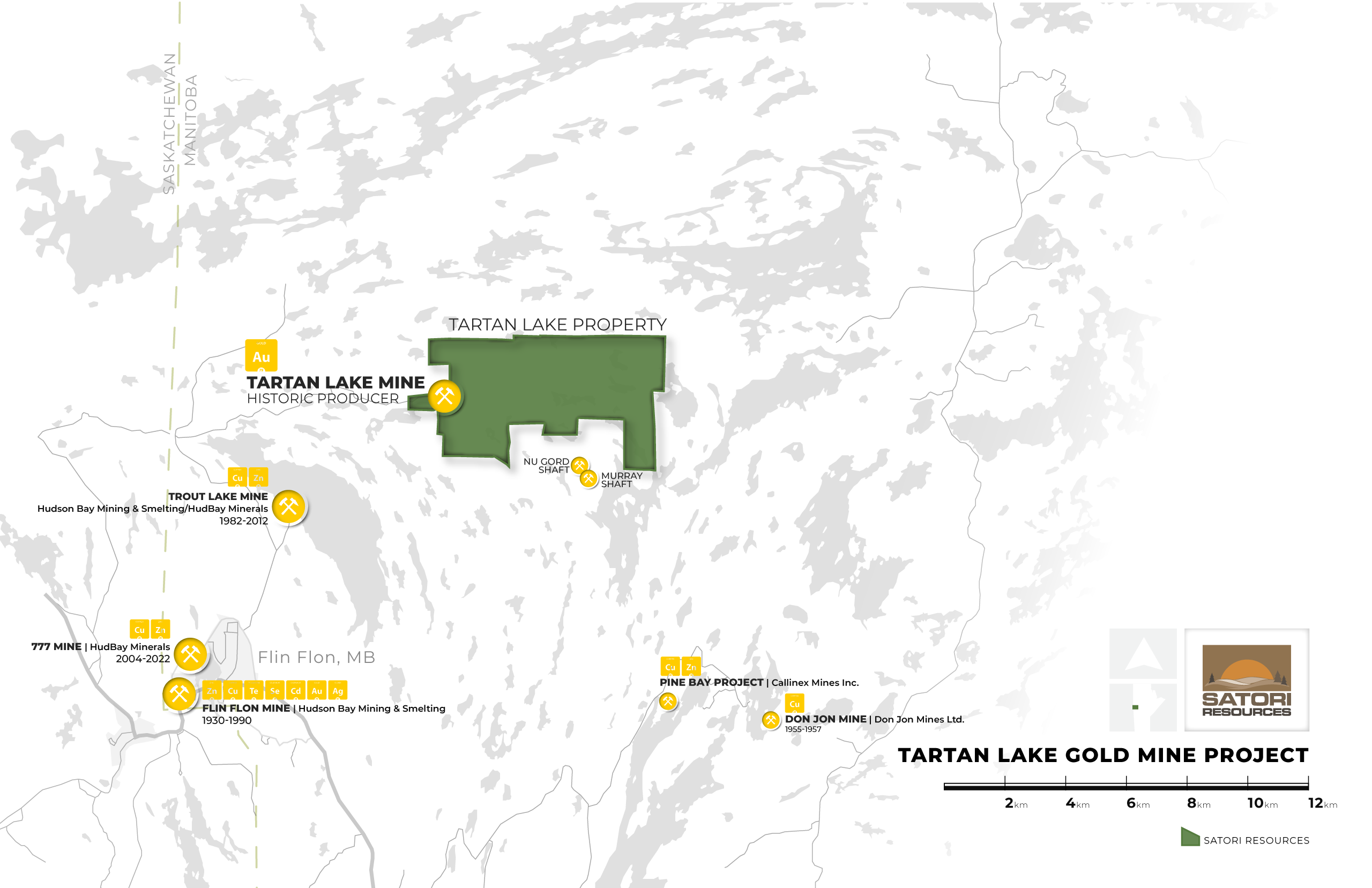

Canadian Gold Corp.'s Tartan Mine: Updated Resource Estimate & Preliminary Economic Assessment

Table of Contents

Updated Mineral Resource Estimate: A Deeper Dive into the Tartan Mine's Potential

The updated resource estimate for Canadian Gold Corp.'s Tartan Mine represents a significant advancement in understanding the project's potential. The estimate was generated using a rigorous methodology, incorporating detailed geological modeling and assay data from extensive drilling programs. This comprehensive approach ensures a high degree of confidence in the reported figures. Key changes compared to previous estimates demonstrate substantial growth in the overall resource base.

- Key Resource Categories:

- Indicated Resources: [Insert tonnage] tonnes grading [Insert grade] g/t gold, containing approximately [Insert gold ounces] ounces of gold.

- Inferred Resources: [Insert tonnage] tonnes grading [Insert grade] g/t gold, containing approximately [Insert gold ounces] ounces of gold.

[Insert a chart or graph visually representing the Indicated and Inferred resources, clearly showing tonnage and grade for each category. Clearly label the axes and provide a concise title such as "Tartan Mine Gold Resource Estimate."]

This substantial increase in gold ounces highlights the significant potential of the Tartan Mine and underscores the effectiveness of Canadian Gold Corp.'s exploration and development strategies. Keywords used here are Tartan Mine resource, Canadian Gold Corp. resource estimate, gold resource update, mineral resource estimate, gold ounces, gold grade.

Preliminary Economic Assessment (PEA) Highlights: Assessing the Economic Viability of the Tartan Mine Project

The PEA for the Tartan Mine presents a highly positive economic outlook. Key indicators confirm the project's strong viability and potential for significant returns.

- Key Economic Indicators:

- Net Present Value (NPV): [Insert NPV value] at a [Insert discount rate]% discount rate.

- Internal Rate of Return (IRR): [Insert IRR value]%.

- Payback Period: [Insert payback period] years.

The PEA projects a substantial gold production over the mine life, with an average annual production rate of [Insert annual production rate] ounces of gold. While capital and operating costs are considered, the PEA incorporates cost-saving measures and operational efficiencies which maximize profitability. Potential environmental and social impacts have been carefully assessed, and mitigation strategies are integrated into the project plan. The PEA also considers potential future exploration upside, which could further enhance the project's economics. Keywords used here are Tartan Mine PEA, economic assessment, NPV, IRR, payback period, gold production, capital costs, operating costs, project economics.

Exploration Potential & Future Plans: Expanding the Tartan Mine's Gold Reserves

Canadian Gold Corp. is actively pursuing exploration activities at the Tartan Mine and in surrounding areas. Promising exploration targets have been identified, offering significant potential for resource expansion. The company plans to utilize advanced exploration techniques, including [Insert specific techniques, e.g., geophysical surveys, diamond drilling], with a budget of [Insert budget]. Successful exploration could substantially increase the mine's lifespan and overall gold production, strengthening the project's long-term viability. Keywords used are Tartan Mine exploration, gold exploration, resource expansion, exploration targets, future plans.

Canadian Gold Corp.'s Overall Strategy and Market Position: A Broader Perspective

The Tartan Mine is a key component of Canadian Gold Corp.'s overall growth strategy, aligning perfectly with their focus on developing high-quality gold assets in Canada. The company's market position is strengthened by the Tartan Mine's robust economics and exploration potential. Recent company announcements regarding the Tartan Mine demonstrate their commitment to the project and its future development. Keywords used are Canadian Gold Corp. strategy, Canadian gold mining, gold market, company portfolio.

Conclusion: Investing in the Future of Canadian Gold Corp.'s Tartan Mine

The updated resource estimate and positive PEA for Canadian Gold Corp.'s Tartan Mine strongly indicate a promising future for this gold production project. The significant increase in gold resources, coupled with the favorable economics and strong exploration potential, presents a compelling investment opportunity. The project’s potential for future growth and expansion makes it an attractive prospect in the Canadian gold mining sector. Learn more about investing in Canadian Gold Corp.'s Tartan Mine and its promising future in gold production. Keywords used are Canadian Gold Corp.'s Tartan Mine, gold investment, gold production.

Featured Posts

-

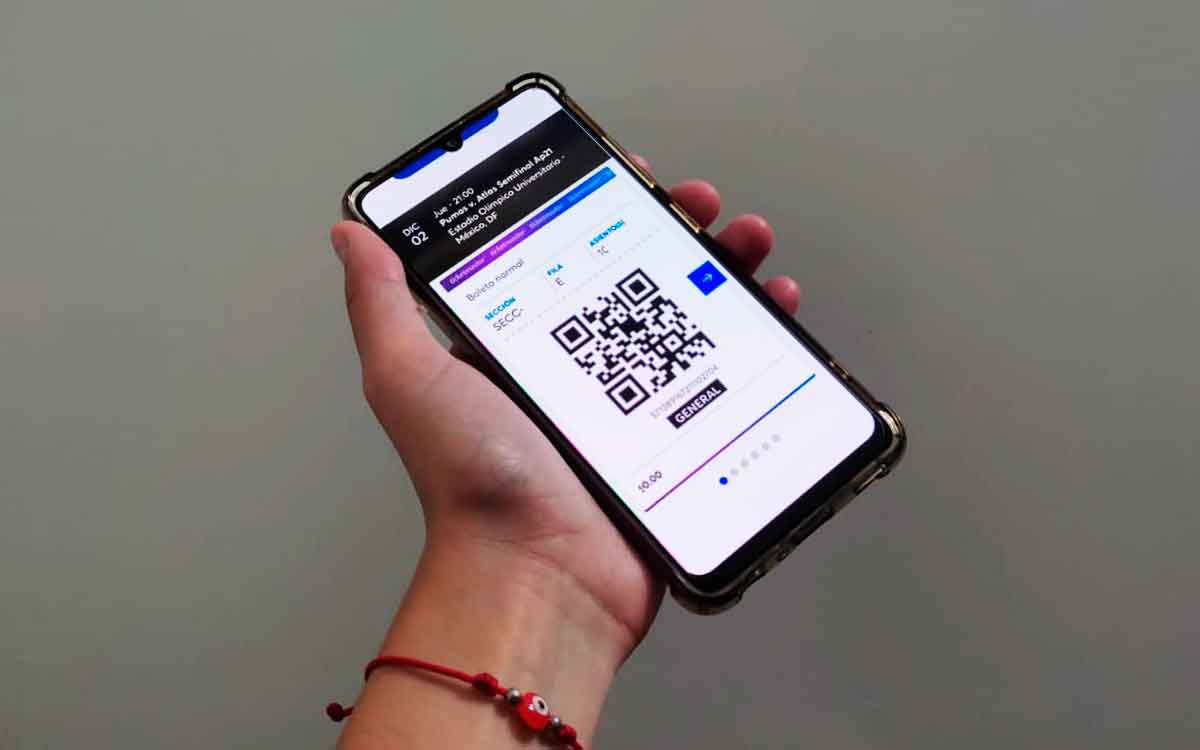

Mas Claridad En Los Precios De Boletos De Ticketmaster Un Nuevo Enfoque

May 30, 2025

Mas Claridad En Los Precios De Boletos De Ticketmaster Un Nuevo Enfoque

May 30, 2025 -

Ne Vykhodite Iz Doma Ekstrennoe Preduprezhdenie Politsii Izrailya

May 30, 2025

Ne Vykhodite Iz Doma Ekstrennoe Preduprezhdenie Politsii Izrailya

May 30, 2025 -

West Virginia Welcomes Maryland Tech A New Business Opportunity

May 30, 2025

West Virginia Welcomes Maryland Tech A New Business Opportunity

May 30, 2025 -

Sierra Leones Immigration Chief Removed From Office Reasons And Reactions

May 30, 2025

Sierra Leones Immigration Chief Removed From Office Reasons And Reactions

May 30, 2025 -

Odigos Tiletheasis Gia Tin Kyriaki 11 5

May 30, 2025

Odigos Tiletheasis Gia Tin Kyriaki 11 5

May 30, 2025