CA Technologies, Symantec's Enterprise Security business, and Brocade Communications Systems. These acquisitions expanded its portfolio of enterprise software and networking solutions.

- Market Position: The VMware acquisition dramatically enhances Broadcom's market position, giving it control over a significant portion of the enterprise virtualization and cloud computing market. This move significantly strengthens its competitive edge against rivals like Cisco and Microsoft.

- Strategic Rationale: The acquisition of VMware allows Broadcom to bundle its existing semiconductor offerings with VMware's powerful virtualization platform, creating a compelling and potentially more expensive suite of products for enterprises.

VMware's Role in AT&T's Infrastructure

VMware's virtualization technology, including VMware vSphere and NSX, plays a critical role in AT&T's network infrastructure. These platforms are essential for managing and optimizing AT&T's vast network resources.

- Key VMware Products: AT&T utilizes VMware's virtualization technologies for various purposes, including server virtualization, network virtualization, and cloud management. This reliance on VMware makes the company highly vulnerable to any price increases following the acquisition.

- Potential Disruption: The acquisition could lead to potential disruptions in AT&T's operations if there are integration issues, compatibility problems, or significant changes to VMware's product offerings and support. This disruption could affect service quality and AT&T's ability to deliver reliable services to its customers.

Anticipated Price Hikes

Analysts predict a substantial increase in licensing and support costs for AT&T following the Broadcom-VMware merger. Estimates suggest a potential 1,050% increase in certain areas, a figure that underscores the severity of this situation.

- Reasons for Price Increases: Several factors could contribute to such significant price hikes, including reduced competition (as Broadcom controls a larger market share), the bundling of services into more expensive packages, and potentially revised licensing agreements that favor Broadcom.

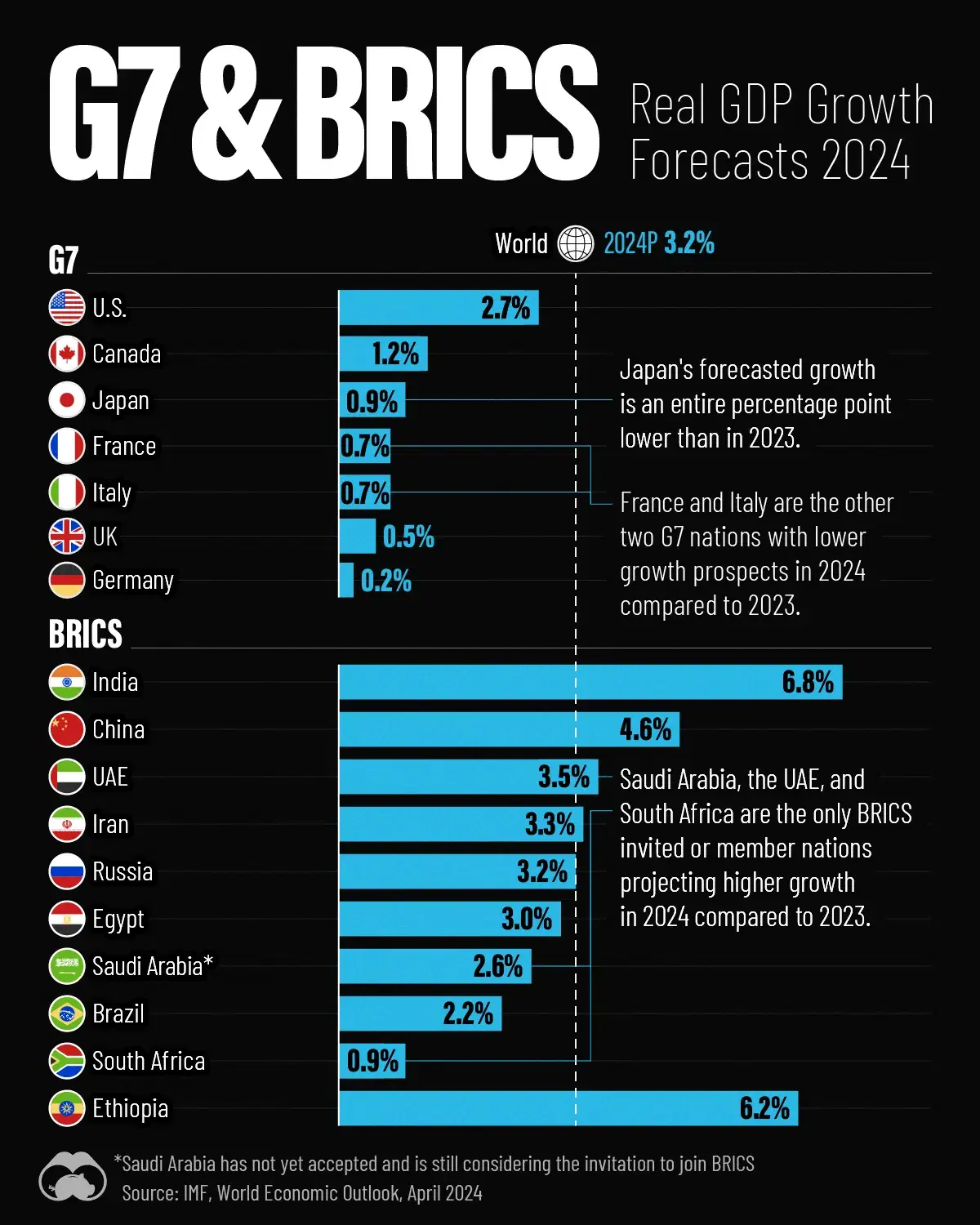

- Visual Representation: [Insert a chart or graph here visually representing the projected cost increase, sourced from a reputable analyst report or financial news outlet].

AT&T's Response and Mitigation Strategies

Potential Responses from AT&T

Facing such a substantial cost increase, AT&T will need to develop robust mitigation strategies. Several options are available, each with its own advantages and disadvantages:

- Renegotiating Contracts: AT&T could attempt to negotiate more favorable terms with Broadcom, potentially seeking discounts or more flexible licensing agreements.

- Seeking Alternative Solutions: AT&T might explore alternative virtualization and cloud platforms to reduce its dependence on VMware's technology. This might involve migrating to open-source solutions or adopting competing products from vendors like Cisco or Microsoft. This requires significant investment in time and resources.

- Internal Development: While a long-term solution, developing internal virtualization technology could reduce reliance on third-party solutions, but it's a costly and time-consuming process.

Impact on AT&T's Business and Customers

The potential cost increase poses significant challenges for AT&T. It could affect the company's profitability, forcing it to either absorb the higher costs or pass them on to its customers through increased prices.

- Impact on Profitability: Absorbing the cost could significantly reduce AT&T's profit margins. Passing it on could damage customer relationships and competitiveness.

- Service Disruptions: Integration issues and potential compatibility problems after the merger could lead to service disruptions for AT&T customers.

- Stock Price Impact: The market's reaction to the potential cost increases and AT&T's response strategy is likely to significantly influence AT&T's stock price.

The Broader Implications of the Deal

Industry-Wide Impact

The Broadcom-VMware merger sets a worrying precedent for the telecommunications and enterprise IT sectors. Other companies relying on VMware's technology may face similar cost pressures.

- Increased Prices: This merger has the potential to drive up prices for VMware products across the board, impacting businesses of all sizes.

- Increased Consolidation: The deal fuels concerns about further consolidation in the tech industry, potentially leading to less competition and higher prices.

Regulatory Scrutiny

The scale of this merger and its potential impact on competition will likely attract regulatory scrutiny.

- Antitrust Concerns: Antitrust regulators may investigate the deal to determine whether it violates any competition laws.

- Potential for Intervention: Depending on the findings, regulators could intervene to mitigate the potential negative impacts on consumers and the market.

Conclusion: Navigating the Post-Merger Landscape of Broadcom and VMware

The Broadcom-VMware merger presents significant challenges for AT&T, potentially leading to a dramatic 1,050% cost increase. This event highlights the growing consolidation in the tech industry and the potential for significant price increases for businesses reliant on key technologies. AT&T must strategically respond to navigate this difficult situation, weighing the options of renegotiation, alternative solutions, and navigating regulatory implications. The impact extends beyond AT&T, affecting the broader telecommunications and enterprise sectors. Staying informed about the ongoing developments in the Broadcom VMware acquisition is crucial for all businesses utilizing VMware's technology. Subscribe to our newsletter for further analysis and insights into this evolving situation.

Featured Posts

-

Analyzing The Evolution Of Armando Iannuccis Work A Critical Look

May 26, 2025

Analyzing The Evolution Of Armando Iannuccis Work A Critical Look

May 26, 2025 -

Monaco Grand Prix 2025 Where And When To Watch The Race

May 26, 2025

Monaco Grand Prix 2025 Where And When To Watch The Race

May 26, 2025 -

Selling Sunsets Stars Name Exposes Post Fire Price Gouging In La

May 26, 2025

Selling Sunsets Stars Name Exposes Post Fire Price Gouging In La

May 26, 2025 -

Klasemen Moto Gp Analisis Lengkap Usai Sprint Race Argentina 2025 Dan Kemenangan Marquez

May 26, 2025

Klasemen Moto Gp Analisis Lengkap Usai Sprint Race Argentina 2025 Dan Kemenangan Marquez

May 26, 2025 -

Open Ais Chat Gpt Faces Ftc Probe What It Means

May 26, 2025

Open Ais Chat Gpt Faces Ftc Probe What It Means

May 26, 2025

Latest Posts

-

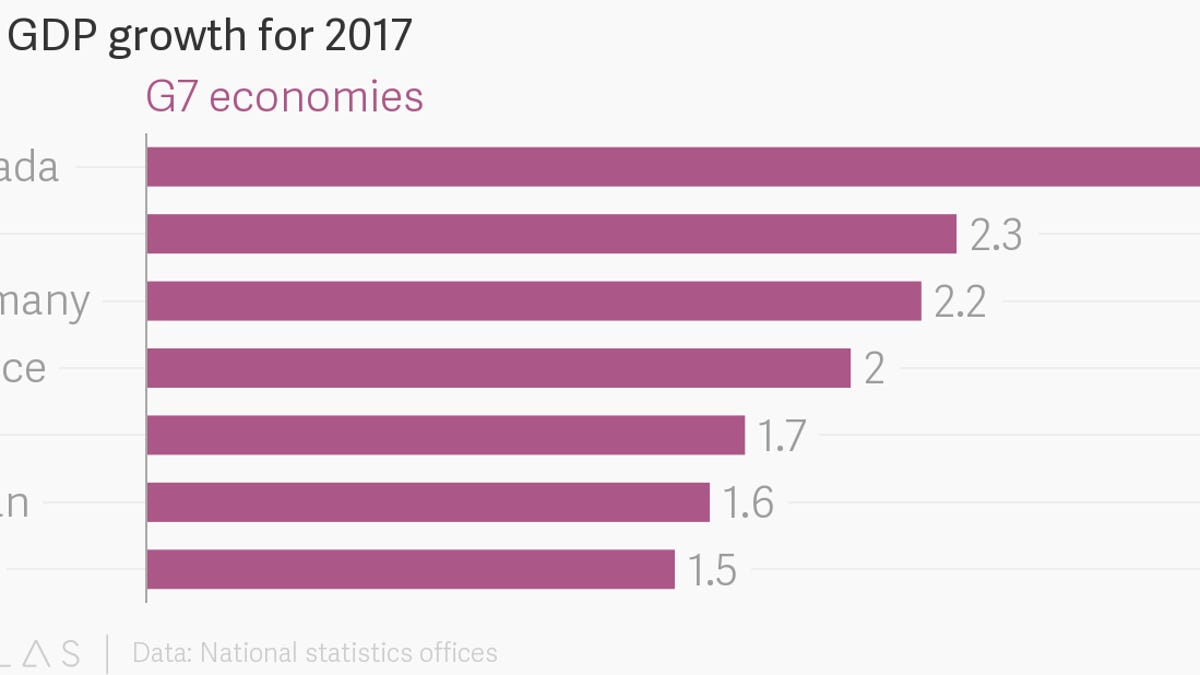

Building The Strongest G7 Economy The Governments Plan

May 29, 2025

Building The Strongest G7 Economy The Governments Plan

May 29, 2025 -

Uk Economic Growth The Royal Push For G7 Leadership

May 29, 2025

Uk Economic Growth The Royal Push For G7 Leadership

May 29, 2025 -

Broadcoms V Mware Acquisition At And T Exposes A Potential 1 050 Cost Increase

May 29, 2025

Broadcoms V Mware Acquisition At And T Exposes A Potential 1 050 Cost Increase

May 29, 2025 -

Strengthening The Uk Economy King Charles Iiis Call To Action

May 29, 2025

Strengthening The Uk Economy King Charles Iiis Call To Action

May 29, 2025 -

Canadas Economic Independence The Need To Limit U S Control

May 29, 2025

Canadas Economic Independence The Need To Limit U S Control

May 29, 2025