Cancer Drug Setback Sends Akeso Shares Into Freefall

Table of Contents

Details of the Cancer Drug Setback

The setback centers around Akeso's lead candidate, [Insert Drug Name Here], a [Type of drug, e.g., monoclonal antibody] designed to target [Type of Cancer, e.g., triple-negative breast cancer]. The drug was in [Stage of development, e.g., Phase 3] clinical trials, a crucial stage before potential regulatory approval. The recent announcement revealed that the trial failed to meet its primary endpoint.

- Specific results: The clinical trial demonstrated [Specific results, e.g., no statistically significant improvement in overall survival compared to the control group].

- Safety concerns: While the company hasn't reported major safety concerns, [mention any reported adverse events, e.g., some patients experienced increased fatigue].

- Official statement: Akeso released an official statement acknowledging the setback, expressing disappointment but emphasizing their commitment to [mention their future plans e.g., further research and analysis of the data].

This clinical trial failure represents a significant hurdle in the drug development process and raises questions about the future of [Insert Drug Name Here]. The failure highlights the inherent risks and challenges associated with bringing novel cancer drugs to market, including navigating complex regulatory hurdles and overcoming unpredictable clinical trial outcomes.

Impact on Akeso's Stock Price

The news of the failed clinical trial triggered a sharp decline in Akeso's share price. The stock experienced a [Percentage]% drop in a single day, wiping out [Dollar amount] in market capitalization. This dramatic stock market crash reflects the significant impact of the setback on investor confidence.

- Share price decline: Akeso's share price plummeted from [Previous price] to [Current price] following the announcement.

- Trading volume: Trading volume surged dramatically, indicating significant investor activity and concern.

- Analyst predictions: Several analysts have revised their price targets for Akeso stock downward, reflecting a more cautious outlook for the company's near-term prospects. Some predict a continued share price decline, while others believe the drop presents a buying opportunity for long-term investors.

Akeso's Response and Future Outlook

In response to the setback, Akeso has stated that they will [Summarize company's response, e.g., thoroughly analyze the data from the Phase 3 trial to understand the reasons behind the failure]. They have also reiterated their commitment to [Mention future plans, e.g., their ongoing research and development efforts across their broader drug pipeline].

- Company statement highlights: [Include specific points from Akeso's statement].

- Future drug development plans: The company is continuing to advance other drug candidates in its pipeline, focusing on [Mention other drug candidates and their target areas].

- Pipeline impact: While this setback is significant, it doesn't necessarily doom the entire pipeline. The success or failure of one drug candidate doesn't automatically predict the fate of others.

Expert Analysis and Market Implications

Industry experts have offered varying perspectives on the implications of the setback. Some analysts believe that this represents a temporary setback, emphasizing the inherent risks in biotech research and development. Others are more cautious, expressing concerns about Akeso's future prospects and the potential impact on investor confidence in the broader biotech sector.

- Analyst quotes: [Include quotes from relevant experts, attributing them correctly].

- Broader biotech implications: The setback underscores the volatile nature of the biotech industry and the unpredictable nature of clinical trials.

- Investor sentiment: Investor sentiment towards Akeso and other biotech companies developing similar cancer treatments may be negatively affected in the short term.

Conclusion: Navigating the Aftermath of the Akeso Cancer Drug Setback

The Akeso cancer drug setback serves as a stark reminder of the inherent risks and uncertainties involved in the development and commercialization of new cancer therapies. The significant drop in Akeso shares underscores the volatility of the biotech sector and highlights the importance of careful risk assessment for investors. While the future remains uncertain for Akeso, the company's response and its broader drug pipeline will play a crucial role in determining its long-term prospects. Stay informed about the latest developments concerning Akeso shares and other cancer drug breakthroughs to make informed investment decisions.

Featured Posts

-

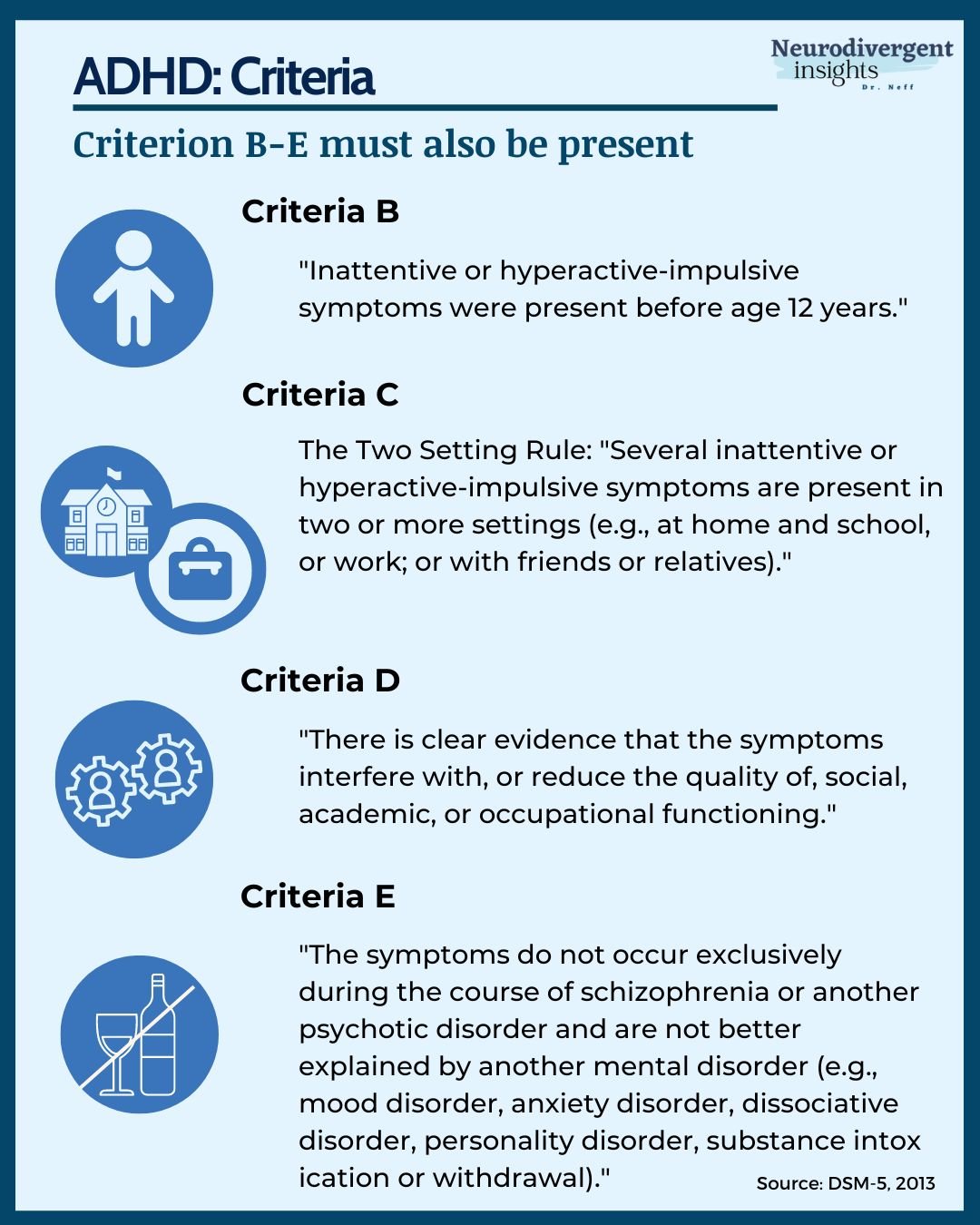

Navigating An Adult Adhd Diagnosis A Practical Guide

Apr 29, 2025

Navigating An Adult Adhd Diagnosis A Practical Guide

Apr 29, 2025 -

Uk Courts Definition Of Woman Impact On Sex Based Rights And Transgender Individuals

Apr 29, 2025

Uk Courts Definition Of Woman Impact On Sex Based Rights And Transgender Individuals

Apr 29, 2025 -

The Fly Did Jeff Goldblums Performance Get Underrated By The Oscars

Apr 29, 2025

The Fly Did Jeff Goldblums Performance Get Underrated By The Oscars

Apr 29, 2025 -

Get Capital Summertime Ball 2025 Tickets A Step By Step Guide

Apr 29, 2025

Get Capital Summertime Ball 2025 Tickets A Step By Step Guide

Apr 29, 2025 -

Sag Aftra Joins Wga On Strike What It Means For Hollywood

Apr 29, 2025

Sag Aftra Joins Wga On Strike What It Means For Hollywood

Apr 29, 2025

Latest Posts

-

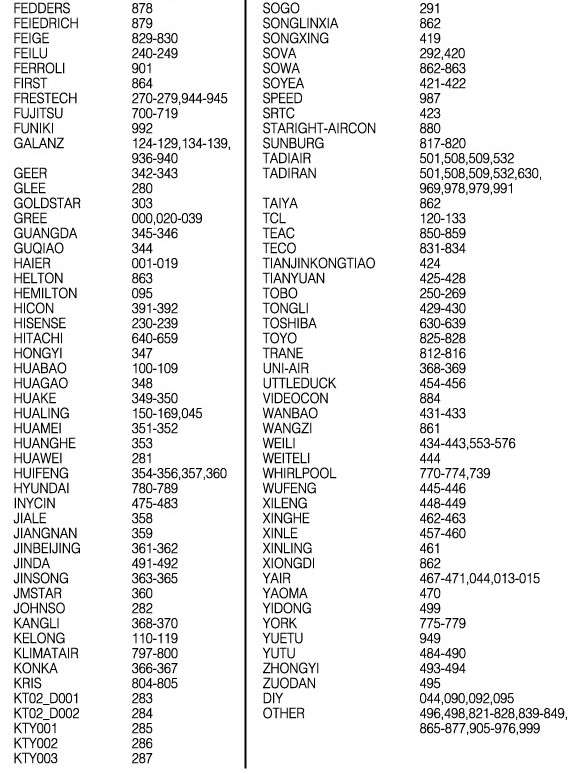

The One Controller Mastering Universal Remote Control

May 12, 2025

The One Controller Mastering Universal Remote Control

May 12, 2025 -

The One Controller To Almost Rule Them All A Comprehensive Guide

May 12, 2025

The One Controller To Almost Rule Them All A Comprehensive Guide

May 12, 2025 -

Ai And Design Figmas Ceo Shares His Strategy

May 12, 2025

Ai And Design Figmas Ceo Shares His Strategy

May 12, 2025 -

Figma Ceos Vision Reimagining Design With Ai

May 12, 2025

Figma Ceos Vision Reimagining Design With Ai

May 12, 2025 -

Adidas 3 D Printed Shoes A Comprehensive Analysis

May 12, 2025

Adidas 3 D Printed Shoes A Comprehensive Analysis

May 12, 2025