Canadian Investors Pour Money Into US Stocks: A New High

Table of Contents

Why the Surge in Canadian Investment in US Equities?

Several factors have converged to drive this dramatic increase in Canadian investment in US stocks. Understanding these factors is crucial for both investors and market analysts.

Attractive US Market Performance

The US stock market has significantly outperformed the Canadian market in recent years, presenting a compelling case for Canadian investors. Higher average returns on US equities, particularly in specific sectors, have attracted significant capital.

- Higher average returns on US equities: Data from [Insert reputable source, e.g., a financial news publication] shows that US equities have delivered consistently higher returns compared to their Canadian counterparts over the past [Number] years.

- Strong performance of specific US sectors (e.g., technology): The robust growth of the technology sector in the US has been a major draw for investors seeking high-growth opportunities. Companies listed on the NASDAQ and other US exchanges have seen substantial gains, attracting significant investment.

- Diversification opportunities beyond the Canadian market: Investing in US stocks allows Canadian investors to diversify their portfolios beyond the Canadian market, reducing their overall risk exposure.

Seeking Diversification

Geographical diversification is a key tenet of sound investment strategy, and Canadian investors are increasingly using US stocks to achieve this. By spreading investments across different markets, investors reduce their reliance on the performance of the Canadian economy.

- Hedging against Canadian market volatility: Investing in US stocks helps mitigate the risk associated with fluctuations in the Canadian market. When the Canadian market experiences downturns, the performance of US stocks can often provide a buffer.

- Access to a broader range of investment opportunities: The US market offers a vastly larger and more diverse range of investment opportunities compared to the Canadian market. This allows investors to tailor their portfolios to their specific risk tolerance and investment goals.

- Reduced portfolio risk through diversification: Diversification across different markets and asset classes is a cornerstone of risk management. Investing in US stocks provides a significant avenue for diversifying and reducing overall portfolio risk.

Favorable Exchange Rates

Favorable exchange rates between the Canadian and US dollar have also played a significant role. A weaker Canadian dollar relative to the US dollar can boost the returns for Canadian investors who invest in US stocks denominated in USD.

- Impact of a stronger US dollar on Canadian investment returns: When the US dollar strengthens against the Canadian dollar, the returns earned on US investments translate to even higher returns in Canadian dollars.

- Historical exchange rate trends and their influence: Examining historical exchange rate fluctuations reveals periods where favourable exchange rates have coincided with increased Canadian investment in US stocks.

- Potential future exchange rate scenarios and their implications: Predicting future exchange rates is challenging, but understanding potential scenarios is vital for strategic investment decisions.

Increased Access to US Markets

Accessing US markets has become significantly easier for Canadian investors in recent years, thanks to advancements in technology and regulatory changes.

- Increased availability of online brokerage accounts: The proliferation of online brokerage platforms has made it simpler and more affordable for Canadian investors to purchase US stocks.

- Simplification of cross-border investment processes: Regulatory changes have streamlined the process of investing across borders, making it easier for Canadians to participate in the US market.

- Role of financial advisors and their services: Financial advisors play a crucial role in guiding Canadian investors through the complexities of investing in US stocks, offering personalized advice and portfolio management.

Implications of this Trend

The surge in Canadian investment in US stocks has significant implications for both the Canadian and US economies.

Impact on the Canadian Economy

The significant outflow of capital to US markets could have both positive and negative effects on the Canadian economy.

- Potential impact on Canadian domestic investment: A shift towards US investments could potentially reduce domestic investment in Canadian businesses and industries.

- Effects on the Canadian dollar: Large-scale capital outflow could put downward pressure on the Canadian dollar, impacting the overall economy.

- Long-term implications for economic growth: The long-term impact on Canadian economic growth will depend on the balance between the benefits of diversification and the potential negative effects of capital outflow.

Risks and Considerations for Canadian Investors

While the potential benefits are significant, investors should be aware of potential risks associated with heavily investing in US stocks.

- Currency risk and its mitigation strategies: Fluctuations in exchange rates can significantly impact returns. Hedging strategies can help mitigate this risk.

- Market volatility and risk management techniques: The US market, while generally robust, is subject to periods of volatility. Effective risk management strategies are crucial.

- Geopolitical risks affecting US investments: Geopolitical events and policy changes can significantly impact the performance of US stocks. Diversification within US markets is one way to lessen this risk.

Conclusion

The record high in Canadian investment in US stocks is a result of attractive US market performance, the desire for diversification, favorable exchange rates, and increased market accessibility. This trend has significant implications for both the Canadian and US economies. While the opportunities are substantial, Canadian investors must carefully consider the potential risks and diversify their portfolio accordingly. Consult with a financial advisor to develop a personalized investment plan that aligns with your risk tolerance and financial goals. Don't miss out on the opportunities presented by the US market – learn more about strategic investing in US stocks today!

Featured Posts

-

Marches Financiers L Integrale Bfm Bourse Du 24 Fevrier

Apr 23, 2025

Marches Financiers L Integrale Bfm Bourse Du 24 Fevrier

Apr 23, 2025 -

Hear From Protesters Anti Trump Rallies Across The Us

Apr 23, 2025

Hear From Protesters Anti Trump Rallies Across The Us

Apr 23, 2025 -

Sf Giants Vs Brewers Flores And Lees Stellar Performances Secure The Win

Apr 23, 2025

Sf Giants Vs Brewers Flores And Lees Stellar Performances Secure The Win

Apr 23, 2025 -

Unde Investesti Banii In Martie 2024 Cele Mai Profitabile Depozite Bancare

Apr 23, 2025

Unde Investesti Banii In Martie 2024 Cele Mai Profitabile Depozite Bancare

Apr 23, 2025 -

Chalet Girls Unveiling The Reality Of Luxury Ski Resorts

Apr 23, 2025

Chalet Girls Unveiling The Reality Of Luxury Ski Resorts

Apr 23, 2025

Latest Posts

-

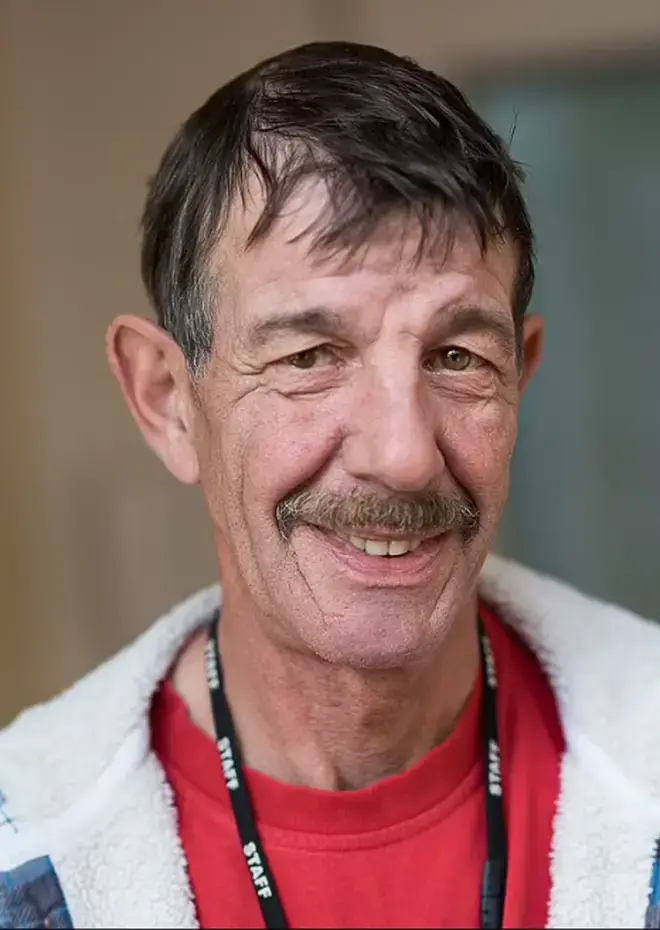

Delaying Farcical Misconduct Proceedings Nottingham Families Plea

May 10, 2025

Delaying Farcical Misconduct Proceedings Nottingham Families Plea

May 10, 2025 -

Harry Styles Seventies Style Mustache Makes A Statement

May 10, 2025

Harry Styles Seventies Style Mustache Makes A Statement

May 10, 2025 -

Harry Styles Debuts Retro Mustache In London

May 10, 2025

Harry Styles Debuts Retro Mustache In London

May 10, 2025 -

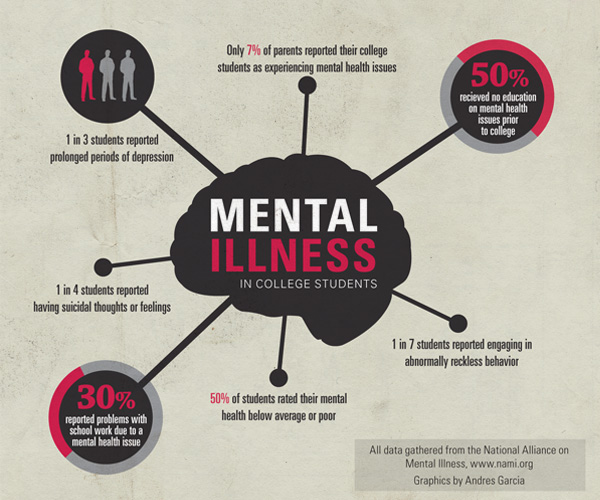

Reframing The Narrative Mental Illness And Violent Crime

May 10, 2025

Reframing The Narrative Mental Illness And Violent Crime

May 10, 2025 -

Nottingham Police Under Scrutiny Following Attacks Misconduct Meeting

May 10, 2025

Nottingham Police Under Scrutiny Following Attacks Misconduct Meeting

May 10, 2025