Canada Significantly Reduces Tariffs On US Imports: A Detailed Analysis

Table of Contents

Details of the Tariff Reduction

Specific Tariff Reductions by Sector

The tariff reduction represents a substantial shift in import duties. While the exact percentages vary by product, several key sectors have seen significant decreases. The following table illustrates the reduction across key sectors:

| Sector | Average Tariff Reduction (%) |

|---|---|

| Agriculture | 15-25 |

| Dairy | 10-18 |

| Lumber | 8-12 |

| Automotive | 5-10 |

Note: These are average reductions; specific tariff rates vary considerably based on the specific product.

Timeline of Implementation

The tariff reduction is being implemented in phases. Phase 1, encompassing the majority of the reductions, commenced on [Insert Start Date]. Subsequent phases will be rolled out on [Insert Subsequent Dates], with full implementation expected by [Insert Completion Date].

- Specific products experiencing tariff reductions: Dairy products (e.g., cheese, milk powder), various agricultural goods (e.g., fruits, vegetables, grains), lumber and wood products, automotive parts.

- Exceptions and exclusions: Certain products, particularly those with sensitive domestic industries, may be subject to exemptions or slower phased-in reductions. Details of these exceptions are available on the [Link to Government Website].

- Sources: Data for these tariff reductions is sourced from the Government of Canada's website [Link to Government Website], and the Office of the United States Trade Representative (USTR) [Link to USTR Website].

Economic Impacts of the Tariff Reduction

Benefits for Canadian Consumers

Canadian consumers are the immediate beneficiaries. Lower import duties translate directly into lower prices for a wide range of goods, increasing consumer purchasing power and offering greater product choice. This is particularly significant for food and automotive products.

Impact on Canadian Businesses

Canadian businesses face a dual impact. While access to cheaper imported inputs (raw materials and components) can boost productivity and lower production costs, increased competition from US imports could also challenge some domestic industries. This necessitates adaptation and innovation for Canadian businesses to remain competitive.

Benefits for US Businesses

For US businesses, the reduction signifies expanded market access within Canada, leading to increased sales and economic growth. This is particularly beneficial for agricultural exporters and automotive part manufacturers. The increased demand for US goods is expected to boost production and employment in these sectors.

- Economic Projections: Independent economic analyses suggest a potential [Insert Percentage]% increase in bilateral trade between Canada and the US following the full implementation of these tariff reductions. [Link to Economic Study]

- Expert Opinions: Experts from [Name of Economic Institution] predict a positive impact on employment, particularly in [Specific Sectors] in both Canada and the US. [Link to Expert Opinion]

- Impact on Employment: The reduced tariffs are expected to create [Number] jobs in the US and [Number] jobs in Canada. (Source: [Insert Source])

Political Context and Implications

The Role of the USMCA

The tariff reductions are largely a direct consequence of the United States-Mexico-Canada Agreement (USMCA), which modernized the North American Free Trade Agreement (NAFTA). The USMCA framework established a pathway for further tariff reductions and streamlined trade processes between the three North American nations.

Government Statements and Reactions

Both Canadian Prime Minister [Name] and US President [Name] have publicly lauded the tariff reductions, emphasizing their importance for fostering economic growth and strengthening bilateral trade ties. [Link to Canadian Government Press Release], [Link to US Government Press Release].

Future Trade Relations

This move signals a commitment to strengthened trade relations between Canada and the US. It may also pave the way for future negotiations on further tariff reductions or trade liberalization measures in other areas.

- Government Documents: Further details and analysis on the tariff reduction can be found in official government documents available at [Link to Government Website].

- Political Debates: While largely welcomed, some sectors within Canada voiced concerns about increased competition. This generated debate on the necessity of supporting domestic industries.

Conclusion

Canada's significant reduction in tariffs on US imports represents a landmark achievement in bilateral trade. This initiative, largely driven by the USMCA, promises substantial economic benefits for both countries, boosting consumer choice, lowering prices, and fostering increased trade. The positive impacts on various sectors, particularly agriculture and automotive, are undeniable. By analyzing the details of the reduction, the economic projections, and the political implications, we can fully appreciate the transformative potential of this trade policy shift. Stay informed about the ongoing impacts of Canada significantly reducing tariffs on US imports by subscribing to our newsletter.

Featured Posts

-

Family First Angel Reeses Message To Mom After Brothers Ncaa Win

May 17, 2025

Family First Angel Reeses Message To Mom After Brothers Ncaa Win

May 17, 2025 -

New York Knicks Thibodeaus Take On Game 2 Referee Performance

May 17, 2025

New York Knicks Thibodeaus Take On Game 2 Referee Performance

May 17, 2025 -

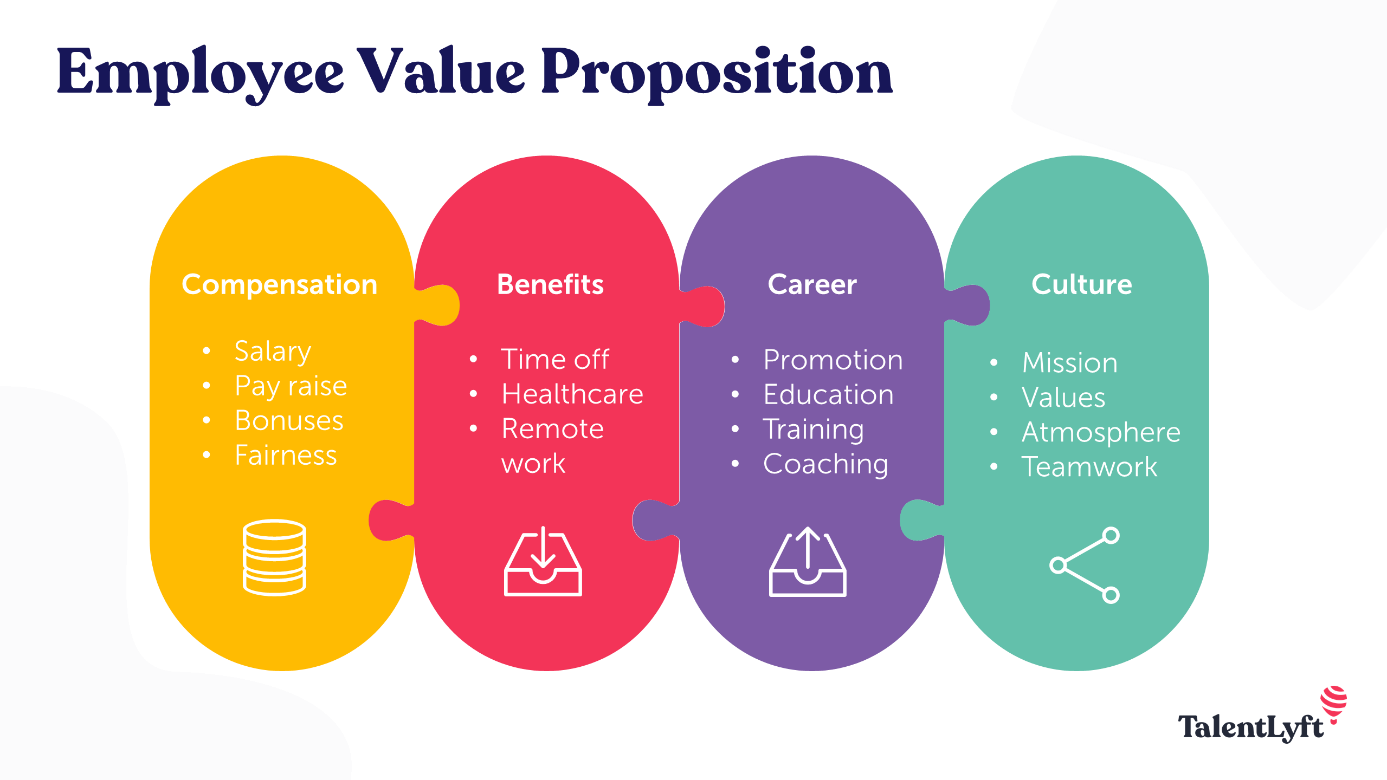

Understanding The Value Proposition Of Middle Managers Benefits For Companies And Employees

May 17, 2025

Understanding The Value Proposition Of Middle Managers Benefits For Companies And Employees

May 17, 2025 -

Angel Reeses Sharp Response To Caitlin Clark Question

May 17, 2025

Angel Reeses Sharp Response To Caitlin Clark Question

May 17, 2025 -

The Closure Of Anchor Brewing Company What It Means For Craft Beer

May 17, 2025

The Closure Of Anchor Brewing Company What It Means For Craft Beer

May 17, 2025

Latest Posts

-

Msum Awards Honorary Degree To North Dakotas Wealthiest Individual

May 17, 2025

Msum Awards Honorary Degree To North Dakotas Wealthiest Individual

May 17, 2025 -

North Dakotas Richest Receives Msum Honorary Degree

May 17, 2025

North Dakotas Richest Receives Msum Honorary Degree

May 17, 2025 -

Univision Noticias Gobierno Intensifica Recaudacion De Prestamos Estudiantiles

May 17, 2025

Univision Noticias Gobierno Intensifica Recaudacion De Prestamos Estudiantiles

May 17, 2025 -

University Of Utahs West Valley City Medical Campus A Comprehensive Overview

May 17, 2025

University Of Utahs West Valley City Medical Campus A Comprehensive Overview

May 17, 2025 -

Deudas Estudiantiles Acciones Del Departamento De Educacion Y Consecuencias Para Morosos

May 17, 2025

Deudas Estudiantiles Acciones Del Departamento De Educacion Y Consecuencias Para Morosos

May 17, 2025