CAAT Pension Plan: A Focus On Canadian Private Market Investments

Table of Contents

Understanding the CAAT Pension Plan's Investment Strategy

The CAAT Pension Plan, a defined benefit plan covering employees of the University of Toronto and affiliated organizations, is renowned for its sophisticated and proactive investment approach. Its mandate is to provide secure and sustainable retirement income for its members. A core element of this mandate is a substantial allocation to Canadian private market investments. This strategic decision is driven by several key factors:

- Long-term Investment Horizon: CAAT’s long-term outlook allows it to weather short-term market fluctuations and capitalize on the often-illiquid nature of private market investments. This patience is crucial for realizing the full potential of private equity, infrastructure, and real estate assets.

- Diversification: Private market investments offer diversification benefits, reducing reliance on publicly traded securities and lowering overall portfolio volatility. This strategy minimizes the impact of market downturns on the plan's long-term performance.

- Higher Return Potential: Historically, private market investments have the potential to deliver higher returns than publicly traded equities, particularly over the long term. This potential is a crucial component of CAAT's strategy to secure its members' financial futures.

- Alignment with Canadian Economic Growth: By investing in Canadian businesses and infrastructure, CAAT actively participates in and benefits from the growth of the Canadian economy. This directly contributes to the long-term success of the plan.

Risk Mitigation Strategies: CAAT employs rigorous risk management strategies, including thorough due diligence, diversification across various asset classes and geographies, and active portfolio management to ensure its investments align with its risk tolerance and long-term goals.

Types of Canadian Private Market Investments in the CAAT Portfolio

CAAT's portfolio is diversified across several key Canadian private market asset classes:

Private Equity

CAAT invests in a range of Canadian private equity firms, participating in venture capital, growth equity, and buyout transactions. This broad approach allows them to capitalize on opportunities across various stages of a company's life cycle and across different sectors.

- Examples of Successful Investments: While specific details may be confidential, CAAT's public disclosures often highlight successes in technology, healthcare, and renewable energy sectors.

- Sector Focus: CAAT demonstrates a diversified approach, investing in companies across various sectors that align with long-term growth trends.

- Geographic Diversification: Investments are spread across Canada to mitigate regional risks and capitalize on opportunities in different provinces.

Infrastructure

CAAT actively participates in Canadian infrastructure projects, including renewable energy, transportation, and utilities. These investments offer predictable cash flows and exposure to essential services with long-term growth prospects.

- Types of Infrastructure Projects: Investments include renewable energy projects (wind, solar), transportation infrastructure (roads, pipelines), and utility infrastructure (water, power).

- Risk Profile: While generally less volatile than other private market assets, infrastructure investments are subject to regulatory changes and operational risks.

- Long-term Return Expectations: These investments are designed to provide stable, long-term returns, contributing to the plan's overall stability.

Real Estate

CAAT holds a significant real estate portfolio in Canada, encompassing various property types and geographic locations. This sector offers diversification within the private market and the opportunity for value creation through property management and development.

- Strategies for Value Creation: CAAT employs active management strategies, including renovations, repositioning, and development to enhance property value.

- Risk Management in Real Estate: They use risk management tools such as hedging strategies and diversification across property types and locations to reduce exposure to market cycles.

- Impact of Market Cycles: CAAT acknowledges market fluctuations and adjusts its real estate strategy accordingly.

Other Alternative Investments

CAAT may also invest in other alternative asset classes, such as venture debt and private debt, further enhancing portfolio diversification and providing additional return streams. These investments often offer attractive risk-adjusted returns and complement its core holdings in private equity, infrastructure, and real estate.

Performance and Risk Management of CAAT's Canadian Private Market Investments

CAAT’s private market investments have generally delivered strong long-term performance, though results may vary depending on market conditions and specific investments. While historical performance is not a guarantee of future results, it indicates a well-managed and successful investment strategy.

- Key Performance Indicators: While specific figures are often confidential, CAAT regularly reports on its overall portfolio performance, providing insights into the success of its private market investments.

- Risk Assessment Methodologies: Rigorous due diligence, stress testing, and scenario planning are employed to assess and manage risks.

- Due Diligence Processes: CAAT employs extensive due diligence processes to thoroughly evaluate potential investments before committing capital.

The Future of CAAT's Canadian Private Market Investments

CAAT anticipates continued investment in Canadian private markets, focusing on opportunities aligned with long-term growth and sustainability goals.

- Emerging Trends: They are likely to focus on sectors such as renewable energy, technology, and healthcare, which are poised for significant growth.

- Potential Impact of Government Policies: Government regulations and policies, particularly those related to environmental, social, and governance (ESG) factors, will influence future investment decisions.

- Sustainability Considerations: ESG factors are increasingly important in CAAT's investment strategy, ensuring its portfolio contributes positively to social and environmental well-being.

Conclusion

The CAAT Pension Plan’s success demonstrates the significant potential of Canadian private market investments for pension funds. By employing a diversified strategy, rigorous risk management, and a long-term perspective, CAAT has created a robust investment portfolio that contributes to the security of its members' retirement. While inherent risks exist, the potential for higher returns and alignment with Canadian economic growth make this a compelling investment approach. Learn more about the CAAT Pension Plan and its innovative approach to Canadian private market investments to discover how your pension fund might benefit from a similar strategy. [Link to CAAT Pension Plan website] [Link to relevant industry reports]

Featured Posts

-

Nine Home Runs Yankees Obliterate Team Record In 2025 Seasons Second Game

Apr 23, 2025

Nine Home Runs Yankees Obliterate Team Record In 2025 Seasons Second Game

Apr 23, 2025 -

La Carte Blanche De Dominique Carlach Une Analyse Approfondie

Apr 23, 2025

La Carte Blanche De Dominique Carlach Une Analyse Approfondie

Apr 23, 2025 -

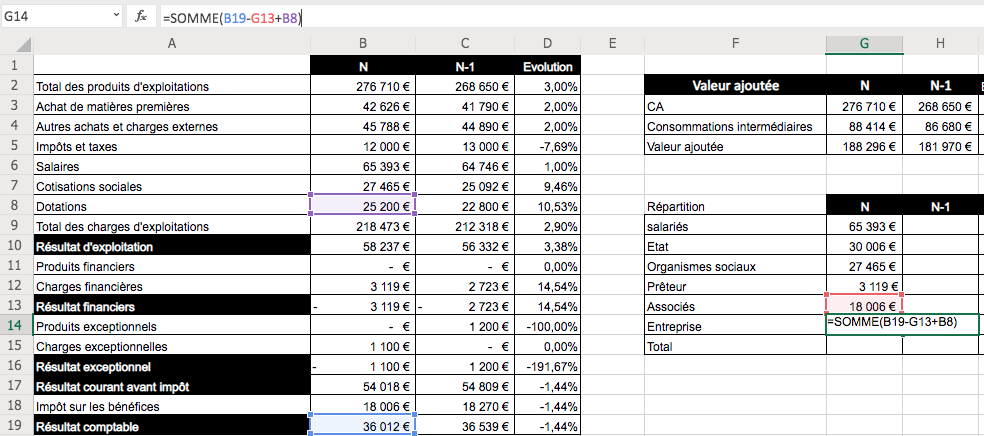

La Valeur Ajoutee D Infotel Un Investissement Reussi

Apr 23, 2025

La Valeur Ajoutee D Infotel Un Investissement Reussi

Apr 23, 2025 -

E Bay Faces Legal Action Over Banned Chemicals Listed Under Section 230

Apr 23, 2025

E Bay Faces Legal Action Over Banned Chemicals Listed Under Section 230

Apr 23, 2025 -

Trump Demands Powells Termination Amidst Economic Concerns

Apr 23, 2025

Trump Demands Powells Termination Amidst Economic Concerns

Apr 23, 2025

Latest Posts

-

Nhl Playoffs Golden Knights Secure Spot Despite Oilers 3 2 Win

May 10, 2025

Nhl Playoffs Golden Knights Secure Spot Despite Oilers 3 2 Win

May 10, 2025 -

6 3 Defeat In Vegas Red Wings Playoff Dream Fades

May 10, 2025

6 3 Defeat In Vegas Red Wings Playoff Dream Fades

May 10, 2025 -

Red Wings Fall To Golden Knights Playoff Chances Fade

May 10, 2025

Red Wings Fall To Golden Knights Playoff Chances Fade

May 10, 2025 -

Vegas Golden Knights Hertls Status Uncertain After Lightning Injury

May 10, 2025

Vegas Golden Knights Hertls Status Uncertain After Lightning Injury

May 10, 2025 -

Vegas Golden Nayts Obygryvaet Minnesotu V Pley Off Podrobnosti Overtayma

May 10, 2025

Vegas Golden Nayts Obygryvaet Minnesotu V Pley Off Podrobnosti Overtayma

May 10, 2025