Canadian Economic Sovereignty: Lessening U.S. Investor Influence

Table of Contents

Understanding the Current State of Canadian Economic Dependence on the U.S.

The Magnitude of U.S. Investment in Key Canadian Sectors

U.S. investment heavily influences several key Canadian sectors, creating a complex web of economic interdependence.

- Energy: U.S. companies play a major role in Canada's oil and gas industry, controlling significant portions of extraction, processing, and distribution. This dependence exposes Canada to fluctuations in the U.S. energy market and policy decisions.

- Finance: A significant portion of Canadian financial institutions have strong ties with U.S. counterparts, leading to potential vulnerabilities during economic downturns south of the border.

- Technology: The Canadian tech sector relies heavily on U.S. venture capital and market access, creating a dependence that could limit the growth of truly independent Canadian tech giants.

This concentration of U.S. investment creates vulnerabilities. Economic shocks in the U.S. can ripple through the Canadian economy, impacting jobs and growth. Furthermore, this dependence can limit Canada's ability to pursue independent economic policies.

Analyzing the Influence of U.S. Investors on Canadian Policy and Regulations

The significant presence of U.S. investors also influences Canadian policy and regulations.

- Lobbying Efforts: U.S. companies actively engage in lobbying efforts to shape Canadian regulations in their favor, potentially hindering policies that prioritize Canadian interests.

- Regulatory Frameworks: In some instances, Canadian regulatory frameworks have been influenced by U.S. standards, potentially overlooking unique Canadian needs and priorities.

- Cross-border Trade: The close economic relationship necessitates navigating complex cross-border trade agreements, sometimes at the expense of Canadian economic autonomy.

This influence can compromise Canadian national interests by creating regulatory environments that favour U.S. companies over Canadian businesses.

Strategies for Diversifying Investments and Reducing Reliance on the U.S.

Attracting Investment from Other Global Partners

Diversifying investment sources is crucial to strengthening Canadian economic sovereignty.

- Trade Agreements: Strengthening trade agreements with countries like China, the European Union, and other key global players can attract foreign direct investment (FDI) and reduce reliance on the U.S.

- Investment Promotion: Targeted investment promotion strategies showcasing Canada's competitive advantages in various sectors can lure investors from diverse global markets.

- International Partnerships: Fostering stronger partnerships with multilateral organizations can help access new funding sources and investment opportunities.

This diversification minimizes risks associated with over-reliance on a single major investor.

Strengthening Domestic Investment and Entrepreneurship

Boosting domestic investment and entrepreneurship is essential for self-reliance.

- Government Incentives: Government programs offering tax breaks, grants, and other incentives to support Canadian businesses and startups are crucial.

- Venture Capital: Encouraging the growth of Canadian venture capital firms can provide funding for innovative businesses, reducing dependence on U.S. investors.

- Innovation Policies: Policies promoting research and development, technological advancement, and a robust innovation ecosystem are critical for long-term economic growth.

A thriving domestic economy creates jobs, fosters innovation, and reduces vulnerability to external economic shocks.

Promoting Canadian Ownership and Control of Key Industries

Prioritizing Canadian ownership in strategic sectors is a key aspect of strengthening Canadian economic sovereignty.

- Strategic Investments: Government-led strategic investments in key industries, ensuring Canadian control, can safeguard national interests.

- Review of Foreign Acquisitions: A robust review process for foreign acquisitions of Canadian companies in strategic sectors can prevent unwanted foreign influence.

- Incentives for Canadian Ownership: Providing incentives for Canadian companies to acquire and control key assets within their respective sectors could significantly bolster domestic control.

This approach ensures vital sectors remain under Canadian ownership and control, enhancing national economic security.

The Role of Government Policy in Enhancing Canadian Economic Sovereignty

Strengthening Regulatory Frameworks to Protect National Interests

Robust and independent regulatory bodies are essential for protecting national interests.

- Independent Regulatory Bodies: Creating and empowering independent regulatory bodies free from undue influence can ensure fair competition and protect Canadian businesses.

- Transparent Processes: Transparent and accountable regulatory processes are crucial to maintain public trust and ensure fair play.

- National Interest Assessments: Implementing comprehensive national interest assessments for significant foreign investments ensures the benefits outweigh potential risks.

Stronger regulatory frameworks prevent unfair practices and safeguard Canadian economic interests.

Investing in Infrastructure and Human Capital to Improve Competitiveness

Investing in infrastructure and human capital enhances Canada's competitiveness and attracts diverse investors.

- Infrastructure Development: Investing in modern infrastructure – transportation, communication, and energy – improves the business environment and attracts investment.

- Skills Development: Investing in education and skills development creates a competitive workforce equipped to meet the demands of a modern economy.

- Research and Development: Robust investments in research and development are crucial for driving innovation and attracting high-value investment.

These investments attract diverse investors and build a strong foundation for sustainable economic growth.

Securing Canadian Economic Sovereignty for a Stronger Future

Strengthening Canadian economic sovereignty requires a multi-pronged approach encompassing diversification of investment sources, bolstering domestic industries, and establishing strong regulatory frameworks. Attracting investment from diverse global partners, promoting Canadian entrepreneurship, and prioritizing Canadian ownership in key sectors are all crucial steps. Government policy plays a vital role, particularly in strengthening regulatory frameworks, investing in infrastructure and human capital, and fostering a competitive business environment. By actively pursuing these strategies, Canada can strengthen its economic sovereignty and build a more resilient and independent future. Learn more about Canadian economic sovereignty initiatives today!

Featured Posts

-

Phone Seizures In France Targeting Drug Dealers And Users

May 29, 2025

Phone Seizures In France Targeting Drug Dealers And Users

May 29, 2025 -

Kyf Hqqna Alastqlal

May 29, 2025

Kyf Hqqna Alastqlal

May 29, 2025 -

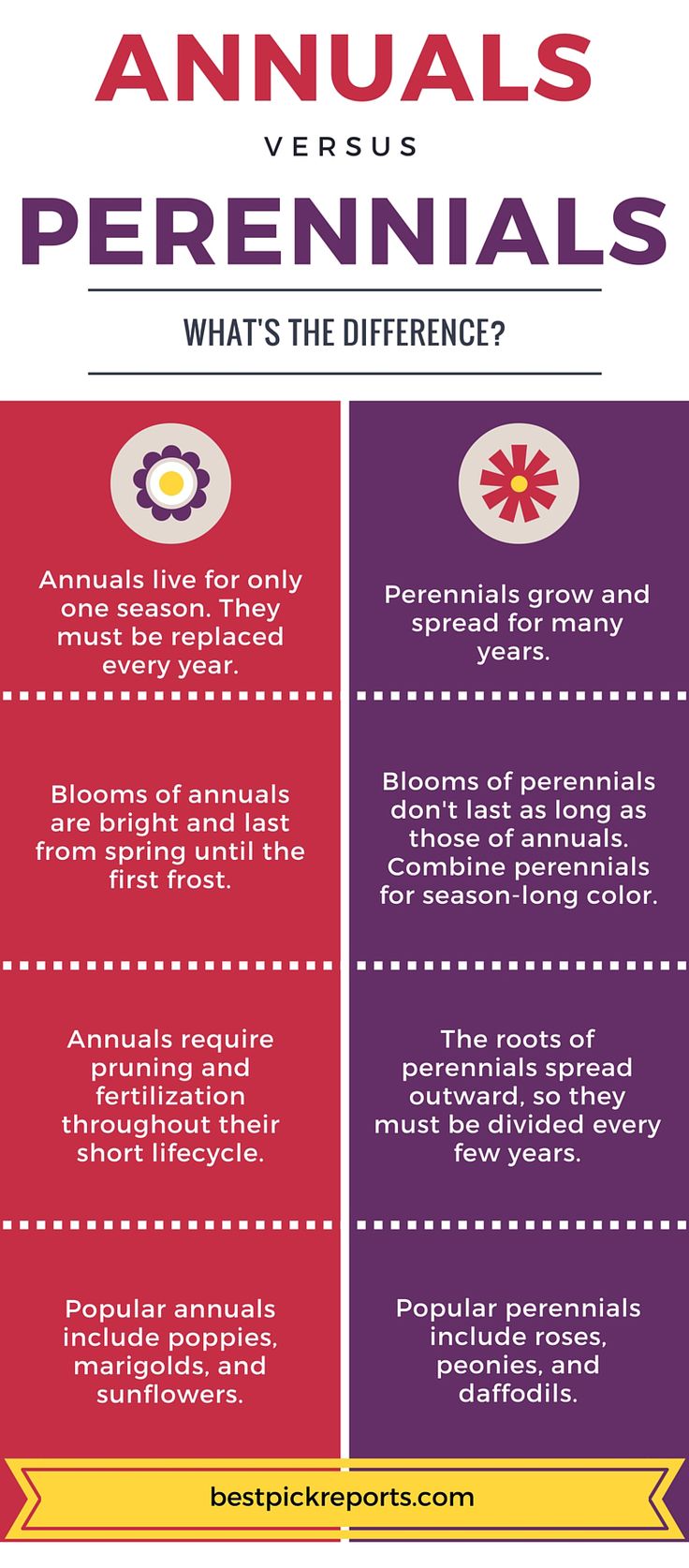

Choosing Between Annuals And Perennials A Practical Guide For Gardeners

May 29, 2025

Choosing Between Annuals And Perennials A Practical Guide For Gardeners

May 29, 2025 -

Building A Powerful Probopass Ex Deck In Pokemon Tcg Pocket

May 29, 2025

Building A Powerful Probopass Ex Deck In Pokemon Tcg Pocket

May 29, 2025 -

Free Transfer Battle Man Utd Challenges Barcelona And Real Madrid

May 29, 2025

Free Transfer Battle Man Utd Challenges Barcelona And Real Madrid

May 29, 2025

Latest Posts

-

Bernard Kerik Former Nyc Police Commissioner Dies At 69

May 31, 2025

Bernard Kerik Former Nyc Police Commissioner Dies At 69

May 31, 2025 -

Owning A Piece Of Banksy Six Screenprints And A Handmade Tool

May 31, 2025

Owning A Piece Of Banksy Six Screenprints And A Handmade Tool

May 31, 2025 -

Immersive Banksy Exhibit Opens In Vancouver A Closer Look

May 31, 2025

Immersive Banksy Exhibit Opens In Vancouver A Closer Look

May 31, 2025 -

Who Is Bernard Keriks Wife Hala Matli Meet His Children Too

May 31, 2025

Who Is Bernard Keriks Wife Hala Matli Meet His Children Too

May 31, 2025 -

Exploring Bernard Keriks Family Hala Matli And His Children

May 31, 2025

Exploring Bernard Keriks Family Hala Matli And His Children

May 31, 2025