Buffett's Apple Bet: Navigating The Impact Of Trump-Era Tariffs

Table of Contents

The Impact of Tariffs on Apple's Production Costs and Pricing

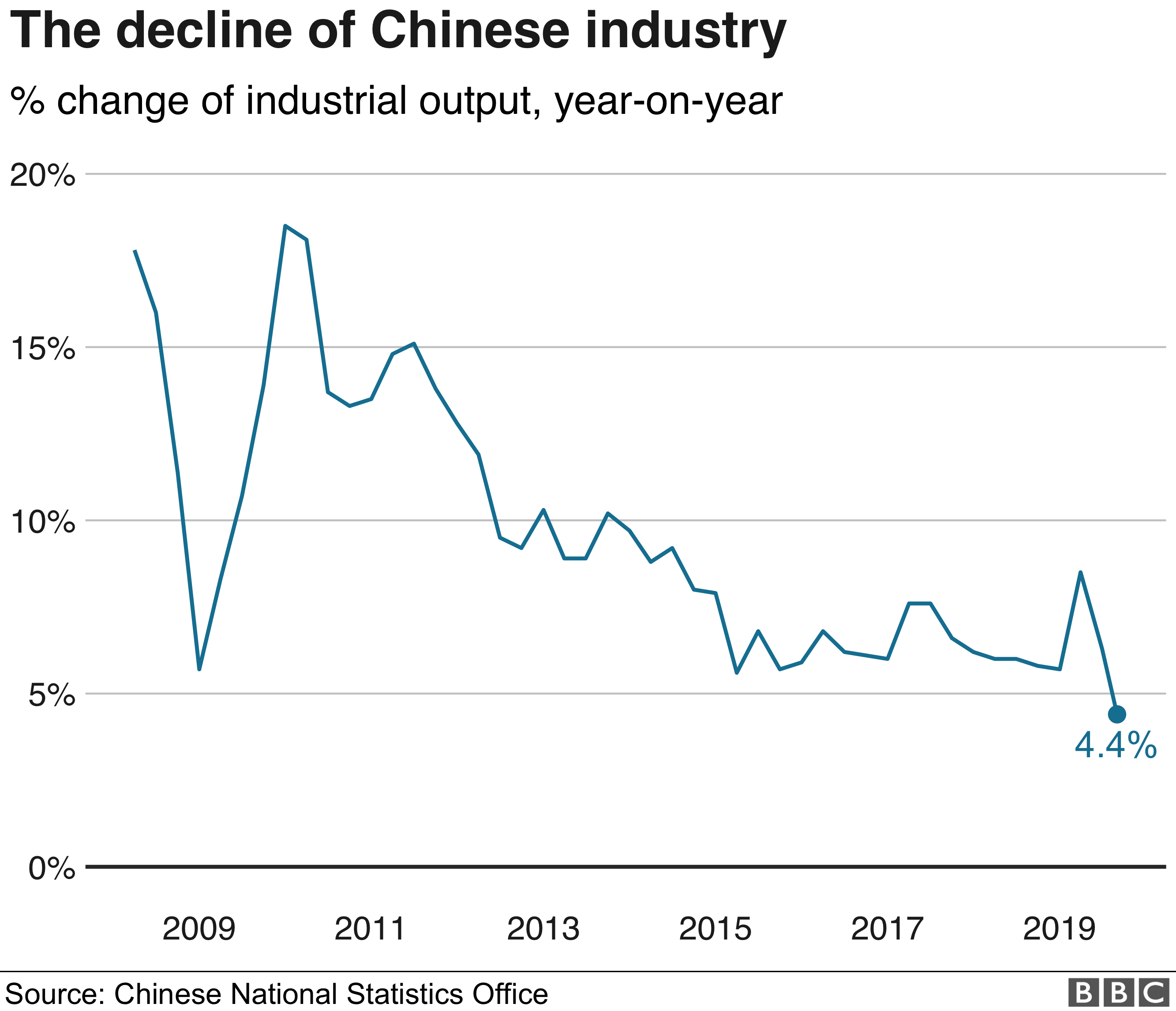

The Trump administration's imposition of tariffs on goods imported from China, a key manufacturing hub for Apple, presented a significant challenge. These tariffs directly increased the cost of Apple's imported components, impacting everything from iPhones to MacBooks.

- Increased component costs: Tariffs added a substantial percentage to the price of components sourced from China, eating into Apple's profit margins.

- Potential price increases for consumers: While Apple absorbed some of these increased costs, some were inevitably passed on to consumers in the form of higher prices. This could have dampened consumer demand and slowed sales growth.

- Apple's diversification strategies to reduce reliance on tariff-affected regions: In response, Apple actively pursued diversification strategies, including shifting some production to other countries like India and Vietnam. This was a complex and costly undertaking, requiring significant investment in new infrastructure and supply chain relationships.

- Analysis of Apple's financial reports during the tariff period: A thorough examination of Apple's financial statements during this period reveals the extent to which tariffs impacted its profitability and overall financial performance. While the company remained highly profitable, the impact of tariffs is undeniably reflected in its margins.

The effect of tariffs on Apple's supply chain highlighted the vulnerability of global businesses to sudden shifts in geopolitical landscapes. The increased cost of production forced Apple to innovate in its supply chain management, a key takeaway for any business operating in a globally integrated market.

Buffett's Investment Strategy and Risk Tolerance in the Face of Tariffs

Buffett's investment philosophy centers around long-term value investing in fundamentally strong companies. His bet on Apple aligns with this strategy, focusing on the company's brand strength and consistent profitability. Did the tariffs significantly alter his approach?

- Long-term vs. short-term perspectives on the tariffs' effects: Buffett’s long-term view likely minimized the immediate impact of the tariffs. He likely anticipated that Apple's resilience would outweigh the short-term effects of increased production costs.

- Assessing the resilience of Apple's business model against external shocks (like tariffs): The tariffs served as a stress test for Apple’s business model, demonstrating its capacity to adapt and mitigate external risks.

- Buffett's potential diversification within his portfolio to offset risks related to Apple's exposure to tariffs: While his Apple investment was substantial, it’s crucial to remember that Buffett's portfolio is extremely diversified. This diversification likely minimized the overall impact of the tariffs on his overall investment returns.

The tariffs did not appear to fundamentally alter Buffett's investment thesis on Apple. His long-term outlook and the company’s inherent strength likely minimized the risk associated with the trade dispute.

Geopolitical Implications and the Shifting Global Landscape

The Trump-era tariffs were part of a broader shift in global trade relations, impacting the overall investment climate.

- The impact of trade wars on global economic growth: The tariffs contributed to increased uncertainty and slowed global economic growth, impacting investor confidence worldwide.

- The effect on investor confidence and market volatility: The imposition of tariffs and the retaliatory measures from other countries created significant market volatility.

- The long-term implications of reshoring and diversification of supply chains: Businesses were forced to reconsider their reliance on single-source manufacturing, leading to a trend of reshoring (bringing production back to the home country) and diversifying their supply chains to reduce risk.

- The role of government policy in shaping international trade and investment: The Trump administration's protectionist policies demonstrated the significant role government policy plays in shaping global trade patterns and investment decisions.

These geopolitical factors underscore the importance of considering international relations and trade policies when making investment decisions.

Case Studies of Other Companies Affected by Tariffs

Many technology companies, including those in the semiconductor and consumer electronics sectors, faced similar challenges due to the tariffs. Comparing their responses reveals varied strategies, highlighting the need for adaptable and flexible supply chain management. Some companies chose to absorb the costs, while others prioritized price increases. These case studies emphasize the importance of proactive risk management in a dynamic global environment.

Conclusion: Learning from Buffett's Apple Bet in a Tariff-Infused World

Buffett's continued investment in Apple, despite the Trump-era tariffs, showcases a long-term perspective and an understanding of the company's fundamental strength. The tariffs served as a stress test for Apple, highlighting the need for diversified supply chains and proactive risk management. The experience underscores the importance of considering geopolitical factors and trade policies when making investment decisions. To better navigate the complexities of global trade and investment, learn more about Buffett's investment strategy and how to mitigate the risks associated with global trade policies. Consult with a financial advisor to analyze your own investments and identify vulnerabilities to similar trade disputes and economic uncertainty. Understanding the potential impact of future trade wars on your Buffett-inspired investment strategy is crucial for long-term success.

Featured Posts

-

Net Asset Value Nav Of Amundi Msci World Ex United States Ucits Etf Acc Explained

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Ex United States Ucits Etf Acc Explained

May 24, 2025 -

Apple Stock Performance Exceeding Q2 Expectations

May 24, 2025

Apple Stock Performance Exceeding Q2 Expectations

May 24, 2025 -

Paris Economic Slowdown Luxury Sector Decline Impacts City Finances March 7 2025

May 24, 2025

Paris Economic Slowdown Luxury Sector Decline Impacts City Finances March 7 2025

May 24, 2025 -

Manny Garcias Lego Workshop Veterans Memorial Elementary School Visit

May 24, 2025

Manny Garcias Lego Workshop Veterans Memorial Elementary School Visit

May 24, 2025 -

The Ultimate Escape To The Country Homes Activities And More

May 24, 2025

The Ultimate Escape To The Country Homes Activities And More

May 24, 2025

Latest Posts

-

Tochnye Goroskopy I Predskazaniya Na Nedelyu

May 24, 2025

Tochnye Goroskopy I Predskazaniya Na Nedelyu

May 24, 2025 -

Dylan Dreyers Physical Transformation Inspiring Nbc Executives

May 24, 2025

Dylan Dreyers Physical Transformation Inspiring Nbc Executives

May 24, 2025 -

Ezhednevnye Goroskopy I Predskazaniya

May 24, 2025

Ezhednevnye Goroskopy I Predskazaniya

May 24, 2025 -

Positive Horoscope Outlook 5 Zodiac Signs On April 14 2025

May 24, 2025

Positive Horoscope Outlook 5 Zodiac Signs On April 14 2025

May 24, 2025 -

Dylan Dreyers Post Baby Body Transformation A Noteworthy Achievement On Today

May 24, 2025

Dylan Dreyers Post Baby Body Transformation A Noteworthy Achievement On Today

May 24, 2025