Call For Regulatory Reform: Indian Insurers And Bond Forward Markets

Table of Contents

Current Regulatory Landscape Stifling Growth

The current regulatory environment significantly restricts the participation of Indian insurers in bond forward markets, limiting their ability to effectively manage risk and capitalize on investment opportunities.

Limitations on Investment in Bond Forwards

Indian insurers face several limitations when investing in bond forwards. These restrictions significantly impact their investment strategies and risk management capabilities.

- Strict Investment Percentage Limits: Current regulations often impose low caps on the percentage of their portfolio insurers can allocate to bond forwards.

- Restricted Bond Types: Only specific types of government securities or highly-rated corporate bonds might be permissible for hedging through forwards, limiting diversification.

- Counterparty Restrictions: Regulations may limit the permissible counterparties for these transactions, reducing liquidity and potentially increasing counterparty risk.

- IRDAI Guidelines: The Insurance Regulatory and Development Authority of India (IRDAI) guidelines, while aiming to protect policyholders, inadvertently restrict insurers' access to sophisticated risk management tools offered by the bond forward market. These guidelines often lag behind best international practices, hindering innovation.

Lack of Clear Regulatory Framework

Ambiguities and gaps in the existing regulatory framework further complicate matters for Indian insurers.

- Risk Management Framework: There’s a lack of a clear, comprehensive risk management framework specifically tailored for bond forward transactions undertaken by insurance companies.

- Reporting Requirements: Inconsistent and complex reporting requirements make it challenging to monitor and analyze the risk exposure associated with these instruments.

- Dispute Resolution Mechanisms: The absence of clearly defined dispute resolution mechanisms adds uncertainty and increases transaction costs.

- Standardized Accounting Practices: A lack of standardized accounting and reporting practices for bond forward transactions makes it difficult to compare and assess the risk profiles of different insurers.

Impact on Risk Management

Restrictive regulations severely hamper insurers’ ability to effectively hedge their interest rate risk.

- Increased Interest Rate Risk Exposure: Limited access to bond forwards increases insurers' vulnerability to fluctuations in interest rates, potentially impacting their profitability and solvency.

- Liability Management Challenges: Inability to effectively manage liabilities through hedging strategies can lead to mismatches between assets and liabilities, increasing financial risk.

- Higher Capital Requirements: To offset the increased risk, insurers may need to maintain higher capital reserves, reducing their profitability and potentially limiting their ability to expand. Improved access to bond forward markets would significantly enhance insurers’ ability to manage interest rate risk, potentially reducing capital requirements and increasing financial stability.

Benefits of Regulatory Reform

Relaxing the regulations governing Indian insurers' participation in bond forward markets would bring numerous benefits.

Enhanced Risk Management Capabilities

Relaxed regulations would allow for:

- Sophisticated Hedging Strategies: Insurers could implement more sophisticated hedging strategies to effectively manage their interest rate and other financial risks.

- Reduced Interest Rate Risk: Better risk management tools will reduce the volatility in their investment portfolios stemming from interest rate changes.

- Efficient Liability Management: Improved asset-liability management techniques will enhance the insurers’ ability to meet their long-term obligations.

- Lower Capital Requirements: More efficient risk management could potentially lead to reduced capital requirements, freeing up capital for investment and growth.

Increased Investment Opportunities

Access to bond forward markets unlocks significant investment potential for Indian insurers:

- Diversification: Bond forwards offer greater diversification opportunities, reducing overall portfolio risk.

- Enhanced Profitability: Access to a wider range of investment strategies could lead to enhanced profitability and improved returns for insurers.

- Asset-Liability Matching: Improved asset-liability matching will strengthen the financial health and stability of insurers.

Boosting Financial Stability

A more efficient and robust insurance sector strengthens the overall financial stability of India:

- Resilience to Economic Shocks: A better-managed insurance sector is more resilient to economic downturns, reducing systemic risk.

- Increased Investor Confidence: A financially sound insurance sector attracts greater investor confidence, boosting capital inflows.

- Economic Growth: A thriving insurance sector fuels economic growth by providing crucial financial services and facilitating investment.

Recommendations for Regulatory Reform

Significant reforms are necessary to unlock the full potential of the bond forward market for Indian insurers.

Modernizing Existing Regulations

Specific changes are required, including:

- Increased Investment Limits: Raise the permissible investment limits for bond forwards, allowing insurers to optimize their portfolios for better risk management.

- Clarify Permissible Instruments: Expand the range of permissible bonds and instruments in bond forward transactions, allowing for greater diversification.

- Streamlined Reporting Requirements: Simplify and standardize reporting requirements to reduce administrative burdens and improve transparency.

- Clear Dispute Resolution Mechanisms: Establish clear and efficient mechanisms for resolving disputes arising from bond forward transactions.

- Adoption of International Best Practices: The IRDAI should adopt international best practices for regulating bond forward markets, ensuring alignment with global standards.

Promoting Transparency and Disclosure

Increased transparency is vital for investor confidence and market integrity:

- Mandatory Disclosure of Positions: Introduce mandatory disclosure requirements for insurers' bond forward positions to enhance market transparency.

- Improved Data Reporting: Implement a robust data reporting system to facilitate efficient monitoring and risk assessment by regulators.

- Stricter Enforcement: Strengthen the enforcement of regulations to ensure compliance and deter manipulative practices.

Strengthening Supervisory Oversight

Strengthening regulatory oversight is critical to maintaining market integrity:

- Increased Transaction Monitoring: Enhance the monitoring of bond forward transactions by the IRDAI and other regulatory bodies.

- Advanced Risk Assessment Methodologies: Develop and implement advanced risk assessment methodologies to identify and mitigate potential systemic risks.

- International Regulatory Collaboration: Foster greater collaboration with international regulatory bodies to share best practices and address cross-border issues.

Conclusion

This article has highlighted the critical need for regulatory reform in Indian Insurers Bond Forward Markets. The current restrictive environment limits the potential of the insurance sector, hindering efficient risk management and investment opportunities. By implementing the recommended reforms, India can unlock significant economic benefits, improve financial stability, and ensure a more robust and competitive insurance industry. We urge policymakers to address these crucial issues and foster a more conducive regulatory framework for Indian insurers to fully leverage the potential of bond forward markets. The future of the Indian insurance sector depends on enacting meaningful changes regarding Indian Insurers Bond Forward Markets Regulation.

Featured Posts

-

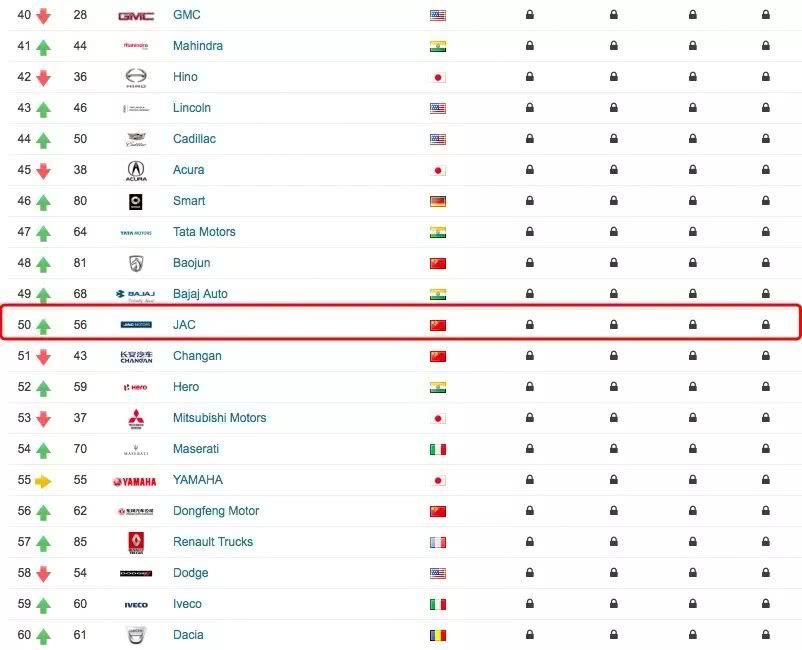

The China Factor Assessing Risks And Opportunities For Global Auto Brands

May 10, 2025

The China Factor Assessing Risks And Opportunities For Global Auto Brands

May 10, 2025 -

Jennifer Anistons Gate Crash Stalker Faces Felony Charges For Vandalism

May 10, 2025

Jennifer Anistons Gate Crash Stalker Faces Felony Charges For Vandalism

May 10, 2025 -

New Music Snippet Young Thugs Profound Commitment To Mariah The Scientist

May 10, 2025

New Music Snippet Young Thugs Profound Commitment To Mariah The Scientist

May 10, 2025 -

Trumps Transgender Military Ban An Opinion And Analysis Of The Controversy

May 10, 2025

Trumps Transgender Military Ban An Opinion And Analysis Of The Controversy

May 10, 2025 -

The 10 Best Film Noir Movies From Beginning To End

May 10, 2025

The 10 Best Film Noir Movies From Beginning To End

May 10, 2025