Cenovus Prioritizes Organic Growth, Dimming Prospects Of MEG Bid

Table of Contents

Cenovus's Commitment to Internal Expansion

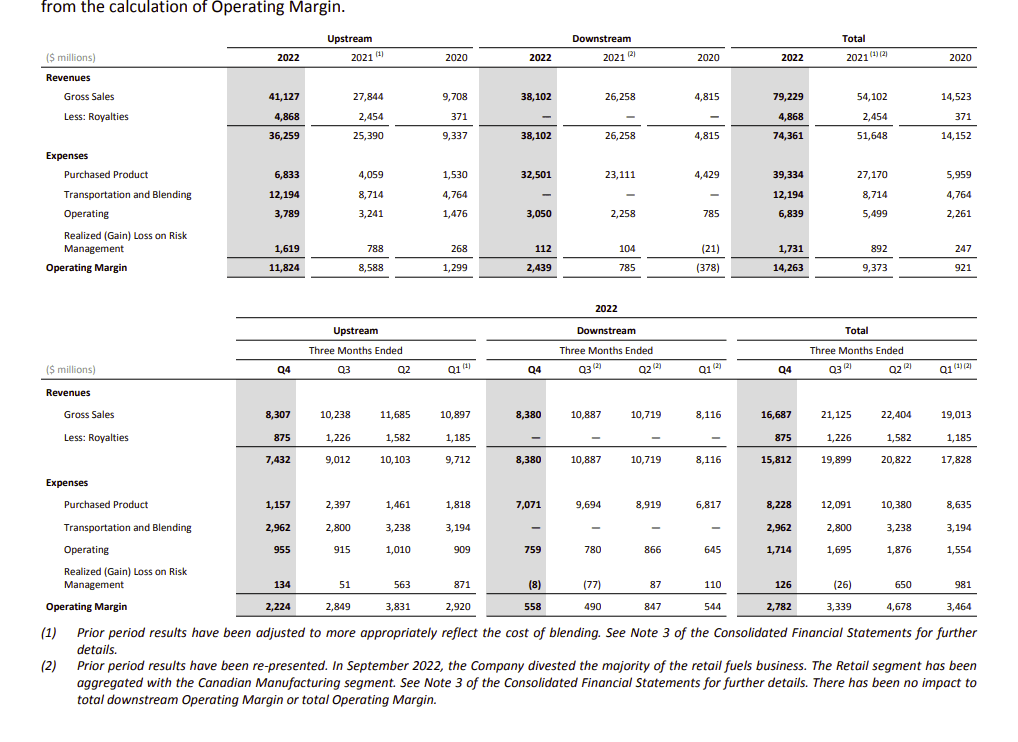

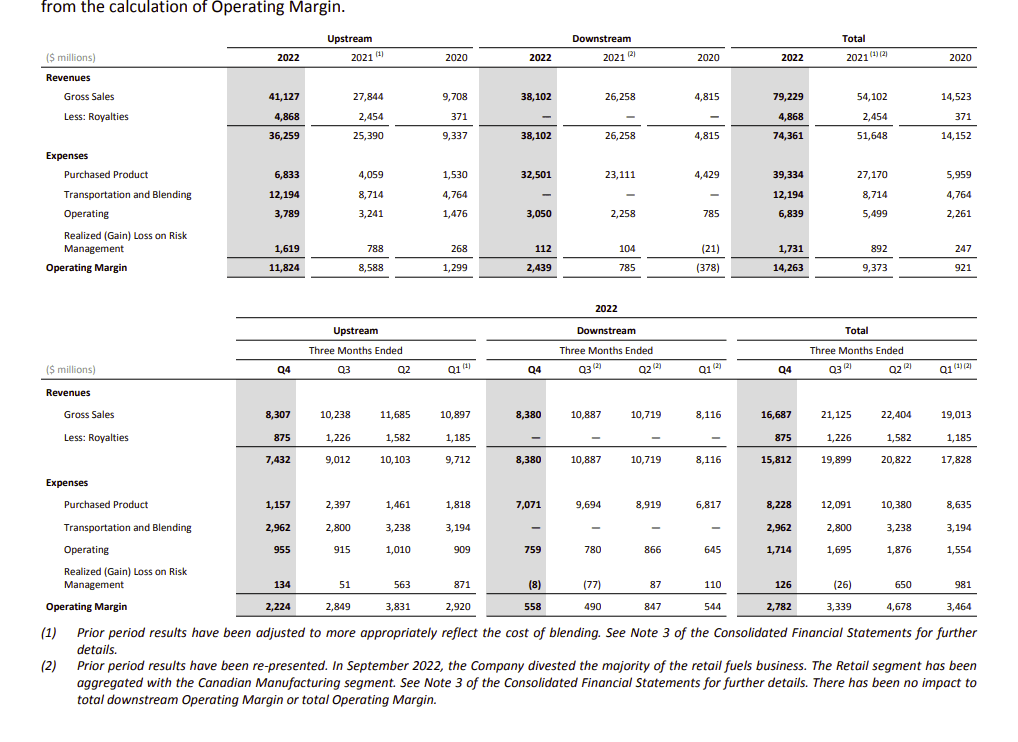

Cenovus Energy is demonstrating a strong commitment to expanding its operations internally, rather than through acquisitions. This strategy focuses on maximizing the potential of its existing assets and optimizing its operational efficiency.

Enhanced Oil Recovery (EOR) Initiatives

Cenovus is heavily investing in Enhanced Oil Recovery (EOR) technologies to significantly boost production from its existing oil sands assets. This involves injecting steam, solvents, or other fluids into reservoirs to increase the extraction of oil.

- Specific EOR projects: Cenovus has several large-scale EOR projects underway, including significant investments in steam-assisted gravity drainage (SAGD) operations at its Christina Lake and Foster Creek projects.

- Expected production increases: These EOR projects are projected to add substantial volumes to Cenovus's overall oil production over the coming years, contributing significantly to organic growth.

- Cost-effectiveness analysis: While EOR projects require substantial upfront capital investment, Cenovus's analysis suggests these initiatives offer a favorable return on investment compared to the costs and risks associated with a major acquisition like MEG Energy.

- Environmental impact considerations: Cenovus is actively pursuing sustainable EOR practices, minimizing environmental impact and incorporating responsible resource management into its plans.

Upstream Operations Optimization

Cenovus is actively implementing efficiency improvements and technological upgrades across its upstream operations, encompassing exploration, drilling, and production.

- Examples of operational improvements: This includes the adoption of advanced drilling technologies, improved reservoir management techniques, and streamlined operational processes to reduce costs and improve productivity.

- Cost savings achieved: These optimizations have already resulted in substantial cost savings, freeing up capital for reinvestment in growth initiatives and enhancing shareholder returns.

- Impact on overall production capacity: Optimizing upstream operations directly increases production capacity, leading to improved profitability and organic growth without the complexities of an acquisition.

Downstream Expansion and Refineries

Cenovus is also focusing on expanding and improving its downstream operations, including refinery upgrades and capacity expansions.

- Refinery upgrades: Investments in upgrading existing refineries enhance refining capabilities, allowing Cenovus to process heavier crudes more efficiently and produce higher-value products.

- Capacity expansions: Increasing refinery capacity allows Cenovus to process more crude oil, further boosting profitability and contributing to overall organic growth.

- Product diversification: Cenovus aims to diversify its product portfolio to reduce reliance on a single product and improve resilience to market fluctuations.

- Market positioning: These downstream expansions strengthen Cenovus’s market position, giving it greater control over its value chain and enhancing profitability.

Why Cenovus is Favoring Organic Growth over MEG Acquisition

Cenovus's decision to prioritize organic growth over acquiring MEG Energy stems from a careful consideration of several factors.

Financial Considerations

The financial implications of a large acquisition like MEG Energy are significant. Cenovus's current financial health plays a crucial role in this decision.

- Cenovus’s debt-to-equity ratio: Maintaining a healthy debt-to-equity ratio is essential. A large acquisition would significantly increase debt levels, potentially impacting credit ratings and investor sentiment.

- Free cash flow: Cenovus's strong free cash flow allows for reinvestment in organic growth initiatives without significantly increasing debt. An acquisition would likely strain this free cash flow.

- Dividend policy: Maintaining a consistent dividend policy is a priority for Cenovus. A large acquisition could jeopardize this commitment to shareholder returns.

- Investor sentiment: Focusing on organic growth aligns with investor preferences for disciplined capital allocation and sustainable long-term value creation.

Integration Risks

Integrating a large company like MEG Energy into Cenovus's existing operations presents substantial challenges.

- Potential for operational disruptions: Merging two companies of similar size could lead to significant operational disruptions, potentially impacting production and efficiency.

- Cultural clashes: Integrating different corporate cultures can be challenging and time-consuming, potentially hindering the success of the acquisition.

- Regulatory hurdles: Acquisitions often face regulatory scrutiny, potentially delaying or even preventing the deal from being completed.

- Cost overruns: The actual costs of integration often exceed initial projections, further impacting profitability.

Strategic Alignment

Organic growth aligns better with Cenovus's long-term strategic goals compared to an external acquisition.

- Focus on core competencies: Organic growth allows Cenovus to focus on its core competencies and strengthens its existing capabilities.

- Risk mitigation: Internal expansion carries less risk compared to the uncertainty and integration challenges associated with a large acquisition.

- Enhanced shareholder value: By prioritizing disciplined capital allocation and focusing on operational efficiency, Cenovus aims to enhance shareholder value over the long term.

Implications for the Energy Sector and Investors

Cenovus's strategic shift has significant implications for the Canadian energy sector and its investors.

The decision reinforces a focus on operational efficiency and disciplined capital allocation within the Canadian oil sands industry. This could influence other energy companies to re-evaluate their M&A strategies and prioritize organic growth. The impact on Cenovus's stock price will depend on the success of its organic growth initiatives. Positive results will likely lead to a positive market reaction. Conversely, any setbacks could negatively impact investor confidence. Future M&A activity in the Canadian energy industry may be slower as companies consolidate and focus on improving internal efficiencies. Forecasting Cenovus’s future growth hinges on the success of its EOR projects and upstream/downstream optimization strategies.

Conclusion: Cenovus's Organic Growth Strategy: A Calculated Risk?

Cenovus Energy's prioritization of organic growth over an MEG Energy acquisition reflects a calculated strategy focused on financial prudence, risk mitigation, and strategic alignment. While organic growth offers significant potential for long-term value creation, it also involves inherent risks. The success of this strategy hinges on the successful execution of EOR projects, operational efficiency improvements, and downstream expansions. However, the avoidance of the complexities and potential pitfalls of a major acquisition offers a more stable and predictable path to growth. Stay tuned for updates on Cenovus Energy's organic growth initiatives and their impact on the future of the company. Learn more about Cenovus Energy's commitment to organic growth by visiting their investor relations website.

Featured Posts

-

From Plaza To Pavement The Black Lives Matter Street Rename

May 25, 2025

From Plaza To Pavement The Black Lives Matter Street Rename

May 25, 2025 -

Bardellas Presidential Bid A Contender Or Outsider

May 25, 2025

Bardellas Presidential Bid A Contender Or Outsider

May 25, 2025 -

Los Mellizos De Alberto De Monaco Celebran Su Primera Comunion

May 25, 2025

Los Mellizos De Alberto De Monaco Celebran Su Primera Comunion

May 25, 2025 -

H Nonline Sk Tisice Prepustenych V Nemecku Reakcia Na Hospodarsky Pokles

May 25, 2025

H Nonline Sk Tisice Prepustenych V Nemecku Reakcia Na Hospodarsky Pokles

May 25, 2025 -

Shop Owner Stabbing Previously Bailed Teenager Taken Into Custody

May 25, 2025

Shop Owner Stabbing Previously Bailed Teenager Taken Into Custody

May 25, 2025