Canada's Housing Market: The Impact Of Sub-3% Mortgage Rates

Table of Contents

The Allure of Sub-3% Mortgage Rates: Increased Purchasing Power and Demand

Historically low interest rates, including the availability of sub-3% mortgage rates, significantly boosted the borrowing capacity of Canadian homebuyers. This increased affordability, relative to periods of higher mortgage rates Canada, fueled a surge in demand. The dream of homeownership suddenly seemed within reach for many, leading to a highly competitive market.

- Increased affordability for first-time homebuyers: Sub-3% mortgage rates made monthly payments significantly lower, allowing more first-time buyers to enter the market.

- Greater competition among buyers, driving up prices: Increased demand, coupled with relatively limited housing supply in many areas, created a seller's market, pushing home prices upward.

- Impact on different housing segments: The impact varied across housing segments. Condos saw increased demand, while detached homes, particularly in desirable urban areas, experienced even more intense price appreciation.

- Regional variations in market response to low rates: While the impact of sub-3% mortgage rates was felt nationwide, the intensity of the response varied regionally, with some markets experiencing more dramatic price increases than others. Major cities like Toronto and Vancouver saw particularly significant jumps in home prices.

Impact on Home Prices: A Booming Market and Potential Risks

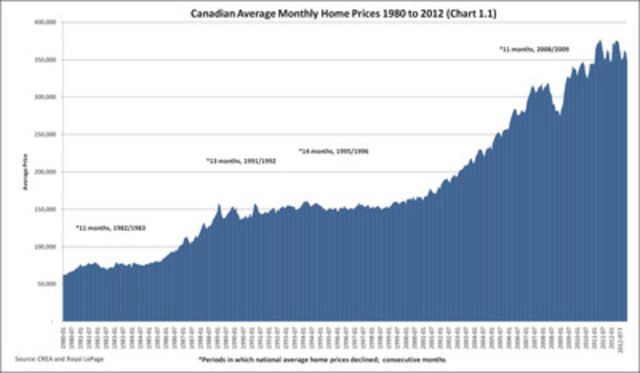

The correlation between sub-3% mortgage rates and rising home prices across Canada is undeniable. The increased purchasing power afforded by these low rates, combined with limited housing supply, led to a booming market, particularly between 2020 and 2022. However, this rapid appreciation also introduced significant risks.

- Statistical data on home price appreciation in major Canadian cities: Data from the Canadian Real Estate Association (CREA) shows substantial year-over-year increases in home prices in major cities during the period of sub-3% mortgage rates.

- Comparison of home prices before and after the sub-3% rate period: A direct comparison reveals a sharp increase in home prices following the period of exceptionally low rates.

- Analysis of the impact on different property types: The impact varied; detached homes generally saw more significant price increases than condos or townhouses.

- Discussion of potential market overheating: The rapid increase in home prices fueled concerns about a potential housing bubble and the risk of a significant market correction.

The Role of Government Policies and Regulations

Government policies played a crucial role in shaping Canada's housing market during the era of sub-3% mortgage rates. Stress tests, designed to ensure borrowers' ability to withstand higher interest rates, and mortgage insurance schemes aimed to mitigate some risks.

- Summary of key government interventions: These included stress tests, mortgage insurance regulations, and various initiatives aimed at stimulating housing construction.

- Evaluation of the success of these policies in influencing market behavior: While these policies offered a degree of protection, they didn't entirely prevent the rapid price increases.

- Potential for future policy changes in response to market conditions: The government may adjust policies in response to market fluctuations, potentially influencing mortgage rates Canada and housing affordability in the future.

The Future of Canada's Housing Market: Predictions and Long-Term Outlook

Predicting the future trajectory of Canada's housing market is complex. While sub-3% mortgage rates are largely a thing of the past, the lingering effects will continue to be felt. Several scenarios are possible.

- Analysis of current interest rate trends and forecasts: Current trends suggest interest rates will remain elevated for the foreseeable future.

- Discussion of potential factors influencing future market dynamics: Factors like inflation, economic growth, immigration levels, and government policies will play a significant role in shaping market dynamics.

- Expert opinions and predictions on the future of the Canadian housing market: Experts anticipate a period of adjustment, with potential for slower growth or even a moderate correction in some markets.

Conclusion: Understanding Canada's Housing Market in the Era of Sub-3% Mortgage Rates

The availability of sub-3% mortgage rates profoundly impacted Canada's housing market, driving up demand, increasing home prices, and prompting government intervention. Understanding the interplay between interest rates, government policies, and market dynamics is crucial for navigating this complex landscape. While the era of sub-3% mortgage rates may be over, the lessons learned and the market shifts they caused will continue to shape the Canadian housing market for years to come. Stay ahead of the curve by regularly monitoring changes in mortgage rates Canada and their impact on Canada's dynamic housing market. Understanding these trends is crucial for making informed decisions in today's complex real estate landscape.

Featured Posts

-

Kyle Tucker Trade Rumors Leave Cubs Fans Frustrated

May 13, 2025

Kyle Tucker Trade Rumors Leave Cubs Fans Frustrated

May 13, 2025 -

Mark Consuelos And Kelly Ripas Live Show Recent Absence And Reactions

May 13, 2025

Mark Consuelos And Kelly Ripas Live Show Recent Absence And Reactions

May 13, 2025 -

Kniga So Romski Ba Ki Pretstavuvanje

May 13, 2025

Kniga So Romski Ba Ki Pretstavuvanje

May 13, 2025 -

Muslim Mega City Mosque Under Scrutiny Official Response To Police Inquiry

May 13, 2025

Muslim Mega City Mosque Under Scrutiny Official Response To Police Inquiry

May 13, 2025 -

Limited Edition Doom Dark Ages Xbox Controller On Sale At Amazon

May 13, 2025

Limited Edition Doom Dark Ages Xbox Controller On Sale At Amazon

May 13, 2025

Latest Posts

-

Navi Mumbai Heatwave Nmmcs Aala Unhala Niyam Pala Campaign Offers Safety Tips

May 13, 2025

Navi Mumbai Heatwave Nmmcs Aala Unhala Niyam Pala Campaign Offers Safety Tips

May 13, 2025 -

Boil Water Advisory Issued For Ogeechee Road Area

May 13, 2025

Boil Water Advisory Issued For Ogeechee Road Area

May 13, 2025 -

Heat Wave Forces School Closures Across Half Of Philippine Capital

May 13, 2025

Heat Wave Forces School Closures Across Half Of Philippine Capital

May 13, 2025 -

Nmmc Launches Heatwave Advisory Aala Unhala Niyam Pala Campaign In Navi Mumbai

May 13, 2025

Nmmc Launches Heatwave Advisory Aala Unhala Niyam Pala Campaign In Navi Mumbai

May 13, 2025 -

Ogeechee Road Residents Under Boil Water Advisory

May 13, 2025

Ogeechee Road Residents Under Boil Water Advisory

May 13, 2025