Can You Afford A Home With Student Loans? A Practical Guide

Table of Contents

Assessing Your Financial Situation

Before diving into house hunting, a thorough assessment of your financial standing is crucial. This involves understanding your debt-to-income ratio (DTI), creating a realistic budget, and analyzing the impact of your student loan interest rates.

Calculating Your Debt-to-Income Ratio (DTI)

Your Debt-to-Income ratio is a critical factor lenders consider when approving mortgages. It represents the percentage of your gross monthly income dedicated to debt payments. Student loan payments significantly impact your DTI.

- Methods for calculating DTI: Add up all your monthly debt payments (student loans, credit cards, car loans, etc.) and divide by your gross monthly income.

- Understanding acceptable DTI ratios: Lenders generally prefer a DTI below 43%, with some aiming for below 36%. A higher DTI might make it harder to secure a mortgage or result in less favorable terms.

- Strategies to lower DTI:

- Aggressively pay down high-interest debt like credit cards.

- Increase your income through a side hustle or a promotion.

- Explore student loan refinancing to potentially lower your monthly payments.

Evaluating Your Monthly Budget

Creating a detailed budget is essential for determining your home affordability. Include all expenses, including:

-

Student loan payments: Factor in both principal and interest.

-

Potential mortgage payments: Research average payments for homes in your desired area.

-

Property taxes: These can vary significantly by location.

-

Homeowners insurance: This is a non-negotiable expense.

-

Utilities: Electricity, gas, water, and internet.

-

Maintenance and repairs: Budget for unexpected home repairs.

-

Sample budgeting templates: Numerous free templates are available online to help you structure your budget.

-

Tools for tracking expenses: Apps like Mint or YNAB can help monitor your spending.

-

Importance of creating a realistic budget: Overestimating your income or underestimating expenses can lead to financial strain.

The Impact of Student Loan Interest Rates

Your student loan interest rates directly affect your monthly payments and overall affordability. Higher rates mean higher monthly payments, leaving less money for other expenses, including your mortgage.

- Understanding amortization schedules: Amortization schedules show how your loan payments are applied to principal and interest over time.

- Exploring refinancing options: Refinancing your student loans could lower your interest rate, potentially freeing up funds for a down payment or reducing your DTI.

- Considering the long-term impact of interest: High interest can significantly increase your overall loan cost over the life of the loan.

Exploring Home Buying Options

Once you've assessed your finances, it's time to explore home buying options. This includes saving for a down payment, choosing the right mortgage, and understanding the importance of your credit score.

Saving for a Down Payment

A significant down payment can reduce your monthly mortgage payments and improve your chances of mortgage approval. Strategies for saving include:

- High-yield savings accounts: Maximize your savings with accounts offering competitive interest rates.

- Investing strategies: Consider low-risk investments to grow your savings.

- Down payment assistance programs: Many programs exist to assist first-time homebuyers with down payments. Research local and national options.

- Exploring alternative financing options: FHA loans, for example, often require lower down payments than conventional loans.

Choosing the Right Mortgage

Different mortgage types offer varying terms and interest rates. Understanding your options is vital:

- Conventional loans: These are offered by private lenders and typically require a higher credit score and larger down payment.

- FHA loans: Backed by the Federal Housing Administration, these are designed for borrowers with lower credit scores and smaller down payments.

- VA loans: Offered to eligible veterans and military members, these often have lower interest rates and no down payment requirements.

- USDA loans: These are available to borrowers in rural areas and may have lower down payment requirements.

- Comparing interest rates and terms: Shop around and compare offers from multiple lenders to secure the best rate.

- Understanding closing costs: These are one-time fees associated with the purchase of a home.

Considering Your Credit Score

Your credit score significantly influences your ability to secure a mortgage and obtain a favorable interest rate. Student loan payments impact your credit score:

- Factors affecting credit score: On-time payments, credit utilization, length of credit history, and new credit applications.

- Strategies for improving credit score: Pay bills on time, keep credit utilization low, and avoid opening multiple new accounts.

- Importance of timely student loan payments: Late student loan payments negatively impact your credit score.

- Checking credit reports regularly: Monitor your credit reports for errors and ensure accuracy.

Strategies for Success

Even with careful planning, buying a home with student loans requires strategic actions.

Negotiating with Lenders

When applying for a mortgage, be prepared to present your financial situation honestly and effectively:

- Preparing a strong financial application: Gather all necessary documentation, including pay stubs, tax returns, and student loan statements.

- Highlighting positive financial aspects: Emphasize your consistent income, responsible debt management, and savings.

- Being transparent about student loan debt: Don't hide your student loan debt; explain your repayment plan.

Prioritizing Debt Repayment

Managing both student loan and mortgage payments requires a strategic debt repayment plan:

- Debt snowball method: Pay off the smallest debt first for motivation, then roll that payment into the next smallest.

- Debt avalanche method: Pay off the highest-interest debt first to save money in the long run.

- Exploring income-driven repayment plans: Consider income-driven repayment plans for your student loans if you’re struggling.

- Considering loan consolidation: Consolidating your student loans might simplify payments and potentially lower your interest rate.

Seeking Professional Advice

Don't hesitate to seek professional guidance:

- Identifying a reputable financial advisor: A financial advisor can help you create a comprehensive financial plan.

- Benefits of using a mortgage broker: A broker can shop around for the best mortgage rates and terms.

- Understanding the importance of personalized financial guidance: Professional advice tailored to your specific situation can make a significant difference.

Conclusion

Buying a home with student loans is achievable with careful planning and a proactive approach. By understanding your financial situation, exploring your options, and employing effective strategies, you can successfully navigate the home-buying process. Remember to meticulously assess your debt-to-income ratio, create a comprehensive budget, and explore various mortgage options tailored to your circumstances. Don't let student loans derail your dream of homeownership—take control of your finances and start planning your path to owning a home! Begin your journey today by researching home affordability and different mortgage programs related to your unique situation with student loans.

Featured Posts

-

Tom Thibodeau On Officiating Knicks Game 2 Post Game Reaction

May 17, 2025

Tom Thibodeau On Officiating Knicks Game 2 Post Game Reaction

May 17, 2025 -

Mariners Vs Reds Prediction Picks And Odds For Todays Mlb Game

May 17, 2025

Mariners Vs Reds Prediction Picks And Odds For Todays Mlb Game

May 17, 2025 -

Yankees Vs Mariners Mlb Game Prediction Picks And Betting Odds

May 17, 2025

Yankees Vs Mariners Mlb Game Prediction Picks And Betting Odds

May 17, 2025 -

Staff At Singapore Airlines To Receive Over 7 Months Pay In Bonuses

May 17, 2025

Staff At Singapore Airlines To Receive Over 7 Months Pay In Bonuses

May 17, 2025 -

Ichiros Influence How The Seattle Mariners Legend Still Shapes Baseball

May 17, 2025

Ichiros Influence How The Seattle Mariners Legend Still Shapes Baseball

May 17, 2025

Latest Posts

-

Best Bitcoin Casinos 2025 Find The Top Crypto Casinos With Fast Payouts

May 17, 2025

Best Bitcoin Casinos 2025 Find The Top Crypto Casinos With Fast Payouts

May 17, 2025 -

Top Online Bitcoin Casinos 2025 Easy Withdrawals And Exclusive Bonus Offers

May 17, 2025

Top Online Bitcoin Casinos 2025 Easy Withdrawals And Exclusive Bonus Offers

May 17, 2025 -

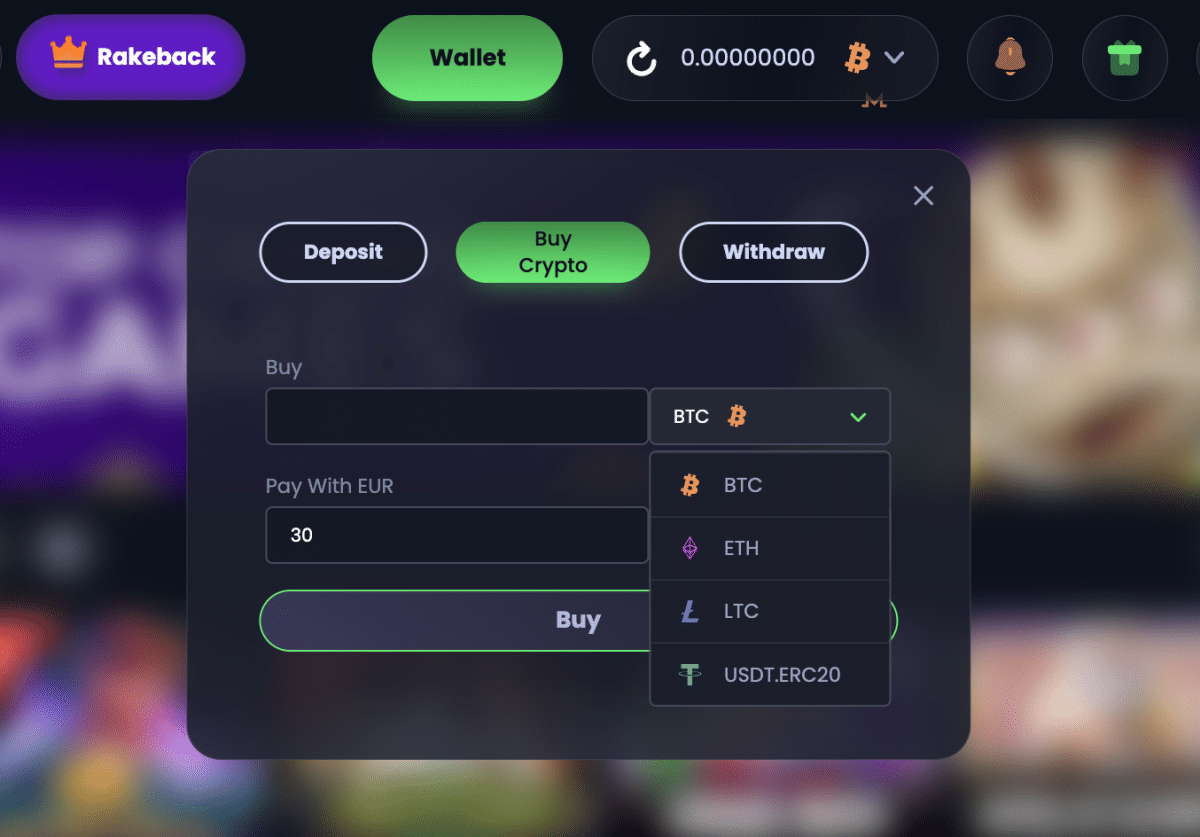

Best Bitcoin Casino For Instant Withdrawals Jack Bit

May 17, 2025

Best Bitcoin Casino For Instant Withdrawals Jack Bit

May 17, 2025 -

Jack Bit Casino Review Top Rated Crypto Casino For Fast Payouts

May 17, 2025

Jack Bit Casino Review Top Rated Crypto Casino For Fast Payouts

May 17, 2025 -

Instant Withdrawals Why Jack Bit Is The Best Bitcoin Casino

May 17, 2025

Instant Withdrawals Why Jack Bit Is The Best Bitcoin Casino

May 17, 2025