California's Budget Crisis: The Impact Of Trump's Tariffs

Table of Contents

The Agricultural Sector: A Major Blow to California's Economy

California's agricultural sector, a significant contributor to the state's GDP, suffered immensely from retaliatory tariffs imposed by trading partners in response to Trump's policies. These tariffs on agricultural products created a trade war impact on agriculture, significantly impacting California's key exports.

-

Key agricultural exports like almonds, walnuts, wine, and dairy products faced reduced demand and lower prices in international markets. The resulting decline in export value directly translated to decreased farm income, impacting both large-scale agricultural businesses and family farms. For example, the price of California almonds, a major export, dropped significantly in certain international markets due to imposed tariffs, leading to substantial losses for almond growers.

-

This led to decreased farm income, impacting both large-scale agricultural businesses and family farms. Many farmers faced financial hardship, struggling to cover operating costs and maintain profitability. The resulting stress on the agricultural industry contributed to a significant number of farm bankruptcies and closures.

-

The resulting job losses in the agricultural sector further contributed to the state's budget crisis through reduced tax revenue and increased demand for social services. As farms downsized or closed, agricultural workers lost their jobs, leading to a decrease in income tax revenue for the state. Concurrently, the increased unemployment led to a higher demand for social safety net programs, placing further strain on the state budget.

-

Quantifiable data (needed to strengthen this section): While precise figures require further research, reports from the California Department of Food and Agriculture and the USDA could provide critical data on:

- Decline in export value of specific agricultural products (e.g., percentage decrease in almond exports to China).

- Number of farm bankruptcies or closures during the period of tariff imposition.

- Impact on employment in the agricultural sector (e.g., number of jobs lost).

Impact on California's Manufacturing Sector and Related Industries

Trump's tariffs on imported goods significantly impacted California's manufacturing sector. The increased cost of imported raw materials and components crucial for California's manufacturing processes had a domino effect.

-

Trump's tariffs increased the cost of imported raw materials and components crucial for California's manufacturing sector. This increased production costs making California manufacturers less competitive in the global marketplace. Businesses struggled to absorb these increased costs and maintain profitability.

-

This led to higher production costs, reduced competitiveness in global markets, and job losses. Many manufacturers were forced to either raise prices, losing market share, or absorb the increased costs, reducing profit margins. This ultimately led to layoffs and plant closures, particularly in industries heavily reliant on imported components.

-

The ripple effect impacted related industries such as transportation and logistics, further straining the state's economy. Reduced manufacturing activity meant less demand for transportation services, impacting trucking companies, warehousing, and other related businesses. This cascading effect further amplified the negative economic consequences of the tariffs.

-

Quantifiable data (needed to strengthen this section): Similar to the agricultural sector, detailed data is needed to fully illustrate the impact. Research should focus on:

- Specific examples of industries affected by increased input costs (e.g., the electronics industry's reliance on imported semiconductors).

- Quantifiable data on job losses in the manufacturing sector (e.g., number of manufacturing jobs lost in specific regions of California).

- Impact on related industries like transportation and logistics (e.g., percentage decrease in trucking activity related to manufacturing).

Reduced State Revenue and Increased Budget Deficit

The economic slowdown resulting from the tariffs directly impacted state revenue, exacerbating the existing California budget crisis.

-

The economic slowdown resulting from the tariffs directly impacted state revenue through reduced income tax collections, sales tax revenue, and corporate tax revenue. Businesses struggling with reduced profits or closures naturally paid less in taxes, creating a significant shortfall in state revenue.

-

Simultaneously, the increased demand for social safety nets due to job losses and business closures put further pressure on the state budget. Unemployment benefits, food assistance programs, and other social services saw increased demand, forcing the state to allocate more resources to these programs while facing declining tax revenue.

-

The state faced the challenge of balancing its budget while providing essential public services despite reduced revenue. This created difficult choices for policymakers, forcing cuts to vital public services or increasing the state's already substantial budget deficit.

-

Quantifiable data (needed to strengthen this section): To fully understand the fiscal impact, the following data is needed:

- Data on the decline in state revenue (specific figures for income tax, sales tax, and corporate tax collections).

- Growth in social services spending due to increased demand (e.g., percentage increase in unemployment benefit payments).

- Size of the budget deficit attributed to the economic consequences of the tariffs.

Conclusion

The Trump administration's tariffs had a demonstrably negative impact on California's economy and significantly exacerbated its existing budget crisis. The agricultural and manufacturing sectors suffered substantial losses, resulting in reduced state revenue, increased social service demands, and a widening budget deficit. Understanding the far-reaching consequences of these trade policies is crucial for policymakers to develop effective strategies to mitigate future economic shocks and build a more resilient state budget. Further research into the long-term effects of these tariffs on California's economy is needed, along with a comprehensive analysis of alternative trade policies to promote sustainable economic growth and protect the state's vital industries. To learn more about the ongoing impact of these trade policies on California's budget, continue your research on the effects of the California budget crisis and the consequences of Trump's tariffs.

Featured Posts

-

Everest In A Week Anesthetic Gas Ascent Raises Safety Concerns

May 16, 2025

Everest In A Week Anesthetic Gas Ascent Raises Safety Concerns

May 16, 2025 -

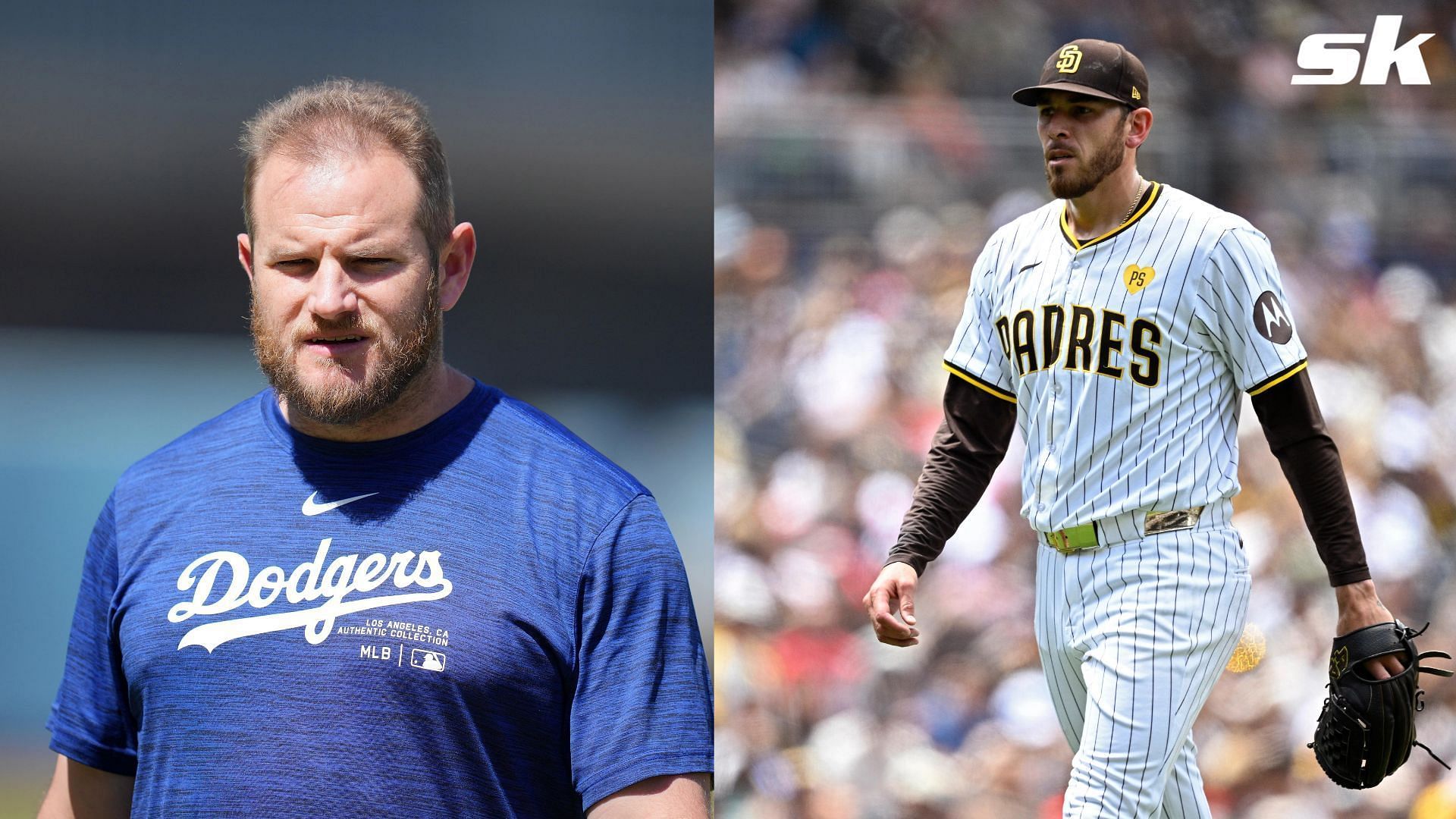

San Diego Padres Vs Los Angeles Dodgers A Battle Of Baseball Strategies

May 16, 2025

San Diego Padres Vs Los Angeles Dodgers A Battle Of Baseball Strategies

May 16, 2025 -

Record Egg Prices Fall Dozens Now Costing 5 In The Us

May 16, 2025

Record Egg Prices Fall Dozens Now Costing 5 In The Us

May 16, 2025 -

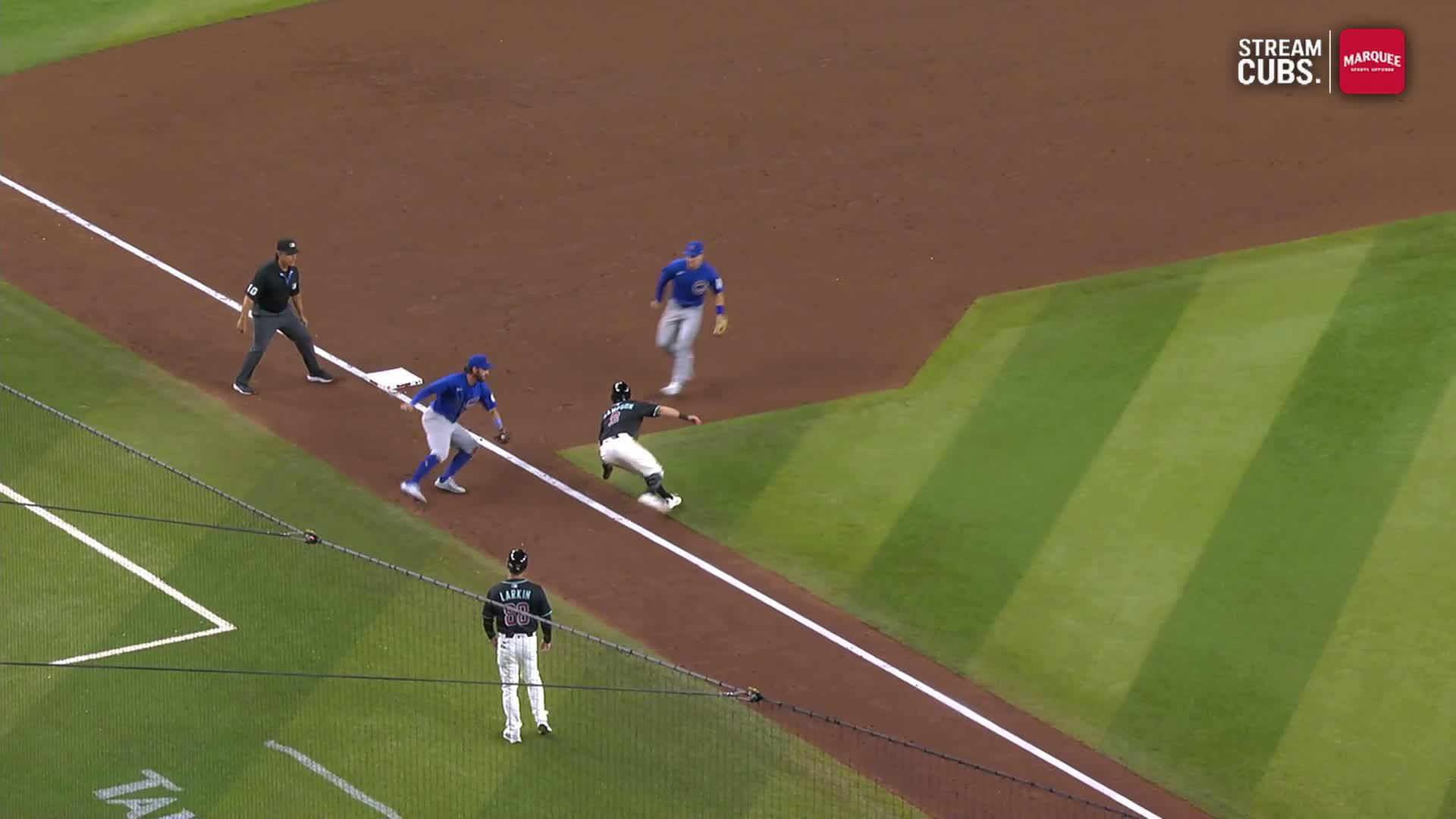

March 4th Spring Training Baseball Cubs Vs Padres In Mesa

May 16, 2025

March 4th Spring Training Baseball Cubs Vs Padres In Mesa

May 16, 2025 -

Vercel Challenges La Ligas Internet Censorship Measures For Copyright Infringement

May 16, 2025

Vercel Challenges La Ligas Internet Censorship Measures For Copyright Infringement

May 16, 2025

Latest Posts

-

How Ha Seong Kim And Blake Snells Friendship Benefits Korean Mlb Players

May 16, 2025

How Ha Seong Kim And Blake Snells Friendship Benefits Korean Mlb Players

May 16, 2025 -

Torpedo Bat Controversy An Mlb All Stars Perspective

May 16, 2025

Torpedo Bat Controversy An Mlb All Stars Perspective

May 16, 2025 -

Max Muncy Ends Hitting Drought With 2025 Home Run

May 16, 2025

Max Muncy Ends Hitting Drought With 2025 Home Run

May 16, 2025 -

Why This Mlb All Star Hated The Torpedo Bat

May 16, 2025

Why This Mlb All Star Hated The Torpedo Bat

May 16, 2025 -

Dodgers Muncy Finally Connects 2025 Home Run Ends Drought

May 16, 2025

Dodgers Muncy Finally Connects 2025 Home Run Ends Drought

May 16, 2025